Impact Of Potential Aircraft And Engine Tariffs Under Trump

Table of Contents

Impact on the Aerospace Industry

The aerospace industry, a cornerstone of global trade and technological innovation, would have been particularly vulnerable to the impact of potential aircraft and engine tariffs under Trump. The proposed tariffs threatened to unravel the complex web of international collaboration and supply chains that define this sector.

Job Losses and Production Cuts

Increased tariffs on aircraft and engine imports would have dramatically increased production costs for major aerospace manufacturers. This would likely have led to:

- Significant job losses: Manufacturing, assembly, and related support roles would have been severely affected, impacting thousands of workers across the US and internationally.

- Reduced production: Companies like Boeing and Airbus, heavily reliant on global supply chains, would have been forced to cut production to mitigate increased costs, further exacerbating job losses.

- Impact on Innovation: Reduced investment in research and development as companies struggle with profitability would have dampened innovation within the sector.

While precise figures remain speculative, economic models suggested substantial job losses and production cutbacks across the board. The ripple effect would have been felt throughout the industry, potentially impacting smaller suppliers and subcontractors disproportionately.

Increased Prices for Consumers

The increased costs associated with tariffs would not have remained confined within the industry. Consumers would have felt the pinch through:

- Higher airline ticket prices: Airlines, facing increased costs for aircraft and maintenance, would have passed these expenses onto consumers in the form of higher fares.

- More expensive aircraft maintenance: The cost of repairing and maintaining aircraft would have risen, further impacting the affordability of air travel.

- Reduced accessibility of air travel: Higher prices would likely have reduced the accessibility of air travel, particularly for budget-conscious travelers.

This ripple effect would have impacted not just leisure travel but also business travel and the broader tourism industry, potentially slowing economic growth in related sectors.

Supply Chain Disruptions

The aerospace industry operates on a global scale, with intricate supply chains spanning numerous countries. Tariffs would have severely disrupted these complex networks:

- Delays in aircraft deliveries: Increased lead times and logistical challenges resulting from trade barriers would have led to significant delays in aircraft deliveries.

- Project cancellations: Uncertainty and increased costs associated with tariffs could have forced companies to cancel or postpone projects, leading to further economic losses.

- Increased reliance on domestic suppliers: The necessity of finding alternative domestic suppliers might have proven costly and less efficient in the short term.

The interconnected nature of the aerospace industry means that disruptions in one area would have quickly cascaded throughout the entire system, creating significant vulnerabilities and instability.

Geopolitical Implications of Aircraft and Engine Tariffs

The potential tariffs were not merely an economic issue; they carried significant geopolitical implications.

Strained International Relations

The imposition of tariffs would have severely strained US relations with major trading partners, including:

- Escalation of trade wars: Retaliatory tariffs from affected countries would have further escalated the trade conflict, creating a tit-for-tat scenario harmful to global economic stability.

- Damage to international alliances: The breakdown of trust and cooperation in trade would have damaged existing alliances and weakened international collaboration on other critical issues.

- Impact on existing trade agreements: The WTO and other trade agreements would have been challenged and potentially undermined by protectionist measures.

The ramifications for international diplomacy and strategic alliances would have been profound.

Shifting Global Manufacturing Landscape

Tariffs could have incentivized companies to:

- Shift production overseas: To avoid tariffs, manufacturers might have moved production facilities to other countries, resulting in a loss of jobs and economic activity in the US.

- Weakening of US competitiveness: The long-term consequence would have been a decline in the competitiveness of the US aerospace industry on the global stage.

- Emergence of new global manufacturing hubs: Other countries would have benefited from the shift in manufacturing, potentially leading to the emergence of new global manufacturing hubs.

This shift in the global manufacturing landscape would have had lasting implications for the US economy and its position in the global aerospace market.

Economic Consequences Beyond the Aerospace Sector

The impact of potential aircraft and engine tariffs under Trump would not have been limited to the aerospace sector.

Impact on GDP and Economic Growth

The disruption of trade and investment would have likely resulted in:

- Reduced overall economic growth: The negative impact on the aerospace industry and related sectors would have reduced overall GDP growth.

- Decline in consumer spending: Increased prices for air travel and other goods and services would have dampened consumer spending.

- Uncertainty and reduced investment: The economic uncertainty associated with trade wars would have discouraged investment, further slowing economic growth.

The macroeconomic consequences of such widespread disruption could have been far-reaching and significant.

Effects on Related Industries

The ripple effects would have impacted industries closely linked to the aerospace sector, including:

- Logistics and transportation: The reduced volume of air freight and disrupted supply chains would have negatively affected the logistics industry.

- Materials suppliers: Companies supplying materials to the aerospace industry would have experienced reduced demand and potentially job losses.

- Tourism and hospitality: The reduced accessibility and higher cost of air travel would have had a knock-on effect on the tourism and hospitality sectors.

