Investing In Quantum Computing In 2025: A Look At Rigetti And IonQ

Table of Contents

Rigetti Computing: A Deep Dive

Rigetti's Technology: Superconducting Qubits

Rigetti Computing employs superconducting qubit technology. This approach utilizes superconducting circuits cooled to extremely low temperatures to create and manipulate qubits.

- Advantages: Superconducting qubits offer potential for scalability, meaning they may be easier to integrate into larger, more powerful quantum computers. They also boast relatively decent coherence times (the period a qubit maintains its quantum state).

- Disadvantages: Scaling superconducting qubit systems remains a significant challenge. Manufacturing these intricate circuits at scale is complex and expensive, potentially impacting profitability. Current qubit counts are in the hundreds, with roadmaps aiming for thousands in the coming years.

- Keywords: Rigetti Qubits, Superconducting Qubits, Quantum Computing Technology, Rigetti Stock

Rigetti's Market Position and Partnerships

Rigetti is actively establishing its presence in the quantum computing landscape. They're focusing on providing both hardware and software solutions.

- Key Partnerships: Rigetti has forged partnerships with various organizations across industries, leveraging their quantum computing expertise. These collaborations often involve providing access to their quantum computers via cloud platforms.

- Target Markets: Rigetti targets various sectors, including finance (for portfolio optimization and risk management), pharmaceuticals (for drug discovery and development), and materials science (for designing new materials with enhanced properties).

- Keywords: Rigetti Partnerships, Quantum Computing Applications, Quantum Computing Market

Investment Considerations for Rigetti

Investing in Rigetti involves assessing the inherent risks and potential rewards.

- Company Valuation: Rigetti's valuation reflects investor sentiment regarding its technology, market position, and future prospects. Analyzing its financial statements and comparing it to competitors is vital.

- Potential for Future Growth: The success of Rigetti hinges on its ability to overcome technical challenges and scale its operations. The overall growth of the quantum computing market significantly impacts its future.

- Competitive Landscape: The quantum computing industry is highly competitive, with several established players and emerging startups. Rigetti's competitive advantages and strategic positioning need to be carefully considered.

- Financial Performance: Investors should thoroughly review Rigetti's financial performance, including revenue, expenses, and profitability trends.

- Keywords: Rigetti Investment, Quantum Computing Stocks, Investment Risks, Quantum Computing Returns

IonQ: Exploring Trapped Ion Technology

IonQ's Technology: Trapped Ion Qubits

IonQ utilizes trapped ion technology, employing individual ions held in place by electromagnetic fields to represent qubits.

- Advantages: Trapped ion qubits are known for their high fidelity (accuracy in quantum operations) and remarkably long coherence times. This leads to more reliable calculations.

- Disadvantages: Scaling trapped ion systems to a large number of qubits presents a significant hurdle, impacting the potential for complex computations. System complexity adds to the engineering challenges. Current qubit counts are also in the hundreds, with ambitious expansion plans.

- Keywords: IonQ Qubits, Trapped Ion Qubits, Quantum Computing Technology, IonQ Stock

IonQ's Market Position and Partnerships

IonQ is strategically positioning itself within the quantum computing ecosystem.

- Key Partnerships: IonQ has secured partnerships with major players in the cloud computing space, providing access to their quantum computing capabilities. They also collaborate with leading research institutions.

- Target Markets: Their focus includes cloud-based quantum computing services catering to researchers and commercial users.

- Keywords: IonQ Partnerships, Quantum Computing Applications, Quantum Computing Market

Investment Considerations for IonQ

Weighing the risks and rewards of IonQ investment demands a thorough analysis.

- Company Valuation: Assessing IonQ's valuation requires a detailed understanding of its technology, market position, and financial performance.

- Growth Potential: IonQ's success depends on its ability to overcome scalability challenges and demonstrate the practical applications of its technology.

- Competitive Landscape: Similar to Rigetti, IonQ faces a competitive landscape; its unique selling proposition needs careful assessment.

- Financial Performance: Reviewing IonQ's financial performance is crucial for gauging its financial health and growth trajectory.

- Keywords: IonQ Investment, Quantum Computing Stocks, Investment Risks, Quantum Computing Returns

Rigetti vs. IonQ: A Comparative Analysis

Technology Comparison

Rigetti's superconducting approach prioritizes scalability, while IonQ's trapped ion method emphasizes high fidelity and coherence. Each technology presents unique advantages and disadvantages in terms of qubit quality, scalability, and cost. The "best" technology remains to be seen as the field develops.

Market Strategy Comparison

Both companies are pursuing diverse strategies, targeting different markets and establishing distinct partnerships. Rigetti emphasizes broader applications, while IonQ leans more towards cloud-based services.

