Improving Your Credit Score After Late Student Loan Payments

Table of Contents

Understanding the Impact of Late Student Loan Payments

How Late Payments Affect Your Credit Score

Late payments on your student loans are reported to the three major credit bureaus – Equifax, Experian, and TransUnion – impacting your FICO score, a crucial factor in determining your creditworthiness. A single late payment can negatively affect your score, and multiple late payments will have a more substantial, detrimental effect. These negative entries generally remain on your credit report for seven years from the date of the delinquency. The longer you have a history of late payments, the harder it will be to improve your credit score.

- Late payments significantly lower your credit score.

- The severity of the impact depends on the number and frequency of late payments.

- Late payments can make it harder to get loans, credit cards, or even rent an apartment.

- Credit scores influence insurance premiums and even employment opportunities.

Strategies to Improve Your Credit Score After Late Payments

Contact Your Loan Servicer

Open communication with your student loan servicer is crucial. Don't ignore the problem; proactively reach out to discuss your situation. Explain your financial challenges and explore options like repayment plans, forbearance, or even a hardship program, which might temporarily reduce or suspend your payments. These programs can prevent further negative marks on your credit report.

- Negotiate a payment plan to bring your account current. This demonstrates your commitment to repaying your debt.

- Inquire about options for loan consolidation or refinancing. Consolidating multiple loans into one can simplify payments and potentially lower your interest rate.

- Document all communication with your loan servicer, including dates, times, and the names of individuals you spoke with. This documentation is vital if disputes arise later.

Dispute Inaccurate Information

Obtain your free annual credit reports from AnnualCreditReport.com (the only authorized source for free reports). Carefully review each report from Equifax, Experian, and TransUnion for any errors or discrepancies related to your student loan payments. If you find inaccurate information, such as incorrect payment dates or amounts, immediately follow the credit bureau's dispute process to have the errors corrected. This can significantly improve your credit score.

- Order your free annual credit reports from each of the three major credit bureaus.

- Carefully review each report for any errors or discrepancies.

- Follow the dispute process outlined by the credit bureaus; typically, this involves submitting a written dispute.

Establish a Positive Payment History

The most effective way to rebuild your credit is to consistently make on-time payments on all your existing accounts – credit cards, other loans, utilities, etc. This demonstrates responsible financial behavior to the credit bureaus.

- Set up automatic payments to avoid missed payments. This simple step prevents accidental late payments.

- Use budgeting tools to track expenses and ensure timely payments. Many free budgeting apps are available to help you manage your finances.

- Consider using a credit card responsibly and paying it off in full each month. This builds positive credit history, but only if you avoid carrying a balance.

Consider Credit Repair Services (Optional)

While you can manage credit repair yourself, credit repair services can assist in navigating the process. However, approach these services with caution. Be wary of inflated promises and scams; reputable services will offer realistic expectations and transparent pricing. Remember, you are ultimately responsible for managing your credit.

- Credit repair services can help navigate the process, but they are not always necessary.

- Be wary of scams and inflated promises. Look for services with positive reviews and transparent pricing.

- Thoroughly research any credit repair service before hiring them. Check their credentials and understand their fees.

Monitoring Your Credit Progress

Regularly Check Your Credit Report

Regularly monitoring your credit reports is crucial to track your progress and ensure accuracy. Use the free annual credit reports from AnnualCreditReport.com and consider using a free credit monitoring service to track your FICO score over time.

- Check your credit report at least once a year. Checking more frequently allows for early detection of any issues.

- Look for any new negative marks or inaccuracies.

- Monitor your credit score to track your progress. Consistent, positive changes will show you're on the right track.

Conclusion

Improving your credit score after late student loan payments requires consistent effort and proactive steps. By communicating with your loan servicer, disputing inaccuracies on your credit reports, and establishing a positive payment history, you can significantly improve your creditworthiness. Remember to monitor your credit progress regularly. Start improving your credit score today! Take control of your financial future by addressing your student loan payments and building a strong credit history. Don't let late student loan payments derail your financial goals; take action now!

