Investigating The Fall: CoreWeave (CRWV) Stock Down On Tuesday

Table of Contents

Market Sentiment and Overall Market Downturn

Tuesday's downturn in CRWV stock wasn't an isolated incident. The broader market experienced a significant pullback, heavily impacting growth stocks, including those in the technology sector. This general negative market sentiment played a crucial role in CRWV's decline. The Nasdaq Composite, a key indicator of tech stock performance, also experienced a substantial drop, highlighting the correlation between the overall market health and CRWV's stock price.

- Correlation between CRWV and broader tech sector performance: CRWV, as a player in the cloud computing and AI infrastructure sectors, is highly sensitive to fluctuations in the overall tech market. Negative sentiment towards the tech industry generally impacts individual tech stocks, like CRWV.

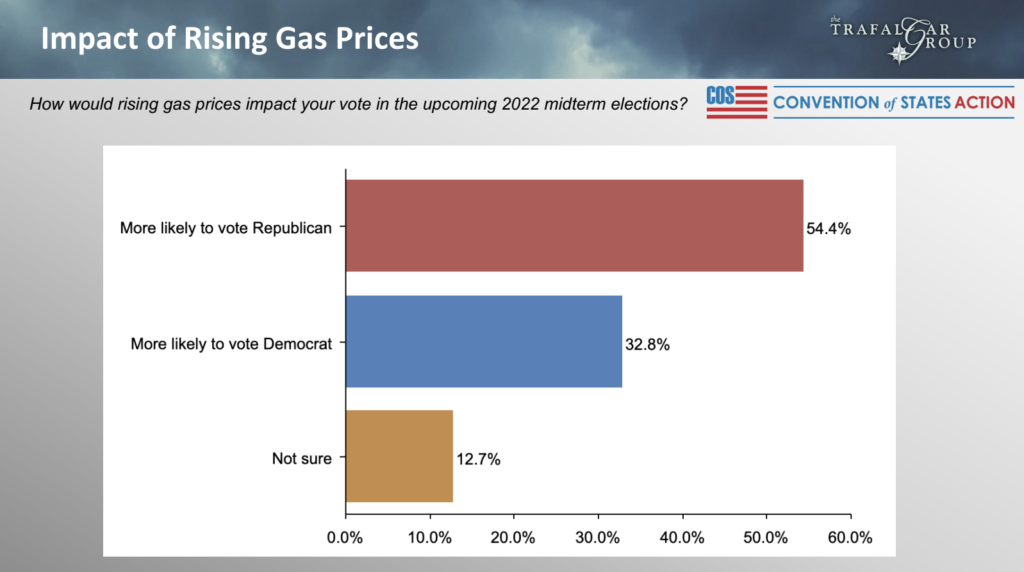

- Impact of rising interest rates or inflation concerns: Rising interest rates and persistent inflation concerns often lead to investors shifting away from riskier growth stocks, like CRWV, towards more conservative investments. This risk aversion contributed to the selling pressure observed on Tuesday.

- Analysis of investor sentiment and trading volume on Tuesday: High trading volume on Tuesday suggests significant investor activity, with many likely selling their CRWV shares due to the prevailing negative market sentiment and concerns about the company's future prospects.

Analysis of CRWV's Recent Financial Performance and News

While the broader market downturn played a significant role, it's crucial to examine CoreWeave's recent financial performance and any news that might have contributed to the stock decline. Any negative news, even unrelated to the company's core operations, can significantly impact investor confidence and stock price.

- Review of recent quarterly earnings reports: A closer look at CoreWeave's most recent quarterly earnings report is essential. Did the company meet or exceed analyst expectations? Any significant deviation from expectations can cause stock price volatility.

- Mention of any press releases or news articles affecting CRWV: Any negative press releases or news articles concerning the company, its leadership, or its operations could have triggered selling pressure among investors. Scrutinizing recent news coverage is vital.

- Analysis of any recent analyst ratings or price target changes: Downgrades from analysts or significant reductions in price targets often signal negative sentiment and can contribute to stock price declines. Tracking analyst ratings and price target adjustments is crucial for understanding market perceptions of CRWV.

