Infineon (IFX) Stock Under Pressure: Sales Forecast Misses Target Due To Tariff Uncertainty

Table of Contents

Infineon's (IFX) Disappointing Sales Forecast: A Detailed Look

Infineon's recent sales forecast significantly missed analyst expectations, leading to a noticeable drop in the IFX stock price. The shortfall represents a substantial blow to the company's projected revenue for the quarter, impacting investor confidence and highlighting challenges within the semiconductor industry. While the company's official statement cited various factors, the impact on different product segments is noteworthy.

-

Key reasons cited by Infineon for the sales miss: The primary factors cited included weaker-than-anticipated demand in certain key market segments, particularly in the automotive sector, coupled with supply chain disruptions. These disruptions were partly attributed to the ongoing global chip shortage, which continues to plague the industry.

-

Comparison to analyst expectations and previous quarters' performance: The sales miss fell considerably short of analyst consensus estimates, marking a significant deviation from the performance observed in previous quarters. This unexpected downturn raised concerns about the company's ability to meet future growth projections.

-

Impact on different Infineon product segments (automotive, industrial, etc.): The automotive sector, a major revenue contributor for Infineon, experienced a particularly sharp decline in demand, significantly impacting overall sales. While the industrial segment showed some resilience, it wasn't enough to offset the shortfall in the automotive sector.

The Role of Tariff Uncertainty in Infineon's (IFX) Stock Performance

The current global trade environment, characterized by escalating tariff disputes and trade wars, is significantly impacting the semiconductor industry, and Infineon is no exception. The uncertainty surrounding future tariff policies creates significant risk for businesses operating globally, including Infineon.

-

Specific tariffs affecting Infineon's products (e.g., import/export duties): Infineon faces increased costs due to tariffs on both imported materials and exported products, impacting profitability and competitiveness. These tariffs create significant uncertainty in financial planning.

-

Increased costs due to tariffs and their impact on profitability: The additional costs associated with tariffs are directly impacting Infineon's bottom line, reducing profit margins and making it more challenging to compete in a price-sensitive market.

-

Geopolitical factors influencing tariff policies and their effect on IFX: The ongoing geopolitical tensions and trade disputes add to the instability, making it difficult for Infineon to accurately predict future costs and plan long-term strategies effectively.

Analyzing Investor Sentiment and Market Reaction to Infineon (IFX) News

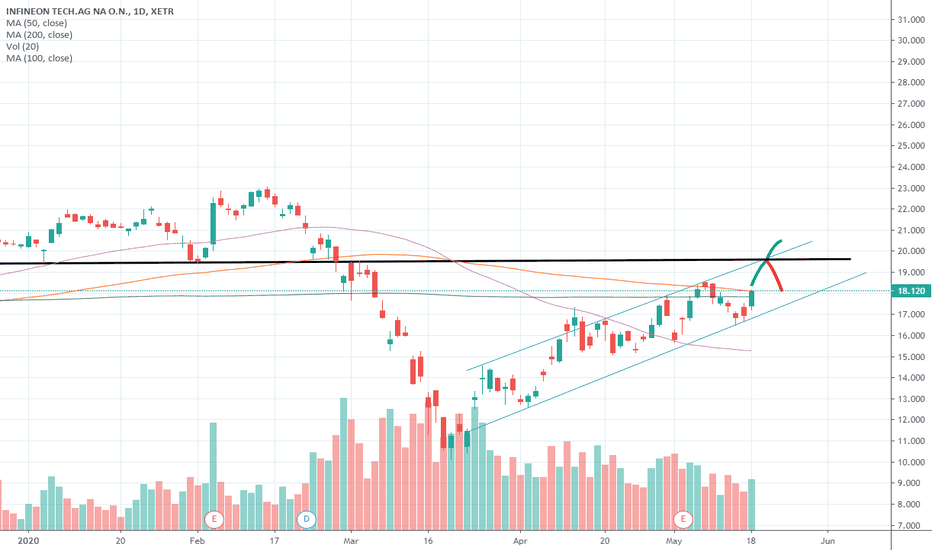

The immediate market reaction to Infineon's disappointing sales forecast was swift and negative, resulting in a substantial drop in the IFX stock price and increased trading volume. This reflects a significant shift in investor sentiment.

-

Stock price fluctuation since the announcement: The stock price experienced a sharp decline immediately following the announcement and has remained volatile since then, reflecting investor uncertainty.

-

Changes in analyst ratings and price targets for IFX stock: Several analysts have downgraded their ratings for IFX stock, and price targets have been adjusted downwards, reflecting the diminished outlook for the company's short-term performance.

-

Investor concerns and expectations regarding future performance: Investor concerns primarily revolve around the ability of Infineon to navigate the current challenges posed by tariff uncertainty and weak demand in key market segments. Expectations for future performance have been revised downwards.

Potential Future Implications and Investment Strategies for Infineon (IFX)

The long-term effects of tariff uncertainty on Infineon's profitability and growth remain uncertain. However, the company is implementing strategies to mitigate the impact.

-

Infineon's diversification strategies to reduce reliance on affected markets: Infineon is actively pursuing diversification strategies to reduce its reliance on markets most significantly impacted by tariffs and trade disputes.

-

Potential for long-term growth despite current challenges: Despite current challenges, Infineon's strong technology portfolio and market position suggest potential for long-term growth.

-

Risk assessment and suggestions for investors (buy, hold, sell): Investors should carefully assess the risks associated with investing in IFX stock, considering the impact of tariff uncertainty and weak demand. A wait-and-see approach might be prudent until greater clarity emerges regarding the company's ability to overcome these challenges.

Conclusion: Navigating the Challenges Facing Infineon (IFX) Stock

Infineon's (IFX) recent stock performance reflects a confluence of factors, including a disappointing sales forecast and the considerable uncertainty surrounding global tariffs. These factors have significantly impacted investor sentiment and the company's outlook. While Infineon possesses strengths and potential for long-term growth, the current challenges require careful consideration. Investors should conduct thorough research and stay updated on Infineon's (IFX) performance and the evolving global trade landscape before making any investment decisions regarding Infineon (IFX) stock. Stay informed about the future of Infineon (IFX) stock and the evolving global trade climate.

Featured Posts

-

Trumps Transgender Military Ban A Critical Analysis Of The Policys Impact

May 10, 2025

Trumps Transgender Military Ban A Critical Analysis Of The Policys Impact

May 10, 2025 -

S Sh A I Noviy Krizis Bezhentsev Vzglyad Iz Germanii

May 10, 2025

S Sh A I Noviy Krizis Bezhentsev Vzglyad Iz Germanii

May 10, 2025 -

Broken By Hate The Story Of A Family Torn Apart By Racism

May 10, 2025

Broken By Hate The Story Of A Family Torn Apart By Racism

May 10, 2025 -

Find Elizabeth Arden Skincare At Walmart Prices

May 10, 2025

Find Elizabeth Arden Skincare At Walmart Prices

May 10, 2025 -

The Jeffrey Epstein File Release Weighing The Decision Made By Ag Pam Bondi And Its Impact On Voters

May 10, 2025

The Jeffrey Epstein File Release Weighing The Decision Made By Ag Pam Bondi And Its Impact On Voters

May 10, 2025