How Tariff Hikes Impact The Bond Market

Table of Contents

Main Points:

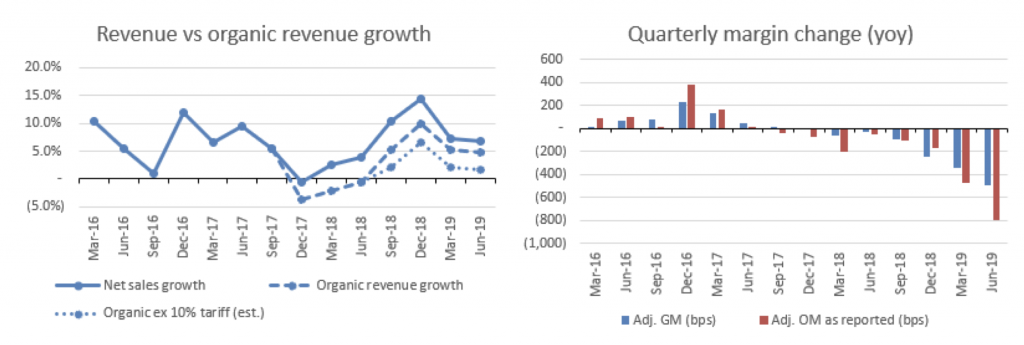

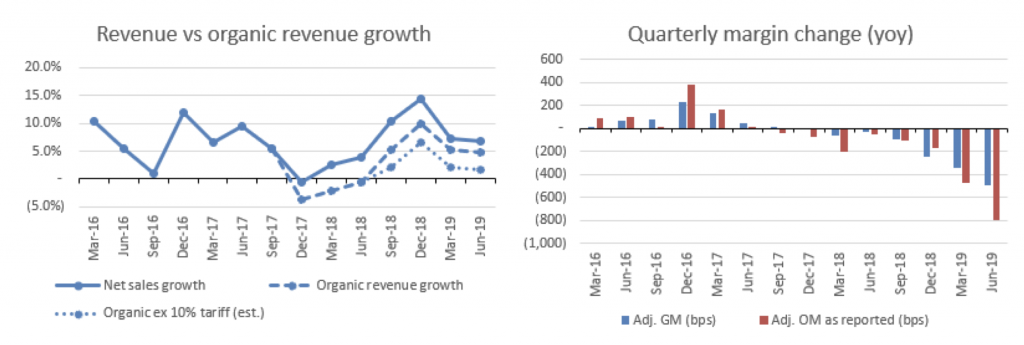

2.1. Inflationary Pressures and Bond Yields

H3: How Tariffs Fuel Inflation: Tariffs, essentially taxes on imported goods, directly increase the price of those goods for consumers. This occurs through several mechanisms. Firstly, increased import costs translate to higher production costs for businesses that rely on imported components. Secondly, reduced consumer purchasing power arises as the cost of living increases, impacting overall demand. Examples abound; the aforementioned US-China trade war saw significant inflationary pressure in certain sectors due to increased tariffs on Chinese imports. Economic indicators like the Consumer Price Index (CPI) and Producer Price Index (PPI) often reflect this inflationary impact.

- Increased production costs: Businesses pass on increased import costs to consumers, leading to higher prices.

- Reduced consumer purchasing power: Higher prices erode consumer spending, potentially slowing economic growth.

- Examples: The US-China trade war saw increased prices on goods subject to tariffs.

H3: The Impact on Bond Yields: Bond prices and yields have an inverse relationship. When inflation rises, investors demand higher returns (yields) on their bond investments to compensate for the erosion of their purchasing power due to inflation. This increased demand for higher yields pushes bond prices down. The Federal Reserve (or other central banks) might respond to inflationary pressures stemming from tariff hikes by raising interest rates, further impacting bond yields. Rising interest rates make existing bonds less attractive, leading to a decline in their prices.

- Inverse relationship: Higher inflation = Higher bond yields = Lower bond prices.

- Federal Reserve response: Interest rate hikes to combat inflation further depress bond prices.

- Existing bonds: Rising interest rates decrease the value of existing lower-yielding bonds.

H3: Flight to Safety and Bond Demand: Ironically, the economic uncertainty created by tariff disputes can also trigger a "flight to safety." Investors, worried about the broader economic consequences, may seek the perceived safety of government bonds. This increased demand for bonds can temporarily lower yields, counteracting the inflationary pressure described above. This is a short-term effect, however, as the long-term inflationary pressures usually dominate.

- Uncertainty: Trade wars create economic uncertainty, pushing investors towards safe-haven assets like government bonds.

- Increased demand: Higher demand for government bonds can temporarily lower yields.

- Short-term effect: This "flight to safety" is often temporary and overshadowed by long-term inflationary pressures.

2.2. Impact on Economic Growth and Bond Market Sentiment

H3: Slowed Economic Growth: Tariffs can impede international trade, leading to slower economic growth. Reduced trade directly impacts businesses relying on imports or exports. This can lead to reduced investment, job losses, and a dampening of overall consumer confidence. The ripple effects throughout the economy are significant.

- Reduced trade: Tariffs create barriers to trade, limiting economic activity.

- Ripple effects: Impacts businesses, consumers, and employment across various sectors.