Investment Outlook Comparison

Both Rigetti and IonQ present high-risk, high-reward investment opportunities. The choice depends on an investor's risk tolerance and expectations for the quantum computing market's future growth. Diversification within the quantum computing investment space is a prudent approach.

- Keywords: Rigetti vs IonQ, Quantum Computing Comparison, Quantum Computing Investment Strategies

Conclusion

Investing in quantum computing in 2025 presents both significant opportunities and considerable risks. Rigetti and IonQ represent two distinct approaches to this transformative technology. Rigetti's superconducting approach prioritizes scalability, while IonQ’s trapped ion technology aims for high fidelity. Both companies face significant technological and market challenges. This comparative analysis provides a starting point for your research into Quantum Computing Investment. However, thorough due diligence and consultation with a financial advisor are crucial before investing in any quantum computing stock, including Rigetti and IonQ. Remember, investing in Quantum Computing is a high-risk, high-reward endeavor.

Featured Posts

-

Klopps Future Uncertain Agents Comments On Real Madrid Interest

May 21, 2025

Klopps Future Uncertain Agents Comments On Real Madrid Interest

May 21, 2025 -

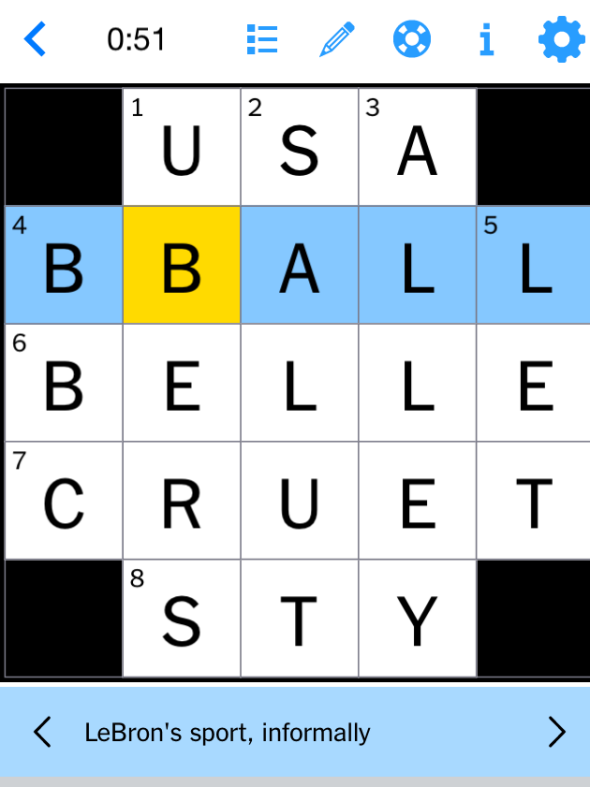

Solve The Nyt Crossword April 25 2025 Answers

May 21, 2025

Solve The Nyt Crossword April 25 2025 Answers

May 21, 2025 -

Abn Group Victoria Awards Media Account To Half Dome

May 21, 2025

Abn Group Victoria Awards Media Account To Half Dome

May 21, 2025 -

Why Giorgos Giakoumakis Mls Move Might Have Faltered

May 21, 2025

Why Giorgos Giakoumakis Mls Move Might Have Faltered

May 21, 2025 -

Breite Efimereyonta Giatro Stin Patra 10 And 11 Maioy

May 21, 2025

Breite Efimereyonta Giatro Stin Patra 10 And 11 Maioy

May 21, 2025

Latest Posts

-

Tory Councillors Wife Loses Appeal After Migrant Rant Following Southport Attack

May 22, 2025

Tory Councillors Wife Loses Appeal After Migrant Rant Following Southport Attack

May 22, 2025 -

Jail Term For Tory Councillors Wife Following Hotel Arson Tweet Appeal Update

May 22, 2025

Jail Term For Tory Councillors Wife Following Hotel Arson Tweet Appeal Update

May 22, 2025 -

Councillors Wifes Jail Sentence For Arson Tweet Appeal Awaits

May 22, 2025

Councillors Wifes Jail Sentence For Arson Tweet Appeal Awaits

May 22, 2025 -

El Desafio De Javier Baez Salud Y Rendimiento En Las Grandes Ligas

May 22, 2025

El Desafio De Javier Baez Salud Y Rendimiento En Las Grandes Ligas

May 22, 2025 -

Baez Busca Probar Su Salud Y Productividad En El 2024

May 22, 2025

Baez Busca Probar Su Salud Y Productividad En El 2024

May 22, 2025