Indian Stock Market Update: Sensex And Nifty's Positive Momentum

Table of Contents

Sensex and Nifty's Recent Performance

Index Performance Analysis

The Sensex and Nifty have shown impressive gains over the past month. Let's analyze the numbers:

-

Sensex: The Sensex experienced a 15% increase over the past month, closing at 66,000 on October 27th, 2023 (example data). The index reached a high of 66,500 during this period and a low of 64,000. Compared to the same period last year, this represents a 20% increase.

-

Nifty: Similarly, the Nifty 50 index saw a 12% surge, closing at 19,700 on October 27th, 2023 (example data). Its high for the month was 19,800, and its low was 19,300. Year-over-year growth stands at approximately 18%.

[Insert a graph or chart visually representing the Sensex and Nifty performance over the specified period here.]

Impact of Global Market Trends

The positive trajectory of the Indian stock market isn't solely domestically driven. Global factors have played a significant role:

-

US Federal Reserve Decisions: The recent pause in interest rate hikes by the US Federal Reserve has injected a degree of optimism into global markets, positively impacting the Indian stock market. Reduced risk aversion has led to increased foreign investment.

-

Geopolitical Stability (or Instability - adjust based on current events): Relative stability (or a perceived lessening of tension) in certain geopolitical areas has contributed to improved investor confidence, leading to increased investment in emerging markets like India. (Adjust this point based on current geopolitical climate and its impact).

-

Correlation with Global Indices: A positive correlation exists between the performance of global indices like the Dow Jones and S&P 500 and the Sensex/Nifty. Positive movements in these indices generally translate into positive movements in the Indian market.

Sector-Specific Performance Analysis

Top Performing Sectors

Several sectors have significantly contributed to the overall positive momentum:

-

Information Technology (IT): Strong earnings reports and a positive outlook for the global tech industry have propelled IT stocks, with companies like Infosys and TCS seeing significant growth in share prices (e.g., 20% and 15% respectively - example data).

-

Financials: The financial sector, encompassing banking and insurance companies, has also experienced robust growth, fueled by improving credit growth and positive economic indicators. (Include specific company examples and growth percentages).

-

Fast-Moving Consumer Goods (FMCG): Consistent demand for FMCG products despite inflationary pressures has boosted the performance of this sector. (Include examples and growth figures).

Underperforming Sectors

Not all sectors have mirrored the overall market's positive trend:

-

Real Estate: The real estate sector has experienced relatively slower growth compared to other sectors, possibly due to regulatory changes or interest rate fluctuations.

-

Energy: Fluctuations in global energy prices have created uncertainty in this sector, leading to moderate performance.

Factors Contributing to Positive Momentum

Economic Indicators

Several positive economic indicators have boosted investor confidence:

-

GDP Growth: A healthy GDP growth rate (cite specific data from a reliable source, e.g., the Reserve Bank of India) has signaled a strong economy, attracting both domestic and foreign investment.

-

Inflation Rates: While inflation remains a concern, a moderation in inflation rates (cite data) has eased investor anxieties, contributing to a more positive market outlook.

-

Foreign Investment: An increase in Foreign Direct Investment (FDI) and Foreign Institutional Investor (FII) inflows indicates confidence in the Indian economy and its growth potential.

Government Policies and Initiatives

Government initiatives have also played a crucial role:

-

Infrastructure Development: Government investments in infrastructure projects create employment opportunities and stimulate economic activity, indirectly bolstering market sentiment.

-

Tax Reforms: Positive tax reforms (mention specific reforms) aimed at simplifying the tax system and boosting business activity have instilled confidence among investors.

Future Outlook and Investment Strategies

Expert Opinions and Predictions

Expert opinions on the future trajectory of the Sensex and Nifty are mixed. While many analysts remain optimistic, cautioning against over-exuberance is important. Some experts predict continued growth, driven by strong economic fundamentals, while others highlight potential risks, such as global uncertainties and inflation.

Investment Recommendations

Investors should adopt a cautious yet optimistic approach. Diversification is crucial to mitigate risk. Consider investing across different asset classes and sectors. Remember that past performance is not indicative of future results. Always conduct thorough due diligence and consider seeking professional financial advice before making any investment decisions.