- Investment decline: Uncertainty discourages investment, further slowing growth.

H3: Investor Sentiment and Risk Aversion: The uncertainty surrounding tariff policies is a major factor impacting investor sentiment. This uncertainty breeds risk aversion, making investors less willing to take on riskier investments. Consequently, demand for safer assets like government bonds increases, while demand for corporate bonds (which carry higher risk) may decline. This can lead to capital flight from riskier markets.

- Uncertainty drives risk aversion: Investors become more cautious, reducing investment in riskier assets.

- Reduced demand for corporate bonds: Increased risk aversion lowers demand for corporate bonds.

- Capital flight: Investors might move capital to safer jurisdictions.

H3: Sectoral Impact: The impact of tariffs isn't uniform across all sectors. Import-dependent industries (e.g., manufacturing) and those reliant on global supply chains are particularly vulnerable. This sectoral impact is reflected in corporate bond yields, with bonds issued by affected companies potentially facing higher yields due to increased risk.

- Uneven impact: Industries heavily reliant on imports are disproportionately affected.

- Corporate bond yields: Higher yields reflect increased risk for companies affected by tariffs.

- Supply chain disruptions: Tariffs can disrupt global supply chains, impacting multiple industries.

2.3. Government Borrowing and the Bond Market

H3: Increased Government Spending and Debt: Governments may attempt to mitigate the negative effects of tariffs through increased spending, such as subsidies for affected industries or bailouts for struggling businesses. This increased spending often leads to a rise in government debt, requiring more government bond issuance.

- Fiscal stimulus: Governments may increase spending to offset the negative effects of tariffs.

- Increased government debt: This increased spending leads to higher government borrowing.

- Higher bond issuance: Governments issue more bonds to finance their increased spending.

H3: Government Response and Policy Implications: The government's response to tariff-related economic challenges significantly influences bond market dynamics. Fiscal stimulus measures might counteract some negative effects, but conflicting policy signals can create further uncertainty. A comprehensive understanding of the government's overall economic strategy is crucial for accurate bond market analysis.

- Policy uncertainty: Inconsistent government policies can create further uncertainty in the market.

- Fiscal stimulus vs. austerity: The government's approach to economic management impacts bond market sentiment.

- Coordination of monetary and fiscal policy: The interaction between central bank actions and government spending is crucial.

Conclusion: Navigating the Bond Market in the Age of Tariff Uncertainty

Tariff hikes exert a multifaceted impact on the bond market, influencing inflation, economic growth, investor sentiment, and government borrowing. The effects are often complex and even contradictory, with short-term "flights to safety" potentially offset by long-term inflationary pressures. Understanding these dynamics is vital for both investors and policymakers. To successfully navigate the bond market in this era of tariff uncertainty, staying informed about tariff developments and their potential implications for your bond investments is crucial. Further research into tariff policies and detailed bond market analysis is recommended for a deeper understanding of how tariff hike impacts on bonds play out in practice. Understanding tariff hike impacts on bonds requires careful consideration of these interconnected factors and a thorough analysis of economic indicators and policy responses.

Featured Posts

-

Valentina Shevchenkos Next Ufc Fight May Showdown Against Manon Fiorot

May 12, 2025

Valentina Shevchenkos Next Ufc Fight May Showdown Against Manon Fiorot

May 12, 2025 -

Boris Dzhonson Protiv Mirnogo Plana Trampa Analiz Situatsii

May 12, 2025

Boris Dzhonson Protiv Mirnogo Plana Trampa Analiz Situatsii

May 12, 2025 -

Trumps Energy Agenda Navigating The Tension Between Low Prices And Industry Loyalty

May 12, 2025

Trumps Energy Agenda Navigating The Tension Between Low Prices And Industry Loyalty

May 12, 2025 -

Colombia Otorga Asilo A Ricardo Martinelli Implicaciones Politicas

May 12, 2025

Colombia Otorga Asilo A Ricardo Martinelli Implicaciones Politicas

May 12, 2025 -

Ohio Train Derailment Aftermath Prolonged Exposure To Toxic Chemicals In Buildings

May 12, 2025

Ohio Train Derailment Aftermath Prolonged Exposure To Toxic Chemicals In Buildings

May 12, 2025

Latest Posts

-

Exploring The Themes Of The Hobbit The Battle Of The Five Armies

May 13, 2025

Exploring The Themes Of The Hobbit The Battle Of The Five Armies

May 13, 2025 -

Analyzing The Battle Of The Five Armies In The Hobbit

May 13, 2025

Analyzing The Battle Of The Five Armies In The Hobbit

May 13, 2025 -

Avengers Doomsday And The Potential For A Comics Accurate Scarlet Witch And Quicksilver Origin

May 13, 2025

Avengers Doomsday And The Potential For A Comics Accurate Scarlet Witch And Quicksilver Origin

May 13, 2025 -

The Hobbit The Battle Of The Five Armies Characters Plot And Legacy

May 13, 2025

The Hobbit The Battle Of The Five Armies Characters Plot And Legacy

May 13, 2025 -

The Hobbit The Battle Of The Five Armies Review And Analysis

May 13, 2025

The Hobbit The Battle Of The Five Armies Review And Analysis

May 13, 2025