ING Group Publishes 2024 Financial Results: Form 20-F Analysis

Table of Contents

Revenue and Profitability Analysis: Deconstructing ING Group's 2024 Performance

ING Group's 2024 financial results showcase a complex picture of performance across its various segments. Analyzing the revenue streams and profitability metrics provides a clearer understanding of the company's overall financial health.

Revenue Breakdown by Segment: Navigating ING Group's diverse income streams

ING Group's revenue is derived from a diverse range of operations. Let's examine the key revenue generating segments:

-

Wholesale Banking: This segment, traditionally a significant contributor to ING's revenue, experienced [insert percentage change]% growth in 2024, reaching [insert revenue figure]. This growth can be attributed to [insert specific factors, e.g., increased trading activity, successful debt issuance]. Keywords: ING Group revenue, Wholesale Banking revenue, 2024 financial results, segment performance.

-

Retail Banking: The Retail Banking segment showed [insert percentage change]% growth, reaching [insert revenue figure]. Key drivers include [insert specific factors, e.g., increased mortgage lending, growth in customer deposits]. Keywords: ING Group revenue, Retail Banking revenue, 2024 financial results, segment performance.

-

Other segments: [Analyze other relevant segments, providing similar detail as above].

Profitability Metrics: A deeper look at ING Group's financial performance

Examining key profitability indicators provides a crucial insight into ING's financial health and efficiency.

-

Net Income: ING Group reported a net income of [insert figure] for 2024, representing a [insert percentage change]% change compared to 2023. This change is largely attributable to [insert specific factors, e.g., changes in revenue streams, cost-cutting measures]. Keywords: ING Group profit, net income, 2024 financial results, profitability analysis.

-

Earnings Per Share (EPS): The EPS for 2024 stands at [insert figure], showcasing [insert interpretation of the EPS change compared to previous year]. Keywords: ING Group EPS, earnings per share, 2024 financial results, profitability analysis.

-

Return on Equity (ROE): The ROE for 2024 is [insert figure]%, indicating [insert analysis of the ROE and its implications for shareholder returns]. Keywords: ING Group ROE, return on equity, 2024 financial results, profitability analysis.

Risk Factors and Regulatory Compliance: Assessing ING's 2024 Exposure

The Form 20-F highlights several key risk factors that could potentially impact ING Group's financial performance. Understanding these risks and ING's mitigation strategies is vital.

Key Risk Factors Identified in the Form 20-F

ING Group's 2024 Form 20-F identifies several significant risks:

-

Credit Risk: ING's exposure to credit risk is [insert description and quantification of the risk]. Mitigation strategies include [insert details of the mitigation strategies employed]. Keywords: ING Group risk, credit risk, Form 20-F risk factors, financial risk management.

-

Market Risk: Fluctuations in financial markets pose a significant risk to ING's profitability. The company's exposure is [insert description and quantification of the risk], with mitigation strategies including [insert details]. Keywords: ING Group risk, market risk, Form 20-F risk factors, financial risk management.

-

Operational Risk: Operational risks, including cybersecurity threats and disruptions, are also significant concerns. [Insert description and quantification of the risk and details of mitigation strategies]. Keywords: ING Group risk, operational risk, Form 20-F risk factors, financial risk management.

Compliance with Regulatory Requirements

ING Group operates under a stringent regulatory environment. The Form 20-F indicates that the company is [insert statement regarding compliance]. Any reported violations or penalties should be discussed here. Keywords: ING Group compliance, regulatory reporting, Form 20-F compliance.

Capitalization and Liquidity: A Look at ING Group's Financial Strength

Analyzing ING Group's capitalization and liquidity positions provides insights into its overall financial strength and stability.

Capital Adequacy Ratios

Key capital adequacy ratios provide insights into ING's ability to absorb potential losses:

- Tier 1 Capital Ratio: ING Group's Tier 1 capital ratio stands at [insert figure]%, exceeding regulatory requirements and indicating a strong capital position. Keywords: ING Group capital, capital adequacy, Tier 1 capital, liquidity.

Liquidity Position

ING Group's liquidity position reflects its ability to meet short-term obligations.