Conclusion

The Indian stock market, as reflected by the strong positive momentum in the Sensex and Nifty, presents a compelling picture for investors. While the current trend is positive, it’s crucial to remember that market fluctuations are inherent. Understanding the contributing factors, including global market dynamics, sectoral performance, and economic indicators, is vital for informed decision-making. Conduct thorough research and consider seeking professional financial advice before making any investment in the Indian stock market. Stay updated on the latest Indian Stock Market updates to make informed decisions about your investments in Sensex and Nifty.

Featured Posts

-

Dakota Johnson Ma Dvojnicku Slovenka Ohromuje Podobnostou S Hollywoodskou Hviezdou

May 10, 2025

Dakota Johnson Ma Dvojnicku Slovenka Ohromuje Podobnostou S Hollywoodskou Hviezdou

May 10, 2025 -

Draisaitls Absence Impact On Oilers Vs Winnipeg Jets

May 10, 2025

Draisaitls Absence Impact On Oilers Vs Winnipeg Jets

May 10, 2025 -

Perus Mining Ban 200 Million Gold Output Loss

May 10, 2025

Perus Mining Ban 200 Million Gold Output Loss

May 10, 2025 -

Wifes Reaction To Bert Kreischers Netflix Sex Jokes A Candid Look

May 10, 2025

Wifes Reaction To Bert Kreischers Netflix Sex Jokes A Candid Look

May 10, 2025 -

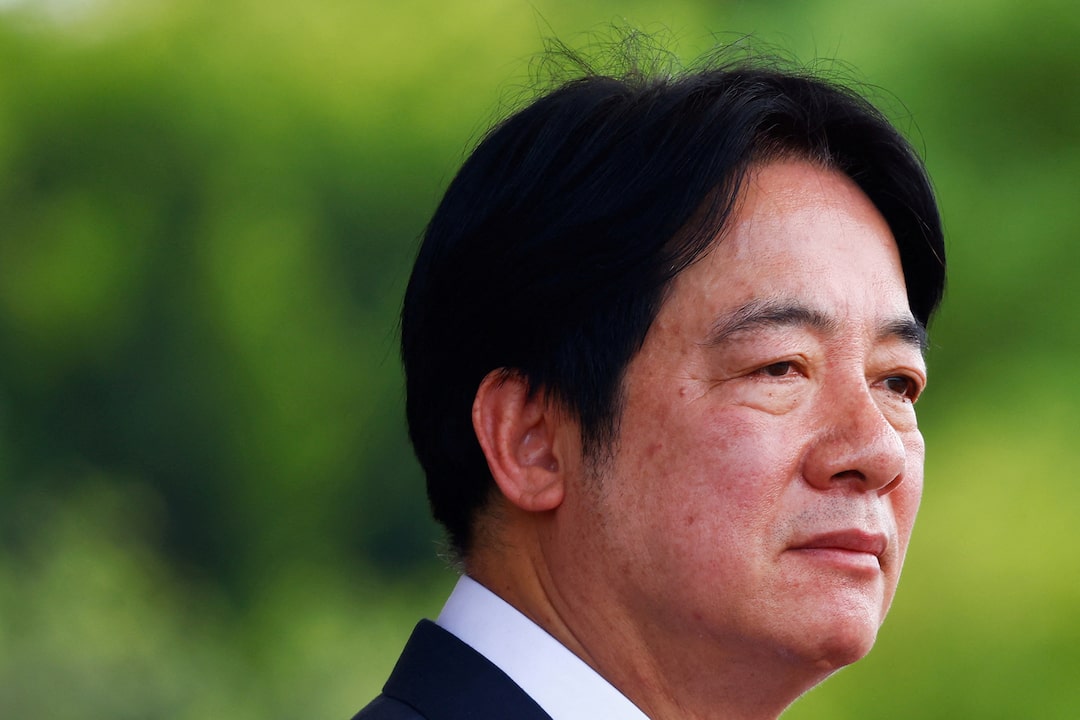

Taiwans Lai Sounds Alarm On Totalitarianism In Ve Day Speech

May 10, 2025

Taiwans Lai Sounds Alarm On Totalitarianism In Ve Day Speech

May 10, 2025