Impact Of UK Inflation On BOE Policy: Pound's Positive Response

Table of Contents

Understanding the Current Inflationary Landscape in the UK

Key Drivers of UK Inflation: Energy Prices, Supply Chain Disruptions, and Wage Growth

The current inflationary pressure in the UK is a multifaceted problem stemming from several interconnected factors.

-

Soaring Energy Prices: The global energy crisis, exacerbated by the war in Ukraine, has significantly increased energy costs for UK households and businesses. This has directly contributed to higher inflation rates, impacting everything from heating bills to transportation costs. The CPI (Consumer Price Index) and RPI (Retail Price Index) have both reflected this sharp increase.

-

Supply Chain Disruptions: The lingering effects of the COVID-19 pandemic and global geopolitical events have created significant bottlenecks in global supply chains. This has led to shortages of various goods, driving up prices and fueling inflation.

-

Wage Growth: While wage increases are generally positive, rapid wage growth exceeding productivity gains can contribute to inflationary pressures, creating a wage-price spiral. This is particularly relevant in a tight labor market where demand for workers is high.

Inflation's Impact on UK Households and Businesses

The high inflation rate in the UK has had a profound impact on both households and businesses.

-

Consumer Spending: The cost of living crisis has significantly reduced consumer confidence and disposable income, leading to decreased consumer spending and impacting economic growth.

-

Business Investment: Businesses are facing increased costs, impacting their profit margins and potentially hindering investment and expansion plans.

-

Economic Growth UK: The overall economic growth of the UK has been negatively affected by the high inflation rate, leading to concerns about a potential recession.

The Bank of England's Response to Rising Inflation

Monetary Policy Tools Employed by the BOE: Interest Rate Hikes and Quantitative Tightening

The BOE has employed several monetary policy tools to combat inflation.

-

Interest Rate Hikes: The Monetary Policy Committee (MPC) has increased the Bank Rate, the base interest rate, several times. This makes borrowing more expensive, aiming to reduce consumer spending and investment, thus cooling down inflationary pressures. Each BOE interest rate decision is closely scrutinized by markets.

-

Quantitative Tightening: The BOE has also engaged in quantitative tightening, selling government bonds held on its balance sheet. This reduces the money supply, further aiming to control inflation.

Analyzing the Effectiveness of BOE's Interventions

The effectiveness of the BOE's interventions is a complex issue.

-

Lagged Effect: Monetary policy operates with a significant time lag. The full impact of interest rate hikes and quantitative tightening is not immediately felt, making it challenging to fine-tune policy in real-time.

-

Inflation Target: The BOE has an inflation target, typically around 2%. The success (or failure) of its policies is measured against its ability to bring inflation back to this target. BOE forecasts are closely monitored to gauge expectations.

The Pound's Positive Response: A Deeper Dive

Factors Contributing to the Pound's Strength

Despite the challenging inflationary environment, the Pound Sterling has shown unexpected strength. This can be attributed to several factors:

-

Investor Confidence: The BOE's decisive action in raising interest rates has boosted investor confidence in the UK economy, attracting capital flows and supporting the pound.

-

Global Economic Conditions: Global economic factors, such as the relative strength of the US dollar, can also affect the GBP exchange rate.

Potential Risks and Challenges to the Pound's Strength

While the Pound's resilience is notable, several risks could negatively impact its strength.

-

Future Inflation Surprises: Unexpectedly high inflation could undermine investor confidence and weaken the pound.

-

Global Economic Downturn: A global recession could negatively impact the UK economy and put downward pressure on the pound.

-

Brexit Impact: The long-term economic consequences of Brexit continue to pose uncertainty and could affect the pound's performance.

Conclusion: The Interplay Between UK Inflation, BOE Policy, and the Pound – A Look Ahead

The relationship between UK inflation, BOE policy decisions, and the Pound Sterling's performance is complex and dynamic. While the BOE's actions have contributed to the pound's unexpected resilience despite inflationary pressures, several risks remain. Understanding the impact of UK inflation on BOE policy and its effect on the Pound Sterling is crucial for navigating the current economic climate. Stay informed about the impact of UK inflation on BOE policy and its subsequent effects on the GBP exchange rate to make informed decisions regarding your investments and financial planning. Understanding this interplay is crucial for effective financial planning and investment strategies.

