ING Group's 2024 Form 20-F Filing: A Comprehensive Overview

Table of Contents

Key Financial Highlights from ING Group's 2024 Form 20-F

This section delves into the core financial figures presented in ING Group's 2024 20-F report, offering a detailed analysis of the company's financial performance. We'll compare these results to previous years to identify significant trends and assess the overall health of the business.

Revenue and Profitability

ING Group's 2024 20-F filing will reveal crucial data on revenue and profitability. Analyzing year-over-year changes provides a clear picture of the company's financial trajectory.

- Revenue Streams: Expect a breakdown of revenue across key segments:

- Wholesale Banking (likely showing figures for trading, lending, and other wholesale activities).

- Retail Banking (including mortgage lending, deposits, and consumer banking services).

- Insurance (detailing premium income and claims).

- Asset Management (showing performance of investment products and funds under management).

- Profitability Metrics: Key metrics to watch for include:

- Net Income: Overall profitability after all expenses.

- Return on Equity (ROE): A measure of how effectively the company uses shareholder investment.

- Return on Assets (ROA): A measure of how efficiently the company uses its assets to generate profit. Year-over-year comparisons will be crucial to understanding trends.

Asset and Liability Management

The 20-F will provide detailed information on ING Group's balance sheet, offering insight into its asset and liability management.

- Asset Composition: The report will reveal the breakdown of ING's assets, including:

- Loans and advances to customers.

- Investment securities.

- Other assets. Significant changes in asset composition should be noted and analyzed.

- Capital Adequacy: Key capital ratios will be crucial indicators of financial strength:

- Tier 1 Capital Ratio: A key measure of a bank's ability to absorb losses.

- Total Capital Ratio: A broader measure of capital adequacy. These ratios should be compared to regulatory requirements and industry benchmarks.

Risk Management and Compliance

The 20-F filing will highlight ING Group's approach to risk management and compliance, a crucial aspect for investors.

- Key Risk Factors: The report will likely discuss several key risk factors, such as:

- Credit risk (the risk of borrowers defaulting on loans).

- Market risk (risks associated with fluctuations in market prices).

- Operational risk (risks associated with internal processes and systems).

- Regulatory risk (risks associated with changes in regulations).

- Regulatory Compliance: The 20-F will showcase ING's adherence to relevant regulations and any material issues encountered. Transparency regarding compliance is key for assessing the long-term sustainability of the business.

Operational Performance and Strategic Initiatives

This section examines ING Group's operational performance across its various business segments and its strategic outlook.

Business Segment Performance

ING's 20-F will offer a detailed performance review of its core business segments. Analyzing these segments will show the relative strengths and weaknesses within the organization.

- Wholesale Banking Performance: Expect data on trading revenue, lending activities, and profitability within this division.

- Retail Banking Performance: The filing will detail growth in customer accounts, mortgage lending, and profitability within the retail segment.

- Insurance Performance: Key metrics here will include premium income, claims, and underwriting profitability.

- Asset Management Performance: This segment's performance will be judged on assets under management and investment returns.

Strategic Outlook and Future Plans

The 20-F provides valuable insight into ING Group's strategic priorities and future plans.

- Key Strategic Initiatives: The document will likely outline key initiatives such as digital transformation, expansion into new markets, or new product development.

- Management Outlook: The management's commentary on the outlook for future performance provides invaluable insight into their expectations and potential challenges.

Analyzing the 20-F: Implications for Investors

This section interprets the data presented in the ING Group 20-F and analyzes its implications for investors.

Investment Implications

The insights from the 20-F provide several key takeaways for investors.

- Key Takeaways: Summarize the key financial highlights, operational trends, and risk assessment from the report.

- Investment Opportunities and Risks: Based on the analysis, pinpoint potential opportunities and risks associated with investing in ING Group.

Comparison to Competitors

A comparative analysis with key competitors provides valuable context for understanding ING's position in the market.

- Key Metrics Comparison: Compare key financial metrics such as ROE, ROA, and revenue growth with leading competitors.

- Competitive Advantages and Disadvantages: Identify ING's strengths and weaknesses compared to its main competitors.

Conclusion

ING Group's 2024 Form 20-F filing provides a comprehensive overview of the company's financial performance, operational efficiency, and strategic direction. A thorough analysis of the 20-F report reveals key financial highlights, including revenue streams, profitability metrics, and asset and liability management details. The report further highlights operational performance across various business segments, strategic priorities, and the overall outlook. For a complete understanding of ING Group's financial performance and strategic direction, access the full 2024 Form 20-F filing directly from the SEC website. Stay informed on ING Group's financial health by regularly reviewing their future 20-F filings and other financial statements.

