Huge Stock Swings: Navigating The New Normal For Investors

Table of Contents

Understanding the Causes of Increased Market Volatility

The increased frequency and magnitude of huge stock swings are a result of several converging factors. Understanding these underlying causes is crucial for developing effective investment strategies.

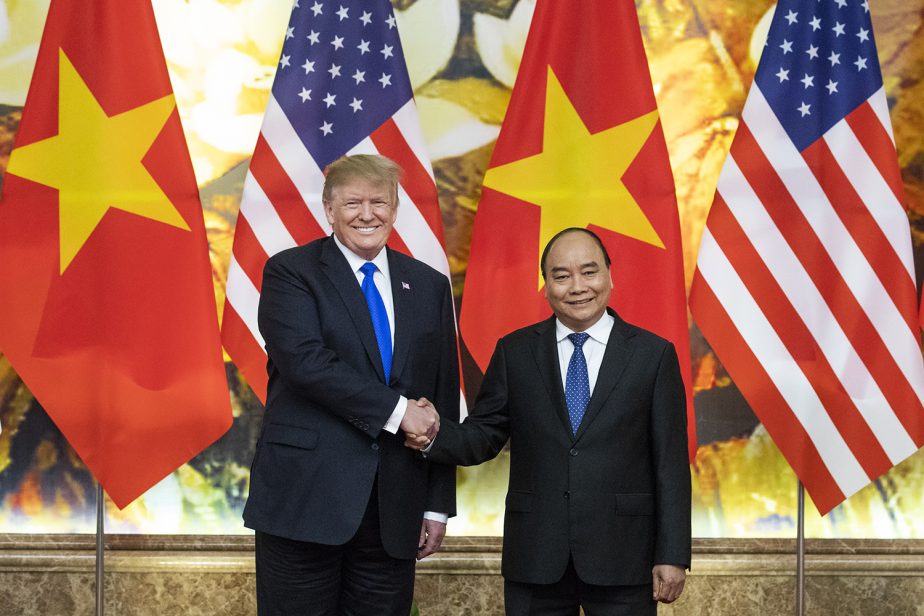

Geopolitical Uncertainty

Global conflicts, political instability, and trade wars significantly impact market sentiment. Uncertainty surrounding international relations creates fear and uncertainty among investors, leading to sharp market corrections.

- Examples of recent geopolitical events causing market swings: The Russian invasion of Ukraine, escalating tensions in the South China Sea, and ongoing trade disputes between major global powers.

- Impact on specific sectors: The energy sector, for example, is highly sensitive to geopolitical events, while technology companies can be affected by trade restrictions and sanctions.

- Related keywords: Global instability, political risk, market uncertainty, international relations, sanctions.

Inflation and Interest Rate Hikes

Inflationary pressures and subsequent interest rate hikes by central banks are major drivers of market volatility. Rising interest rates increase borrowing costs for companies, impacting their profitability and valuations.

- How rising interest rates impact company valuations: Higher interest rates make borrowing more expensive, reducing corporate investment and potentially slowing economic growth. This can lead to lower earnings and decreased stock prices.

- Relationship between inflation and investor confidence: High inflation erodes purchasing power and reduces investor confidence, leading to sell-offs.

- Impact on bond yields and their correlation with stocks: Rising interest rates generally lead to higher bond yields, making bonds more attractive relative to stocks, and potentially causing capital to flow out of the stock market.

- Related keywords: Inflationary pressures, interest rate hikes, monetary policy, bond market, yield curve, quantitative tightening.

Technological Disruption and Market Competition

Rapid technological advancements and fierce competition disrupt established industries and reshape market landscapes, causing significant stock price fluctuations.

- Examples of disruptive technologies affecting established industries: The rise of e-commerce impacting brick-and-mortar retailers, the emergence of electric vehicles challenging traditional automakers, and advancements in artificial intelligence reshaping various sectors.

- The role of innovation in driving market fluctuations: Rapid innovation can lead to significant gains for some companies while others struggle to adapt, leading to wide price swings.

- The rise of new market leaders and the decline of others: Disruptive technologies create winners and losers, resulting in substantial shifts in market capitalization and stock valuations.

- Related keywords: Technological innovation, market disruption, competitive landscape, digital transformation, disruptive technology.

Strategies for Navigating Huge Stock Swings

Navigating the turbulent waters of huge stock swings requires a well-defined investment strategy that incorporates several key elements.

