Hudson's Bay Leases Sought By B.C. Billionaire Mall Owner

Table of Contents

The Billionaire's Investment Strategy and Interests

The identity of the B.C. billionaire involved remains undisclosed at this time, however, sources indicate a significant player in the Canadian real estate market with a history of shrewd acquisitions. This individual's investment portfolio is largely focused on high-value commercial properties, particularly those located in prime urban locations with high foot traffic. Their investment philosophy centers on long-term value appreciation and strategic portfolio diversification.

- Previous Acquisitions: While specifics are limited due to privacy concerns, sources suggest a pattern of acquiring underperforming assets, revitalizing them, and reaping substantial returns. This successful track record in real estate investment points towards a calculated and ambitious approach.

- Reasons for Targeting HBC Leases: The strategic interest in Hudson's Bay leases likely stems from the prime locations of many HBC properties. These locations often represent key commercial real estate in major Canadian cities, making them valuable assets for redevelopment or long-term rental income.

- Investment Goals: While the specific goals remain unconfirmed, the pursuit of these Hudson's Bay leases suggests an aim to expand their existing portfolio, diversify holdings, and potentially capitalize on opportunities within the evolving Canadian retail sector. This represents a significant move in real estate investment.

Hudson's Bay Company's Current Situation and Potential Sale

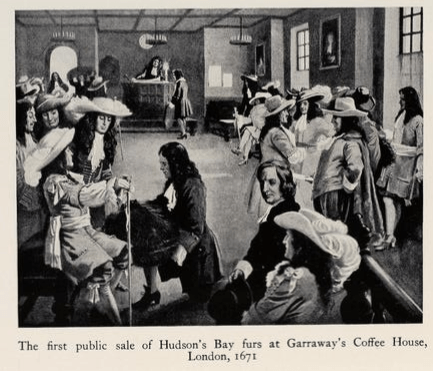

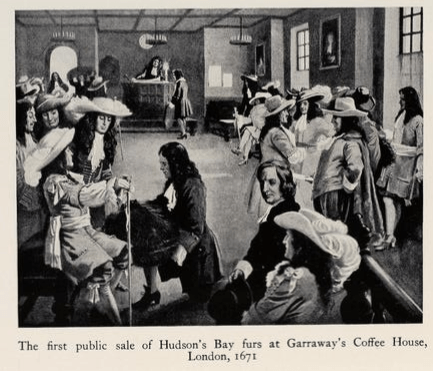

Hudson's Bay Company (HBC), a Canadian institution with a long and storied history, has been navigating a challenging retail environment. Recent financial reports have shown mixed results, with the company undertaking significant restructuring efforts to improve profitability. This includes streamlining operations and reassessing its real estate holdings.

- HBC's Financial Performance: While specific financial data is publicly available, the general trend shows a need for strategic adjustments within the company's business model.

- Real Estate Strategies: HBC has indicated a willingness to explore options to optimize its real estate portfolio, potentially including leasing or selling properties that are deemed non-core assets. This could explain their openness to the billionaire's overtures regarding Hudson's Bay leases.

- Future Plans: The company's future plans are likely to focus on streamlining its core operations and focusing on key, high-performing locations.

Implications for the Canadian Retail Landscape

The potential acquisition of numerous Hudson's Bay leases could trigger significant changes within the Canadian retail landscape. The billionaire's investment strategy could lead to redevelopment of existing properties, potentially introducing new retail concepts or repurposing spaces for alternative uses like residential or mixed-use developments.

- Competition: The acquisition could intensify competition in certain markets depending on the specific leases acquired and how the properties are subsequently utilized.

- Existing Tenants: Current tenants within HBC properties could face uncertainty regarding their leases and future occupancy, depending on the buyer's plans.

- Redevelopment: The redevelopment potential of these prime locations could significantly alter the urban fabric of the cities involved, potentially enhancing the shopping experience but also bringing about challenges related to displacement and community impact. This real estate transaction would have a considerable impact on the Canadian retail market.

Legal and Regulatory Aspects of the Deal

The acquisition of such a significant number of Hudson's Bay leases will undoubtedly face legal and regulatory scrutiny. Several factors will influence the success of this transaction.

- Antitrust Concerns: Depending on the scale of the acquisition, competition authorities may examine the deal for potential anti-competitive effects.

- Environmental Regulations: Any redevelopment projects would be subject to various environmental regulations, potentially impacting timelines and costs.

- Zoning Laws and Building Codes: Compliance with local zoning laws and building codes will be crucial for any redevelopment plans, presenting potential hurdles and delays. The real estate transactions of this magnitude require strict regulatory compliance.

Conclusion: The Future of Hudson's Bay Leases and Canadian Retail

The pursuit of Hudson's Bay leases by a B.C. billionaire represents a significant event in the Canadian retail and real estate sectors. The outcome will impact not only HBC's future but also the broader landscape of Canadian shopping and urban development. The billionaire's investment strategy, HBC's current situation, and the potential legal and regulatory hurdles all play crucial roles in shaping the future of these valuable properties. Stay tuned for further updates on this high-stakes battle for Hudson's Bay leases and their impact on the future of Canadian retail. We will continue to monitor this situation and provide analysis as the story develops.

Featured Posts

-

Melanie Thierry Et Raphael L Education De Leurs Enfants Malgre Un Ecart D Age Important

May 26, 2025

Melanie Thierry Et Raphael L Education De Leurs Enfants Malgre Un Ecart D Age Important

May 26, 2025 -

Naomi Kempbell Otkrovennye Obrazy V Novoy Fotosessii Dlya Glyantsa

May 26, 2025

Naomi Kempbell Otkrovennye Obrazy V Novoy Fotosessii Dlya Glyantsa

May 26, 2025 -

Nvidias Rtx 5060 Launch A Warning For Gamers And Tech Reviewers

May 26, 2025

Nvidias Rtx 5060 Launch A Warning For Gamers And Tech Reviewers

May 26, 2025 -

The Death Of Architecture One Architects Controversial Claim

May 26, 2025

The Death Of Architecture One Architects Controversial Claim

May 26, 2025 -

Zurueck In Der Bundesliga Der Hsv Und Der Weg Nach Oben

May 26, 2025

Zurueck In Der Bundesliga Der Hsv Und Der Weg Nach Oben

May 26, 2025