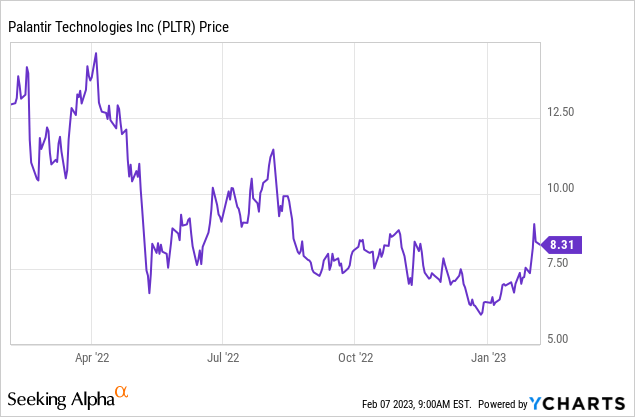

Investing In Palantir: Potential For 40% Growth In 2025?

Table of Contents

Palantir's Current Market Position and Financial Performance

Palantir, a leading big data analytics company, provides software platforms to government and commercial clients worldwide. Understanding its current financial health is crucial to evaluating the 40% growth prediction for 2025. Recent financial reports reveal a complex picture. While Palantir has demonstrated consistent revenue growth, profitability remains a key focus.

- Revenue Growth: Palantir has shown steady revenue growth over the past few years, indicating a strong demand for its data analytics solutions. However, the rate of growth needs to be assessed against the projected 40% target for 2025.

- Profit Margins: Analyzing profit margins will indicate the efficiency of Palantir's operations and its ability to translate revenue into profit. Improving margins will be vital for supporting a significant stock price increase.

- Market Share: Palantir holds a significant, though not dominant, share in the big data analytics market. Competition from established tech giants is fierce, and maintaining and expanding market share will be crucial for achieving the projected growth. Specific market share figures from reputable sources need to be incorporated here.

- Key Competitors: Companies like AWS, Microsoft, and Google Cloud Platform offer competing data analytics solutions. Palantir's competitive advantages lie in its specialized software designed for complex data analysis in government and commercial sectors.

Factors Contributing to Potential 40% Growth in 2025

Several factors could contribute to Palantir achieving a 40% stock price increase by 2025. These positive trends must be weighed against the inherent risks involved.

Increasing Government Contracts

Government contracts represent a significant portion of Palantir's revenue. Increased government spending on defense, intelligence, and cybersecurity could significantly boost Palantir's growth.

- Recent Contract Wins: Highlighting significant recent contract wins and their value would provide strong evidence of this growth driver.

- Projected Government Spending: Analyzing projections for government spending on relevant technologies and incorporating data from reputable sources is essential.

Expansion into the Commercial Sector

Palantir is actively expanding its commercial offerings across sectors like healthcare and finance. Success in this area could dramatically increase its revenue streams.

- Successful Commercial Partnerships: Examples of successful partnerships and their contributions to Palantir's revenue growth need to be cited.

- Market Growth in Target Sectors: Demonstrating the growth potential in the target sectors Palantir is entering is crucial to supporting the 40% growth prediction.

Technological Innovation and Product Development

Continuous innovation and new product development are essential for maintaining a competitive edge. Palantir's investment in R&D and its ability to launch cutting-edge products will significantly influence its future growth.

- New Product Launches: Recent product launches and their market reception must be reviewed and included.

- Patents and Cutting-Edge Technologies: Mentioning any patents or groundbreaking technologies under development will reinforce Palantir's commitment to innovation.

Risks and Challenges that Could Hinder Growth

Despite the potential for significant growth, several risks and challenges could hinder Palantir from achieving a 40% stock price increase by 2025.

Competition from Established Players

The big data analytics market is highly competitive. Established tech giants pose a significant threat to Palantir's market share.

- Key Competitors and Strengths: Listing key competitors (AWS, Microsoft Azure, Google Cloud) and their competitive strengths is crucial.

- Counter-Strategies: Discussing Palantir's strategies to counter competition, such as innovation and specialized solutions, is important.

Economic Uncertainty and Geopolitical Risks

Economic downturns or geopolitical instability could negatively impact Palantir's business, particularly its government contracts.

- Potential Economic Headwinds: Analyzing potential economic downturns and their likely impact on Palantir's revenue is crucial.

- Geopolitical Risks: Discussing specific geopolitical events that could affect Palantir's contracts or market access needs to be addressed.

Dependence on Large Contracts

Palantir's reliance on a few large, long-term contracts presents a significant risk. The loss of a major contract could severely impact its financial performance.

- Diversification Strategies: Examining Palantir's strategies to diversify its client base and mitigate this risk is important.

- Impact of Losing Major Contracts: Analyzing the potential consequences of losing a significant contract is crucial for a realistic assessment.

Conclusion: Investing in Palantir's Future – A Calculated Risk?

The potential for Palantir stock to achieve 40% growth by 2025 is intriguing, driven by potential growth in government and commercial sectors, and technological innovation. However, significant risks exist, including intense competition, economic uncertainty, and dependence on large contracts. Before investing in Palantir, consider the potential upside against these risks. Conduct your own thorough due diligence, examining financial statements, analyzing market trends, and understanding the competitive landscape. Remember to consult with a qualified financial advisor before making any investment decisions regarding Palantir. Investing in Palantir represents a calculated risk; careful analysis is key before committing your capital.

Featured Posts

-

News From The Bangkok Post Transgender Community Seeks Legal Reform

May 10, 2025

News From The Bangkok Post Transgender Community Seeks Legal Reform

May 10, 2025 -

Voters Guide Evaluating The Release Of Jeffrey Epstein Files By Attorney General Pam Bondi

May 10, 2025

Voters Guide Evaluating The Release Of Jeffrey Epstein Files By Attorney General Pam Bondi

May 10, 2025 -

Novoe Voennoe Soglashenie Frantsiya I Polsha Protivostoyat Rossii I S Sh A

May 10, 2025

Novoe Voennoe Soglashenie Frantsiya I Polsha Protivostoyat Rossii I S Sh A

May 10, 2025 -

Increased Scrutiny Of Asylum Claims Uk Targets Specific Nationalities

May 10, 2025

Increased Scrutiny Of Asylum Claims Uk Targets Specific Nationalities

May 10, 2025 -

Fusion Renaissance Modem Elisabeth Borne Clarifie La Ligne Gouvernementale

May 10, 2025

Fusion Renaissance Modem Elisabeth Borne Clarifie La Ligne Gouvernementale

May 10, 2025