Indian Stock Market: BSE Earnings To Drive Share Price Increase

Table of Contents

Understanding the Impact of BSE Earnings on Share Prices

The Correlation Between Earnings and Share Price

A company's profitability, as reflected in its earnings, is fundamentally linked to its share price. Positive earnings, especially those exceeding market expectations (positive earnings surprises), often boost investor confidence. This increased confidence leads to higher demand for the company's shares, pushing the share price upward. Conversely, disappointing earnings can lead to selling pressure and a decline in share price. This relationship is driven by several factors:

- Increased investor confidence: Strong earnings demonstrate a company's financial health and future growth potential, attracting more investors.

- Higher demand for shares: As more investors seek to buy shares of profitable companies, the price increases due to supply and demand dynamics.

- Positive market sentiment: Strong earnings announcements contribute to a positive overall market sentiment, further boosting share prices.

- Potential for dividend announcements: Companies with strong earnings are more likely to announce dividends, attracting income-seeking investors and pushing share prices higher.

Analyzing BSE Listed Companies' Financial Performance

Before investing, thorough due diligence is crucial. Analyzing key financial metrics provides a comprehensive picture of a company's performance and its potential for future growth. Investors should focus on:

- EPS growth: Earnings Per Share (EPS) growth indicates the company's profitability on a per-share basis. Consistent EPS growth is a positive sign.

- Revenue trends: Analyzing revenue growth over time reveals the company's ability to generate sales and expand its market share.

- Profit margin analysis: Profit margins (gross, operating, and net) show the company's efficiency in converting revenue into profit. Improving margins are a positive indicator.

- Debt levels: High debt levels can be a risk factor, impacting a company's financial stability and future growth. A low debt-to-equity ratio is generally preferred.

- Industry benchmarks: Comparing a company's financial performance against its industry peers provides valuable context and helps identify relative strengths and weaknesses.

Identifying Potential Winners: Sectors Poised for Growth

High-Growth Sectors with Strong Earnings Prospects

Several sectors listed on the BSE are expected to report robust earnings, contributing significantly to the overall share price increase. These include:

- Information Technology (IT): The Indian IT sector continues to benefit from strong global demand for software services and digital transformation initiatives. Keywords: Indian IT sector, software services, digital transformation.

- Pharmaceuticals: The pharmaceutical industry is expected to see continued growth driven by increasing healthcare expenditure and the development of new drugs. Keywords: Pharmaceutical industry, healthcare expenditure, drug development.

- Fast-Moving Consumer Goods (FMCG): The FMCG sector is typically resilient to economic downturns, and strong brands are expected to deliver solid earnings. Keywords: FMCG sector, consumer staples, brand strength.

These sectors offer promising investment opportunities, but thorough research into individual companies within each sector is vital.

Analyzing Company-Specific Factors

While overall market trends and sector performance are important, individual company performance is paramount. Factors to consider include:

- Strong management teams: Experienced and effective leadership is crucial for a company's success.

- Competitive advantages: A strong competitive advantage, such as a unique product or efficient operations, can help a company outperform its peers.

- Innovative products/services: Companies that continually innovate and adapt to changing market conditions are better positioned for long-term growth.

- Operational efficiency: Efficient operations lead to lower costs and higher profitability, which positively impact share prices.

Strategies for Investing in the BSE During Earnings Season

Risk Management and Diversification

Diversification is key to mitigating risk. A well-diversified portfolio reduces the impact of losses from individual investments. Consider:

- Diversification strategies: Spread investments across different sectors, asset classes, and geographic regions.

- Risk tolerance assessment: Understand your own risk tolerance before making investment decisions.

- Long-term vs. short-term investment horizons: Long-term investing generally offers better returns but requires greater patience.

- Stop-loss orders: Use stop-loss orders to limit potential losses on individual investments.

Utilizing Fundamental and Technical Analysis

Investors can use both fundamental and technical analysis to identify potential investment opportunities:

- Fundamental analysis techniques: Evaluate a company’s financial health using metrics like EPS, revenue, and debt levels. Discounted cash flow (DCF) analysis can help assess intrinsic value.

- Technical analysis indicators: Use indicators such as moving averages, Relative Strength Index (RSI), and chart patterns to identify potential entry and exit points.

