ING Group 2024 Annual Report (Form 20-F) Released

Table of Contents

ING Group's 2024 Financial Performance: A Detailed Look at Key Metrics

This section examines the core financial performance of ING Group as detailed in its 2024 Form 20-F filing. We will analyze key metrics to assess the company's financial health and stability.

Revenue and Net Profit:

The ING Group 2024 Annual Report revealed [Insert actual figures from the report here - e.g., a total revenue of €X billion and a net profit of €Y billion]. This represents [Insert percentage change compared to the previous year - e.g., a Y% increase in net profit] compared to 2023. This growth can be attributed to several factors, including:

- Strong performance in [mention specific high-performing segments, e.g., retail banking in specific regions].

- Successful implementation of [mention specific initiatives that boosted revenue, e.g., new digital banking solutions].

- Improved efficiency and cost management resulting in higher profit margins.

Analyzing revenue streams shows a [describe the distribution of revenue across segments - e.g., balanced distribution across wholesale and retail banking]. Profit margins also show [mention trends in profit margins - e.g., a slight improvement compared to the previous year]. These figures, when compared to industry benchmarks, position ING Group [describe ING's position compared to competitors - e.g., competitively in the European banking sector].

Key Performance Indicators (KPIs): Assessing ING's Success

Understanding ING's performance requires looking beyond just revenue and profit. Key Performance Indicators (KPIs) provide a more nuanced picture. The 2024 report highlights:

- Return on Equity (ROE): [Insert reported ROE and analysis – e.g., an ROE of X%, indicating a strong return on shareholder investment].

- Cost-to-Income Ratio: [Insert reported ratio and analysis – e.g., a cost-to-income ratio of Y%, demonstrating improved efficiency].

- Other relevant KPIs: [Include other important KPIs mentioned in the report and their analysis].

These KPIs showcase ING's [overall assessment of performance based on KPIs - e.g., strong operational efficiency and profitability].

Segment Performance Analysis:

ING operates across various segments, including Wholesale Banking, Retail Banking, and others. The 2024 report details the performance of each:

- Wholesale Banking: [Describe performance - e.g., experienced robust growth in investment banking activities].

- Retail Banking: [Describe performance - e.g., saw steady growth driven by strong mortgage lending and digital banking adoption].

- Other Segments: [Analyze other segments’ performance].

This segment-wise analysis shows ING's strengths lie in [mention specific segments where ING excelled] while areas needing further attention include [mention areas needing improvement].

Risk Management and Regulatory Compliance in the ING Group 2024 Report

The ING Group 2024 Annual Report (Form 20-F) dedicates significant attention to risk management and regulatory compliance.

Risk Factors Discussed:

The 20-F filing meticulously outlines various risk factors, including:

- Credit Risk: [Describe ING's approach to credit risk management].

- Market Risk: [Describe ING's strategies to mitigate market risks].

- Operational Risk: [Describe ING's measures to control operational risks].

- Regulatory Risk: [Describe ING's approach to navigating regulatory changes].

Understanding these risk factors is crucial for evaluating the overall financial health and stability of the company.

Regulatory Compliance and Governance:

ING's commitment to regulatory compliance and robust corporate governance is evident in the report. [Mention specific details from the report on regulatory adherence and governance practices]. The company highlights its ongoing efforts in [mention initiatives related to compliance and governance]. This focus on sustainability reporting and ethical business practices further underscores ING’s dedication to responsible financial operations.

Future Outlook and Strategic Initiatives in the ING Group 2024 Report (Form 20-F)

The ING Group 2024 Annual Report provides valuable insights into the company's future outlook and strategic initiatives.

Management's Discussion and Analysis (MD&A):

Management's outlook for the coming year is [summarize management’s outlook based on the MD&A]. Key strategic initiatives include [list and briefly describe key strategic initiatives]. These initiatives are aimed at [mention the overarching goals of these initiatives, e.g., driving sustainable growth and enhancing customer experience].

Dividend Policy and Shareholder Returns:

ING's dividend policy for 2024 [summarize the dividend policy as described in the report]. This reflects the company's commitment to [mention the reasons behind the dividend policy, e.g., rewarding shareholders and demonstrating financial strength]. The implications for shareholders are [analyze the impact of the dividend policy on shareholders].

Conclusion: Understanding the Implications of the ING Group 2024 Annual Report (Form 20-F)

The ING Group 2024 Annual Report (Form 20-F) paints a picture of [overall summary of ING's performance and outlook based on the report]. Key takeaways include [list 2-3 key takeaways]. This report is vital for investors and stakeholders to assess ING's financial performance, risk profile, and future prospects. To gain a comprehensive understanding of the company's performance and strategic direction, we strongly encourage you to download and review the full ING Group 2024 Annual Report (Form 20-F) available on the SEC website [insert link] and the ING investor relations website [insert link]. Understanding the intricacies of this ING Group 2024 Annual Report (Form 20-F) is crucial for informed decision-making.