Featured Posts

-

American Couple Arrested In Uk Following Bbc Antiques Roadshow Episode

May 22, 2025

American Couple Arrested In Uk Following Bbc Antiques Roadshow Episode

May 22, 2025 -

Huizenmarktprognose Abn Amro Stijgende Prijzen Dalende Rente

May 22, 2025

Huizenmarktprognose Abn Amro Stijgende Prijzen Dalende Rente

May 22, 2025 -

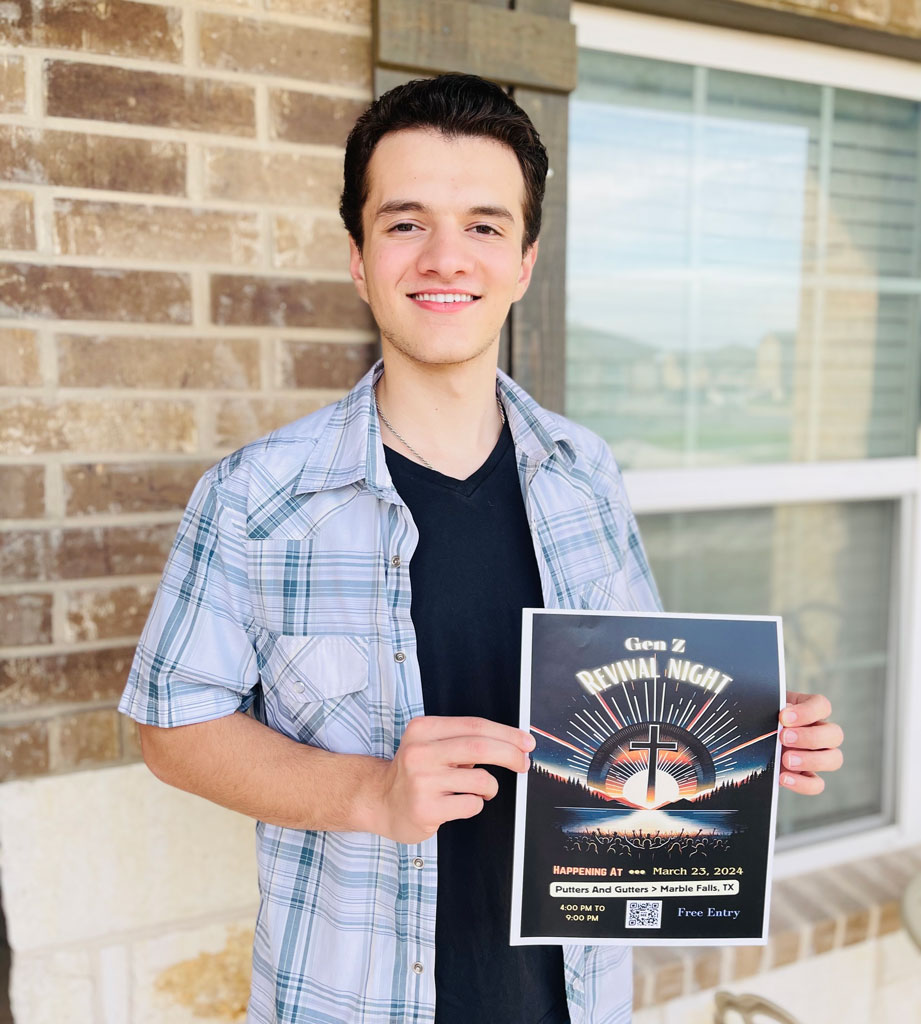

Little Britain A Gen Z Revival Exploring Its Continued Popularity

May 22, 2025

Little Britain A Gen Z Revival Exploring Its Continued Popularity

May 22, 2025 -

Peppa Pig And Her Baby Sister A Family Update

May 22, 2025

Peppa Pig And Her Baby Sister A Family Update

May 22, 2025 -

Premier League 2024 25 Champions Image Gallery

May 22, 2025

Premier League 2024 25 Champions Image Gallery

May 22, 2025

Latest Posts

-

Antiques Roadshow Couples Appraisal Results In Serious Charges

May 22, 2025

Antiques Roadshow Couples Appraisal Results In Serious Charges

May 22, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Ends In Arrest

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Ends In Arrest

May 22, 2025 -

Antiques Roadshow Stolen Goods Discovery Leads To Arrests

May 22, 2025

Antiques Roadshow Stolen Goods Discovery Leads To Arrests

May 22, 2025 -

Antiques Roadshow Couple Arrested After National Treasure Appraisal

May 22, 2025

Antiques Roadshow Couple Arrested After National Treasure Appraisal

May 22, 2025 -

Appraisal On Antiques Roadshow Results In Jail Sentences

May 22, 2025

Appraisal On Antiques Roadshow Results In Jail Sentences

May 22, 2025