How Trump's Tariffs Harmed Small Businesses: A Critical Analysis

Table of Contents

Increased Input Costs and Reduced Profit Margins

Trump's tariffs significantly increased the cost of imported raw materials and goods, crippling many small businesses. This section will analyze the impact of these increased input costs and the resulting reduced profit margins on small businesses.

Rising Prices of Raw Materials and Goods

Trump's tariffs led to significant increases in the cost of imported raw materials and goods crucial for many small businesses' production processes. Examples include substantial price hikes on steel, aluminum, and various manufactured components, all essential inputs for countless industries. This surge in costs directly translated into thinner profit margins, forcing many businesses to make difficult choices.

- Reduced profit margins: Businesses were forced to absorb increased costs, leading to significantly lower profits or the need to raise prices.

- Increased operational costs: Higher input costs meant increased operational expenses, putting a strain on already limited resources.

- Difficulty competing with larger businesses: Larger businesses often have more financial resources to absorb cost increases, giving them a competitive advantage over smaller businesses struggling with shrinking margins. This resulted in a widening gap between large and small businesses.

Supply Chain Disruptions

The tariffs also introduced considerable uncertainty and disruptions to global supply chains. Small businesses, often reliant on established, cost-effective international suppliers, were forced to scramble for more expensive alternatives, impacting their bottom line.

- Delayed production: Finding new suppliers took time, leading to production delays and lost revenue.

- Inventory shortages: The disruption in supply chains caused inventory shortages, hindering the ability of businesses to meet customer demand.

- Loss of sales: Delayed production and inventory shortages directly translated into lost sales and revenue, severely impacting profitability.

Decreased Consumer Demand and Sales

The ripple effect of Trump's tariffs extended to consumer demand, creating further challenges for small businesses. This section explores how higher prices and retaliatory tariffs decreased consumer demand and negatively impacted sales for small businesses.

Higher Prices for Consumers

Tariffs increased the prices of many goods, leading to a decrease in consumer spending. This decrease affected small businesses disproportionately, as they are often more reliant on local consumer spending and less able to absorb increased costs without passing them on to the consumer.

- Reduced sales volume: Higher prices led to lower sales volumes, impacting revenue and profitability.

- Difficulty maintaining cash flow: Reduced sales directly impacted cash flow, making it harder for businesses to meet their financial obligations.

- Increased risk of business failure: The combination of reduced sales and increased costs increased the risk of business failure for many small businesses.

Impact on International Trade and Exports

Retaliatory tariffs imposed by other countries in response to Trump's tariffs further harmed small businesses. This retaliatory action severely limited access to international markets, reducing sales and growth opportunities.

- Loss of export revenue: Retaliatory tariffs reduced or eliminated export opportunities, leading to significant revenue losses.

- Decreased market share: Businesses lost market share to competitors in countries not facing retaliatory tariffs.

- Increased business vulnerability: The loss of international markets increased the vulnerability of small businesses, making them more susceptible to economic downturns.

Limited Access to Capital and Financing

The economic uncertainty created by Trump's tariffs made it significantly more difficult for small businesses to secure loans and other forms of financing. This section will analyze the impact on access to capital and its effect on business investment and growth.

Increased Financial Risk and Uncertainty

The uncertainty surrounding the economic impact of Trump's tariffs made lenders hesitant to provide capital to small businesses. The perceived increased risk translated into tighter lending policies.

- Difficulty obtaining loans: Small businesses faced increased difficulty in obtaining loans, limiting their access to much-needed capital.

- Higher interest rates: Lenders often charged higher interest rates to compensate for the perceived increased risk associated with lending to small businesses during this period.

- Reduced investment opportunities: The combination of difficulty securing loans and higher interest rates limited investment opportunities for small businesses.

Impact on Business Investment and Growth

The uncertainty and reduced profitability stemming from Trump's tariffs hampered small businesses' ability to invest in growth and expansion. Many businesses were forced to delay hiring, expansion plans, or essential technological upgrades.

- Stagnant growth: The lack of investment opportunities led to stagnant or even negative growth for many small businesses.

- Decreased hiring: Businesses were less likely to hire new employees due to financial uncertainty and reduced profitability.

- Reduced innovation: The lack of investment in research and development led to reduced innovation within the small business sector.

Conclusion

Trump's tariffs imposed significant and lasting harm on small businesses across various sectors. The increased input costs, reduced consumer demand, and limited access to capital created a perfect storm that severely impacted profitability, growth, and even survival for countless small businesses. Understanding the negative impacts of these trade policies is crucial to prevent similar economic damage in the future. We need to carefully consider the potential consequences of any trade policy on small businesses before implementation to support a healthy and thriving small business sector. Further research and policy discussions focusing on mitigating the negative impacts of future tariffs on small businesses are crucial. The long-term effects of Trump's tariffs on the small business community demand continued investigation and understanding to avoid repeating similar economic hardships. We must learn from the impact of Trump's tariffs to better protect small businesses from future economic shocks related to trade policies.

