Impact Of Student Loan Debt On Your Home Buying Ability

Table of Contents

Understanding the Impact of Student Loan Debt on Mortgage Approval

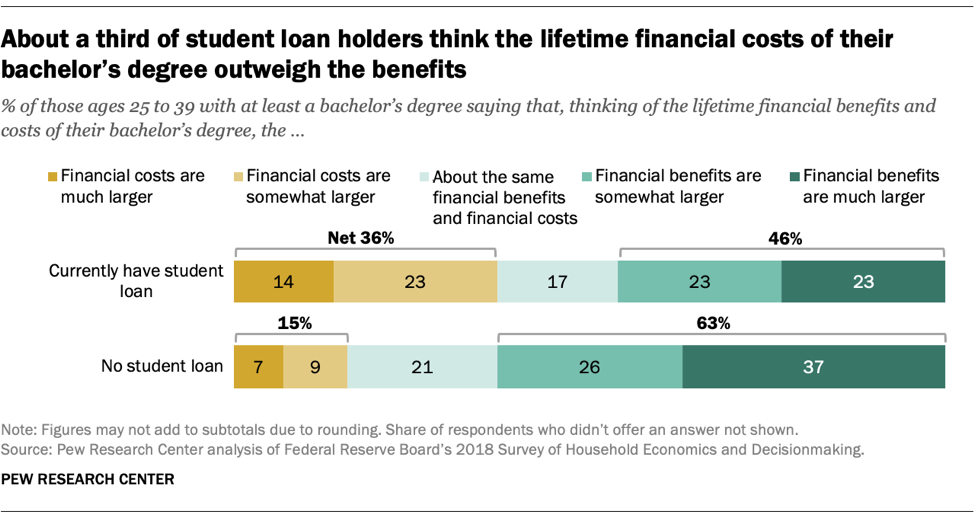

Securing a mortgage with outstanding student loan debt requires careful planning and understanding of its impact. Two key areas significantly influence your mortgage approval: your debt-to-income ratio (DTI) and your credit score.

Debt-to-Income Ratio (DTI):

Your DTI is a crucial factor in mortgage approval. High student loan payments significantly reduce your ability to qualify for a mortgage as lenders assess your capacity to manage monthly expenses. Lenders use your DTI to determine how much risk you pose as a borrower.

- A high DTI limits your borrowing power and may disqualify you from obtaining a mortgage altogether. A higher DTI indicates less disposable income available to cover your mortgage payments.

- Lenders typically prefer a DTI ratio below 43%, and student loan payments heavily influence this calculation. Even small increases in your student loan payments can push your DTI above this threshold.

- Consider strategies to lower your DTI before applying for a mortgage, such as reducing expenses or increasing income. This may involve creating a detailed budget and identifying areas where you can cut back on spending.

Credit Score and Student Loan Payments:

Your credit score is another critical factor influencing mortgage approval. Late or missed student loan payments negatively affect your credit score, making it harder to secure a favorable mortgage interest rate. A strong credit score demonstrates financial responsibility to lenders.

- A lower credit score translates into higher interest rates, increasing your monthly mortgage payments and overall cost. A higher interest rate can significantly impact your affordability and long-term financial stability.

- Consistent on-time payments demonstrate financial responsibility, improving your creditworthiness. Make timely student loan payments a priority to maintain a good credit score.

- Check your credit report regularly for errors and address any issues promptly. Errors on your credit report can negatively impact your credit score, so it's important to stay vigilant and correct any inaccuracies.

Strategies to Manage Student Loan Debt for Home Buying

While student loan debt presents challenges, several strategies can help you manage it effectively and improve your chances of homeownership.

Income-Driven Repayment (IDR) Plans:

Explore IDR plans to lower your monthly student loan payments, thereby improving your DTI. These plans are designed to make student loan repayment more manageable.

- These plans adjust your monthly payments based on your income and family size. This flexibility can significantly reduce your monthly expenses, freeing up more money for savings and mortgage payments.

- While extending the repayment period, IDR plans can significantly improve your chances of mortgage approval. The trade-off is a longer repayment period, but the improved DTI can outweigh this disadvantage.

- Research different IDR plans to find the one best suited to your financial situation. Each plan has its own eligibility requirements and terms, so understanding these details is crucial.

Student Loan Refinancing:

Refinancing your student loans could potentially lower your interest rate and monthly payments. This strategy can consolidate multiple loans into one, making repayment more efficient.

- Shop around and compare rates from different lenders to secure the best deal. Different lenders offer various interest rates and terms, so it's crucial to compare offers before making a decision.

- Refinancing can consolidate multiple loans into one, simplifying repayment. This simplifies your budgeting and tracking of payments.

- Careful consideration is needed; ensure the new interest rate is lower than your existing rates. Refinancing isn't always beneficial; only proceed if the new rate offers substantial savings.

