ING Group 2024 Annual Report: Key Highlights From Form 20-F

Table of Contents

Financial Performance Overview: Revenue, Profitability, and Key Metrics

ING Group's 2024 financial performance reflects a year of [positive/negative - replace with actual data from the report] growth and significant developments within the financial markets. Analyzing key financial metrics provides a comprehensive understanding of the company's financial health.

- Revenue Growth: ING Group reported [insert actual revenue figures and percentage change from 2023]. This growth/decline can be attributed to [mention key factors impacting revenue, e.g., market conditions, specific business strategies].

- Net Income: The net income for 2024 was [insert actual figures and percentage change]. This indicates [positive or negative] profitability compared to the previous year.

- Earnings Per Share (EPS): The EPS for 2024 was [insert actual figures], showing a [positive or negative] change compared to [previous year]. This is a crucial metric for evaluating shareholder returns.

- Return on Equity (ROE): ING Group’s ROE stood at [insert actual figures] in 2024, reflecting [positive or negative] performance in utilizing shareholder equity to generate profits. This compares to [previous year's ROE].

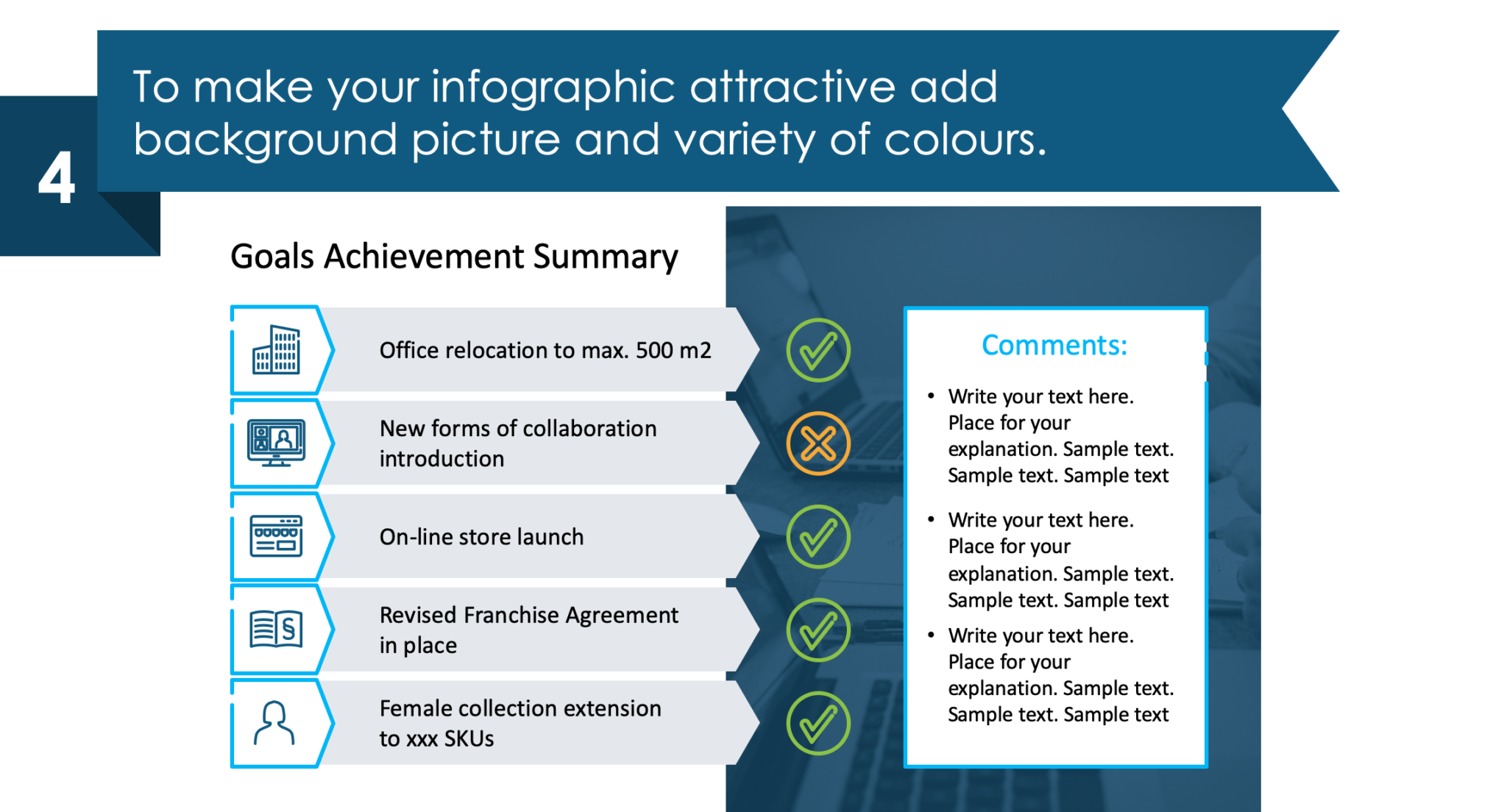

[Insert a chart or graph visually representing the revenue, net income, EPS, and ROE data for comparison across 2022, 2023 and 2024. This enhances readability and understanding.] Key terms like ING Group financial results, revenue growth, net income, EPS, ROE, financial performance analysis, and year-over-year comparison are crucial for SEO purposes.

