How To Effectively Read And Interpret Proxy Statements (Form DEF 14A)

Table of Contents

A proxy statement (Form DEF 14A) is a document that publicly traded companies are required to file with the Securities and Exchange Commission (SEC) before shareholder meetings. Its purpose is to provide shareholders with the information they need to make informed decisions on matters to be voted on at the meeting, including the election of directors and approval of significant corporate actions. Effectively reading and interpreting these statements is critical for investors, shareholders, and financial analysts alike, allowing for a deeper understanding of a company's governance, financial health, and future prospects.

Understanding the Structure of a Proxy Statement (Form DEF 14A)

A proxy statement’s structure is generally consistent across filings, although the length and detail can vary significantly depending on the company's size and complexity. Understanding this structure is the first step towards effective analysis. The typical sections include:

- Notice of Meeting: This section outlines the date, time, and location (physical and virtual) of the shareholder meeting. It also details the types of matters that will be voted upon.

- Voting Procedures: This section explains how shareholders can vote, whether by proxy, in person, or electronically. It also specifies any deadlines for submitting votes.

- Executive Compensation: A detailed breakdown of compensation for the company’s top executives, including salary, bonuses, stock options, and other benefits. This is often a significant focus for shareholder scrutiny.

- Shareholder Proposals: This section lists any proposals submitted by shareholders for consideration at the meeting. These proposals can cover a wide range of topics related to corporate governance, social responsibility, and environmental concerns.

- Election of Directors: This section provides information about the nominees for the board of directors, including their backgrounds, qualifications, and any potential conflicts of interest.

- Ratification of Auditors: This section details the process for ratifying the company's independent auditors.

The "voting section" is particularly crucial. It allows shareholders to exercise their voting rights on matters presented in the proxy statement. Understanding how to interpret and utilize this section is vital for influencing company decisions and protecting shareholder interests. This includes understanding shareholder voting rights, which can differ depending on the class of shares held.

Deciphering Key Information within a Proxy Statement (Form DEF 14A)

Successfully interpreting a proxy statement requires careful attention to several key areas.

Executive Compensation

Analyzing executive compensation requires a thorough examination of the components of their packages. This includes:

- Salary: Base annual compensation.

- Bonuses: Performance-based incentives.

- Stock Options: The right to purchase company stock at a predetermined price.

- Restricted Stock: Shares awarded that vest over time, subject to performance conditions.

- Other Benefits: Perks such as company cars, retirement plans, and other benefits.

It's vital to assess the reasonableness of compensation packages compared to industry benchmarks and company performance. Look for potential conflicts of interest, ensuring executive incentives are aligned with shareholder value creation, avoiding excessive golden parachutes and other potentially problematic arrangements.

Shareholder Proposals

Shareholder proposals often address important issues of corporate governance, environmental, social, and governance (ESG) investing, and social responsibility. Understanding these proposals allows shareholders to vote in alignment with their values and investment priorities. Different types of shareholder proposals include:

- Governance proposals: Focusing on board structure, executive compensation, and shareholder rights.

- Social responsibility proposals: Addressing issues such as diversity, equity, and inclusion (DEI), human rights, and labor practices.

- Environmental proposals: Related to climate change, emissions reduction, and sustainable business practices.

Board of Directors

The board of directors' composition and qualifications are critical indicators of effective corporate governance. When analyzing the board, look for:

- Independence: The proportion of independent directors (those without significant ties to management).

- Expertise: The presence of directors with relevant skills and experience.

- Diversity: Representation of diverse backgrounds, perspectives, and skills.

- Board committees: The structure and composition of key committees, such as the audit, compensation, and nominating committees.

Risk Factors

The risk factors section provides a detailed overview of potential challenges and uncertainties that could affect the company's financial performance and stability. Carefully review this section to assess:

- Financial risks: Potential impacts from market volatility, economic downturns, and debt levels.

- Operational risks: Challenges related to supply chain disruptions, cybersecurity threats, and competition.

- Legal and regulatory risks: Potential legal challenges, regulatory changes, and compliance issues.

- Reputational risks: The potential impact of negative publicity and damage to brand image.

Assess the severity and likelihood of each risk, considering their potential impact on the company's valuation and future prospects.

Utilizing Online Resources and Tools to Analyze Proxy Statements (Form DEF 14A)

Several online resources can significantly aid in the analysis of proxy statements. The SEC's EDGAR database is the primary source for accessing these filings. Financial news websites often provide analysis and insights on specific proxy statements, offering valuable context and interpretation. Using these resources can enhance your understanding and facilitate efficient analysis. Many investment research platforms also offer tools and resources to streamline the review process.

Conclusion: Become a Proxy Statement Pro

Mastering the art of reading and interpreting proxy statements (Form DEF 14A) is an essential skill for informed investing. By understanding the structure, key information sections, and available online resources, you can gain valuable insights into a company's governance, financial health, and future prospects. Analyzing executive compensation, shareholder proposals, board composition, and risk factors enables you to assess potential investment risks and opportunities. Start analyzing proxy statements (Form DEF 14A) today to become a more informed and empowered investor! Actively engage with proxy statements and use your acquired knowledge to make better investment choices, ensuring your investments align with your goals and risk tolerance. The more you understand Form DEF 14A, the better equipped you will be to make informed decisions and participate effectively in shareholder engagement.

