Investing In Riot Platforms (RIOT): Assessing The Risks And Rewards At Current Levels

Table of Contents

Understanding Riot Platforms (RIOT) and its Business Model

Riot Platforms' core business revolves around Bitcoin mining. They operate large-scale facilities equipped with high-performance computing hardware to solve complex cryptographic puzzles, earning Bitcoin as a reward. This process, known as Bitcoin mining, requires significant computational power and energy consumption. Understanding RIOT's business model necessitates examining several key aspects:

-

Mining Infrastructure: Riot Platforms boasts a substantial hash rate, a measure of its computing power, and strategically located facilities optimized for efficient Bitcoin mining. They focus on securing cost-effective energy sources, a critical factor impacting profitability in this sector.

-

Expansion Plans: The company continually invests in expanding its mining capacity and upgrading its hardware to maintain a competitive edge in the increasingly challenging Bitcoin mining landscape. Their future growth heavily depends on the success of these expansion plans and their ability to secure sustainable energy sources.

-

Key Aspects of their Business:

- Key Partnerships and Collaborations: Riot Platforms actively seeks strategic partnerships to secure access to favorable energy rates and cutting-edge mining technology.

- Mining Efficiency Metrics (kWh/TH): Monitoring and improving their kWh/TH (kilowatt-hours per terahash) is crucial for maintaining profitability. Lower kWh/TH indicates greater energy efficiency.

- Self-Mining Strategy: Riot Platforms primarily focuses on self-mining Bitcoin, retaining control over the process and maximizing profits.

- Geographic Diversification: Diversifying their mining operations geographically mitigates risks associated with localized regulations or energy disruptions.

Assessing the Risks of Investing in RIOT Stock

Investing in RIOT stock carries inherent risks, primarily stemming from the volatility of the cryptocurrency market and the regulatory landscape surrounding Bitcoin mining. A comprehensive risk assessment includes:

-

Cryptocurrency Market Volatility: The price of Bitcoin, the primary output of Riot Platforms' mining operations, is highly volatile. Sharp declines in Bitcoin's price directly impact RIOT's stock price and profitability.

-

Regulatory Risks: Changes in cryptocurrency regulations, either at the national or international level, could significantly impact the operations and profitability of Bitcoin mining companies like Riot Platforms. Uncertainty surrounding regulatory frameworks poses a substantial risk.

-

Energy Costs: Bitcoin mining is energy-intensive. Fluctuations in electricity prices directly affect RIOT's profitability. Rising energy costs can severely squeeze margins, impacting the company's bottom line.

-

Competition: The Bitcoin mining space is competitive. New entrants and established players constantly vie for market share, creating a challenging environment.

-

Specific Risk Factors:

- Bitcoin Price Fluctuations: A negative correlation exists between Bitcoin price and RIOT stock performance.

- Government Regulations: Changes in mining regulations could restrict operations or increase costs.

- Electricity Price Volatility: Unpredictable electricity prices can significantly impact profitability.

- Competitive Landscape: Intense competition necessitates continuous innovation and cost optimization.

Evaluating the Rewards of Investing in RIOT Stock

Despite the risks, investing in RIOT stock offers several potential rewards, particularly for investors with a higher risk tolerance and a long-term perspective:

-

Bitcoin Price Appreciation: The primary reward lies in Bitcoin's potential for price appreciation. As Bitcoin's value rises, so too does the value of the Bitcoin mined by Riot Platforms.

-

Improved Profitability: As mining technology advances and energy costs potentially decrease, Riot Platforms' profitability could increase, leading to higher stock prices.

-

Long-Term Growth: The cryptocurrency industry is still in its early stages of development. The long-term growth prospects of the industry and RIOT's position within it are compelling for some investors.

-

Potential for Shareholder Returns: Depending on the company's financial performance, future dividend payouts or share buybacks could enhance returns for investors.

-

Potential Upside:

- Bitcoin Price History: Past Bitcoin price performance provides a glimpse into the potential for substantial returns.

- Bitcoin Adoption Growth: Increased Bitcoin adoption translates into higher demand and potentially higher prices.

- Strategic Initiatives: RIOT's strategic initiatives to improve efficiency and reduce costs can drive profitability.

- Capital Appreciation: Long-term investors may benefit from significant capital appreciation.

Comparing RIOT to Competitors in the Cryptocurrency Mining Sector

Riot Platforms competes with other publicly traded cryptocurrency mining companies such as Marathon Digital Holdings and Canaan Inc. A comparative analysis reveals both advantages and disadvantages:

-

Performance Metrics: Comparing Riot Platforms' hash rate, mining efficiency, and overall mining output to its competitors provides a benchmark for evaluating its relative performance and competitive positioning within the industry.

