Ignoring High Stock Valuations: A BofA-Supported Investment Strategy

Table of Contents

Understanding the BofA Perspective on High Valuations

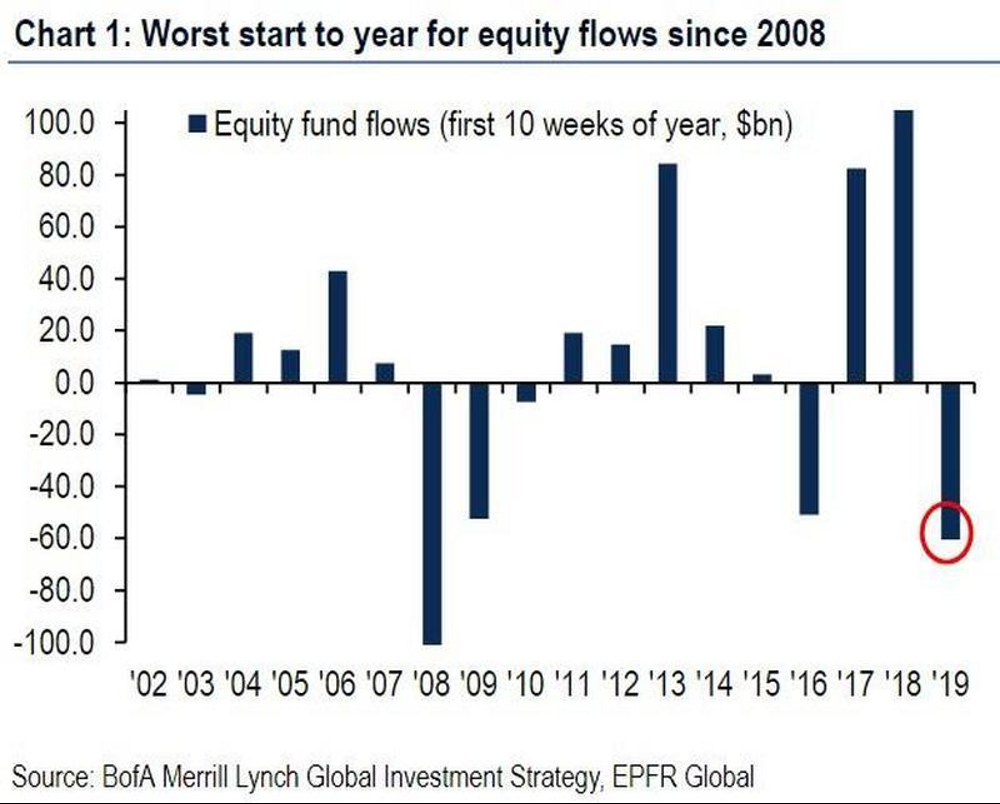

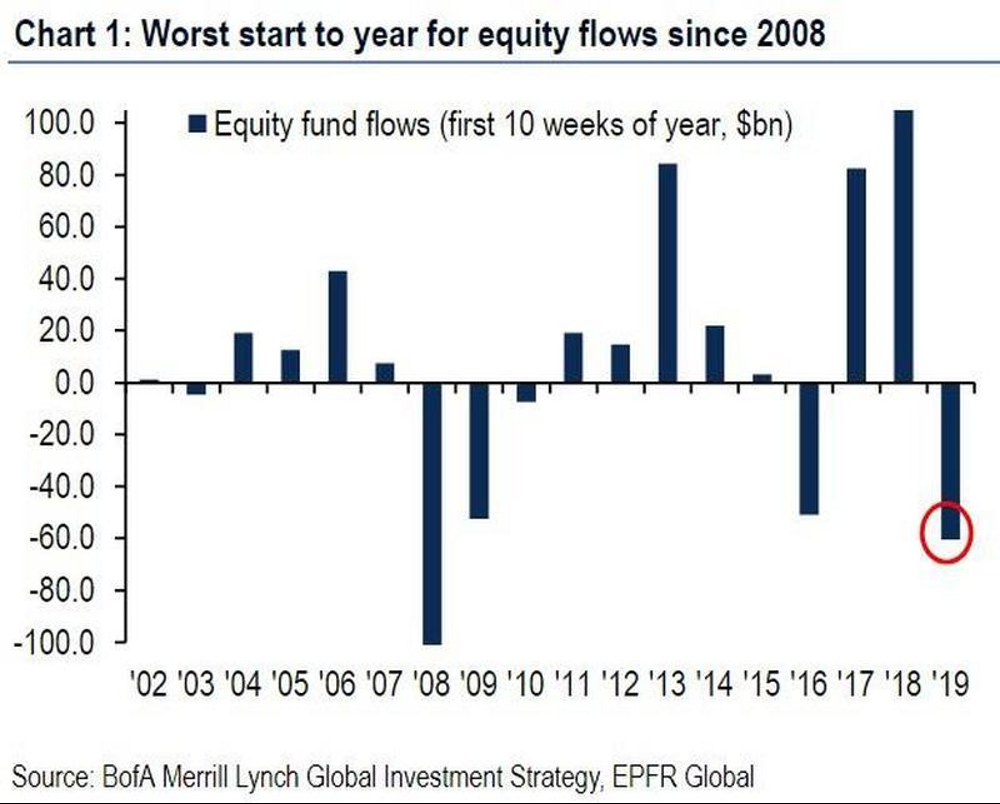

Bank of America's analysts have, at times, presented a contrarian view on high stock valuations. While acknowledging the elevated price-to-earnings (P/E) ratios of certain sectors, their outlook often considers factors beyond simple valuation metrics. Their reports often highlight the long-term growth potential of specific companies and sectors, even when short-term valuations appear stretched. This approach emphasizes a long-term investment horizon rather than focusing solely on short-term market fluctuations.

- BofA's justification for overlooking high valuations: BofA's justification often centers on several key factors: persistently low interest rates, strong corporate earnings growth, and robust long-term economic growth projections. These factors can support higher stock prices despite seemingly high valuations. The belief is that future earnings will justify current prices.

- Key economic indicators BofA considers: BofA's analysts carefully monitor key economic indicators, including inflation rates, GDP growth, and unemployment figures. These metrics provide context for their valuation assessments and inform their predictions about future earnings growth.

- Specific sectors or stocks BofA recommends: While specific recommendations change frequently based on market conditions, BofA has historically highlighted technology, healthcare, and certain consumer staples sectors as having strong growth potential, even with higher valuations. Always refer to the latest BofA research reports for the most up-to-date information.

The Role of Interest Rates in High-Valuation Environments

The relationship between interest rates and stock valuations is inversely correlated. Low interest rates generally support higher stock valuations because they reduce the discount rate used in discounted cash flow (DCF) analysis. This means future earnings are worth more today when interest rates are low.

- How low interest rates can support higher stock prices: Lower interest rates make borrowing cheaper for companies, allowing them to invest more, which can lead to higher earnings and stock prices. They also make bonds less attractive relative to stocks, encouraging investors to move into the equity market.

- Discounted cash flow analysis and interest rates: DCF analysis is a crucial valuation tool. It discounts future cash flows back to their present value, using the interest rate as a discount factor. Lower interest rates lead to higher present values, justifying higher stock prices.

- Potential impact of future interest rate hikes: A significant increase in interest rates could negatively impact stock valuations, particularly for companies with high debt levels or those reliant on future earnings growth. This is a key risk to consider when employing this strategy.

Identifying Opportunities Despite High Valuations

Even in a market with high valuations, opportunities exist for discerning investors. Focusing on specific qualities can help identify promising companies.

- Companies with strong revenue growth and earnings potential: Prioritize companies demonstrating consistent and substantial revenue growth, coupled with strong earnings and profit margins. This indicates a strong underlying business model.