Featured Posts

-

Konchita Vurst Zhivott Sled Bradatata

May 25, 2025

Konchita Vurst Zhivott Sled Bradatata

May 25, 2025 -

Thames Water Executive Bonuses Transparency And Accountability

May 25, 2025

Thames Water Executive Bonuses Transparency And Accountability

May 25, 2025 -

Los Angeles Wildfires A Reflection Of Societal Shifts Through Gambling Trends

May 25, 2025

Los Angeles Wildfires A Reflection Of Societal Shifts Through Gambling Trends

May 25, 2025 -

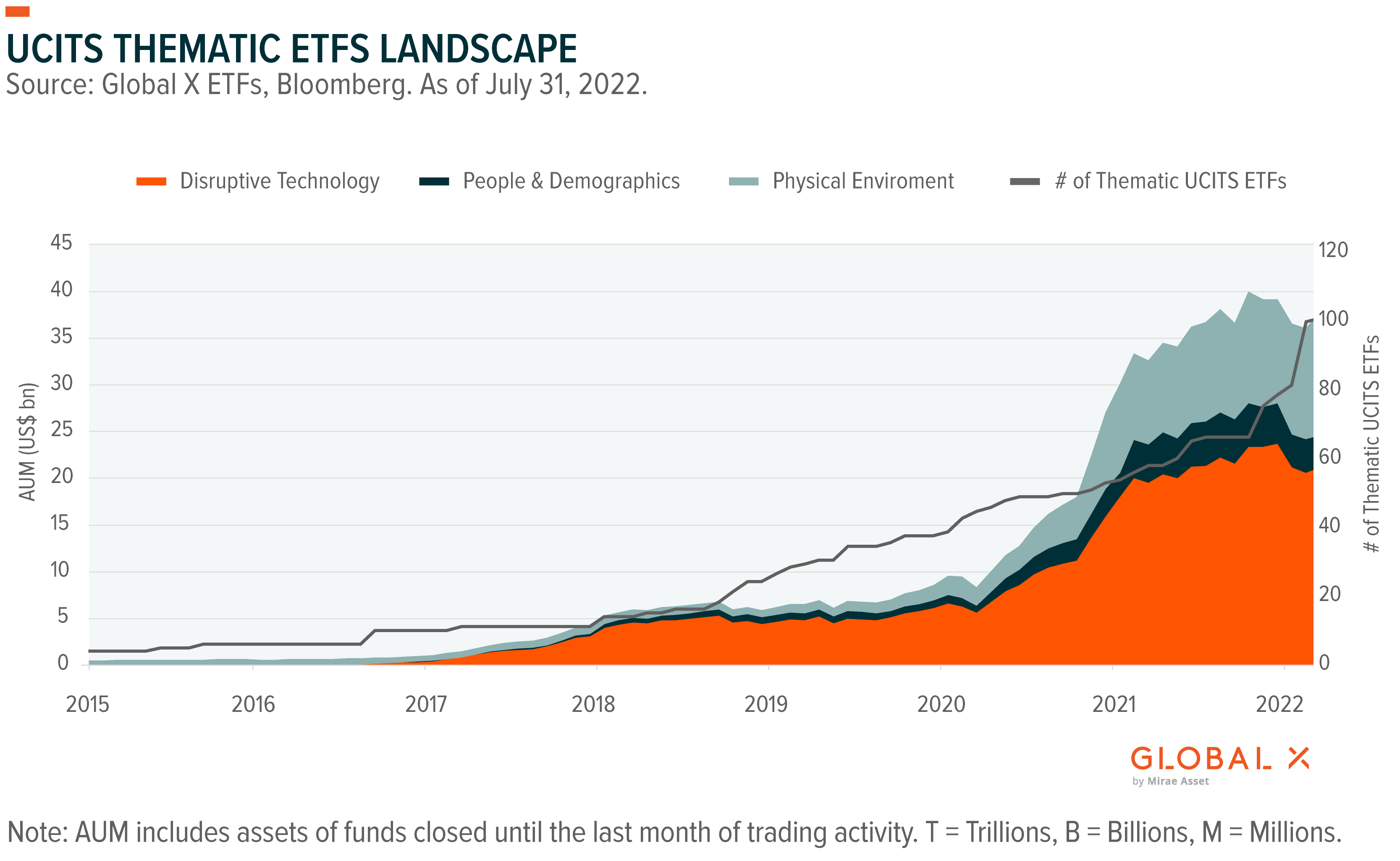

Amundi Msci World Catholic Principles Ucits Etf Acc Nav Analysis And Tracking

May 25, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc Nav Analysis And Tracking

May 25, 2025 -

Schekotat Nervy Analiz Trillerov I Lichnosti Pavla I Po Lavrovu

May 25, 2025

Schekotat Nervy Analiz Trillerov I Lichnosti Pavla I Po Lavrovu

May 25, 2025

Latest Posts

-

Mercedes F1 Wolffs New Hints On Russells Contract Status

May 25, 2025

Mercedes F1 Wolffs New Hints On Russells Contract Status

May 25, 2025 -

The George Russell Contract Why Mercedes Must Act

May 25, 2025

The George Russell Contract Why Mercedes Must Act

May 25, 2025 -

Will Mercedes Re Sign George Russell The Key Factor

May 25, 2025

Will Mercedes Re Sign George Russell The Key Factor

May 25, 2025 -

Toto Wolffs Latest Comments On George Russells Mercedes Contract

May 25, 2025

Toto Wolffs Latest Comments On George Russells Mercedes Contract

May 25, 2025 -

1 5 Million Debt Paid George Russells Financial Update And Its Impact On His F1 Career

May 25, 2025

1 5 Million Debt Paid George Russells Financial Update And Its Impact On His F1 Career

May 25, 2025