Hudson's Bay Acquiring Canadian Tire: Potential Benefits And Risks

Table of Contents

Potential Benefits of a Hudson's Bay - Canadian Tire Merger

A successful merger between Hudson's Bay and Canadian Tire could unlock significant advantages, reshaping the Canadian retail landscape.

Increased Market Share and Dominance

- Combined dominance in the Canadian retail market: The combined entity would control a massive portion of the Canadian retail market, potentially surpassing major competitors like Walmart and Loblaws.

- Expansion into new customer demographics: Hudson's Bay's focus on fashion and home goods, coupled with Canadian Tire's strength in automotive, sporting goods, and home improvement, would create a broader appeal to a wider range of consumers.

- Reduced competition from other major retailers: Increased market share would undoubtedly exert pressure on competing retailers, potentially leading to price adjustments and strategic shifts within the industry. Competitors like Rona, Lowe's, and Sport Chek would feel the impact most acutely.

- Potential for economies of scale and cost savings: Merging operations would allow for significant cost reductions through streamlined supply chains, shared resources, and bulk purchasing power.

The combined market share would significantly alter the competitive landscape. This consolidated power could lead to increased profitability through economies of scale and potentially influence pricing strategies across the market. The ripple effect on competitors would be substantial, forcing them to adapt or risk losing market share.

Synergies and Operational Efficiencies

- Combined supply chain optimization for reduced costs: Integrating logistics and distribution networks could significantly reduce operational expenses.

- Shared resources and infrastructure leading to cost savings: Combining back-office functions, IT systems, and marketing departments would lead to substantial cost savings.

- Merging marketing and branding strategies for wider reach: A unified marketing approach could amplify brand awareness and reach a much larger customer base.

- Opportunities for cross-selling and upselling of products: Customers of one brand could be easily targeted with offers from the other, increasing sales and revenue.

By streamlining operations and leveraging synergies, the merged entity could achieve significant cost reductions and improved efficiency. Imagine a customer purchasing a new bike at Canadian Tire and being offered a stylish helmet from Hudson's Bay's online store – this is the power of cross-selling.

Enhanced Brand Portfolio and Customer Reach

- Leveraging existing customer bases for cross-promotion: Hudson's Bay's loyalty program could be integrated with Canadian Tire's, expanding the reach of marketing campaigns.

- Expansion into new product categories and market segments: The merger would open avenues to diversify product offerings and penetrate new market segments.

- Strengthened brand recognition and customer loyalty: A combined entity would benefit from enhanced brand recognition and potentially greater customer loyalty.

- Ability to offer a more comprehensive range of products and services: Customers would have access to a significantly wider selection of goods and services under one roof (or online platform).

The combined brand portfolios offer a powerful opportunity to attract a significantly larger customer base, creating a more comprehensive and competitive retail experience. This enhanced offering would attract both existing customers of each brand and new customers looking for a one-stop shop.

Potential Risks of a Hudson's Bay - Canadian Tire Merger

While the potential benefits are considerable, a Hudson's Bay-Canadian Tire merger also presents significant risks.

Regulatory Hurdles and Antitrust Concerns

- Potential for regulatory scrutiny and delays: The merger would likely face intense scrutiny from the Competition Bureau of Canada to ensure it doesn't stifle competition.

- Antitrust concerns related to reduced competition: Concerns about reduced competition and potential price increases could trigger lengthy regulatory reviews and potential legal challenges.

- Need for regulatory approvals before the merger can proceed: Securing all necessary regulatory approvals could be a time-consuming and complex process.

- Potential for government intervention to prevent the merger: Depending on the outcome of the regulatory review, the government may intervene to prevent the merger if deemed anti-competitive.

Navigating regulatory hurdles and antitrust concerns is a critical challenge. The merger's success hinges on successfully addressing these concerns and obtaining the necessary approvals.

Integration Challenges and Cultural Conflicts

- Difficulties in merging different corporate cultures: Integrating two distinct corporate cultures with potentially different management styles and operational philosophies could be challenging.

- Potential for employee layoffs and job displacement: Overlapping roles and functions might lead to job losses, impacting employee morale and potentially leading to legal challenges.

