Impact Of Saudi Arabia's New ABS Regulations: A Market Bigger Than Spain's

Table of Contents

Increased Investment Opportunities in Saudi Arabia's Growing Market

The new Saudi Arabia ABS regulations unlock significant investment opportunities, both domestically and internationally. The changes create a more attractive environment for capital inflow, fostering economic growth and diversification.

Unlocking Domestic Capital

The regulations aim to stimulate domestic investment by providing a clearer, more transparent framework for ABS issuance. This is expected to significantly impact several key areas:

- Stimulating Domestic Investment: The new regulations provide a clearer path for domestic investors to participate in the market, unlocking previously untapped capital.

- Enhanced Transparency and Standardization: Increased transparency and standardized processes will attract both local and international investors, boosting confidence and participation.

- Boosting Specific Sectors: Sectors like real estate and infrastructure are expected to benefit significantly from increased access to capital facilitated by the new ABS framework. For example, developers can now more easily securitize mortgages and infrastructure projects, attracting funding for large-scale developments crucial to Vision 2030.

Attracting Foreign Direct Investment (FDI)

Improved regulatory clarity significantly enhances investor confidence, leading to a substantial increase in Foreign Direct Investment (FDI).

- Attracting International Capital: The sheer size of the Saudi Arabian market, exceeding that of Spain, makes it a highly attractive destination for foreign capital seeking diversification and exposure to a rapidly developing economy.

- Competitive Regional Advantage: Compared to other regional markets, Saudi Arabia's improved regulatory environment offers a competitive advantage, attracting investors seeking a stable and transparent jurisdiction for their ABS investments.

- Diversification Opportunities: International investors can diversify their portfolios by accessing a growing market with unique investment opportunities within various sectors.

Impact on the Saudi Arabian Financial Sector

The introduction of these new Saudi Arabia ABS Regulations will have a profound and transformative impact on the Kingdom's financial sector.

Development of a More Sophisticated Financial Market

The new ABS framework promotes the development of a more robust and sophisticated financial market.

- Enhanced Market Depth and Breadth: It fosters innovation by providing avenues for securitization of various assets, leading to the creation of new financial products and services.

- Supporting Vision 2030: The development of a more robust financial market is directly aligned with Saudi Arabia's Vision 2030 goals for economic diversification and sustainable growth. The efficient allocation of capital, facilitated by the ABS market, is crucial to achieving these objectives.

- Increased Financial Innovation: The new regulations provide fertile ground for financial innovation, attracting fintech companies and encouraging the development of novel financial products tailored to the specific needs of the Saudi market.

Strengthening Financial Stability

Stricter regulatory measures contribute to a more stable and regulated financial system.

- Protecting Investors: The regulations offer greater investor protection and promote greater confidence in the market.

- Improved Risk Management: The new framework enhances risk management and mitigation practices within the Saudi financial sector, leading to a more resilient and stable financial system.

- Alignment with Global Best Practices: The new regulations are designed in line with international best practices, ensuring alignment with global standards and enhancing the credibility of the Saudi financial market.

Challenges and Opportunities Presented by the New Regulations

While the new Saudi Arabia ABS regulations present significant opportunities, businesses must also navigate certain challenges.

Navigating Regulatory Complexity

The new regulations, while beneficial, may initially present complexities for businesses unfamiliar with ABS structuring.

- Specialized Expertise Required: Navigating the new framework requires specialized expertise in ABS structuring, legal compliance, and financial engineering.

- Compliance and Implementation Challenges: Businesses may face challenges related to compliance and implementation, requiring careful planning and execution.

- Support and Resources: Fortunately, various resources and support are available to help businesses adapt to the new regulations, including consulting firms specializing in ABS structuring and legal advice.

Opportunities for Innovation and Growth

The new framework provides significant opportunities for innovation and growth within the Saudi ABS market.

- Financial Product Innovation: The new regulations stimulate innovation in financial product development, leading to the creation of new and tailored products catering to specific market needs.

- Market Expansion and Spillover Effects: The growth of the Saudi ABS market is expected to have spillover effects on other sectors of the economy, stimulating overall economic activity.

- Job Creation and Economic Activity: The development of the ABS market will create new job opportunities and stimulate economic activity across various sectors.

Conclusion

Saudi Arabia's new ABS regulations represent a pivotal step towards a more sophisticated and robust financial market. The potential for growth is immense, offering unprecedented investment opportunities and shaping the financial landscape of a nation with a market size surpassing that of Spain. By understanding and adapting to these changes, businesses and investors can capitalize on this expanding market and contribute to Saudi Arabia's ongoing economic transformation. Learn more about the implications of Saudi Arabia ABS Regulations and discover how you can benefit from this dynamic market.

