How Trump Tariffs Shut Down The IPO Market For Fintech Companies Like Affirm (AFRM)

Table of Contents

The Economic Uncertainty Created by Trump Tariffs

The imposition of Trump-era tariffs created a climate of heightened economic uncertainty, significantly impacting the Fintech IPO market. This uncertainty stemmed from several interconnected factors.

Increased Trade Wars and Global Instability

Trump's tariffs ignited a series of trade wars, fueling global economic instability. This instability directly impacted the Fintech sector in several ways:

- Tariffs on key components: Tariffs on semiconductors and data storage devices, crucial components for many Fintech technologies, increased production costs. This impacted the bottom line of many Fintech startups, making them less attractive to potential investors.

- Stock market volatility: The period saw increased volatility in the stock market, reflecting investor anxieties about the global economic outlook. This volatility made IPOs, already inherently risky, even less appealing.

- Expert commentary: Many financial experts warned that the uncertainty surrounding trade policy severely undermined investor confidence, making them hesitant to commit capital to new ventures. The unpredictable nature of trade relations created a risk premium that many investors were unwilling to bear.

Impact on Investor Sentiment and Risk Appetite

The uncertainty generated by the trade wars dramatically altered investor sentiment and risk appetite.

- Increased risk aversion: Investors, facing unpredictable trade policies, shifted towards a more risk-averse strategy. This meant a preference for established, less volatile investments over the inherently riskier ventures common in the Fintech startup ecosystem.

- Impact on funding rounds: Many Fintech companies found it more difficult to secure funding during this period, impacting their ability to scale and eventually consider an IPO. Investors demanded higher returns to compensate for the increased uncertainty.

- Shift towards safer investments: Investor capital flowed towards more established, less volatile sectors, leaving many promising Fintech startups starved of the funding needed to prepare for an IPO.

The Direct Impact on Fintech Companies like Affirm (AFRM)

While the exact impact of tariffs on Affirm's specific supply chain isn't publicly detailed, the broader economic uncertainty undoubtedly influenced its IPO journey and the Fintech landscape as a whole.

Supply Chain Disruptions and Increased Costs

Although specific data regarding Affirm's direct exposure to tariffs is limited, the general increase in input costs across various sectors likely impacted their operations indirectly. Increased costs for services and infrastructure related to their operations could have affected their profitability.

- Indirect cost increases: Tariffs on imported goods could have increased the price of various services or hardware components used by Affirm, indirectly impacting their operational efficiency and profitability.

- Impact on investor perception: Any negative impact on Affirm's profit margins due to increased costs, even if indirect, would have likely been factored into investor valuations during their IPO process.

Delayed IPOs and Reduced Valuation

The economic uncertainty created by Trump's tariffs likely influenced Affirm's IPO timing and valuation.

- Comparative analysis: A comparative study of IPO timelines for similar Fintech companies during periods of less economic volatility could reveal the impact of the tariffs on Affirm's decision-making process.

- Valuation factors: The overall market sentiment at the time of Affirm's IPO, heavily influenced by the economic uncertainty, undoubtedly contributed to its final valuation.

The Broader Impact on the Fintech Landscape

The challenges faced by Affirm were not unique. Many other Fintech companies were impacted by the uncertainty.

- Delayed or cancelled IPOs: Several Fintech companies are believed to have either postponed their IPO plans indefinitely or cancelled them entirely due to the unfavorable market conditions created by the trade wars.

- Impact on investment landscape: The overall Fintech investment landscape was significantly altered. The diminished investor confidence and increased risk aversion resulted in less capital flowing into the sector.

Alternative Explanations and Contributing Factors

While Trump's tariffs played a significant role, it's crucial to acknowledge other factors contributing to the decline in Fintech IPOs.

Other Factors Affecting Fintech IPOs

Several other factors influenced the IPO market beyond trade policy:

- Regulatory changes: New regulations within the Fintech sector could have added complexity and uncertainty for companies preparing for an IPO.

- Market corrections: General market corrections independent of trade policy could also have dampened investor enthusiasm for IPOs across various sectors.

- Competition: Increased competition within the Fintech space might have also made investors more selective about which companies they supported.

Despite these factors, the economic uncertainty created by the Trump tariffs remains a significant contributing factor, exacerbating the already challenging environment for Fintech IPOs.

Conclusion: Navigating the Complexities of Fintech IPOs in Uncertain Times

Trump's tariffs created significant economic uncertainty, negatively impacting investor confidence and contributing to a decline in Fintech IPOs, as illustrated by the Affirm (AFRM) example. The increased risk aversion among investors, coupled with supply chain disruptions and increased costs, made it harder for many Fintech companies to go public. While other factors played a role, the impact of the tariffs on investor sentiment cannot be overlooked.