Featured Posts

-

Aews Josh Alexander Interview Highlights From 97 1 Double Q

May 17, 2025

Aews Josh Alexander Interview Highlights From 97 1 Double Q

May 17, 2025 -

Tesla Berlin Prosvjed I Optuzbe Za Prijetnju Okolisu

May 17, 2025

Tesla Berlin Prosvjed I Optuzbe Za Prijetnju Okolisu

May 17, 2025 -

Severance And Game Of Thrones Gwendoline Christie Discusses Challenging Roles

May 17, 2025

Severance And Game Of Thrones Gwendoline Christie Discusses Challenging Roles

May 17, 2025 -

Greenkos Founders Explore Orix Stake Purchase In India

May 17, 2025

Greenkos Founders Explore Orix Stake Purchase In India

May 17, 2025 -

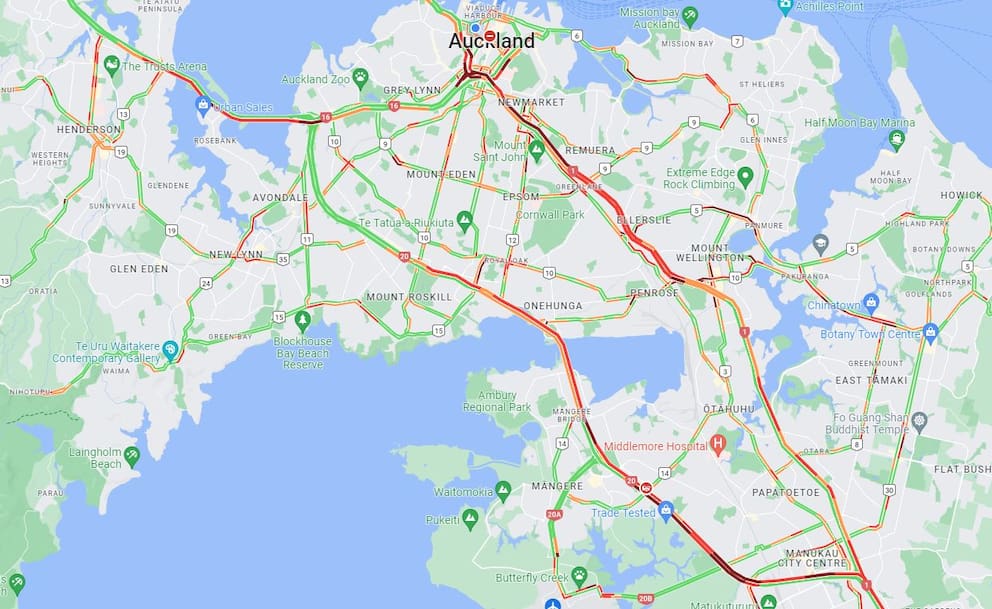

Risky E Scooter Ride On Aucklands Southern Motorway Dashcam Footage Released

May 17, 2025

Risky E Scooter Ride On Aucklands Southern Motorway Dashcam Footage Released

May 17, 2025

Latest Posts

-

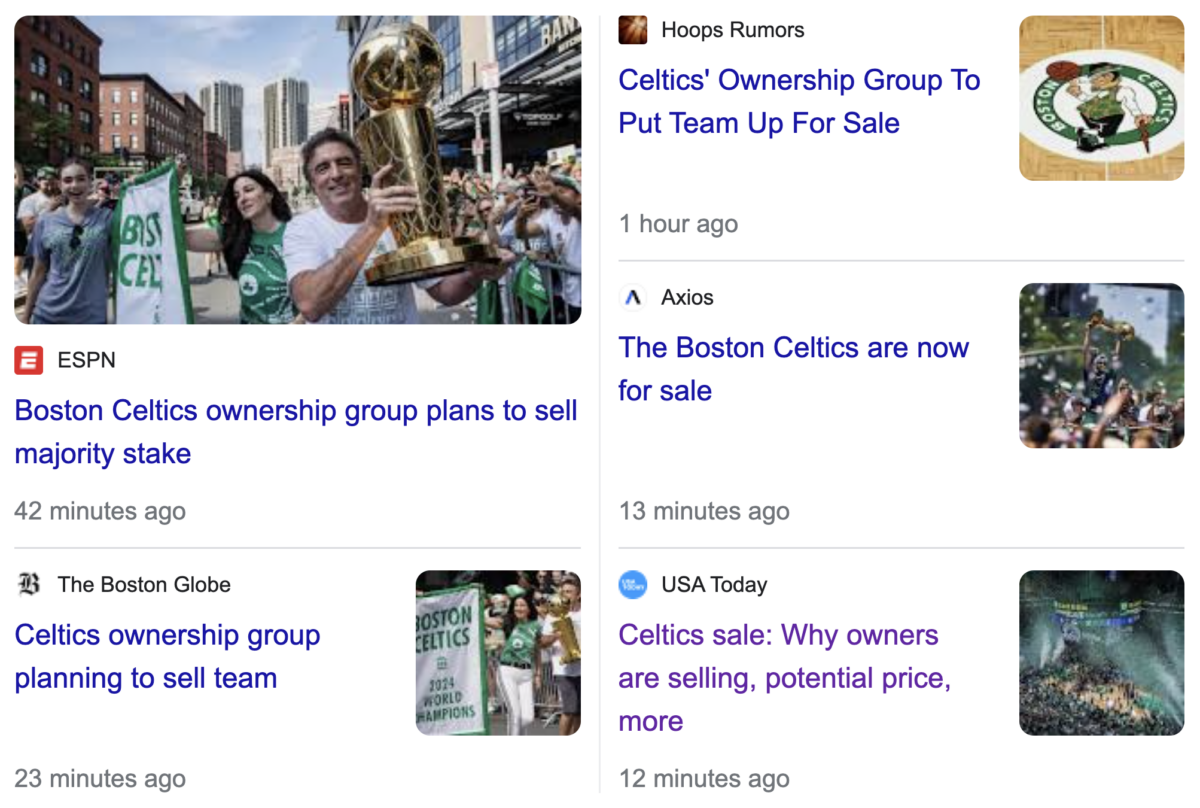

Boston Celtics Future Uncertain After Record Breaking 6 1 Billion Sale

May 17, 2025

Boston Celtics Future Uncertain After Record Breaking 6 1 Billion Sale

May 17, 2025 -

Boston Celtics Ownership Change Private Equity Purchase Sparks Debate

May 17, 2025

Boston Celtics Ownership Change Private Equity Purchase Sparks Debate

May 17, 2025 -

Boston Celtics Sold Private Equity Buyout Sparks Fan Uncertainty

May 17, 2025

Boston Celtics Sold Private Equity Buyout Sparks Fan Uncertainty

May 17, 2025 -

Boston Celtics 6 1 Billion Sale What It Means For The Future

May 17, 2025

Boston Celtics 6 1 Billion Sale What It Means For The Future

May 17, 2025 -

6 1 Billion Celtics Sale Analyzing The Impact On The Franchise And Its Fans

May 17, 2025

6 1 Billion Celtics Sale Analyzing The Impact On The Franchise And Its Fans

May 17, 2025