- Liquidity Coverage Ratio (LCR): [Insert data on LCR and analysis of the liquidity position]. Keywords: ING Group liquidity, short-term funding, long-term funding, financial stability.

Conclusion: Key Takeaways from ING Group's 2024 Form 20-F Filing

ING Group's 2024 Form 20-F reveals a mixed performance. While revenue growth across certain segments is encouraging, careful consideration of identified risks is essential. The strong capital position and liquidity offer reassurance of financial stability. Further analysis of specific segments and risk factors is recommended. For a deeper dive into ING Group's 2024 financial performance, download the complete Form 20-F filing and conduct your own in-depth analysis of ING Group's 2024 financial results.

Featured Posts

-

Cassis Blackcurrant Uses Benefits And Production

May 21, 2025

Cassis Blackcurrant Uses Benefits And Production

May 21, 2025 -

Podcast Production Revolution Ai Digestion Of Repetitive Scatological Documents

May 21, 2025

Podcast Production Revolution Ai Digestion Of Repetitive Scatological Documents

May 21, 2025 -

Chinas Orbital Supercomputer Technological Advancement And Challenges

May 21, 2025

Chinas Orbital Supercomputer Technological Advancement And Challenges

May 21, 2025 -

Gumballs New Home Hulu And Disney

May 21, 2025

Gumballs New Home Hulu And Disney

May 21, 2025 -

Capturing Cannes The Photographic Legacy Of The Traverso Family

May 21, 2025

Capturing Cannes The Photographic Legacy Of The Traverso Family

May 21, 2025

Latest Posts

-

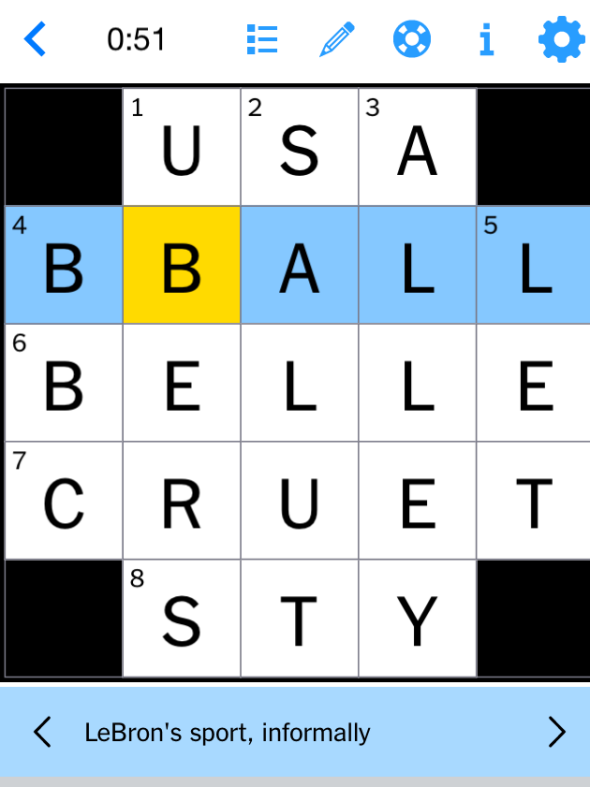

Nyt Mini Crossword Solutions March 13 Puzzle And Solving Guide

May 21, 2025

Nyt Mini Crossword Solutions March 13 Puzzle And Solving Guide

May 21, 2025 -

Canadas Response To Oxford Report Us Tariffs Largely Unchanged

May 21, 2025

Canadas Response To Oxford Report Us Tariffs Largely Unchanged

May 21, 2025 -

Metas Monopoly Trial Ftc Defense Strategy

May 21, 2025

Metas Monopoly Trial Ftc Defense Strategy

May 21, 2025 -

Dispute Over Us Tariffs Canada Challenges Oxford Report Conclusions

May 21, 2025

Dispute Over Us Tariffs Canada Challenges Oxford Report Conclusions

May 21, 2025 -

Fp Video Assessing The Economic Effects Of Recent Tariff Changes

May 21, 2025

Fp Video Assessing The Economic Effects Of Recent Tariff Changes

May 21, 2025