Investing In A Watch: Understanding Value And Resale Potential

Table of Contents

Identifying Valuable Watch Brands

Brand recognition is paramount when investing in a watch. The prestige associated with certain brands significantly impacts resale value. Top luxury watch brands known for their strong resale potential include Rolex, Patek Philippe, and Audemars Piguet. But what makes these brands so valuable?

- Heritage and Craftsmanship: These brands boast a long history of producing high-quality, meticulously crafted timepieces. Their legacy contributes significantly to their desirability and value retention.

- Exclusivity and Limited Production: Many models are produced in limited quantities, increasing their rarity and, consequently, their value. Waiting lists and limited availability further enhance their desirability.

- Technological Innovation: Some brands consistently push the boundaries of horological innovation, creating highly complex and technically advanced movements that command premium prices.

Beyond the established giants, there are also lesser-known brands with considerable potential for appreciation. Microbrands and independent watchmakers often offer unique designs and exceptional craftsmanship at more accessible price points, representing an interesting area for those investing in a watch. Examples include [mention specific microbrand examples here, linking to reputable sources if possible]. Researching these up-and-coming brands can yield significant returns for savvy investors. Specific models within these brands, especially limited editions, often experience disproportionate price increases.

Understanding the Impact of Watch Condition on Resale Value

The condition of a watch drastically affects its resale value. A pristine watch will fetch a significantly higher price compared to one with scratches, dents, or other imperfections. Maintaining your watch in excellent condition is crucial for maximizing your return when you decide to sell.

- Original Packaging and Documentation: The presence of the original box, papers, and warranty card adds considerable value and helps verify authenticity.

- Proper Care and Maintenance: Regular servicing by a qualified watchmaker is essential. This ensures the watch's accuracy and longevity, impacting its desirability. Avoid harsh chemicals and impacts to prevent damage.

- Professional Watch Servicing: A documented service history from an authorized service center is a significant asset when selling a high-value watch, demonstrating proper care and extending its lifespan.