Featured Posts

-

Leading Australian Crypto Casino Sites In 2025

May 17, 2025

Leading Australian Crypto Casino Sites In 2025

May 17, 2025 -

A New Cold War Brewing The Rare Earth Minerals Struggle

May 17, 2025

A New Cold War Brewing The Rare Earth Minerals Struggle

May 17, 2025 -

Mike Breens Comments On Mikal Bridges Minutes Spark Discussion

May 17, 2025

Mike Breens Comments On Mikal Bridges Minutes Spark Discussion

May 17, 2025 -

Why Were These 10 Great Tv Shows Cancelled A Critical Look

May 17, 2025

Why Were These 10 Great Tv Shows Cancelled A Critical Look

May 17, 2025 -

Angelo Stiller Barcelona And Arsenals Pursuit Of Young Talent

May 17, 2025

Angelo Stiller Barcelona And Arsenals Pursuit Of Young Talent

May 17, 2025

Latest Posts

-

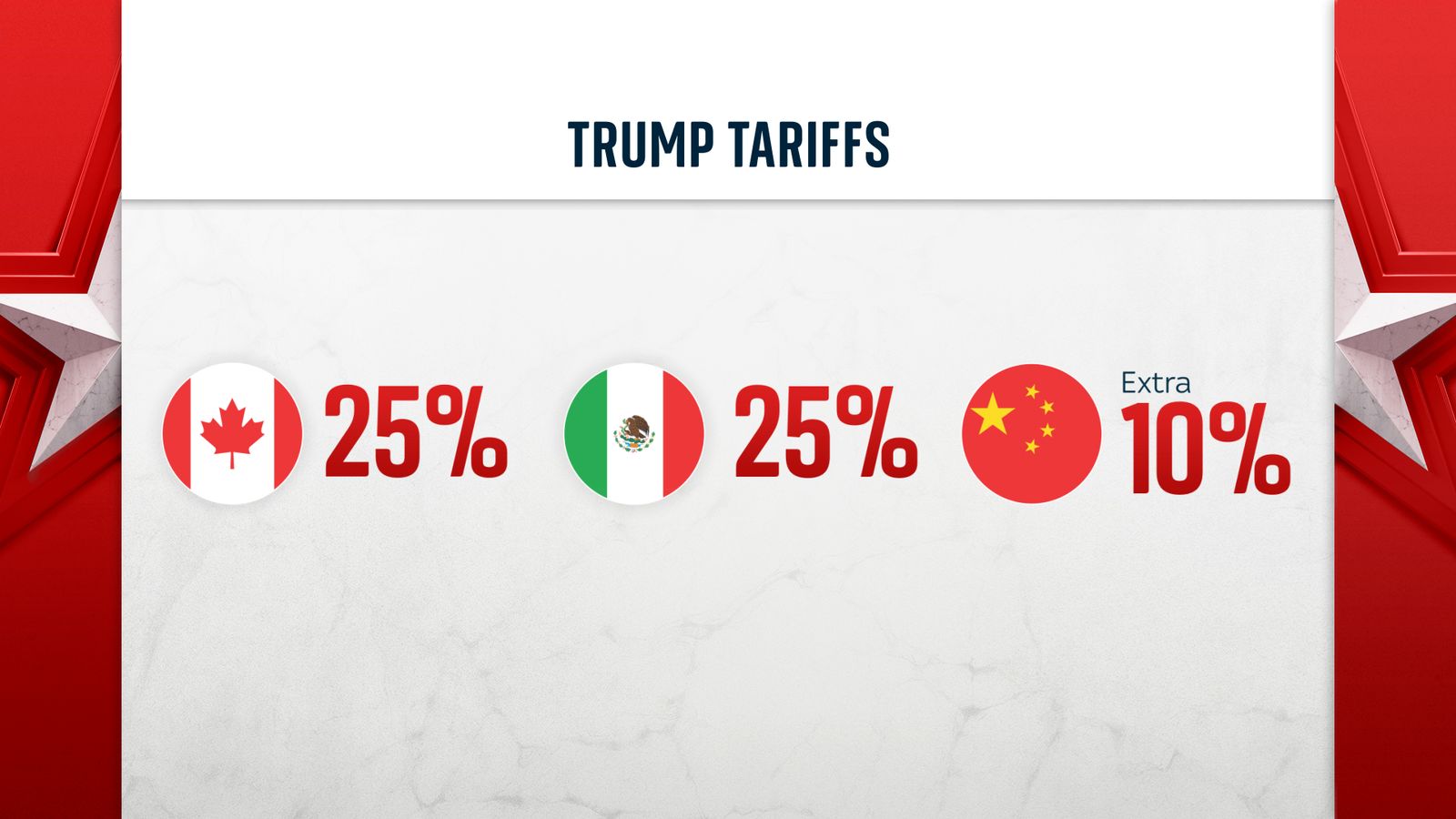

Dutch Viewpoint Against Eu Countermeasures To Trumps Tariffs

May 18, 2025

Dutch Viewpoint Against Eu Countermeasures To Trumps Tariffs

May 18, 2025 -

The Netherlands And The Trump Tariffs A Nations Resistance To Retaliation

May 18, 2025

The Netherlands And The Trump Tariffs A Nations Resistance To Retaliation

May 18, 2025 -

Analysis Dutch Opposition To Eu Response To Trump Import Duties

May 18, 2025

Analysis Dutch Opposition To Eu Response To Trump Import Duties

May 18, 2025 -

Public Opinion In The Netherlands No Retaliation On Trump Tariffs

May 18, 2025

Public Opinion In The Netherlands No Retaliation On Trump Tariffs

May 18, 2025 -

Poll Most Dutch Against Eu Retaliation On Trumps Import Tariffs

May 18, 2025

Poll Most Dutch Against Eu Retaliation On Trumps Import Tariffs

May 18, 2025