- Companies with durable competitive advantages (moats): Look for companies with strong brands, patents, or other competitive advantages that protect them from competition and ensure long-term profitability. These "moats" provide a buffer against economic downturns.

- Long-term growth prospects: Consider companies with clear paths to future growth, even if current valuations seem high. Focus on the long-term potential rather than short-term market noise.

- Importance of diversification: Diversifying across different sectors and asset classes is crucial to mitigate risk, even when employing this seemingly aggressive strategy. Don't put all your eggs in one basket.

Managing Risk When Ignoring High Stock Valuations

Ignoring high valuations inherently involves higher risk. A market correction could lead to significant losses. Thorough risk management is paramount.

- Potential for significant losses: If the market experiences a sharp downturn, stocks with high valuations could suffer disproportionately large losses. Be prepared for this possibility.

- Thorough due diligence and risk assessment: Before investing, conduct comprehensive research, including a thorough analysis of financial statements, competitive landscape, and management quality.

- Strategies for mitigating risk: Employ strategies like dollar-cost averaging (investing a fixed amount at regular intervals) and setting stop-loss orders (selling a stock when it reaches a predetermined price) to limit potential losses.

- Considering alternative investment options: Diversification beyond stocks, such as bonds or real estate, is vital for a balanced portfolio and reducing overall risk.

Conclusion

Ignoring high stock valuations can be a viable investment strategy under specific circumstances, supported by certain analyses from firms like BofA. This approach leverages factors like low interest rates and strong corporate earnings, but it's not without risks. The potential for significant losses is real, and thorough due diligence and risk management are absolutely critical. Remember to carefully consider your risk tolerance and invest only what you can afford to lose. Ignoring high stock valuations requires a long-term perspective and a disciplined approach. Don't let fear of high valuations paralyze you—start researching high-growth companies today and build a robust portfolio. Remember to conduct thorough due diligence before implementing any investment strategy involving ignoring high stock valuations.