Saving for a Down Payment:

Saving a substantial down payment reduces your loan amount and improves your chances of mortgage approval. A larger down payment demonstrates financial stability.

- A larger down payment typically translates to lower monthly payments and a better interest rate. This can significantly reduce your long-term cost of homeownership.

- Consider opening a high-yield savings account to maximize your savings growth. High-yield savings accounts offer better interest rates compared to traditional savings accounts.

- Explore down payment assistance programs offered by government agencies or local organizations. These programs can provide financial assistance to help you reach your down payment goal.

Seeking Professional Financial Advice

Navigating student loan debt and home buying can be complex. Seeking professional guidance is highly recommended.

Financial Advisors and Mortgage Brokers:

Consulting with financial advisors and mortgage brokers can provide personalized guidance and support. These professionals have expertise in different aspects of personal finance and home buying.

- A financial advisor can help create a comprehensive financial plan that addresses your student loan debt and home buying goals. They can help you develop a realistic budget and savings plan.

- A mortgage broker can help you navigate the mortgage application process and find the best mortgage options. They can assist you in comparing different loan products and finding the most favorable terms.

- These professionals offer valuable insights and strategies tailored to your unique circumstances. Their expert advice can make a significant difference in your success.

Conclusion

Student loan debt significantly impacts your ability to buy a home, primarily affecting your debt-to-income ratio and credit score. However, by strategically managing your student loans through IDR plans, refinancing, and diligent saving, you can significantly improve your chances of homeownership. Don't let student loan debt derail your dreams. Seek professional advice and develop a solid financial plan to overcome these challenges and achieve your goal of owning a home. Take control of your financial future and start planning your path to homeownership today! Learn more about managing the impact of your student loan debt on your home buying ability and find resources to help you succeed.