Competitive Landscape and Industry Factors

CoreWeave operates in a highly competitive market dominated by established giants like Amazon Web Services (AWS), Google Cloud, and Microsoft Azure. The actions and performance of these competitors can significantly influence CRWV's stock price.

- Comparison with key competitors (e.g., AWS, Google Cloud, Microsoft Azure): Analyzing the performance and market share of CRWV's main competitors offers valuable context. Strong performance from competitors could lead to increased investor preference for these established players, potentially at the expense of CRWV.

- Analysis of market share trends and competitive pressures: Assessing the overall competitive landscape and identifying any shifts in market share can reveal potential challenges or opportunities for CRWV. Increased competitive pressure often impacts a company's stock valuation.

- Discussion of any significant technological advancements affecting the industry: Rapid technological advancements in the cloud computing and AI infrastructure sectors can create winners and losers. If competitors introduce innovative technologies that outperform CRWV's offerings, it could negatively impact investor sentiment.

Technical Analysis of CRWV Stock Chart

A technical analysis of CRWV's stock chart from Tuesday's trading session provides additional insights into the decline. Looking at key support and resistance levels and chart patterns can help explain the price movement.

- Mention of relevant chart patterns (e.g., head and shoulders, double top): Certain chart patterns can signal potential price reversals or further declines. Identifying such patterns could indicate underlying technical factors behind the stock price drop.

- Analysis of trading volume and price action: High trading volume accompanied by a significant price drop reinforces the intensity of the selling pressure on Tuesday. Analyzing price action in relation to volume helps confirm the strength of the downward trend.

- Mention of any technical indicators (e.g., RSI, MACD): Technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can provide signals about overbought or oversold conditions, potentially explaining the price movement.

Understanding the CoreWeave (CRWV) Stock Dip and Future Outlook

Tuesday's decline in CRWV stock price was likely a result of a confluence of factors: a broader market downturn impacting investor sentiment towards growth stocks, potential concerns related to CoreWeave's financial performance or news, competitive pressures within the cloud computing and AI infrastructure market, and technical indicators suggesting a downward trend. While it's impossible to predict the future with certainty, investors should continue monitoring CRWV's performance closely, conducting thorough research, and staying updated on news and developments in the cloud computing and AI sectors. A diversified investment strategy is always recommended to mitigate risk. To make informed decisions regarding CRWV, conduct further CoreWeave stock analysis, develop a robust CRWV investment strategy, and diligently monitor CRWV. Understanding the intricacies of cloud computing investment is essential for navigating this dynamic market.

Featured Posts

-

Southern French Alps Weather Update Late Season Snow And Storms

May 22, 2025

Southern French Alps Weather Update Late Season Snow And Storms

May 22, 2025 -

Core Weave Inc Crwv Explaining Last Weeks Significant Stock Increase

May 22, 2025

Core Weave Inc Crwv Explaining Last Weeks Significant Stock Increase

May 22, 2025 -

National Average Gas Price Dips Below 3 Amidst Economic Worries

May 22, 2025

National Average Gas Price Dips Below 3 Amidst Economic Worries

May 22, 2025 -

The Costco Campaign And Saskatchewan Politics A Panel Discussion

May 22, 2025

The Costco Campaign And Saskatchewan Politics A Panel Discussion

May 22, 2025 -

Bgt Judge David Walliams His Exit And The Aftermath

May 22, 2025

Bgt Judge David Walliams His Exit And The Aftermath

May 22, 2025

Latest Posts

-

Wordle Today 370 March 20 Hints Clues And The Answer

May 22, 2025

Wordle Today 370 March 20 Hints Clues And The Answer

May 22, 2025 -

Todays Wordle Puzzle March 26 Nyt Wordle Solution

May 22, 2025

Todays Wordle Puzzle March 26 Nyt Wordle Solution

May 22, 2025 -

Solving Todays Nyt Wordle March 26 Hints And Answer

May 22, 2025

Solving Todays Nyt Wordle March 26 Hints And Answer

May 22, 2025 -

Todays Wordle March 26 Nyt Wordle Answer And Hints

May 22, 2025

Todays Wordle March 26 Nyt Wordle Answer And Hints

May 22, 2025 -

March 26 Wordle Answer Todays Nyt Wordle Word

May 22, 2025

March 26 Wordle Answer Todays Nyt Wordle Word

May 22, 2025