Improving HMRC Customer Service With Voice Recognition

Table of Contents

Enhanced Efficiency and Reduced Wait Times with Voice Recognition

Integrating voice recognition technology into HMRC's call handling processes can dramatically improve efficiency and reduce frustrating wait times.

Streamlined Call Handling

Voice recognition systems can automatically route incoming calls to the appropriate departments based on the caller's stated needs. This intelligent routing eliminates the need for lengthy menu navigation, directing callers swiftly to the right agent. This results in:

- Faster call resolution: Calls are handled more quickly, freeing up agents to assist more taxpayers.

- Reduced agent workload: Agents spend less time navigating systems and more time resolving customer queries.

- Improved call center efficiency: Overall call center performance is enhanced, leading to significant cost savings.

Seamless integration with existing HMRC systems is crucial for optimal performance and avoids disruption to existing workflows. This may involve APIs and data sharing agreements with existing CRM and data management systems.

Automated Information Retrieval

An interactive voice response (IVR) system powered by voice recognition can provide instant answers to frequently asked questions (FAQs). This 24/7 availability offers crucial self-service options, reducing the burden on human agents:

- 24/7 availability: Taxpayers can access information anytime, day or night.

- Reduced agent intervention for simple queries: Agents are freed up to handle more complex issues requiring human intervention.

- Improved self-service options: Taxpayers can independently check their tax refund status, understand payment deadlines, and access personal information.

Examples include verifying payment details, checking the status of a claim, and obtaining information on tax allowances.

Improved Accessibility and Inclusivity through Voice Technology

Voice recognition significantly enhances accessibility for a broader range of HMRC customers.

Catering to Diverse Needs

Voice technology is particularly beneficial for individuals with disabilities:

- Increased accessibility for a wider range of users: Customers with visual impairments or those who struggle with online systems can easily access HMRC services.

- Improved inclusivity: HMRC can provide equal access to services for all citizens, regardless of their abilities.

- Compliance with accessibility regulations: Adoption of voice recognition helps HMRC meet its legal obligations regarding accessibility for disabled users.

Incorporating text-to-speech capabilities further enhances accessibility, allowing for a more inclusive and user-friendly experience.

Multilingual Support

HMRC serves a diverse population, and voice recognition can facilitate communication in multiple languages:

- Improved communication with non-native English speakers: Taxpayers can interact with the system in their preferred language, improving understanding and reducing misunderstandings.

- Increased customer satisfaction: Providing multilingual support fosters inclusivity and improves overall customer satisfaction.

- Broader reach: HMRC can reach a wider audience and better serve the needs of its diverse customer base.

Accurate and reliable language processing is paramount to ensure the effectiveness of multilingual support. Investing in high-quality language models is crucial for success.

Boosting Customer Satisfaction and Reducing Frustration

Voice recognition can significantly enhance the customer experience, leading to greater satisfaction and reduced frustration.

Personalized Interactions

Voice recognition enables personalized interactions:

- Improved customer relationship management (CRM): The system can recognize returning customers and tailor interactions based on their history and preferences.

- Enhanced customer loyalty: Personalized service increases customer satisfaction and encourages loyalty.

- Increased satisfaction scores: A more personalized and efficient experience leads to higher customer satisfaction ratings.

Integration with existing HMRC data systems will be key to accessing and utilising this customer data appropriately and securely.

Proactive Customer Support

Voice recognition can anticipate customer needs and proactively offer assistance:

- Improved customer experience: Taxpayers receive timely reminders and alerts, reducing stress and anxiety.

- Reduced frustration: Proactive support prevents potential issues from escalating into major problems.

- Increased efficiency: Proactive interventions can resolve issues before they become major problems, freeing up agents' time.

Examples include sending reminders about upcoming tax deadlines, alerts about potential discrepancies in tax returns, and proactive offers of assistance with complex tax issues.

Transforming HMRC Customer Service with Voice Recognition for a Brighter Future

Implementing voice recognition technology offers significant advantages for HMRC, improving efficiency, increasing accessibility, and enhancing customer satisfaction. The benefits extend to both HMRC staff, who can focus on more complex tasks, and taxpayers, who experience faster, more convenient, and more accessible service. By embracing voice recognition solutions, HMRC can create a more modern, efficient, and customer-centric agency.

We encourage you to explore the potential of voice recognition technology for improving HMRC customer service and consider investing in solutions that leverage this innovative technology. Adopting robust voice recognition solutions for optimal HMRC customer service is a crucial step towards building a more responsive and efficient tax administration system, benefiting both the agency and the taxpayers it serves.

Featured Posts

-

The Delayed Murder In Agatha Christies Towards Zero Episode 1 Explained

May 20, 2025

The Delayed Murder In Agatha Christies Towards Zero Episode 1 Explained

May 20, 2025 -

Finding Your Path A Comprehensive Guide To Solo Travel

May 20, 2025

Finding Your Path A Comprehensive Guide To Solo Travel

May 20, 2025 -

Transfert De Melvyn Jaminet Kylian Jaminet Denonce Un Montant Excessif

May 20, 2025

Transfert De Melvyn Jaminet Kylian Jaminet Denonce Un Montant Excessif

May 20, 2025 -

15eme Edition Du Salon International Du Livre D Abidjan Conference De Presse

May 20, 2025

15eme Edition Du Salon International Du Livre D Abidjan Conference De Presse

May 20, 2025 -

Unclaimed Savings Thousands Unaware Of Hmrc Debt

May 20, 2025

Unclaimed Savings Thousands Unaware Of Hmrc Debt

May 20, 2025

Latest Posts

-

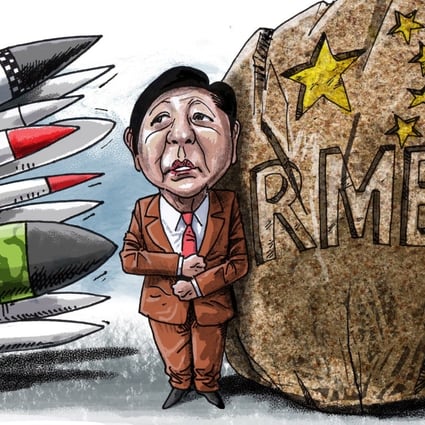

Chinas Demand Philippines Withdraw Typhon Missiles To Maintain Peace

May 20, 2025

Chinas Demand Philippines Withdraw Typhon Missiles To Maintain Peace

May 20, 2025 -

Philippines Stands Strong Against Chinese Pressure Over Missiles

May 20, 2025

Philippines Stands Strong Against Chinese Pressure Over Missiles

May 20, 2025 -

Us Army Expands Pacific Presence With Second Typhon Battery Deployment

May 20, 2025

Us Army Expands Pacific Presence With Second Typhon Battery Deployment

May 20, 2025 -

China Urges Philippines To Remove Typhon Missile System For Regional Stability

May 20, 2025

China Urges Philippines To Remove Typhon Missile System For Regional Stability

May 20, 2025 -

Manila Rejects Chinese Demands Missile System Remains

May 20, 2025

Manila Rejects Chinese Demands Missile System Remains

May 20, 2025