Infineon's (IFX) Revised Sales Outlook: Impact Of Trade War Uncertainty

Table of Contents

Infineon Technologies AG (IFX), a leading semiconductor manufacturer, recently revised its sales outlook for the current fiscal year, sending ripples through the global semiconductor industry. This adjustment reflects the persistent impact of trade war uncertainty and its cascading effects on the global economy and supply chains. This article delves into the key factors driving Infineon's revised sales forecast and analyzes its implications for investors and the broader market.

Infineon's Revised Sales Forecast and Reasons Behind the Downgrade

Keywords: Infineon sales, revenue forecast, guidance reduction, reasons for downgrade, macroeconomic factors, industry headwinds

Infineon's revised sales forecast represents a significant shift in expectations. While the exact percentage change will need to be filled in based on the most up-to-date information from Infineon's official announcements (e.g., "Infineon lowered its sales forecast by 5% for the fiscal year"), the downgrade highlights several interconnected factors.

-

Weaker-than-expected demand: Specific sectors, such as automotive or industrial automation, might be experiencing reduced demand, impacting Infineon's sales projections. This slowdown could be attributed to various factors, including global economic uncertainties and softening consumer spending.

-

Supply chain disruptions: Continued disruptions in the global supply chain, including shortages of raw materials and logistical bottlenecks, affect Infineon's ability to meet demand and deliver products on time. These disruptions contribute to increased costs and reduced sales.

-

Impact of tariffs and trade tensions: The ongoing trade war has introduced significant uncertainty and increased costs for Infineon. Tariffs on imported components and trade restrictions can directly impact manufacturing costs and pricing strategies.

-

Global Chip Shortage Lingering Effects: While the acute phase of the global chip shortage might have eased, its lingering effects continue to constrain production and sales for Infineon. This includes difficulties procuring certain components and managing inventory levels effectively.

Impact of Trade War Uncertainty on Infineon's Operations

Keywords: Trade war, tariffs, supply chain disruptions, geopolitical risks, international trade, semiconductor tariffs, global trade tensions

The ongoing trade war significantly impacts Infineon's operations in several ways:

-

Increased manufacturing costs: Tariffs on imported components or materials directly increase Infineon's production costs, potentially squeezing profit margins and affecting competitiveness.

-

Supply chain vulnerabilities: Infineon's reliance on a globalized supply chain exposes it to disruptions caused by trade tensions. Delays or interruptions in the supply of critical components can lead to production slowdowns and missed sales opportunities.

-

Geopolitical risks: The trade war introduces geopolitical uncertainty, making it challenging for Infineon to plan long-term investments and strategies. This uncertainty affects investment decisions and overall operational planning.

-

Mitigation Strategies: To mitigate these risks, Infineon is likely pursuing strategies such as diversifying its manufacturing locations, exploring alternative sourcing options, and building stronger relationships with key suppliers. These efforts aim to enhance resilience against future disruptions.

Analysis of Infineon's Response and Future Outlook

Keywords: Infineon strategy, risk management, future growth, competitive landscape, investor confidence, stock performance, long-term outlook

Infineon's response to the revised outlook will likely include a combination of strategies:

-

Cost-cutting measures: To offset the impact of reduced sales, Infineon might implement cost-cutting measures, including streamlining operations, optimizing manufacturing processes, and potentially reducing workforce.

-

Restructuring initiatives: The company may undertake restructuring initiatives to improve efficiency, enhance competitiveness, and better position itself for future growth.

-

Long-term growth prospects: Despite the current challenges, Infineon's long-term prospects remain dependent on its ability to adapt to changing market dynamics and to capitalize on growth opportunities in key markets like electric vehicles and renewable energy.

-

Investor sentiment and stock price: The revised outlook will likely negatively impact investor confidence and potentially lead to a temporary decline in the company's stock price. However, the long-term impact will depend on how effectively Infineon manages the challenges and communicates its future strategies.