Featured Posts

-

Improving Mental Healthcare In Ghana Tackling The Psychiatrist Deficit

May 03, 2025

Improving Mental Healthcare In Ghana Tackling The Psychiatrist Deficit

May 03, 2025 -

Syracuse High School Lacrosse Hazing Scandal 11 Players Surrender

May 03, 2025

Syracuse High School Lacrosse Hazing Scandal 11 Players Surrender

May 03, 2025 -

National Lottery Results Wednesday 30th April 2025

May 03, 2025

National Lottery Results Wednesday 30th April 2025

May 03, 2025 -

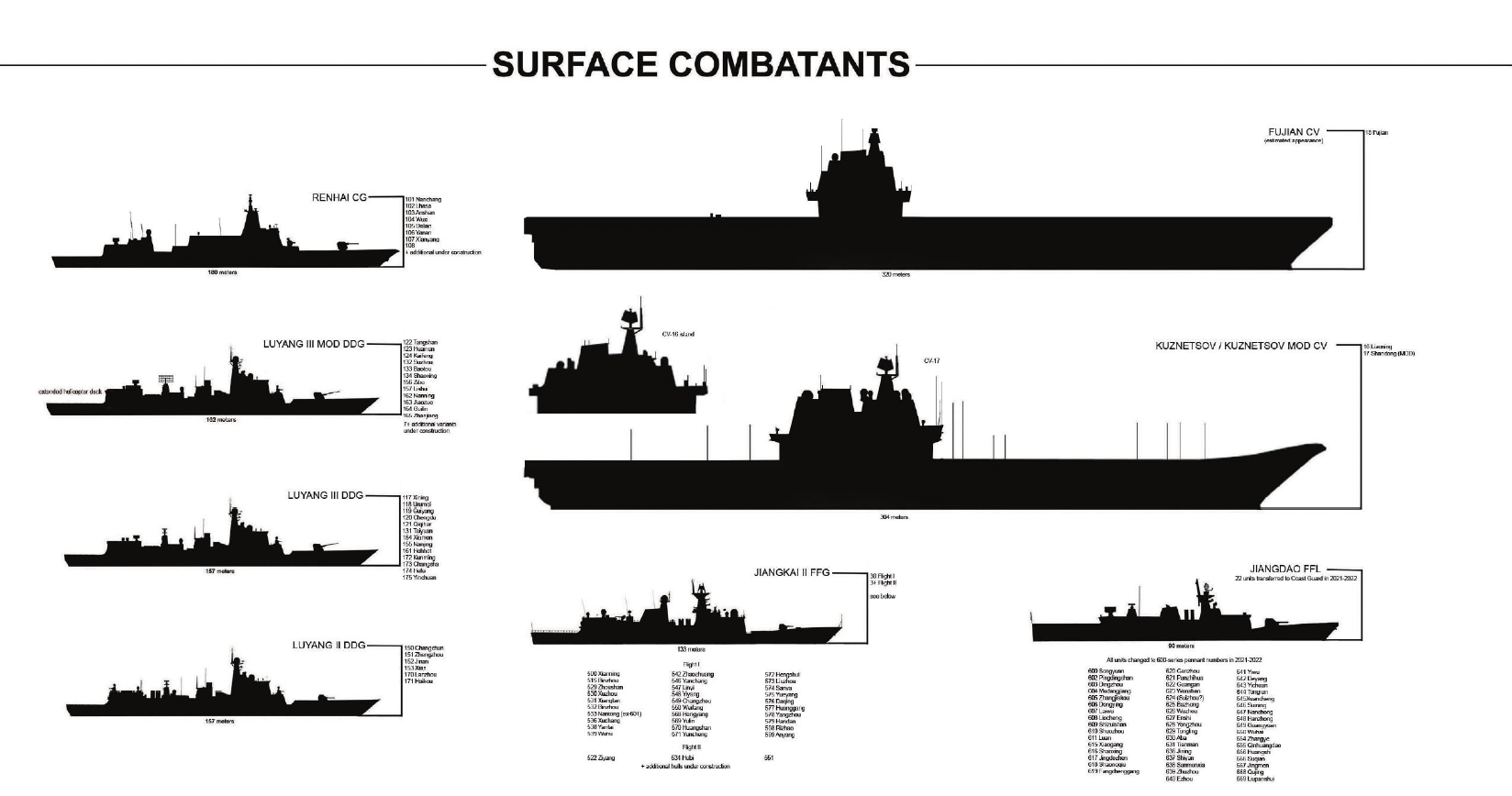

Increased Chinese Naval Activity Off Sydney Coast What Does It Mean For Australia

May 03, 2025

Increased Chinese Naval Activity Off Sydney Coast What Does It Mean For Australia

May 03, 2025 -

Indias Pm Modis France Trip Ai Focus And Business Engagement

May 03, 2025

Indias Pm Modis France Trip Ai Focus And Business Engagement

May 03, 2025