Investing In Growth: Identifying The Country's Promising Business Hotspots

Table of Contents

Did you know that strategic investment in specific geographic locations can yield returns up to 30% higher than average market performance? This isn't just luck; it's the result of understanding Investing in Growth: Identifying the Country's Promising Business Hotspots. Identifying these hotspots is crucial for investors seeking strong returns and mitigating risk. A thriving business environment is fueled by several interconnected factors: robust economic indicators, innovative industries, supportive government policies, and a favorable demographic landscape. This article will guide you through the process of identifying such locations within the country, helping you make informed investment decisions.

2. Main Points:

H2: Analyzing Economic Indicators for High-Growth Areas:

H3: GDP Growth and Sectoral Performance: A strong indicator of a region's economic health is its GDP growth rate. Focus on sectors exhibiting exceptional performance, such as technology, renewable energy, or tourism, as these often drive significant economic expansion.

- Data Sources:

- Government websites (e.g., Ministry of Finance, National Statistical Office) provide official GDP data and sectoral breakdowns.

- Reputable economic reports from organizations like the World Bank, IMF, and private research firms offer in-depth analysis.

- Sectoral Analysis:

- The technology sector, particularly in areas with strong innovation ecosystems (discussed later), often shows high growth potential.

- Renewable energy is a rapidly expanding sector, driven by global sustainability initiatives and government incentives.

- Tourism hotspots benefit from increased international travel and domestic spending, resulting in substantial economic activity.

H3: Infrastructure Development and Accessibility: Robust infrastructure is essential for business growth. Regions with well-developed transportation networks, reliable communication systems, and efficient utilities attract investments and foster economic activity.

- Infrastructure Indicators:

- Assess road networks, rail connections, and port facilities to evaluate transportation efficiency.

- Analyze internet penetration rates and mobile network coverage to gauge communication infrastructure.

- Examine the availability of reliable electricity and water supplies.

- Impact of Infrastructure:

- Improved infrastructure significantly reduces logistics costs, enhancing business efficiency and profitability.

- Reliable infrastructure attracts foreign investment and fosters a positive business climate.

H2: Identifying Emerging Industries and Technological Advancements:

H3: Innovation Clusters and Startup Ecosystems: Regions with thriving startup ecosystems and innovation clusters are prime candidates for investment. These areas foster collaboration, innovation, and job creation.

- Identifying Clusters:

- Look for the presence of research universities, technology parks, and incubator programs that nurture innovation.

- Monitor venture capital activity and angel investor networks as indicators of a vibrant startup ecosystem.

- Positive Effects:

- A robust startup ecosystem drives economic diversification, creating new industries and job opportunities.

- These clusters often lead to the development of disruptive technologies and innovative business models.

H3: Technological Advancements Driving Growth: Emerging technologies like Artificial Intelligence (AI), Fintech, and sustainable technologies are transforming industries and creating significant investment opportunities in specific regions.

- Regional Impact:

- AI is rapidly impacting various sectors, from healthcare to finance, offering investment opportunities in AI-related companies and infrastructure.

- Fintech is revolutionizing financial services, creating new markets and business models, particularly in urban centers.

- Regions focused on sustainable technologies are benefiting from growing global demand for green energy solutions.

- Future Trends: Consider the long-term implications of these technologies when evaluating investment prospects; technological advancements often dictate future economic growth.

H2: Assessing the Regulatory Environment and Government Policies:

H3: Business-Friendly Regulations and Incentives: A supportive regulatory environment is vital for attracting investment. Regions with streamlined business registration processes, clear regulations, and attractive tax incentives are more attractive.

- Favorable Policies:

- Consult "Ease of Doing Business" rankings published by international organizations like the World Bank.

- Identify regions offering tax breaks, subsidies, and other incentives for specific industries.

- Government Support: Understanding government support programs and incentives is crucial for optimizing investment returns.

H3: Political Stability and Risk Assessment: Political stability is paramount. Conduct a thorough risk assessment, considering factors such as political climate, corruption levels, and potential social unrest.

- Risk Assessment Methods:

- Utilize political risk reports from reputable agencies.

- Consult with political risk experts to gain insights into the potential impact of political instability.

- Impact of Instability: Political instability can severely impact investment returns, potentially leading to losses.

H2: Understanding Demographic Trends and Consumer Behavior:

H3: Population Growth and Consumption Patterns: Analyze demographic trends like population growth, age distribution, and consumer spending habits to identify regions with strong consumer demand.

- Data Sources:

- Utilize census data and market research reports to understand consumer demographics and spending patterns.

- Market Understanding: A clear understanding of your target market and its consumption preferences is critical for successful investments.

H3: Labor Market Dynamics and Skilled Workforce: A skilled workforce is a key asset. Evaluate the availability of a skilled workforce and labor market dynamics to determine the region's productivity potential.

- Workforce Evaluation:

- Assess education levels, skill sets, and the availability of specialized talent in the region.

- Impact on Productivity: A skilled workforce directly contributes to higher business productivity and competitiveness.