Segment Performance: A Deep Dive into ING's Business Units

ING Group operates across various business segments, each contributing differently to the overall financial performance. Analyzing individual segment performance provides a more granular understanding of the company's strengths and weaknesses.

- Wholesale Banking: This segment reported [insert key performance indicators like revenue, profit, and market share]. [Discuss any noteworthy achievements or challenges].

- Retail Banking: Performance in Retail Banking was characterized by [mention key highlights, e.g., growth in customer base, loan origination, etc.]. [Discuss any significant changes in market share or customer acquisition].

- Investment Management: The Investment Management segment showcased [insert key performance data, e.g., assets under management, investment returns]. [Discuss performance relative to market benchmarks].

[Consider adding a table summarizing the key performance indicators for each segment for improved readability.] Relevant keywords for this section include: ING Wholesale Banking, ING Retail Banking, ING Investment Management, segment performance, and business unit analysis.

Risk Management and Regulatory Compliance: Navigating the Financial Landscape

Effective risk management and regulatory compliance are critical for a financial institution like ING Group. The 2024 Form 20-F provides insights into their approach.

- Risk Management Framework: ING Group's risk management framework focuses on [mention key risk areas addressed, e.g., credit risk, market risk, operational risk, liquidity risk]. [Describe their mitigation strategies].

- Regulatory Compliance: The report highlights ING Group's commitment to complying with [mention relevant regulations and legislation]. [Discuss any significant regulatory changes and their impact].

- Risk Exposure: ING Group's exposure to various risks is discussed in the report, providing transparency on potential vulnerabilities. [Mention any significant risks highlighted and the measures taken to manage them].

Keywords for this section are: ING risk management, regulatory compliance, financial risk, credit risk, market risk, operational risk, and compliance framework.

Outlook and Future Prospects: ING Group's Strategic Direction

The 2024 Form 20-F offers glimpses into ING Group's strategic direction and future prospects.

- Strategic Priorities: ING Group's strategic priorities for the coming years include [mention key strategic initiatives, e.g., digital transformation, expansion into new markets, sustainable finance].

- Investment Plans: The report may detail planned investments in [mention areas of investment, e.g., technology, infrastructure, new business lines].

- Challenges and Opportunities: The company acknowledges [mention key challenges faced, e.g., macroeconomic uncertainty, competition]. Simultaneously, they highlight opportunities in [mention key growth areas].

Keywords for this section are: ING Group future outlook, strategic direction, business strategy, investment plans, future growth, challenges, and opportunities.

Conclusion: Key Takeaways from the ING Group 2024 Form 20-F

The ING Group 2024 Form 20-F reveals a year of [summarize overall performance: growth, stability, or challenges]. Key highlights include [mention 2-3 key financial achievements or challenges]. The company's strategic direction points towards [mention key strategic goals and initiatives]. While challenges remain in the dynamic financial landscape, ING Group's robust risk management framework and focus on innovation position them for future growth. For a complete understanding of ING Group's 2024 performance, download the full Form 20-F [insert link to the report if available]. Dive deeper into the details of the ING Group 2024 Annual Report to gain a comprehensive understanding of their financial performance and future outlook.

Featured Posts

-

Vanja Mijatovic Razlozi Za Promenu Imena

May 22, 2025

Vanja Mijatovic Razlozi Za Promenu Imena

May 22, 2025 -

Debat Litteraire Les Grands Fusains De Boulemane De Abdelkebir Rabi Au Book Club Le Matin

May 22, 2025

Debat Litteraire Les Grands Fusains De Boulemane De Abdelkebir Rabi Au Book Club Le Matin

May 22, 2025 -

Activite Des Cordistes A Nantes Impact De L Essor Des Grandes Tours

May 22, 2025

Activite Des Cordistes A Nantes Impact De L Essor Des Grandes Tours

May 22, 2025 -

Defilarea Fratilor Tate Prin Bucuresti Video Cu Bolidul De Lux

May 22, 2025

Defilarea Fratilor Tate Prin Bucuresti Video Cu Bolidul De Lux

May 22, 2025 -

Paris Dans Le Viseur Stephane La Nouvelle Voix De La Suisse Romande

May 22, 2025

Paris Dans Le Viseur Stephane La Nouvelle Voix De La Suisse Romande

May 22, 2025

Latest Posts

-

Antiques Roadshow Couples Appraisal Results In Serious Charges

May 22, 2025

Antiques Roadshow Couples Appraisal Results In Serious Charges

May 22, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Ends In Arrest

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Ends In Arrest

May 22, 2025 -

Antiques Roadshow Stolen Goods Discovery Leads To Arrests

May 22, 2025

Antiques Roadshow Stolen Goods Discovery Leads To Arrests

May 22, 2025 -

Antiques Roadshow Couple Arrested After National Treasure Appraisal

May 22, 2025

Antiques Roadshow Couple Arrested After National Treasure Appraisal

May 22, 2025 -

Appraisal On Antiques Roadshow Results In Jail Sentences

May 22, 2025

Appraisal On Antiques Roadshow Results In Jail Sentences

May 22, 2025