Diversification

Diversification is a cornerstone of effective risk management. By spreading investments across different asset classes (stocks, bonds, real estate, commodities) and sectors, investors can reduce their overall portfolio volatility.

- Examples of diversified portfolios: A portfolio including a mix of large-cap and small-cap stocks, international equities, bonds, and potentially real estate investment trusts (REITs).

- Benefits of international diversification: Reduces exposure to country-specific risks and economic downturns.

- Risk reduction through diversification: Not all asset classes move in the same direction at the same time, helping to buffer against losses in any single asset.

- Related keywords: Portfolio diversification, asset allocation, risk management, global diversification, asset class correlation.

Long-Term Investing

Maintaining a long-term investment horizon is crucial for weathering short-term market fluctuations. Focusing on the long-term growth potential of your investments allows you to ride out periods of volatility.

- Benefits of dollar-cost averaging: Investing a fixed amount of money at regular intervals, regardless of market conditions, reduces the impact of market timing.

- Importance of sticking to a financial plan: A well-defined financial plan, aligned with your long-term goals, provides a roadmap to follow during turbulent times.

- Emotional discipline in investing: Avoiding impulsive decisions driven by fear or greed is vital for long-term success.

- Related keywords: Long-term investment strategy, buy and hold, dollar-cost averaging, long-term growth, patience in investing.

Risk Management and Stop-Loss Orders

Effective risk management involves setting realistic risk tolerance levels and employing strategies to mitigate potential losses.

- Explanation of stop-loss orders and their benefits: Stop-loss orders automatically sell your investments when they reach a predetermined price, limiting potential losses.

- Setting realistic risk tolerance levels: Understanding your comfort level with risk is essential for making informed investment decisions.

- Importance of regular portfolio review: Regularly reviewing your portfolio allows you to rebalance your holdings and adjust your strategy as needed.

- Related keywords: Risk management, stop-loss orders, risk tolerance, portfolio review, risk assessment, downside protection.

Conclusion

Huge stock swings are becoming increasingly common, driven by a complex interplay of geopolitical factors, economic conditions, and technological change. By understanding these underlying causes and adopting effective strategies like diversification, long-term investing, and robust risk management, investors can navigate this new normal and protect their portfolios. Don't let huge stock swings derail your financial goals. Learn more about building a resilient investment strategy designed to withstand market volatility. Start planning your approach to navigating huge stock swings today!

Featured Posts

-

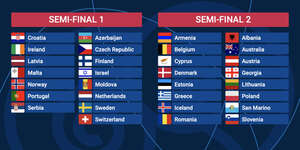

Eurovision 2025 Semi Final Running Orders Announced

Apr 25, 2025

Eurovision 2025 Semi Final Running Orders Announced

Apr 25, 2025 -

Krw Usd Outlook Assessing The Effects Of Currency Manipulation Claims

Apr 25, 2025

Krw Usd Outlook Assessing The Effects Of Currency Manipulation Claims

Apr 25, 2025 -

Jack O Connell Cast In Godzilla X Kong Sequel

Apr 25, 2025

Jack O Connell Cast In Godzilla X Kong Sequel

Apr 25, 2025 -

Blue Origin Rocket Launch Cancelled Subsystem Malfunction Investigation Underway

Apr 25, 2025

Blue Origin Rocket Launch Cancelled Subsystem Malfunction Investigation Underway

Apr 25, 2025 -

Coachella Lollapalooza And Outside Lands 2025 What To Expect From The Lineups

Apr 25, 2025

Coachella Lollapalooza And Outside Lands 2025 What To Expect From The Lineups

Apr 25, 2025

Latest Posts

-

New Spring Collection Elizabeth Stewart X Lilysilk

May 10, 2025

New Spring Collection Elizabeth Stewart X Lilysilk

May 10, 2025 -

Wynne Evanss Go Compare Future Uncertain After Strictly Scandal

May 10, 2025

Wynne Evanss Go Compare Future Uncertain After Strictly Scandal

May 10, 2025 -

Lilysilk And Elizabeth Stewart A Spring Capsule Collection Unveiled

May 10, 2025

Lilysilk And Elizabeth Stewart A Spring Capsule Collection Unveiled

May 10, 2025 -

Go Compare Axe Wynne Evans Following Strictly Controversy

May 10, 2025

Go Compare Axe Wynne Evans Following Strictly Controversy

May 10, 2025 -

Wynne Evans Strictly Scandal A Turning Point With Fresh Evidence

May 10, 2025

Wynne Evans Strictly Scandal A Turning Point With Fresh Evidence

May 10, 2025