-

Competitive Advantages and Disadvantages: Riot Platforms' competitive advantages might include its strategic partnerships, access to cost-effective energy, or superior mining technology. Conversely, disadvantages could include higher operational costs or a less diversified geographic footprint compared to competitors.

-

Key Comparative Factors:

- Market Capitalization: Comparing market capitalization offers insight into the relative size and valuation of each company.

- Mining Hardware and Technology: The efficiency and technological advancements of mining hardware vary significantly between competitors.

- Financial Health: Analyzing the balance sheets of competing companies is crucial in assessing their long-term viability.

- Growth Strategies: Differing growth strategies reflect varying approaches to market share acquisition and profitability.

Financial Analysis of Riot Platforms (RIOT)

A thorough financial analysis of Riot Platforms is crucial for assessing the investment's viability. This includes a review of:

-

Key Financial Metrics: Examination of revenue, earnings, and cash flow trends helps gauge the company's financial performance and sustainability.

-

Debt Levels and Financial Health: Analyzing the company's debt levels, debt-to-equity ratio, and overall financial health provides insights into its financial stability and risk profile.

-

Profitability and Margins: Analyzing gross and net profit margins helps evaluate the company's efficiency and ability to generate profits.

-

Crucial Financial Data:

- Key Financial Ratios: Ratios like P/E ratio, debt-to-equity ratio, and return on equity provide valuable insights into financial performance.

- Revenue Growth: Examining revenue growth trends indicates the company's success in scaling its operations.

- Balance Sheet Strength: A robust balance sheet is crucial for financial stability and ability to weather market downturns.

- Cash Flow Analysis: Analyzing cash flow helps assess the company's ability to generate cash and fund its operations and growth.

Investing in Riot Platforms (RIOT): A Final Assessment

Investing in Riot Platforms presents a high-risk, high-reward opportunity. While the potential for substantial returns tied to Bitcoin's price appreciation is significant, the volatility of the cryptocurrency market, regulatory uncertainties, and competition within the Bitcoin mining sector pose substantial risks. A thorough understanding of RIOT's business model, financial health, and the competitive landscape is crucial before making any investment decision. Remember to conduct thorough due diligence, considering your personal risk tolerance and financial goals before investing in RIOT stock or any other cryptocurrency mining stock. For more detailed information, visit Riot Platforms' investor relations page. Informed decisions about investing in Riot Platforms (RIOT) and other cryptocurrency mining ventures should always be made based on your personal assessment of the risks and rewards involved.

Featured Posts

-

Loai Qua Quy Hiem Gia 60 000d Kg Huong Vi Doc Dao Duoc Nhieu Nguoi Yeu Thich

May 03, 2025

Loai Qua Quy Hiem Gia 60 000d Kg Huong Vi Doc Dao Duoc Nhieu Nguoi Yeu Thich

May 03, 2025 -

Ukraina Makron Dobilsya Ot S Sh A Uzhestocheniya Pozitsii Protiv Rossii

May 03, 2025

Ukraina Makron Dobilsya Ot S Sh A Uzhestocheniya Pozitsii Protiv Rossii

May 03, 2025 -

Analysis Trumps Argument Against Judicial Review Of Tariffs

May 03, 2025

Analysis Trumps Argument Against Judicial Review Of Tariffs

May 03, 2025 -

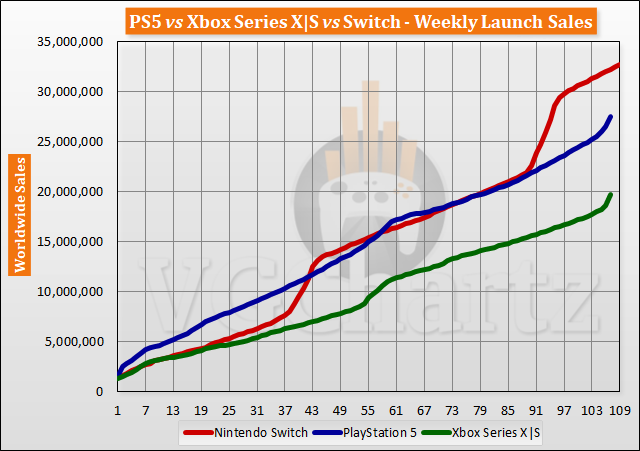

Ps 5 Vs Xbox Series X S In The Us A Sales Performance Review

May 03, 2025

Ps 5 Vs Xbox Series X S In The Us A Sales Performance Review

May 03, 2025 -

Christina Aguilera Fans Inappropriate Kiss Sparks Outrage

May 03, 2025

Christina Aguilera Fans Inappropriate Kiss Sparks Outrage

May 03, 2025