Featured Posts

-

China Tariffs Analysts Predict Trumps 30 Duty Until 2025

May 18, 2025

China Tariffs Analysts Predict Trumps 30 Duty Until 2025

May 18, 2025 -

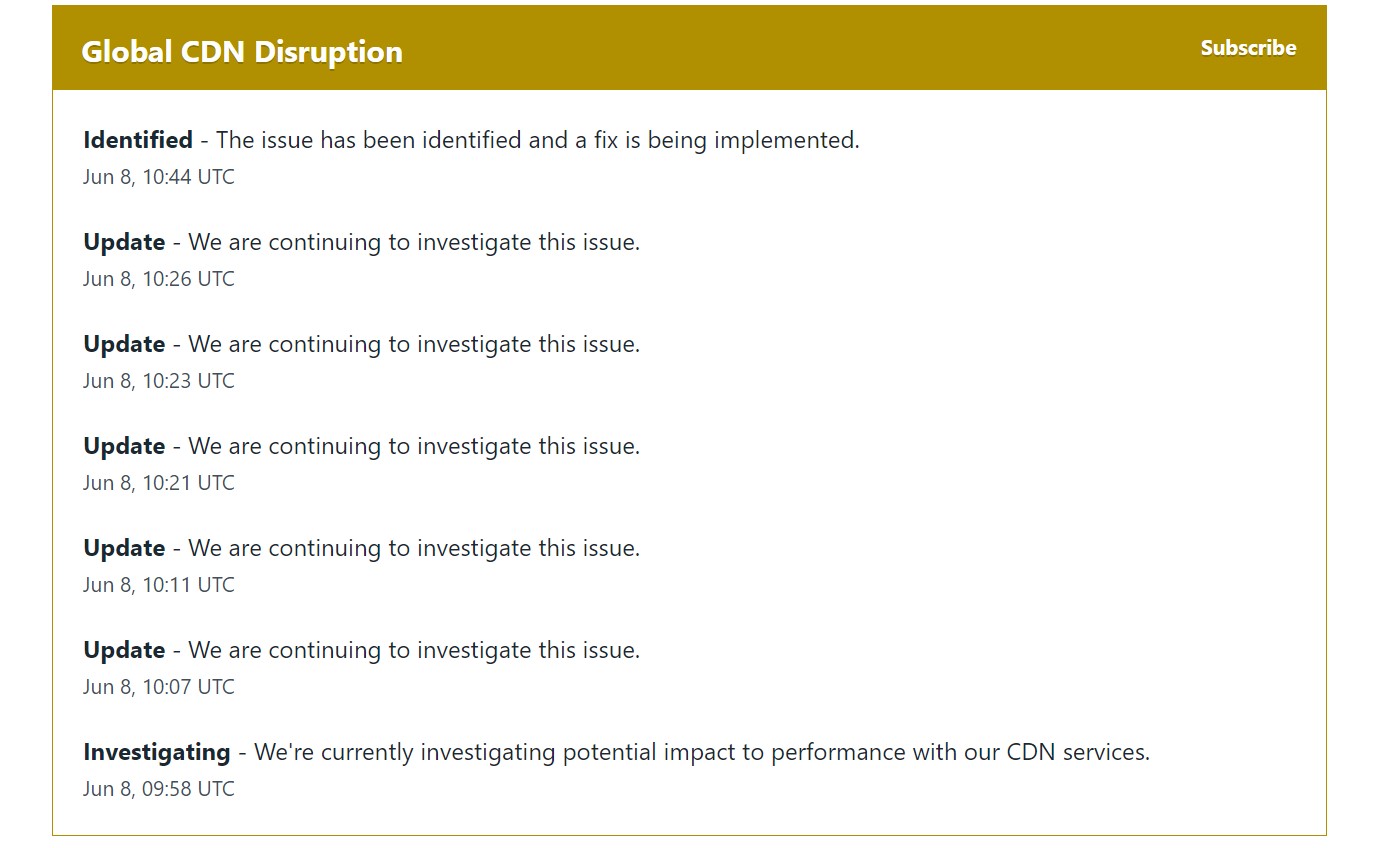

Major Reddit Outage Affecting Users Worldwide

May 18, 2025

Major Reddit Outage Affecting Users Worldwide

May 18, 2025 -

Nederlandse Defensie Industrie Groeiende Steun Voor Expansie In Onzekere Tijden

May 18, 2025

Nederlandse Defensie Industrie Groeiende Steun Voor Expansie In Onzekere Tijden

May 18, 2025 -

Exploring Taylor Swifts Eras Tour Fashion A Comprehensive Photo Guide

May 18, 2025

Exploring Taylor Swifts Eras Tour Fashion A Comprehensive Photo Guide

May 18, 2025 -

Damiano David A Deep Dive Into Funny Little Fears

May 18, 2025

Damiano David A Deep Dive Into Funny Little Fears

May 18, 2025

Latest Posts

-

Low Scoring Affair Sorianos Pitching Leads Angels To 1 0 Win Over White Sox

May 18, 2025

Low Scoring Affair Sorianos Pitching Leads Angels To 1 0 Win Over White Sox

May 18, 2025 -

Is The Red Sox Cardinals Trade The Answer To Bostons Bullpen Woes

May 18, 2025

Is The Red Sox Cardinals Trade The Answer To Bostons Bullpen Woes

May 18, 2025 -

Red Sox And Cardinals Trade Key Improvements To Bostons Bullpen

May 18, 2025

Red Sox And Cardinals Trade Key Improvements To Bostons Bullpen

May 18, 2025 -

Jose Sorianos Gem Angels Secure 1 0 Win Against White Sox

May 18, 2025

Jose Sorianos Gem Angels Secure 1 0 Win Against White Sox

May 18, 2025 -

White Sox Fall To Angels 1 0 Sorianos Commanding Game

May 18, 2025

White Sox Fall To Angels 1 0 Sorianos Commanding Game

May 18, 2025