3. Conclusion:

Successfully Investing in Growth: Identifying the Country's Promising Business Hotspots requires a multi-faceted approach. By carefully analyzing economic indicators, identifying emerging industries, assessing the regulatory environment, and understanding demographic trends, you can identify lucrative investment opportunities. Conduct thorough research, leveraging the strategies outlined in this article. To further enhance your understanding and discover more promising hotspots, consider consulting with financial advisors specializing in regional investment strategies. Don't miss out on the potential for significant returns; start your journey towards Investing in Growth: Identifying the Country's Promising Business Hotspots today.

1 26 000

1 26 000

The Walking Deads Negan In Fortnite Jeffrey Dean Morgan Speaks Out

The Walking Deads Negan In Fortnite Jeffrey Dean Morgan Speaks Out

Solving Fortnites Most Common Matchmaking Error

Solving Fortnites Most Common Matchmaking Error

Family Mourns The Loss Of Devoted Manchester United Fan Poppy A Touching Tribute

Family Mourns The Loss Of Devoted Manchester United Fan Poppy A Touching Tribute

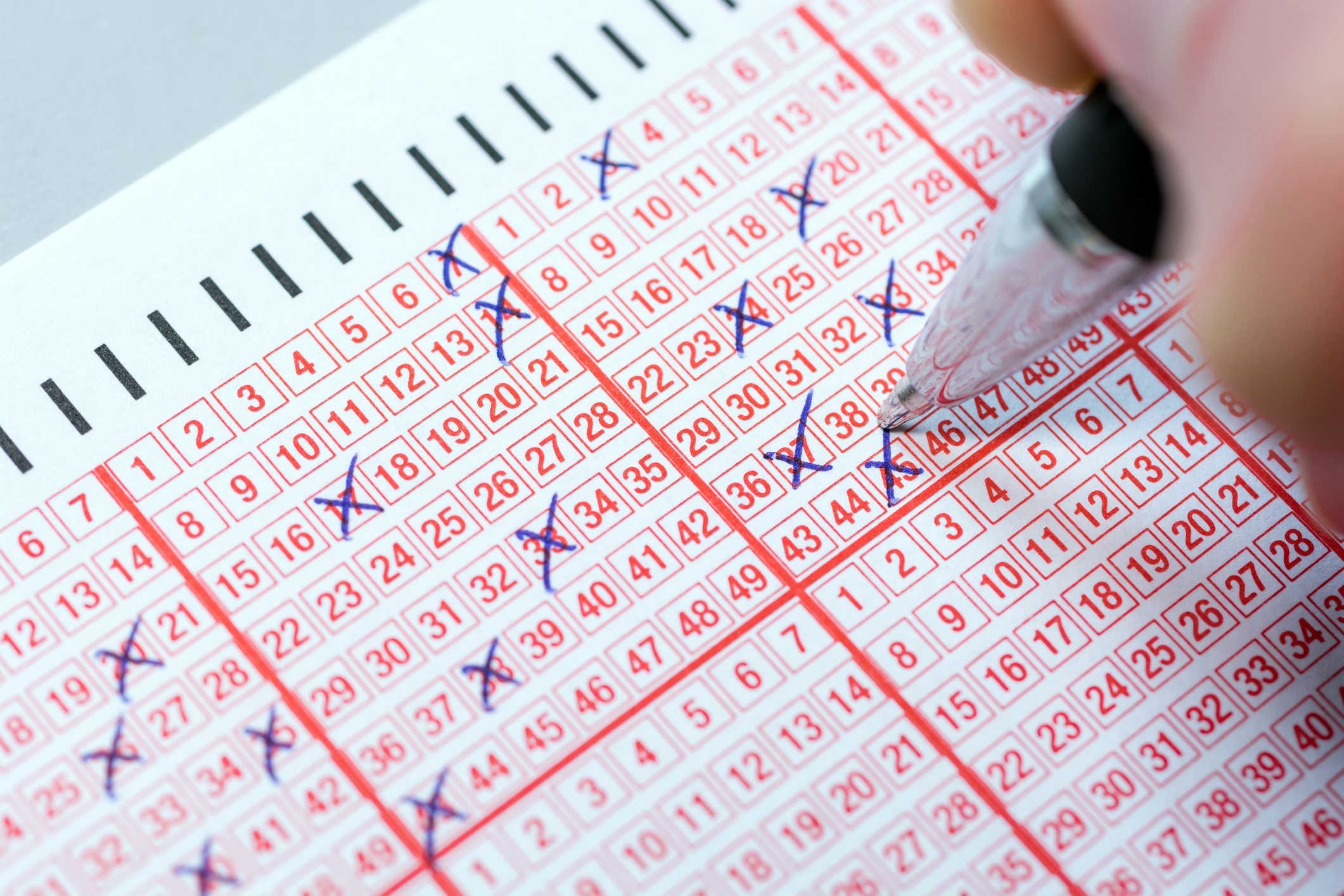

Daily Lotto Results Thursday 17th April 2025

Daily Lotto Results Thursday 17th April 2025