Featured Posts

-

Peppa Pig Gender Reveal A New Baby Joins The Family

May 21, 2025

Peppa Pig Gender Reveal A New Baby Joins The Family

May 21, 2025 -

Ex Councillors Wife Challenges Racial Hatred Tweet Verdict

May 21, 2025

Ex Councillors Wife Challenges Racial Hatred Tweet Verdict

May 21, 2025 -

Rehabilitacion Y Rendimiento La Meta De Javier Baez

May 21, 2025

Rehabilitacion Y Rendimiento La Meta De Javier Baez

May 21, 2025 -

American Couple Arrested In Uk After Appearing On Bbc Antiques Roadshow

May 21, 2025

American Couple Arrested In Uk After Appearing On Bbc Antiques Roadshow

May 21, 2025 -

Od Reddita Do Velikog Platna Sydney Sweeney U Novoj Filmskoj Adaptaciji

May 21, 2025

Od Reddita Do Velikog Platna Sydney Sweeney U Novoj Filmskoj Adaptaciji

May 21, 2025

Latest Posts

-

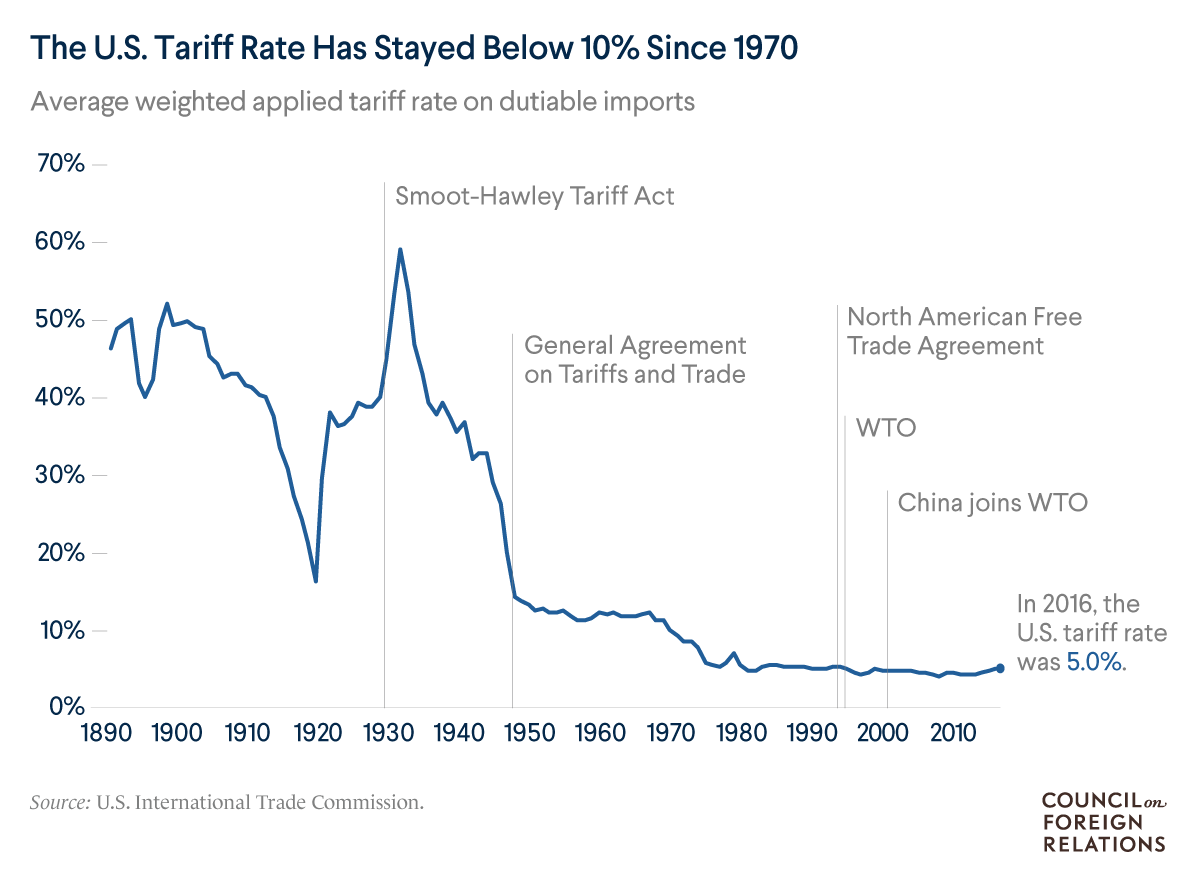

Canada Maintains Us Tariffs Despite Oxford Report Findings

May 21, 2025

Canada Maintains Us Tariffs Despite Oxford Report Findings

May 21, 2025 -

The Evolving Tariff Landscape A Current Analysis By Fp Video

May 21, 2025

The Evolving Tariff Landscape A Current Analysis By Fp Video

May 21, 2025 -

Understanding Tariff Volatility Insights From Fp Videos Global Analysis

May 21, 2025

Understanding Tariff Volatility Insights From Fp Videos Global Analysis

May 21, 2025 -

Canada Post Mail Delivery Changes Commission Reports Recommendations

May 21, 2025

Canada Post Mail Delivery Changes Commission Reports Recommendations

May 21, 2025 -

Home And Abroad Fp Videos Perspective On Current Tariff Challenges

May 21, 2025

Home And Abroad Fp Videos Perspective On Current Tariff Challenges

May 21, 2025