Featured Posts

-

Sylvester Stallone And Coming Home A Missed Oscar Opportunity

May 12, 2025

Sylvester Stallone And Coming Home A Missed Oscar Opportunity

May 12, 2025 -

Chaos Erupts After Ice Arrest Civilians Attempt Intervention

May 12, 2025

Chaos Erupts After Ice Arrest Civilians Attempt Intervention

May 12, 2025 -

Crowd Intervention Following Ice Arrest Causes Chaos

May 12, 2025

Crowd Intervention Following Ice Arrest Causes Chaos

May 12, 2025 -

Mlb Player Jurickson Profar Suspended For Ped Use

May 12, 2025

Mlb Player Jurickson Profar Suspended For Ped Use

May 12, 2025 -

Saisonende Bundesliga Abstieg Fuer Bochum Und Kiel Leipzig Ohne Champions League

May 12, 2025

Saisonende Bundesliga Abstieg Fuer Bochum Und Kiel Leipzig Ohne Champions League

May 12, 2025

Latest Posts

-

Triumf Za Barnli Pobeda Vo Derbito I Promotsi A Vo Premier Ligata

May 13, 2025

Triumf Za Barnli Pobeda Vo Derbito I Promotsi A Vo Premier Ligata

May 13, 2025 -

Barnli I Lids Se Vrakjaat Vo Premier Ligata

May 13, 2025

Barnli I Lids Se Vrakjaat Vo Premier Ligata

May 13, 2025 -

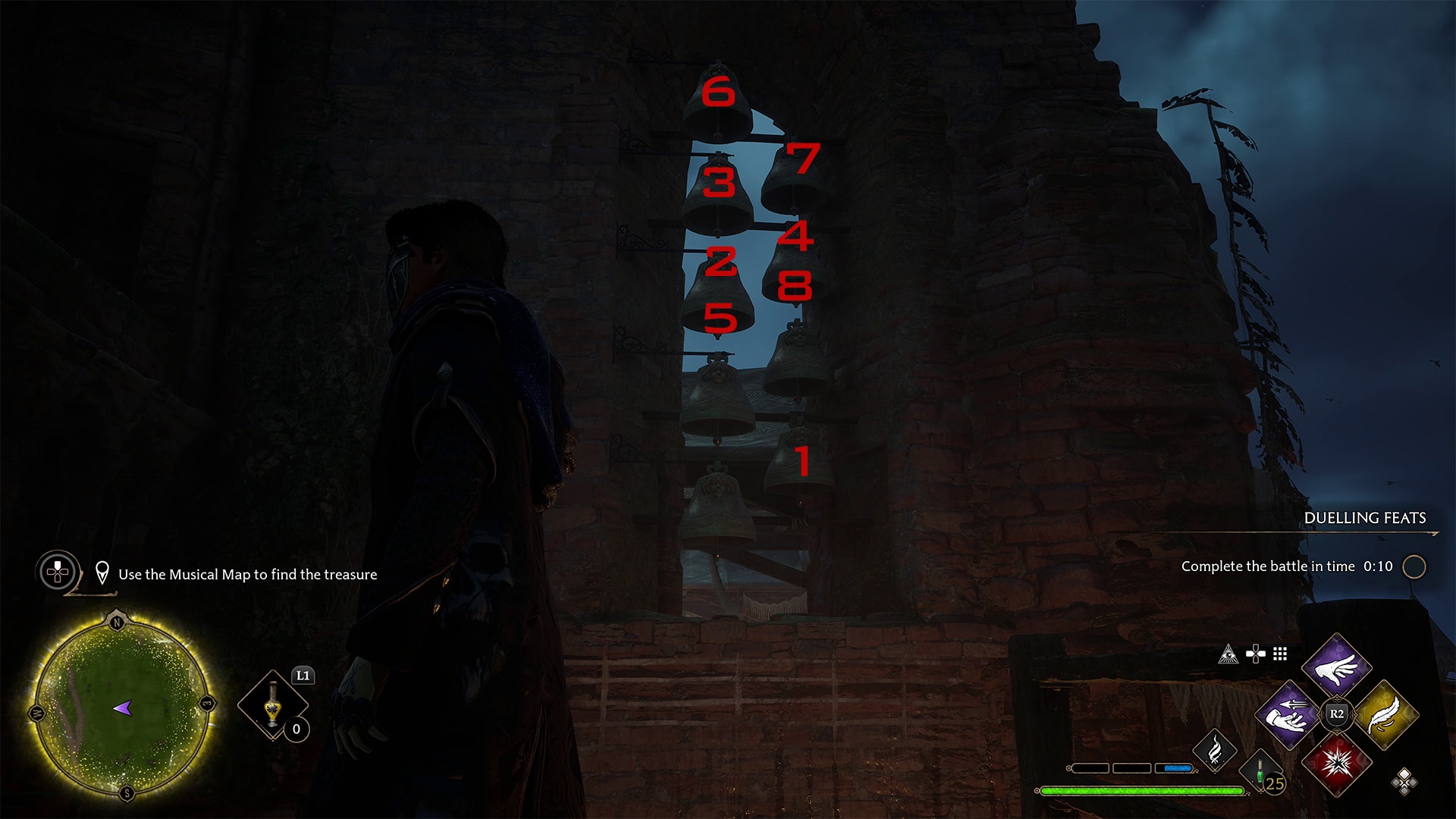

Discover Cp Music Productions A Father And Sons Musical Talent

May 13, 2025

Discover Cp Music Productions A Father And Sons Musical Talent

May 13, 2025 -

The Musical Legacy Of Cp Music Productions A Father Son Story

May 13, 2025

The Musical Legacy Of Cp Music Productions A Father Son Story

May 13, 2025 -

Sefilnt Gioynaitent O Mpalntok Giortazei Gymnothora Meta To Ntermpi

May 13, 2025

Sefilnt Gioynaitent O Mpalntok Giortazei Gymnothora Meta To Ntermpi

May 13, 2025