Conclusion

Strong BSE earnings are expected to drive a significant increase in share prices. Investors should focus on identifying companies with strong fundamentals and favorable growth prospects within high-performing sectors. A well-diversified portfolio and a sound investment strategy are crucial for managing risk and maximizing returns. Stay informed about upcoming BSE earnings announcements and leverage this valuable information to capitalize on the potential for increased share prices. Thorough research and a well-defined investment plan are key to successful investing in the dynamic Indian stock market. Learn more about maximizing your returns with BSE earnings analysis and investment strategies.

Featured Posts

-

Xrp Whales Massive 20 M Token Buy A Big Bet On Ripple

May 07, 2025

Xrp Whales Massive 20 M Token Buy A Big Bet On Ripple

May 07, 2025 -

Cavaliers Vs Knicks Prediction Will The Knicks Dominate At Msg

May 07, 2025

Cavaliers Vs Knicks Prediction Will The Knicks Dominate At Msg

May 07, 2025 -

De Echte Soldaat Van Oranje Het Leven Van Spion Peter Tazelaar

May 07, 2025

De Echte Soldaat Van Oranje Het Leven Van Spion Peter Tazelaar

May 07, 2025 -

April 12th Lotto Draw Winning Numbers And Jackpot Details

May 07, 2025

April 12th Lotto Draw Winning Numbers And Jackpot Details

May 07, 2025 -

Warriors Vs Rockets The Impact Of Home Court Advantage

May 07, 2025

Warriors Vs Rockets The Impact Of Home Court Advantage

May 07, 2025

Latest Posts

-

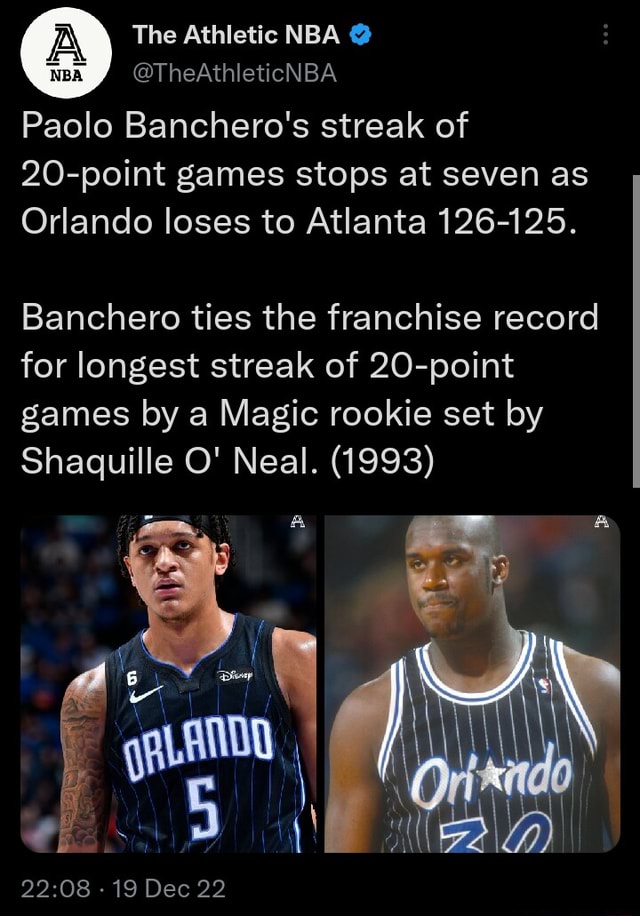

Bancheros 24 Points End Cavaliers 16 Game Win Streak

May 07, 2025

Bancheros 24 Points End Cavaliers 16 Game Win Streak

May 07, 2025 -

Mitchell And Mobley Lead Cavaliers To Dominant Victory Over Knicks

May 07, 2025

Mitchell And Mobley Lead Cavaliers To Dominant Victory Over Knicks

May 07, 2025 -

Orlando Magic Defeat Cavaliers Banchero Leads With 24 Points

May 07, 2025

Orlando Magic Defeat Cavaliers Banchero Leads With 24 Points

May 07, 2025 -

Boston Celtics Vs Cavaliers 4 Takeaways From The Upset

May 07, 2025

Boston Celtics Vs Cavaliers 4 Takeaways From The Upset

May 07, 2025 -

Cavaliers Star On Celtics Rivalry Key Lessons Learned

May 07, 2025

Cavaliers Star On Celtics Rivalry Key Lessons Learned

May 07, 2025