Featured Posts

-

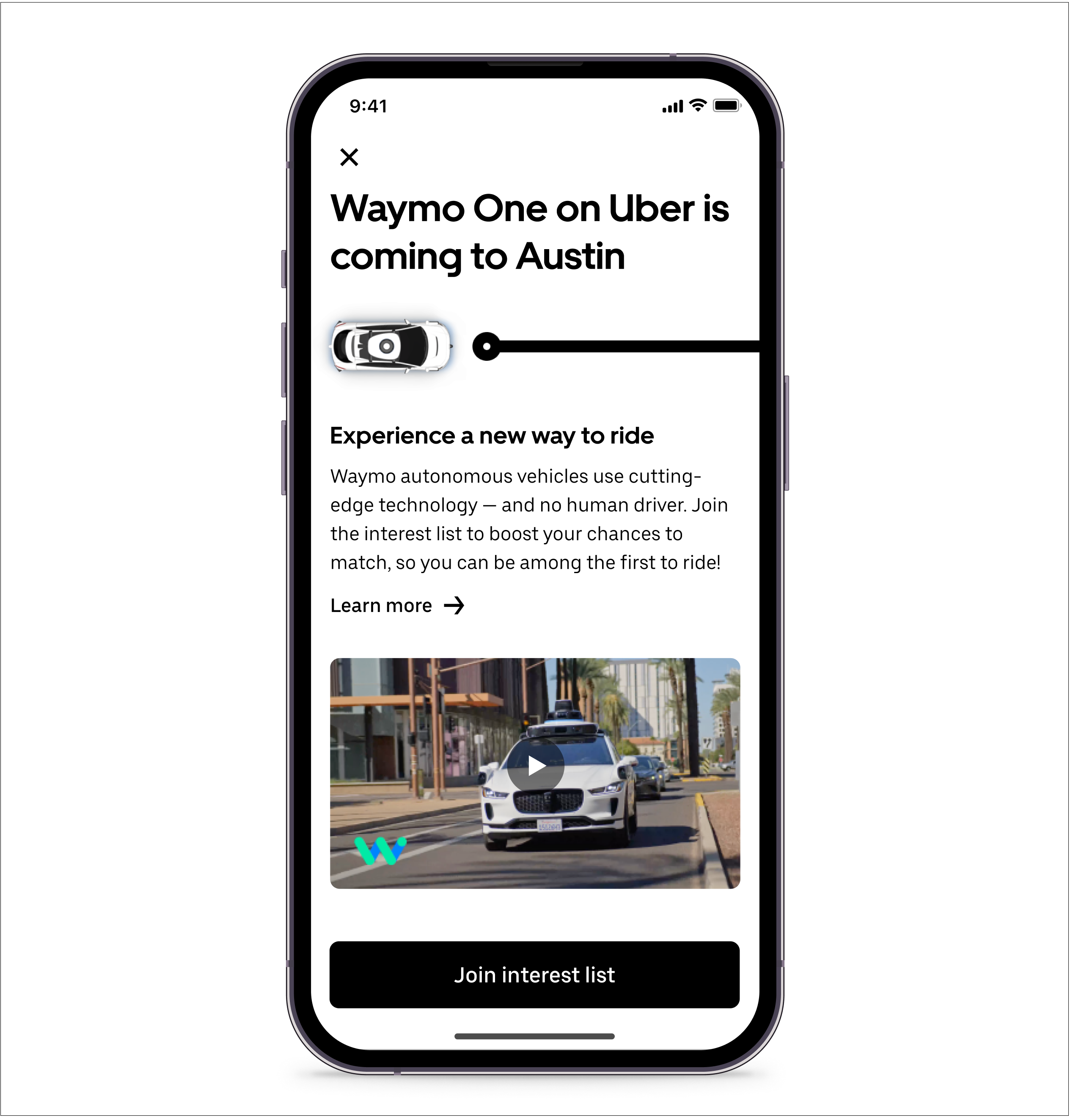

Tom Cruises 1 Debt To Tom Hanks A Hollywood Oddity

May 17, 2025

Tom Cruises 1 Debt To Tom Hanks A Hollywood Oddity

May 17, 2025 -

Laporan Keuangan Manfaat Dan Implementasinya Bagi Pertumbuhan Bisnis

May 17, 2025

Laporan Keuangan Manfaat Dan Implementasinya Bagi Pertumbuhan Bisnis

May 17, 2025 -

Trumps Middle East Trip On May 15 2025 Implications For His Presidency

May 17, 2025

Trumps Middle East Trip On May 15 2025 Implications For His Presidency

May 17, 2025 -

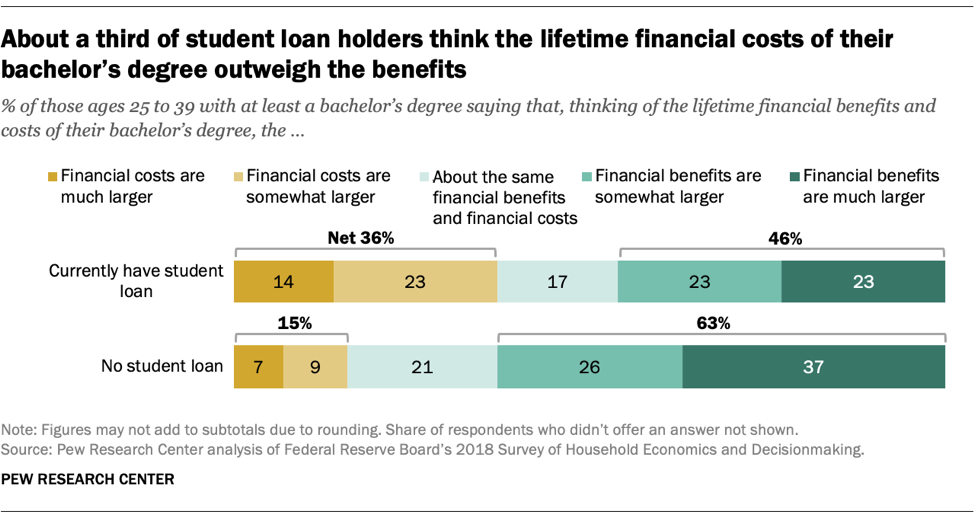

Robo Taxi Competition Heats Up Uber Vs Waymo In Austin

May 17, 2025

Robo Taxi Competition Heats Up Uber Vs Waymo In Austin

May 17, 2025 -

Farq 26 Eama Hl Trbt Twm Krwz Wana Dy Armas Elaqt Eatfyt

May 17, 2025

Farq 26 Eama Hl Trbt Twm Krwz Wana Dy Armas Elaqt Eatfyt

May 17, 2025

Latest Posts

-

Ujedinjeni Arapski Emirati Kompletni Vodic Za Putovanje

May 17, 2025

Ujedinjeni Arapski Emirati Kompletni Vodic Za Putovanje

May 17, 2025 -

Ancaman Houthi Serangan Rudal Ke Dubai Dan Abu Dhabi

May 17, 2025

Ancaman Houthi Serangan Rudal Ke Dubai Dan Abu Dhabi

May 17, 2025 -

De Volta Aos Gramados Ex Vasco Conquista Camisa 10 E Mira Copa 2026 Nos Emirados Arabes

May 17, 2025

De Volta Aos Gramados Ex Vasco Conquista Camisa 10 E Mira Copa 2026 Nos Emirados Arabes

May 17, 2025 -

Camisa 10 Nos Emirados Arabes Ex Jogador Do Vasco Sonha Com A Copa De 2026

May 17, 2025

Camisa 10 Nos Emirados Arabes Ex Jogador Do Vasco Sonha Com A Copa De 2026

May 17, 2025 -

Nos Emirados Arabes Ex Jogador Do Vasco Conquista Camisa 10 E Almeja Copa 2026

May 17, 2025

Nos Emirados Arabes Ex Jogador Do Vasco Conquista Camisa 10 E Almeja Copa 2026

May 17, 2025