Ignoring The Bond Crisis: A Risky Strategy For Investors

Table of Contents

Understanding the Current Bond Market Crisis

The current bond market crisis is a confluence of several interconnected factors, each posing significant challenges to investors.

Rising Interest Rates and Their Impact

Rising interest rates have a direct and inverse impact on bond prices. When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower coupon rates less attractive. This causes the prices of existing bonds to fall.

- Mechanics of Interest Rate Hikes: Central banks raise interest rates to combat inflation. This increase affects the yield curve, pushing up yields on newly issued bonds and diminishing the value of existing bonds.

- Impact on Existing Bonds: Bonds with longer maturities are more sensitive to interest rate changes. A rise in interest rates leads to larger price declines for long-term bonds compared to short-term bonds.

- Implications for Fixed-Income Investors: Fixed-income investors relying on bond income face reduced returns as bond prices decline. Reinvesting matured bonds at lower prices further impacts overall returns.

Keywords: interest rate risk, bond yield, fixed-income investments, rising interest rates, bond market volatility

Inflation's Erosive Power on Bond Returns

Inflation significantly erodes the purchasing power of bond returns. Even if a bond generates a positive nominal yield, if inflation outpaces that yield, the real return is negative.

- Real Yield: Real yield reflects the actual return after accounting for inflation. It's calculated by subtracting the inflation rate from the nominal yield.

- Inflation-Adjusted Returns: Investors need to consider inflation-adjusted returns to accurately assess the true return on their bond investments. Unexpected inflation surges can dramatically reduce real returns.

- TIPS (Treasury Inflation-Protected Securities): TIPS are designed to protect investors from inflation risk by adjusting their principal based on inflation. They offer a hedge against inflation but may not always outperform traditional bonds.

Keywords: inflation risk, real yield, purchasing power, inflation-adjusted bonds, TIPS (Treasury Inflation-Protected Securities)

Geopolitical Uncertainty and its Ripple Effect

Global events profoundly impact bond markets. Geopolitical instability creates uncertainty, prompting investors to seek safer havens, often impacting bond prices.

- Impact of War and Trade Tensions: Periods of war or heightened trade tensions increase market volatility and can trigger significant shifts in bond prices, especially in sovereign debt markets.

- Political Instability: Political instability within a country can negatively affect its sovereign bonds' perceived risk, leading to lower prices and higher yields.

- Safe-Haven Assets: During times of uncertainty, investors often flock to safe-haven assets like US Treasury bonds, driving their prices up and yields down. This flight to safety can create imbalances across different bond markets.

Keywords: geopolitical risk, safe-haven assets, sovereign debt, global bond market, political risk

The Consequences of Ignoring the Bond Crisis

Ignoring the warning signs of a potential bond crisis can have severe repercussions for investors.

Potential Portfolio Losses

A deepening bond crisis could result in significant capital losses within bond portfolios.

- Scenarios of Loss: A sharp rise in interest rates can trigger substantial price declines, especially for long-term bonds. Defaults on corporate bonds can lead to complete loss of principal.

- Impact on Different Bond Types: Corporate bonds, typically higher yielding but riskier, are more vulnerable to defaults than government bonds during a crisis. Even government bonds can experience price fluctuations.

Keywords: capital losses, bond portfolio diversification, risk management, portfolio optimization, bond defaults

Missed Opportunities for Higher Returns

Ignoring the crisis could lead to missing out on potentially higher returns in other asset classes.

- Alternative Investments: Asset classes like equities (stocks), real estate, and commodities may offer superior risk-adjusted returns during a period of bond market distress.

- Strategic Asset Allocation: A well-diversified portfolio that includes alternative investments can cushion the impact of bond market volatility.

Keywords: alternative investments, asset allocation, risk-adjusted returns, diversification strategy, investment portfolio

Increased Market Volatility and its Impact

Increased market volatility leads to sharper price swings, creating challenges for investors.

- Psychological Impact: Market volatility can trigger emotional reactions, leading to panic selling and potentially exacerbating losses.

- Market Timing Challenges: Attempting to time the market perfectly is incredibly difficult and often results in poor investment decisions.

Keywords: market volatility, risk tolerance, emotional investing, panic selling, market timing

Strategies for Navigating the Bond Crisis

Proactive strategies are vital to mitigating risks and potentially capitalizing on opportunities.

Diversification and Asset Allocation

Diversifying investments across multiple asset classes is paramount.

- Asset Class Diversification: Including stocks, real estate, commodities, and alternative investments can reduce overall portfolio volatility and protect against bond market downturns.

- Strategic Asset Allocation: A strategic asset allocation plan considers your risk tolerance and investment goals to determine the optimal mix of assets in your portfolio.

