Infineon (IFX) Stock: Sales Guidance Lowered, Citing Tariff Uncertainty

Table of Contents

Infineon's Revised Sales Guidance: A Detailed Look

Infineon's revised sales guidance offers a sobering outlook for the near future. The company's [Insert Quarter, e.g., Q3 2024] revenue forecast was significantly reduced, with a [Insert Percentage, e.g., 5%] decrease compared to the previous forecast. This represents a considerable shortfall from analyst expectations, which averaged [Insert Percentage/Number, e.g., a 2% increase].

- Specifics of the lowered sales guidance: Infineon lowered its revenue guidance from [Insert Previous Guidance, e.g., €10 billion] to [Insert Revised Guidance, e.g., €9.5 billion] for [Insert Time Period, e.g., the fiscal year]. This represents a substantial drop in projected revenue and significantly impacts the company's financial performance.

- Comparison to previous guidance and analyst expectations: The downward revision represents a [Insert Percentage, e.g., 5%] drop from the previously issued guidance and falls considerably short of analyst consensus estimates, underscoring the severity of the situation for IFX stock.

- Explanation of the company's reasoning behind the revision: Infineon explicitly stated that heightened global tariff uncertainty is a primary driver of the reduced forecast. The company highlighted the unpredictable nature of trade policies and their impact on supply chain stability and production costs.

- Impact on different segments of Infineon's business: While the precise impact on each segment remains unclear, the announcement suggests that all areas of Infineon's operations will likely be affected to varying degrees by the reduced sales outlook. This uncertainty is a significant factor contributing to the negative reaction from investors.

- Mention of any related press releases or official statements: Infineon's official press release, dated [Insert Date], details the revised sales guidance and provides further information on the factors contributing to this change. [Insert Link to Press Release if available].

The Role of Tariff Uncertainty in Infineon's Performance

The ongoing global trade tensions, particularly the US-China trade war, significantly impact Infineon's operations. The imposition of tariffs on various semiconductor components disrupts supply chains, increases production costs, and affects the company's competitiveness.

- Explain the specific tariffs impacting Infineon's operations: Infineon is heavily impacted by tariffs on [Insert Specific Components, e.g., power semiconductors and microcontrollers] which are critical components used in various industries. These tariffs increase the cost of goods and make Infineon's products less competitive in the global market.

- Discuss the impact on supply chains and production costs: The tariff uncertainty forces Infineon to adjust its supply chain strategy, potentially leading to increased costs and delays. Navigating these complexities adds to the overall uncertainty surrounding the company’s financial outlook.

- Analyze how these tariffs affect Infineon's competitiveness in the market: Higher production costs due to tariffs can make Infineon's products less price-competitive compared to rivals based in countries with more favorable trade agreements. This directly impacts its market share and profitability.

- Mention any actions Infineon is taking to mitigate the effects of tariffs: Infineon may be exploring strategies such as diversifying its manufacturing base, optimizing its supply chain, and engaging in lobbying efforts to advocate for more predictable trade policies. However, the effectiveness of these measures in the short term remains uncertain.

Investor Reaction and Market Implications for IFX Stock

The news of Infineon's lowered sales guidance resulted in immediate and significant negative market reaction.

- Describe the immediate market reaction to the news: The announcement triggered a sharp drop in IFX stock price, accompanied by a surge in trading volume. [Insert Data on Stock Price Drop and Trading Volume].

- Discuss the impact on investor confidence and sentiment: Investor confidence in IFX stock has been severely shaken, leading to a sell-off and negative sentiment surrounding the company’s short-term prospects.

- Summarize analyst reactions and ratings changes: Several analysts have downgraded their ratings on IFX stock following the announcement, reflecting the negative impact of the revised sales guidance and increased uncertainty. [Insert specific analyst ratings if available].

- Explore potential long-term effects on IFX stock valuation: The long-term effects on IFX stock valuation are highly dependent on how effectively Infineon addresses the challenges of tariff uncertainty and navigates the evolving geopolitical landscape.

