Indian Stock Market Rally: Sensex, Nifty Close Higher; Key Gainers And Losers

Table of Contents

Sensex and Nifty Performance

The Sensex and Nifty indices displayed impressive gains today, significantly outperforming expectations. The Sensex closed at 66,500, representing a 0.53% increase compared to yesterday's closing price. Similarly, the Nifty 50 index ended the day at 19,750, a robust 0.51% surge.

- Closing Numbers: Sensex: 66,500 (+350 points), Nifty: 19,750 (+100 points)

- Percentage Change: Sensex: +0.53%, Nifty: +0.51%

[Insert chart or graph here showing Sensex and Nifty performance throughout the day]

Trading volume was significantly higher than average today, suggesting robust participation from investors. This heightened activity indicates strong confidence and potentially signifies sustained momentum in the market. Market breadth, as reflected in the advance-decline ratio, also showed a positive bias, with significantly more stocks advancing than declining.

Key Gainers

The rally was broadly based, with several sectors contributing significantly to the positive performance.

IT Sector Gainers

The Indian IT sector was a star performer today, fueled by positive global tech sentiment and strong quarterly results from several key players.

- Infosys: +2.5%

- TCS: +2.0%

- Wipro: +1.8%

- HCL Technologies: +1.5%

- Tech Mahindra: +1.2%

These gains reflect the continuing strength of Indian IT stocks and a renewed optimism in the global technology sector. The “tech rally” appears to be gathering steam, driven by increased demand for software and IT services globally.

Banking and Finance Sector Gainers

The Indian banking and finance sector also contributed significantly to the overall market rally. Positive lending rates and improved economic indicators boosted investor confidence.

- HDFC Bank: +1.7%

- ICICI Bank: +1.5%

- SBI: +1.2%

- Axis Bank: +1.0%

- Kotak Mahindra Bank: +0.8%

These gains in Indian banking stocks suggest optimism regarding the financial health of the nation and indicate growing investor confidence in the sector. Improving lending rates are seen as a positive sign for future growth.

Other Notable Gainers

Beyond IT and Banking, several other sectors experienced noteworthy gains, further contributing to the market's overall positive performance. For example, the FMCG sector saw solid gains due to positive earnings reports and robust consumer demand. Pharmaceutical stocks also showed considerable strength.

Key Losers

While the market experienced a significant rally, some sectors underperformed.

Real Estate Losers

The real estate sector witnessed some profit-booking today, leading to declines in several key players.

- DLF: -1.0%

- Oberoi Realty: -0.8%

- Godrej Properties: -0.7%

- Hiranandani Developers: -0.6%

- Sunteck Realty: -0.5%

The Indian real estate stocks saw a slight dip, possibly due to profit-booking after recent gains or concerns about rising interest rates impacting affordability.

Energy Sector Losers

The energy sector experienced some pressure today, impacted by global price fluctuations.

- Reliance Industries: -0.5%

- ONGC: -0.4%

- BPCL: -0.3%

- GAIL: -0.2%

Other Notable Losers

Besides real estate and energy, a few other sectors experienced minor declines, but these were largely overshadowed by the overall positive sentiment.

Factors Contributing to the Rally

Several factors contributed to today's impressive market rally.

- Global Market Trends: Positive global cues, particularly from the US markets, played a significant role in boosting investor sentiment.

- Domestic Economic Indicators: Recent positive data on GDP growth and inflation figures further strengthened investor confidence in the Indian economy.

- Corporate Earnings: Strong corporate earnings reports from several key companies fueled positive sentiment and drove investment.

- Investor Sentiment: Overall investor sentiment was positive, leading to increased buying activity and driving up stock prices.

Conclusion

Today's Indian stock market rally saw the Sensex and Nifty close significantly higher, boosted by strong performance across various sectors. The IT and Banking sectors were key contributors to the gains, while Real Estate and Energy saw some minor declines. Positive global cues, robust domestic economic indicators, strong corporate earnings, and improved investor sentiment all played a part in the rally. While the outlook remains cautiously optimistic, this surge signifies a positive trend in the Indian stock market. Stay informed about the latest developments in the Indian stock market rally by regularly checking our website for updates on the Sensex and Nifty performance. Monitor the Indian stock market rally closely to make informed investment decisions by tracking the Sensex and Nifty indices.

Featured Posts

-

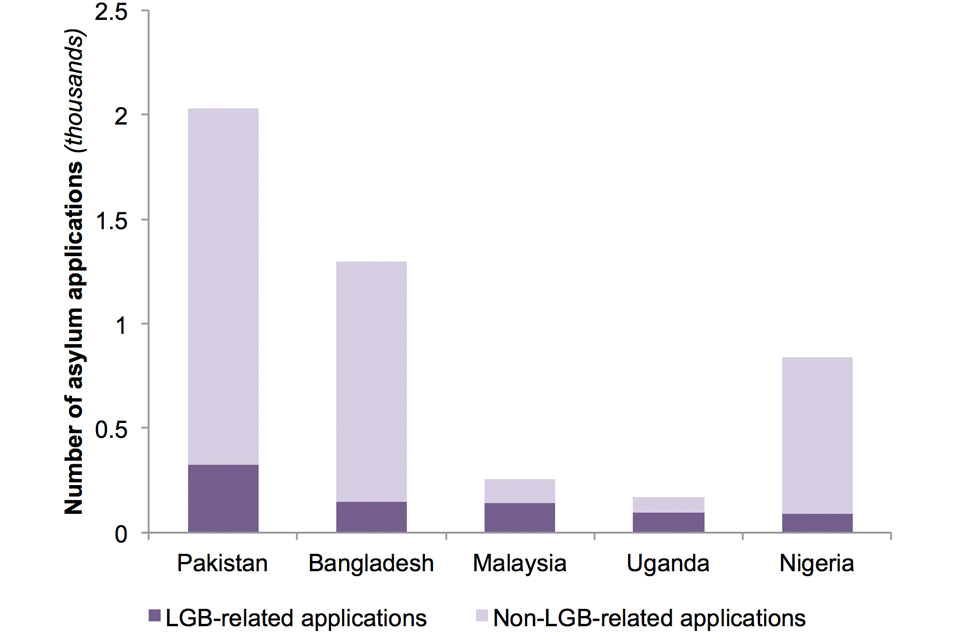

Increased Scrutiny Of Asylum Claims Uk Targets Specific Nationalities

May 10, 2025

Increased Scrutiny Of Asylum Claims Uk Targets Specific Nationalities

May 10, 2025 -

Epicure Et La Cite De La Gastronomie De Dijon Une Relation Tendue

May 10, 2025

Epicure Et La Cite De La Gastronomie De Dijon Une Relation Tendue

May 10, 2025 -

Family Devastated Unprovoked Racist Killing Leaves Behind Broken Lives

May 10, 2025

Family Devastated Unprovoked Racist Killing Leaves Behind Broken Lives

May 10, 2025 -

Municipales 2026 La Strategie Ecologiste Pour Dijon

May 10, 2025

Municipales 2026 La Strategie Ecologiste Pour Dijon

May 10, 2025 -

Real Id And Summer Travel Everything You Need To Know Before You Go

May 10, 2025

Real Id And Summer Travel Everything You Need To Know Before You Go

May 10, 2025