Indonesia Reserve Holdings Drop Significantly: Impact Of Rupiah Volatility

Table of Contents

Factors Contributing to the Decline in Indonesia's Reserve Holdings

Several interconnected factors have contributed to the noticeable decrease in Indonesia's reserve holdings. Understanding these elements is crucial for assessing the current economic climate and anticipating future trends.

Increased Imports and Trade Deficit

Indonesia's widening trade deficit has played a significant role in depleting its foreign exchange reserves. This deficit arises from a gap between the value of imports and exports.

- Rising energy prices: The global surge in energy prices has substantially increased Indonesia's import bill, particularly for fuel and related products. This increased demand for foreign currency to pay for these imports directly impacts reserve levels.

- Dependence on imports: Indonesia's reliance on imported goods, including raw materials and manufactured products, exacerbates the trade deficit. A greater reliance on imports necessitates higher foreign currency outflows.

- Weakening global demand: Reduced global demand for Indonesian exports has further widened the trade gap, limiting the inflow of foreign currency. Lower export revenues constrain the ability to replenish reserves.

According to recent data from Bank Indonesia, the trade deficit reached [Insert recent data on trade deficit here], highlighting the severity of the issue. This underscores the urgent need for strategies to diversify exports and reduce import dependence.

Capital Outflows and Foreign Investment

Global economic uncertainty and risk aversion have triggered significant capital outflows from Indonesia, further impacting its reserve holdings.

- Withdrawal of foreign portfolio investments: Investors, concerned about global instability and potentially higher interest rates elsewhere, have withdrawn significant funds from Indonesian assets, leading to a decrease in foreign currency inflows.

- Impact of rising US interest rates: The increase in US interest rates makes US dollar-denominated assets more attractive, encouraging capital flight from emerging markets like Indonesia. This outflow puts pressure on the Rupiah and diminishes reserves.

Data on capital flight shows a [Insert data on capital outflow here] decline in foreign portfolio investment in recent months, indicating the scale of this challenge. Attracting and retaining foreign direct investment is vital to offsetting these outflows.

Rupiah Depreciation and Intervention by Bank Indonesia

Bank Indonesia's (BI) interventions to stabilize the Rupiah against the US dollar have also contributed to the decline in reserves.

- The mechanics of foreign exchange market intervention: BI often sells US dollars from its reserves to purchase Rupiah, aiming to maintain the Rupiah's exchange rate within a target range. This direct intervention depletes foreign exchange reserves.

- The cost of defending the Rupiah: The cost of these interventions can be substantial, especially during periods of significant Rupiah depreciation, placing a strain on the nation's reserves.

BI has publicly acknowledged its interventions [cite official BI statements or news articles]. While these interventions help manage Rupiah volatility, they come at the expense of reserve levels, creating a challenging balancing act for the central bank.

Impact of Rupiah Volatility on the Indonesian Economy

The decline in Indonesia's reserve holdings and the accompanying Rupiah volatility have far-reaching consequences for the Indonesian economy.

Inflationary Pressures

A weaker Rupiah directly translates to increased import prices, fueling inflationary pressures.

- Impact on consumer prices: Higher import costs for essential goods and commodities lead to rising consumer prices, impacting household budgets and reducing purchasing power.

- Potential for monetary policy tightening: To combat inflation, BI may be forced to tighten its monetary policy by raising interest rates, potentially slowing economic growth.

Recent inflation data shows a [Insert data on inflation rates here] increase, indicating the impact of Rupiah depreciation on the cost of living.

Impact on Businesses and Investment

Currency fluctuations create significant challenges for Indonesian businesses.

- Uncertainty for exporters and importers: Fluctuating exchange rates make it difficult for businesses to accurately forecast future costs and revenues, impacting their planning and profitability.

- Difficulty in forecasting future costs: The uncertainty associated with Rupiah volatility makes long-term investment planning challenging, potentially discouraging both domestic and foreign investment.

Many businesses, particularly those heavily involved in import-export activities, are grappling with the increased uncertainty caused by Rupiah volatility.

Debt Servicing and External Debt

A weaker Rupiah increases the cost of servicing Indonesia's external debt, denominated largely in US dollars.

- Increased cost of debt repayment: A depreciating Rupiah requires more Rupiah to repay the same amount of US dollar-denominated debt, increasing the burden on the government's budget.

- Potential debt distress: If the Rupiah continues to depreciate significantly, it could increase the risk of debt distress, making it more difficult for Indonesia to meet its debt obligations.