Keywords: portfolio diversification, asset allocation strategy, risk mitigation, alternative asset classes, strategic asset allocation

Short-Term Bonds and Their Role

Short-term bonds are less sensitive to interest rate fluctuations than long-term bonds.

- Reduced Price Sensitivity: Short-term bonds have shorter maturities, meaning their prices are less affected by changes in interest rates.

- Bond Laddering: Constructing a bond ladder with bonds maturing at different times can provide a stable stream of income and reduce interest rate risk.

Keywords: short-term bonds, interest rate risk management, maturity matching, bond laddering, yield curve strategies

Professional Advice and Due Diligence

Seeking professional financial advice is crucial for navigating complex market conditions.

- Personalized Investment Plans: A financial advisor can create a personalized investment plan tailored to your risk tolerance, investment goals, and financial situation.

- Risk Assessment: A professional risk assessment helps you understand your portfolio’s exposure to different risks and develop strategies to mitigate them.

Keywords: financial advisor, investment planning, risk assessment, wealth management, portfolio management

Conclusion

Ignoring the looming bond crisis is a reckless strategy that could lead to significant financial setbacks. By comprehending the driving forces behind this crisis and implementing proactive risk management strategies, investors can substantially mitigate potential losses. Diversification, a strategic asset allocation plan, and seeking expert financial advice are indispensable steps in navigating this turbulent period. Don't gamble with your financial future; actively manage your bond holdings, diversify your portfolio, and develop a robust strategy to effectively navigate the challenges of the bond market crisis.

Featured Posts

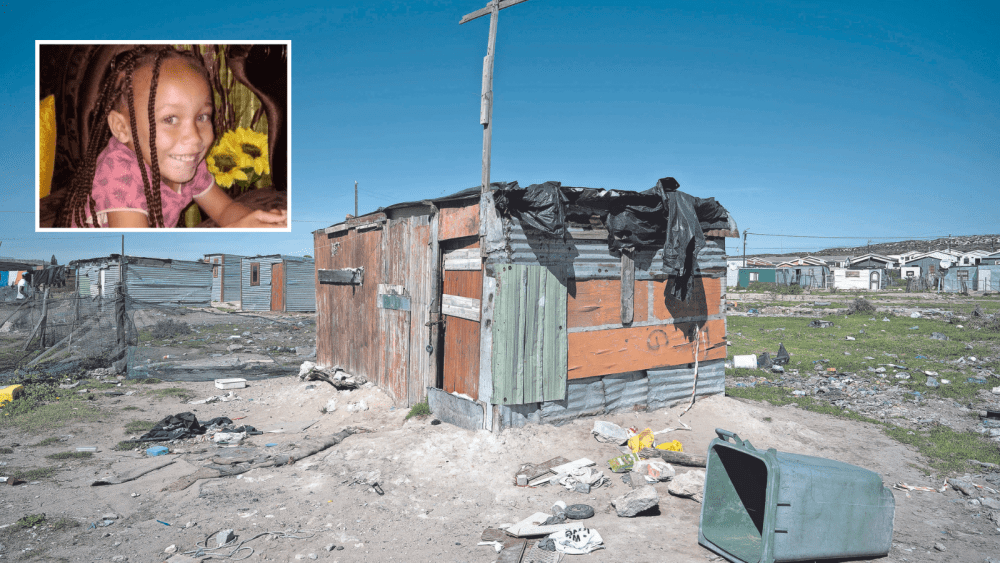

-

Alleged Torture In Joshlin Smith Case Appolliss Testimony

May 29, 2025

Alleged Torture In Joshlin Smith Case Appolliss Testimony

May 29, 2025 -

Brisbane Councils Funding Cut Sparks Debate Queensland Music Awards In Jeopardy

May 29, 2025

Brisbane Councils Funding Cut Sparks Debate Queensland Music Awards In Jeopardy

May 29, 2025 -

Alsbaq Mhtdm Bayrn Mywnkh Wbrshlwnt Ytnafsan Ela Laeb Mwhwb

May 29, 2025

Alsbaq Mhtdm Bayrn Mywnkh Wbrshlwnt Ytnafsan Ela Laeb Mwhwb

May 29, 2025 -

Double Trouble In Hollywood Writers And Actors Strike Impacts Production

May 29, 2025

Double Trouble In Hollywood Writers And Actors Strike Impacts Production

May 29, 2025 -

Lakasodban Rejlo Kincs Szazezres Erteket Erhetnek Ezek Az Aprosagok

May 29, 2025

Lakasodban Rejlo Kincs Szazezres Erteket Erhetnek Ezek Az Aprosagok

May 29, 2025