- Challenges in integrating different IT systems and supply chains: Combining different IT infrastructure and supply chains can be complex and costly, potentially leading to operational disruptions.

- Potential for customer confusion and loss of brand loyalty: Changes in branding, product offerings, and customer service could lead to customer confusion and potentially a decline in brand loyalty.

Successful integration requires careful planning and execution. Failing to address these potential cultural conflicts and operational challenges could lead to significant setbacks and negatively impact the merged entity’s performance.

Financial Risks and Debt Burden

- Potential for increased debt levels for the acquiring company: Financing the acquisition could significantly increase the debt burden of the acquiring company, increasing financial risk.

- Risk of financial instability if integration fails: If the integration process is poorly managed, leading to operational inefficiencies and decreased profitability, the combined company could face financial instability.

- Impact of economic downturns on the merged entity: A large merged entity would be more vulnerable to economic downturns, given its increased size and complexity.

- Potential for shareholder dissatisfaction: If the merger fails to deliver the expected financial returns, it could lead to shareholder dissatisfaction and a decline in the company’s stock price.

The financial implications of the merger are significant. A thorough financial assessment is crucial to understand and mitigate these potential risks.

Conclusion

The potential acquisition of Canadian Tire by Hudson's Bay presents both significant opportunities and substantial risks. While a merger could lead to increased market share, operational efficiencies, and a broader customer reach, challenges related to regulatory hurdles, integration complexities, and financial burdens must be carefully considered. A thorough analysis of the potential synergies and risks is crucial for all stakeholders. Further research into the Hudson's Bay acquiring Canadian Tire scenario is essential before drawing definitive conclusions. Only time will tell if this potential merger will ultimately benefit the Canadian retail landscape. Continued monitoring of developments surrounding a potential Hudson's Bay Canadian Tire acquisition is vital for anyone interested in the future of Canadian retail.

Featured Posts

-

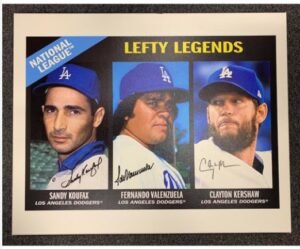

Dodger Slumping Lefties A Look At The Recent Struggles And The Path To Recovery

May 18, 2025

Dodger Slumping Lefties A Look At The Recent Struggles And The Path To Recovery

May 18, 2025 -

Union Challenges Amazons Warehouse Closures In Quebec Before Labour Tribunal

May 18, 2025

Union Challenges Amazons Warehouse Closures In Quebec Before Labour Tribunal

May 18, 2025 -

Facing The Music How Universities Are Handling Severe Budget Shortfalls

May 18, 2025

Facing The Music How Universities Are Handling Severe Budget Shortfalls

May 18, 2025 -

Find Easy A On Bbc Three Hd Tv Schedule And More

May 18, 2025

Find Easy A On Bbc Three Hd Tv Schedule And More

May 18, 2025 -

Trumps Aerospace Deals A Deep Dive Into The Numbers And Missing Details

May 18, 2025

Trumps Aerospace Deals A Deep Dive Into The Numbers And Missing Details

May 18, 2025

Latest Posts

-

7 Bit Casino Vs The Competition Finding The Best Online Casino In Canada For 2025

May 18, 2025

7 Bit Casino Vs The Competition Finding The Best Online Casino In Canada For 2025

May 18, 2025 -

Iga Svjontek Dominira Pobeda Nad Ukrajinkom I Povezane Vesti

May 18, 2025

Iga Svjontek Dominira Pobeda Nad Ukrajinkom I Povezane Vesti

May 18, 2025 -

Novak Dokovic Retki Podatak Iz Njegove Karijere Pre 19 Godina

May 18, 2025

Novak Dokovic Retki Podatak Iz Njegove Karijere Pre 19 Godina

May 18, 2025 -

Finding The Best Online Casino In New Zealand A Players Guide

May 18, 2025

Finding The Best Online Casino In New Zealand A Players Guide

May 18, 2025 -

Best Online Casinos In Canada 2025 7 Bit Casino Among The Top Performers

May 18, 2025

Best Online Casinos In Canada 2025 7 Bit Casino Among The Top Performers

May 18, 2025