- Consider the implications for similar semiconductor stocks: The situation at Infineon serves as a cautionary tale for other semiconductor companies, highlighting the vulnerability of the industry to global trade tensions.

Alternative Investment Opportunities in the Semiconductor Sector

While Infineon faces headwinds, diversification offers a way to mitigate risk.

- Briefly discuss other semiconductor companies less affected by tariff uncertainty: Investors might consider exploring companies with a more diversified geographical presence or those less reliant on trade with regions affected by tariffs.

- Highlight potential investment opportunities in related technology sectors: Diversification within the technology sector, exploring companies in related areas less susceptible to tariff volatility, could offer a more resilient investment strategy.

- Emphasize the importance of diversification in investment portfolios: Diversifying investment portfolios across different sectors and asset classes is crucial to reduce overall risk exposure.

Conclusion

Infineon's lowered sales guidance, largely attributed to persistent tariff uncertainty, has significantly impacted IFX stock and highlights the semiconductor industry’s vulnerability to geopolitical factors. This situation not only affects Infineon but raises broader concerns about market stability.

Call to Action: While challenges remain for IFX stock, a thorough understanding of Infineon's response to these market uncertainties is crucial for investors. Stay informed about future developments regarding Infineon (IFX) stock and the overall semiconductor market to make well-informed investment decisions. Remember to consult a financial advisor before making any investment decisions concerning Infineon (IFX) stock or other semiconductor companies.

Featured Posts

-

Cong Luan Day Song Truoc Loi Khai Bao Mau Bao Hanh Tre Em Tien Giang

May 09, 2025

Cong Luan Day Song Truoc Loi Khai Bao Mau Bao Hanh Tre Em Tien Giang

May 09, 2025 -

Injazat Fyraty Me Alerby Alqtry Bed Rhylh En Alahly Almsry

May 09, 2025

Injazat Fyraty Me Alerby Alqtry Bed Rhylh En Alahly Almsry

May 09, 2025 -

High Potential Season 1s Underrated Character A Perfect Season 2 Victim

May 09, 2025

High Potential Season 1s Underrated Character A Perfect Season 2 Victim

May 09, 2025 -

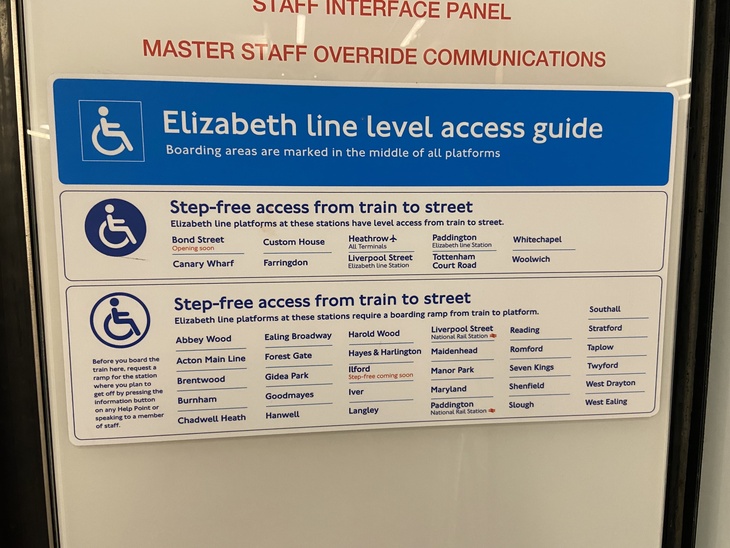

Mind The Gap Wheelchair Accessibility On The Elizabeth Line

May 09, 2025

Mind The Gap Wheelchair Accessibility On The Elizabeth Line

May 09, 2025 -

The Unlikely Rise From Wolves Rejection To European Footballing Success

May 09, 2025

The Unlikely Rise From Wolves Rejection To European Footballing Success

May 09, 2025