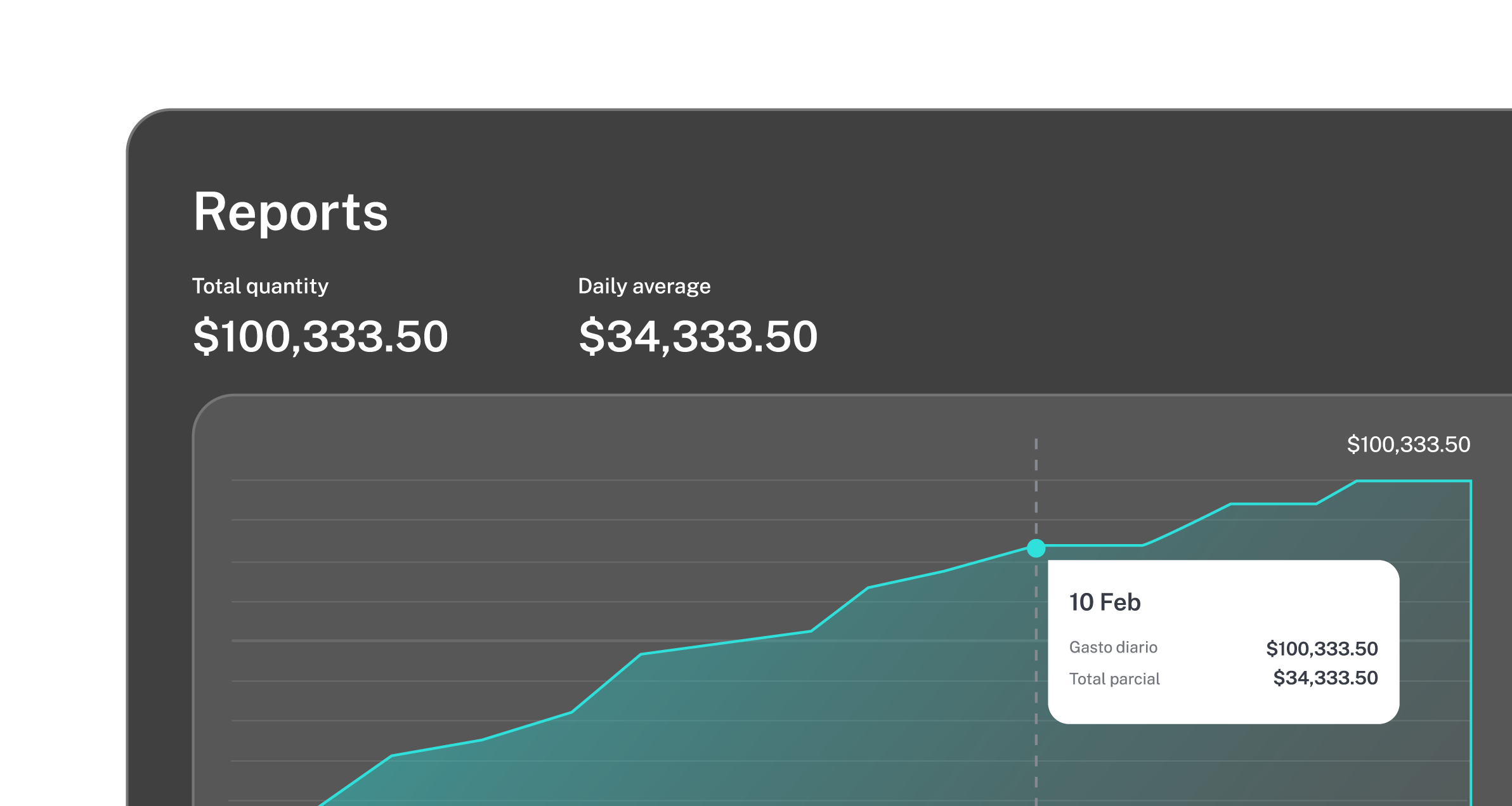

Market Trends and Their Influence on Watch Investment

The luxury watch market is dynamic, influenced by various factors that impact prices. Understanding these trends is critical for successful investing in a watch.

- Hype and Limited Editions: Limited-edition releases and those promoted by celebrities or influencers often experience substantial price increases driven by high demand.

- Supply and Demand: Like any collectible market, supply and demand play a crucial role. Scarcity drives up prices, while oversupply can lead to depreciation.

- Tracking Market Trends: Stay informed by following online forums dedicated to watches, analyzing auction results (e.g., Christie's, Sotheby's), and monitoring reputable watch news websites. This diligent tracking will help you understand current market sentiment and anticipate potential price fluctuations. Be aware, however, that highly speculative watches can carry significant risk.

Where to Buy and Sell Watches for Optimal Returns

Choosing the right platform for buying and selling watches is essential. Several options exist, each with advantages and disadvantages.

- Authorized Dealers: Offers peace of mind regarding authenticity but may come with a higher price tag.

- Reputable Online Marketplaces: Platforms like Chrono24 offer a wide selection but require careful vetting of sellers to ensure authenticity.

- Auctions: Can offer competitive prices but involve risks related to authenticity and potential hidden flaws.

When investing in a watch, remember these critical points:

- Authenticity Verification: Always verify the authenticity of a watch before purchasing, using a reputable source or professional appraiser if necessary.

- Price Negotiation: Develop strong negotiation skills to secure favorable prices, both when buying and selling.

- Fees and Commissions: Be aware of the fees and commissions associated with different platforms to avoid unexpected costs.

Conclusion

Successfully investing in a watch requires careful consideration of several key factors: brand reputation, meticulous maintenance to preserve the watch's condition, awareness of current market trends, and strategic selection of buying and selling platforms. Thorough research, due diligence, and a discerning eye are crucial for maximizing your return. Remember, investing in watches is not simply about acquiring a timepiece; it's about making informed decisions to build a valuable collection that will appreciate over time. Ready to explore the world of watch investment? Start your research today and discover the potential returns of investing in a watch.

Featured Posts

-

Tracker Season 2 Episode 18 Premiere Date Time And Where To Watch

May 27, 2025

Tracker Season 2 Episode 18 Premiere Date Time And Where To Watch

May 27, 2025 -

Gucci Cruise 2026 A Florentine Renaissance

May 27, 2025

Gucci Cruise 2026 A Florentine Renaissance

May 27, 2025 -

Where To Watch Bad Moms In Hd Comedy Central

May 27, 2025

Where To Watch Bad Moms In Hd Comedy Central

May 27, 2025 -

Gucci Re Web Gradient Blue Gg Supreme May 2025 Release 838949 Faev 58460

May 27, 2025

Gucci Re Web Gradient Blue Gg Supreme May 2025 Release 838949 Faev 58460

May 27, 2025 -

Ashton Kutcher And Mila Kuniss Beverly Hills Appearance After Venice Film Shoot

May 27, 2025

Ashton Kutcher And Mila Kuniss Beverly Hills Appearance After Venice Film Shoot

May 27, 2025

Latest Posts

-

Expert German Insight The Latest On Rayan Cherki

May 28, 2025

Expert German Insight The Latest On Rayan Cherki

May 28, 2025 -

Mart Ayinda Abd Tueketici Kredilerindeki Artis Nedenleri Ve Sonuclari

May 28, 2025

Mart Ayinda Abd Tueketici Kredilerindeki Artis Nedenleri Ve Sonuclari

May 28, 2025 -

Understanding The Terms Of Tribal Loans For Bad Credit

May 28, 2025

Understanding The Terms Of Tribal Loans For Bad Credit

May 28, 2025 -

Abd De Tueketici Kredilerinde Beklenmedik Artis

May 28, 2025

Abd De Tueketici Kredilerinde Beklenmedik Artis

May 28, 2025 -

Rayan Cherki A German Perspective On His Career

May 28, 2025

Rayan Cherki A German Perspective On His Career

May 28, 2025