Ignoring High Stock Market Valuations: A BofA-Supported Argument

Table of Contents

BofA's Rationale: Why High Valuations Might Not Matter

BofA's investment strategy, in certain market conditions, suggests that focusing solely on high stock market valuations might be overly simplistic. Their rationale hinges on several key factors: low interest rates, strong earnings growth, positive market sentiment, and the inflationary environment.

Low Interest Rates: Historically low interest rates significantly influence stock market valuations.

- Low interest rates make bonds less attractive, driving investors towards equities. When bond yields are low, the relatively higher returns offered by stocks, even at seemingly high valuations, become more appealing. This increased demand pushes stock prices higher.

- Quantitative easing (QE) programs implemented by central banks further inflate stock valuations. By injecting liquidity into the market, QE can lead to higher stock prices, even if underlying fundamentals don't fully justify the increase. This effect needs careful consideration when evaluating market conditions.

Strong Earnings Growth: Robust corporate earnings growth can mitigate concerns about high Price-to-Earnings (P/E) ratios.

- Many companies continue to exceed earnings expectations, even with high stock prices. This demonstrates that strong fundamental performance can support elevated valuations. Analyzing individual company performance is critical to understanding if high valuations are justified.

- Sustainable earnings growth is key. High valuations are more easily justified when supported by consistent and predictable growth in earnings. Investors should carefully examine the long-term prospects of companies before investing.

Positive Market Sentiment: Investor confidence and optimism play a critical role in supporting higher valuations.

- Positive economic news fuels market sentiment. Positive economic data often translates into increased investor confidence, leading to higher stock prices and valuations.

- Market sentiment can become a self-fulfilling prophecy. Optimism can lead to more buying, pushing prices even higher, further reinforcing the positive sentiment. This can create a cyclical effect that sustains high valuations.

Inflationary Environment: Inflation can significantly impact valuations, potentially lessening concerns about high P/E ratios.

- Inflation erodes the value of cash and bonds, making equities a comparatively better hedge. In an inflationary environment, stocks often outperform other asset classes as companies can pass on increased costs to consumers.

- The interplay between inflation, interest rates, and stock valuations is complex. Rising inflation may lead to higher interest rates, which could negatively impact stock valuations. However, if inflation is moderate and controlled, it could still support higher valuations.

Counterarguments and Risks of Ignoring High Valuations

While BofA's arguments provide a compelling perspective, it's crucial to acknowledge the counterarguments and inherent risks associated with ignoring high stock market valuations.