-

Competitive Landscape: Infineon's position within the competitive semiconductor landscape will be crucial in determining its ability to weather this storm. Analysis of its competitors' responses and market share dynamics will further inform the outlook.

Implications for Investors and the Broader Semiconductor Industry

Keywords: Investment implications, semiconductor stocks, market analysis, industry trends, investor concerns, risk assessment, portfolio management

Infineon's revised sales outlook carries significant implications:

-

Investment decisions: Investors considering investing in Infineon or the broader semiconductor sector should carefully assess the risks associated with trade war uncertainty and its potential impact on future earnings.

-

Industry-wide impact: The challenges faced by Infineon are not unique. Other semiconductor companies are also grappling with similar issues, indicating broader industry-wide headwinds.

-

Future trends and risks: Analyzing future trends, including the ongoing evolution of trade policies, technological advancements, and the overall global economic climate, is critical for understanding the long-term outlook for Infineon and its competitors.

Conclusion

Infineon's revised sales outlook underscores the significant impact of trade war uncertainty on the semiconductor industry. The downgrade reflects weaker-than-expected demand, supply chain disruptions, and the increased costs associated with tariffs. While the company is likely implementing strategies to mitigate these risks, investors should carefully consider these factors when assessing investment opportunities in Infineon or the broader semiconductor sector. Stay informed about Infineon (IFX) and its evolving sales outlook amidst ongoing trade war uncertainty. Follow our updates for continuous analysis and insights into the semiconductor industry. Learn more about managing investment risk in the face of changing global economic conditions and Infineon’s strategies to navigate these challenges.

Featured Posts

-

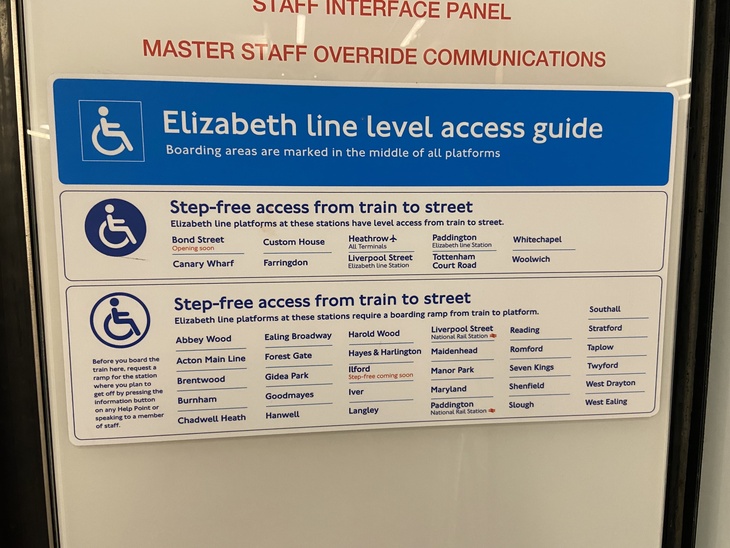

Mind The Gap Wheelchair Accessibility On The Elizabeth Line

May 09, 2025

Mind The Gap Wheelchair Accessibility On The Elizabeth Line

May 09, 2025 -

F1 News Montoya Reveals Predetermined Doohan Decision

May 09, 2025

F1 News Montoya Reveals Predetermined Doohan Decision

May 09, 2025 -

Silniy Snegopad Aeroport Permi Zakryt Do 4 00

May 09, 2025

Silniy Snegopad Aeroport Permi Zakryt Do 4 00

May 09, 2025 -

11 Lojtaret E Psg Se Qe Dominojne Futbollin

May 09, 2025

11 Lojtaret E Psg Se Qe Dominojne Futbollin

May 09, 2025 -

Uk Visa Restrictions New Plans For Certain Nationalities

May 09, 2025

Uk Visa Restrictions New Plans For Certain Nationalities

May 09, 2025