The interconnectedness of the global economy means that the impact of aircraft and engine tariffs would have extended far beyond the aerospace sector itself.

Conclusion: Assessing the Long-Term Impact of Aircraft and Engine Tariffs Under Trump

The potential impact of potential aircraft and engine tariffs under Trump painted a concerning picture. The analysis reveals that the consequences would have been far-reaching, affecting not only the aerospace industry but also international relations, and the broader US economy. Job losses, increased prices, supply chain disruptions, and strained international relations were all likely outcomes. The long-term implications include a potential decline in the competitiveness of the US aerospace industry and a reshaping of the global manufacturing landscape. Understanding the Impact of Potential Aircraft and Engine Tariffs Under Trump is crucial for navigating the complexities of global trade. Continue your research to stay informed on the future of aerospace and international trade relations.

Featured Posts

-

Yankees Giants April 11 13 Key Injuries To Watch

May 11, 2025

Yankees Giants April 11 13 Key Injuries To Watch

May 11, 2025 -

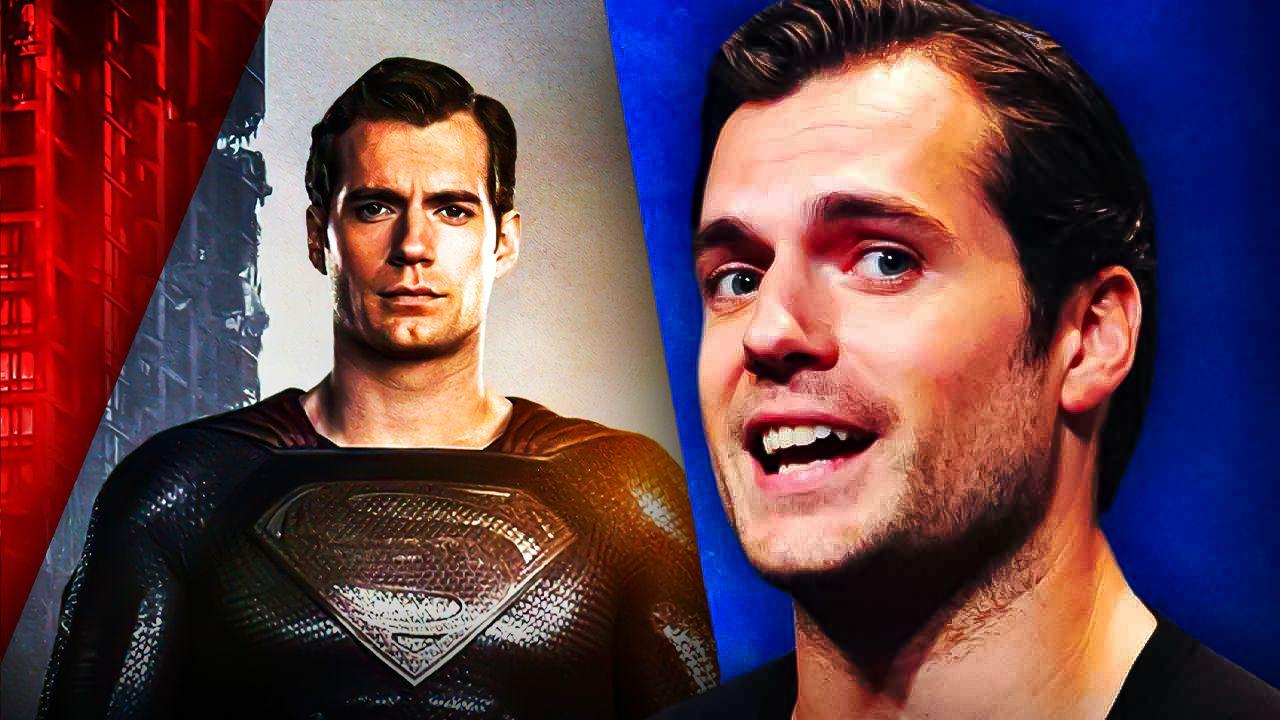

Marvels Cancellation Of Henry Cavill Show A Potential Upside

May 11, 2025

Marvels Cancellation Of Henry Cavill Show A Potential Upside

May 11, 2025 -

Anunoby Anota 27 Knicks Vencen A Sixers Novena Derrota Para Filadelfia

May 11, 2025

Anunoby Anota 27 Knicks Vencen A Sixers Novena Derrota Para Filadelfia

May 11, 2025 -

Virginia Giuffre Prince Andrew Accuser Involved In Car Crash Reports Of Imminent Death

May 11, 2025

Virginia Giuffre Prince Andrew Accuser Involved In Car Crash Reports Of Imminent Death

May 11, 2025 -

Whoop Facing Backlash Free Upgrade Controversy Sparks User Outrage

May 11, 2025

Whoop Facing Backlash Free Upgrade Controversy Sparks User Outrage

May 11, 2025