To further understand the dynamics of the Fintech investment landscape, we need to conduct more research on the interplay between global economic events and IPO markets. Thorough Fintech IPO analysis, paying close attention to the impact of Trump tariff policies, and monitoring IPO market trends are essential for investors and entrepreneurs alike. Understanding macroeconomic factors, such as trade policy, is crucial when evaluating investment opportunities in the ever-evolving Fintech sector.

Featured Posts

-

Tommy Fury Fined For Speeding Days After Molly Mae Hague Split

May 14, 2025

Tommy Fury Fined For Speeding Days After Molly Mae Hague Split

May 14, 2025 -

Captain America Brave New World A Significant Characters Absence And Its Mcu Consequences

May 14, 2025

Captain America Brave New World A Significant Characters Absence And Its Mcu Consequences

May 14, 2025 -

Bahnreise Planen Oschatz Nach Saechsische Schweiz

May 14, 2025

Bahnreise Planen Oschatz Nach Saechsische Schweiz

May 14, 2025 -

Broadcoms V Mware Acquisition A 1 050 Price Hike Sparks Outrage

May 14, 2025

Broadcoms V Mware Acquisition A 1 050 Price Hike Sparks Outrage

May 14, 2025 -

Patike Poput Novakovikh Gde Prona I Slichne Za Manje Novtsa

May 14, 2025

Patike Poput Novakovikh Gde Prona I Slichne Za Manje Novtsa

May 14, 2025

Latest Posts

-

Maya Jama On Love And Relationships Post Stormzy Reflections

May 14, 2025

Maya Jama On Love And Relationships Post Stormzy Reflections

May 14, 2025 -

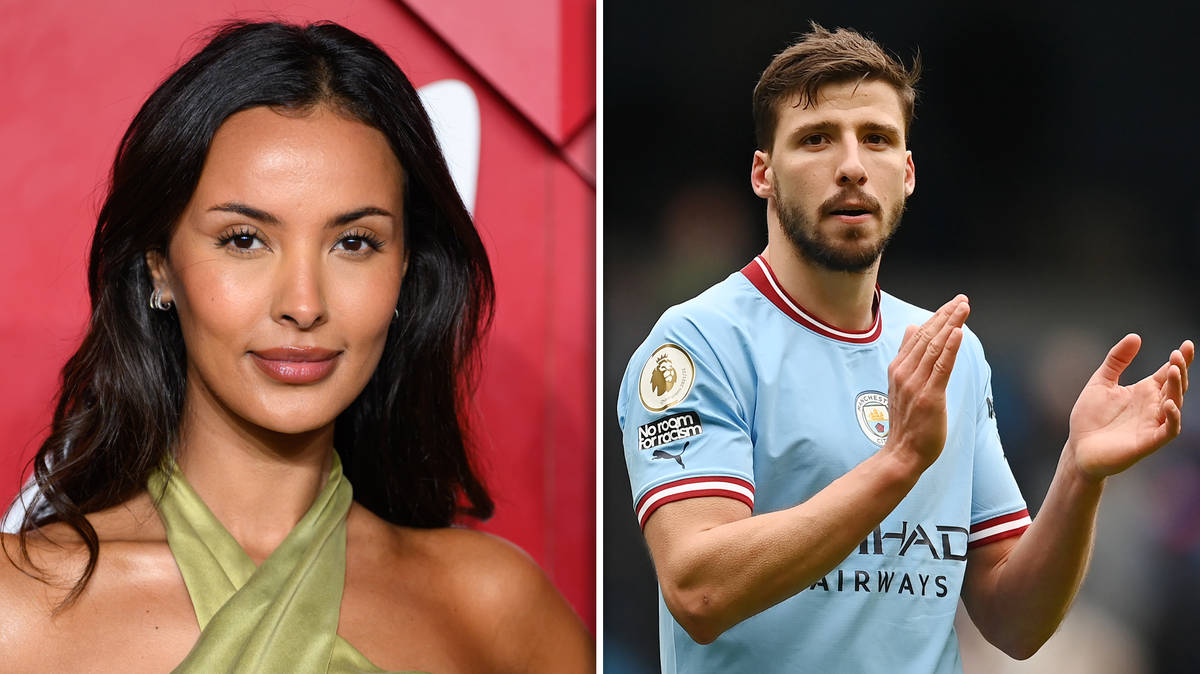

Maya Jama And Ruben Dias Are They Getting More Serious

May 14, 2025

Maya Jama And Ruben Dias Are They Getting More Serious

May 14, 2025 -

Gold Dress Perfection Maya Jama Channels Grecian Mythology

May 14, 2025

Gold Dress Perfection Maya Jama Channels Grecian Mythology

May 14, 2025 -

Wynonna And Ashley Judd Open Up Intimate Family Stories In New Docuseries

May 14, 2025

Wynonna And Ashley Judd Open Up Intimate Family Stories In New Docuseries

May 14, 2025 -

Is Maya Jamas Relationship With Ruben Dias Getting Serious

May 14, 2025

Is Maya Jamas Relationship With Ruben Dias Getting Serious

May 14, 2025