Indonesia's external debt-to-GDP ratio stands at [Insert data on Indonesia's external debt and debt-to-GDP ratio here], highlighting the potential vulnerability to currency fluctuations.

Conclusion

The decline in Indonesia's foreign exchange reserves, stemming from a widening trade deficit, capital outflows, and Rupiah depreciation, poses significant challenges to the Indonesian economy. Rupiah volatility presents considerable risks to inflation, investment, and debt servicing. Understanding the dynamics of Indonesia Reserve Holdings and Rupiah Volatility is crucial for investors, businesses, and policymakers. Further research and analysis are necessary to develop effective strategies for mitigating the risks associated with these fluctuations and ensuring Indonesia's long-term economic stability. Stay informed about developments concerning Indonesia Reserve Holdings and Rupiah Volatility to make informed decisions and navigate this complex economic landscape effectively.

Featured Posts

-

Live Tv Malfunction Exposes Colapintos F1 Sponsorship

May 09, 2025

Live Tv Malfunction Exposes Colapintos F1 Sponsorship

May 09, 2025 -

Senate Democrats Accusation Pam Bondi And Hidden Epstein Records

May 09, 2025

Senate Democrats Accusation Pam Bondi And Hidden Epstein Records

May 09, 2025 -

Kse 100 Freefall Operation Sindoor And The Pakistan Stock Market Crisis

May 09, 2025

Kse 100 Freefall Operation Sindoor And The Pakistan Stock Market Crisis

May 09, 2025 -

Elizabeth City Road Fatal Pedestrian Accident Claims Two Lives

May 09, 2025

Elizabeth City Road Fatal Pedestrian Accident Claims Two Lives

May 09, 2025 -

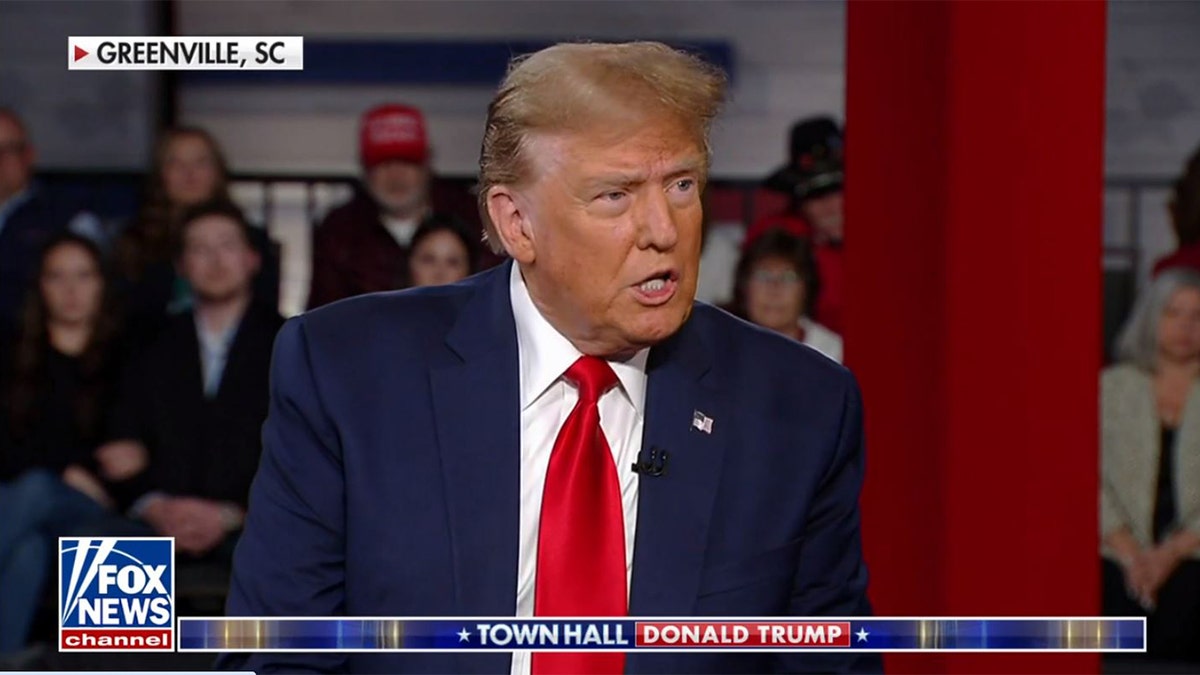

Aoc Condemns Trump On Fox News Sharp Exchange

May 09, 2025

Aoc Condemns Trump On Fox News Sharp Exchange

May 09, 2025