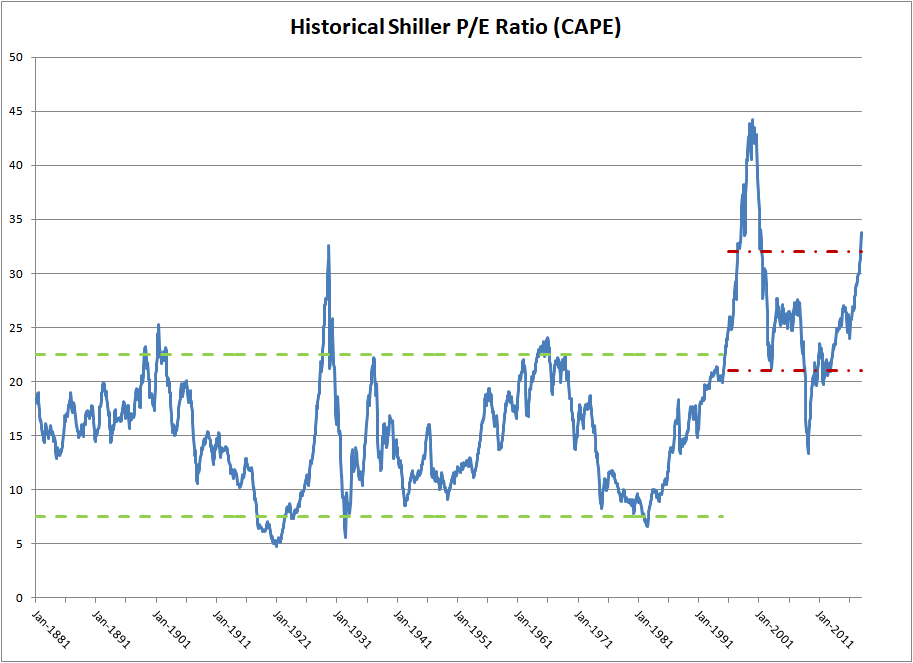

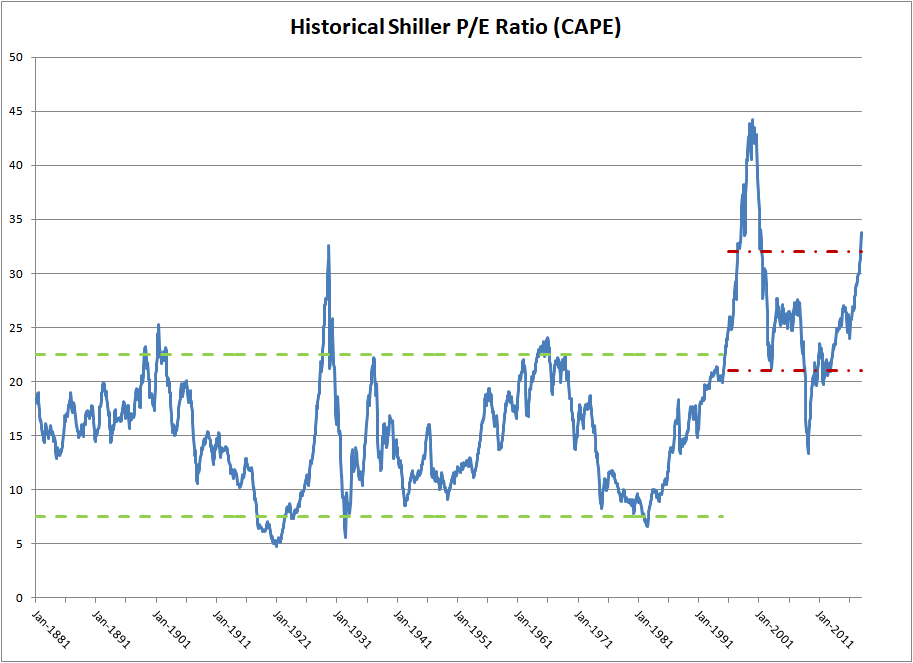

Potential for Market Correction: High valuations often precede market corrections.

- History is replete with examples of market corrections following periods of high valuations. These corrections can be sharp and swift, significantly impacting portfolios heavily weighted in high-valuation stocks.

- Thorough risk assessment is essential before investing in a market with high valuations. Understanding your risk tolerance and investment horizon is paramount.

Valuation Bubble Concerns: The possibility of a valuation bubble is a significant risk.

- Historical valuation bubbles share common characteristics, including rapid price increases detached from fundamental values. Recognizing these characteristics is vital for identifying potential bubbles.

- Recognizing warning signs is key. These may include excessively optimistic market sentiment, speculative trading activity, and unsustainable levels of debt.

Importance of Diversification: Diversification remains critical to mitigate risk.

- Diversifying investments across different sectors, asset classes, and geographies reduces the impact of a potential market downturn. This minimizes exposure to any single risk.

- Investing across different asset classes, such as stocks, bonds, and real estate, helps balance your portfolio. This strategy can improve overall risk-adjusted returns.

Developing a Prudent Investment Strategy

Navigating high stock market valuations requires a well-defined investment strategy.

Assessing Your Risk Tolerance: Understanding your risk tolerance is paramount.

- A simple questionnaire or checklist can help you determine your risk profile. Consider your comfort level with potential losses.

- Your risk tolerance should directly influence your investment decisions. Higher risk tolerance might allow you to invest more aggressively in higher-valuation stocks.

Setting Your Investment Horizon: Your investment timeframe significantly impacts your choices.

- Short-term investors are more vulnerable to market fluctuations than long-term investors. Long-term investors can weather short-term volatility.

- Long-term investors can potentially benefit from compounding returns, even if the market experiences short-term corrections.

Considering Asset Allocation: Asset allocation is critical for a balanced portfolio.

- Different asset allocation strategies cater to diverse risk tolerances and goals. A balanced portfolio often includes a mix of stocks and bonds.

- Regularly review and adjust your asset allocation based on market conditions and your changing circumstances.

Seeking Professional Advice: Consider consulting a financial advisor.

- A financial advisor can offer personalized guidance tailored to your specific financial situation, risk tolerance, and investment goals.

- Numerous resources can help you find a qualified financial advisor. Due diligence is essential to ensure the advisor's expertise and suitability for your needs.

Conclusion

While BofA's arguments for potentially overlooking high stock market valuations provide a valuable perspective, a cautious approach remains crucial. Understanding the underlying rationale—including low interest rates, strong earnings growth, and positive market sentiment—is essential. However, equally important is acknowledging the risks of market corrections and valuation bubbles. A prudent investment approach involves a thorough risk assessment, a well-defined investment horizon, a diversified portfolio, and, ideally, professional guidance.

Call to Action: Don't ignore the complexities surrounding high stock market valuations. Carefully weigh the arguments presented here, analyze your risk tolerance, and create a well-informed investment strategy that aligns perfectly with your circumstances. Learn more about effectively managing risk in high-valuation markets and navigate your investment journey confidently.

Featured Posts

-

Report Negotiations Sour George Pickens May Leave Steelers Before 2026

May 07, 2025

Report Negotiations Sour George Pickens May Leave Steelers Before 2026

May 07, 2025 -

A List Celebs Dazzle At The Met Gala Red Carpet

May 07, 2025

A List Celebs Dazzle At The Met Gala Red Carpet

May 07, 2025 -

Nba Slaps Anthony Edwards With 50 000 Fine For Vulgar Language

May 07, 2025

Nba Slaps Anthony Edwards With 50 000 Fine For Vulgar Language

May 07, 2025 -

The Karate Kid Part Ii A Deeper Dive Into Daniels Journey

May 07, 2025

The Karate Kid Part Ii A Deeper Dive Into Daniels Journey

May 07, 2025 -

Zendayas Sheer Dress Stuns In The South Of France

May 07, 2025

Zendayas Sheer Dress Stuns In The South Of France

May 07, 2025

Latest Posts

-

Currys All Star Weekend Capstone A Championship In A Controversial Format

May 07, 2025

Currys All Star Weekend Capstone A Championship In A Controversial Format

May 07, 2025 -

Is A Privileged Path To Wto Accession The Right Approach

May 07, 2025

Is A Privileged Path To Wto Accession The Right Approach

May 07, 2025 -

Wto Fast Track A Balancing Act Of Privilege

May 07, 2025

Wto Fast Track A Balancing Act Of Privilege

May 07, 2025 -

The Privilege Dilemma Implications For Wto Accession

May 07, 2025

The Privilege Dilemma Implications For Wto Accession

May 07, 2025 -

Mitigating The Risks Of Flood Damage To Livestock

May 07, 2025

Mitigating The Risks Of Flood Damage To Livestock

May 07, 2025