Investing In Palantir Before May 5th: What Wall Street Thinks

Table of Contents

Wall Street's Current Sentiment Towards Palantir

Understanding Wall Street's current outlook on Palantir is crucial for any potential investor. Analyzing analyst ratings, price targets, and recent news provides a valuable snapshot of market sentiment regarding PLTR stock.

Analyst Ratings and Price Targets

Major investment banks offer various ratings and price targets for Palantir stock. These predictions provide insights into Wall Street's expectations for future PLTR stock performance. For example, Goldman Sachs recently maintained a Buy rating with a $15 price target, reflecting a bullish outlook. However, other firms may hold more conservative views.

- Bullish Sentiment: Many analysts highlight Palantir's strong government contracts and growing commercial business as key drivers for future growth, leading to bullish predictions.

- Bearish Sentiment: Some analysts express concerns about Palantir's profitability and the competitive landscape within the big data and analytics market, resulting in bearish outlooks.

- Neutral Sentiment: A segment of analysts maintains a neutral stance, citing uncertainty about the company's long-term growth trajectory and the impact of macroeconomic factors.

[Insert chart here showing distribution of analyst ratings (Buy, Hold, Sell).]

Recent News and Events Impacting Palantir's Stock Price

Recent news and events significantly influence Palantir's stock price. Understanding these factors is critical for assessing the potential for a surge or dip before May 5th.

- New Contracts and Partnerships: The securing of major government contracts or significant partnerships with private sector companies can trigger positive price movements for PLTR stock.

- Product Launches and Innovations: Successful product launches and technological advancements often lead to increased investor confidence and positive stock price reactions.

- Earnings Reports: Palantir's quarterly earnings reports provide insights into the company's financial health and future prospects, influencing investor decisions and consequently, stock price.

Key Factors to Consider Before Investing in Palantir

Before investing in Palantir, potential investors must carefully consider several key factors influencing the PLTR stock price and overall investment risk.

Palantir's Financial Performance and Growth Potential

Analyzing Palantir's financial performance is essential for evaluating its investment potential. Key metrics such as revenue growth, profitability, and debt levels provide crucial insights.

- Revenue Growth: Consistent and substantial revenue growth demonstrates Palantir's ability to secure contracts and expand its market share.

- Profitability: Reaching profitability signifies financial stability and sustainability, influencing investor confidence.

- Debt Levels: High debt levels can pose a risk and must be considered alongside other financial indicators.

- Market Position: Palantir's position within the competitive big data and analytics landscape is another critical factor influencing its growth trajectory.

Risks Associated with Investing in Palantir

Investing in Palantir, like any stock, carries inherent risks. Understanding these risks is crucial for informed decision-making.

- Market Volatility: The tech sector is known for its volatility, and PLTR stock is no exception. Market downturns can significantly impact the stock price.

- Competition: Palantir faces competition from established players in the big data and analytics market, potentially impacting its growth and market share.

- Regulatory Risks: Government regulations and compliance requirements can influence Palantir's operations and profitability.

- Diversification: It is crucial to remember that diversification is a key risk management strategy. Investing heavily in a single stock like Palantir can be risky.

Alternative Investment Strategies

While Palantir offers potential, considering alternative investment strategies is wise. Diversification minimizes risk and allows for a balanced investment portfolio.

Diversification Options

Diversifying your investments reduces overall portfolio risk. Consider investing in:

- Other Tech Stocks: Explore other promising technology companies to balance your exposure to the tech sector.

- Different Asset Classes: Diversify your portfolio across various asset classes, including bonds, real estate, and commodities.

Risk Management Strategies

Several strategies can help mitigate risk when investing in volatile stocks like Palantir:

- Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of the stock price, reducing the impact of volatility.

- Stop-Loss Orders: Set a stop-loss order to automatically sell your shares if the price falls below a predetermined level, limiting potential losses.

- Portfolio Diversification: Diversify your investments across different stocks, sectors, and asset classes to reduce the impact of individual stock price fluctuations.

Conclusion

This analysis of Wall Street's sentiment towards Palantir, considering its financial performance, risk factors, and upcoming announcements before May 5th, provides a framework for investors. While Palantir presents exciting growth potential, it's crucial to weigh the potential rewards against the inherent risks. Remember to conduct thorough due diligence and consider your own risk tolerance before making any investment decisions.

Call to Action: Weigh the factors discussed and make an informed decision about your Palantir (PLTR) investment strategy before May 5th. Remember to always consult with a financial advisor before investing. Don't miss out on the potential of Palantir – research and invest wisely!

Featured Posts

-

Beautiful Castle Near Manchester The Venue For Olly Murs Music Festival

May 10, 2025

Beautiful Castle Near Manchester The Venue For Olly Murs Music Festival

May 10, 2025 -

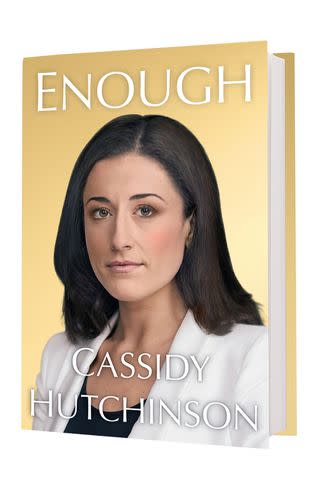

Cassidy Hutchinsons Memoir A Jan 6 Witness Tells All This Fall

May 10, 2025

Cassidy Hutchinsons Memoir A Jan 6 Witness Tells All This Fall

May 10, 2025 -

Vegas Golden Knights Defeat Wild In Overtime Thanks To Barbashev

May 10, 2025

Vegas Golden Knights Defeat Wild In Overtime Thanks To Barbashev

May 10, 2025 -

Once Rejected Now A Key Player For Europes Best Team

May 10, 2025

Once Rejected Now A Key Player For Europes Best Team

May 10, 2025 -

India Stock Market Today Sensex Nifty 50 Close Flat Amidst Volatility

May 10, 2025

India Stock Market Today Sensex Nifty 50 Close Flat Amidst Volatility

May 10, 2025