How Much Wealth Did Musk, Bezos, And Zuckerberg Lose After Trump's Inauguration?

Table of Contents

The Impact of Trump's Economic Policies on Tech Stocks

Trump's economic policies had a profound and multifaceted impact on the tech sector, influencing the valuations of companies like Tesla, Amazon, and Facebook, and consequently, the net worth of their respective CEOs.

Trade Wars and Tariffs

Trump's protectionist trade policies, characterized by the imposition of significant tariffs on imported goods, created considerable uncertainty within the global supply chains relied upon by tech companies.

- Example 1: Tariffs on imported components for electronics manufacturing led to increased production costs for companies like Tesla, impacting profit margins and potentially influencing investor sentiment.

- Example 2: Tariffs on Chinese goods disrupted established supply chains, forcing companies to reassess their sourcing strategies, leading to delays and increased expenses. This uncertainty often translates into stock market volatility.

- Example 3: The resulting trade war with China created a climate of instability, impacting consumer confidence and impacting investment decisions.

Keywords: Trump tariffs, trade war impact, tech stock volatility, supply chain disruption, global trade, import tariffs.

Regulatory Uncertainty and Changes

The Trump administration's approach to regulation also introduced a degree of uncertainty into the tech sector. Changes in antitrust scrutiny and immigration policies presented potential challenges for these companies.

- Example 1: Increased antitrust investigations into large tech companies like Facebook and Amazon created uncertainty about their future business models and potential regulatory fines. This uncertainty can negatively affect stock prices.

- Example 2: Changes to immigration policies, including restrictions on visas for highly skilled workers, potentially impacted the ability of tech companies to attract and retain top talent, hindering innovation and growth.

- Example 3: Regulatory shifts impacting data privacy and online content moderation led to increased compliance costs and potential reputational risks for companies like Facebook.

Keywords: Antitrust laws, immigration policy, regulatory uncertainty, tech company regulations, data privacy regulations.

Market Volatility and the Broader Economic Climate

Beyond specific policies, the overall economic climate and market volatility following Trump's inauguration played a significant role in the fluctuations of these tech giants' net worth.

Overall Market Fluctuations

The period following the inauguration witnessed considerable market fluctuations. Major indices like the S&P 500 and Nasdaq experienced periods of both growth and decline, impacting the overall value of tech stocks.

- Example 1: Initial market uncertainty following the election resulted in a period of volatility in the stock market, affecting the valuations of all major companies.

- Example 2: Changes in interest rates and other macroeconomic factors influenced investor sentiment and risk appetite, impacting stock prices.

- Example 3: The overall economic growth or contraction under the new administration directly impacted the valuations of tech companies.

Keywords: Market volatility, stock market fluctuations, investor sentiment, economic uncertainty, S&P 500, Nasdaq.

Geopolitical Factors

Geopolitical events also played a role in the global economic landscape and influenced market sentiment.

- Example 1: Escalating tensions in various regions of the world could lead to increased risk aversion among investors, impacting stock prices.

- Example 2: International trade agreements and disputes significantly impacted global markets and the performance of multinational tech companies.

- Example 3: Unforeseen global events – such as pandemics or major political shifts – can create sudden and unpredictable fluctuations in the market.

Keywords: Geopolitical risk, global markets, international relations, economic sanctions, global uncertainty.

Individual Company Performance and Stock Prices

Examining the individual performance of Tesla, Amazon, and Facebook reveals further insights into the wealth changes experienced by their CEOs.

Tesla Stock Performance

Tesla's stock performance in the post-inauguration period was influenced by several factors, impacting Elon Musk's net worth.

- Example 1: Production challenges and delivery delays affected investor confidence and stock prices.

- Example 2: Regulatory hurdles and competition in the electric vehicle market added to the volatility.

- Example 3: Elon Musk's public statements and actions also significantly influenced market sentiment and Tesla's stock price.

Keywords: Tesla stock price, Elon Musk net worth, electric vehicle market, Tesla production, Tesla controversies.

Amazon Stock Performance

Amazon's stock performance after the inauguration was shaped by its position in the e-commerce sector and regulatory scrutiny.

- Example 1: Increased competition in the e-commerce market created challenges for Amazon's growth trajectory.

- Example 2: Antitrust investigations and regulatory concerns impacted investor sentiment and stock prices.

- Example 3: Amazon's expansion into new markets and business ventures contributed to its overall performance.

Keywords: Amazon stock, Jeff Bezos net worth, e-commerce trends, Amazon competition, Amazon antitrust.

Facebook (Meta) Stock Performance

Facebook/Meta's stock price in the post-inauguration period reflected its challenges with data privacy concerns, advertising revenue, and increasing competition.

- Example 1: Controversies surrounding data privacy and political advertising negatively affected Facebook's reputation and stock price.

- Example 2: Changes in advertising algorithms and competition from other social media platforms impacted Facebook's revenue growth.

- Example 3: The evolution of the social media landscape, including the rise of new platforms, posed challenges to Facebook's dominance.

Keywords: Facebook stock, Mark Zuckerberg net worth, social media market, data privacy concerns, Facebook controversies, Meta stock.

Conclusion

The changes in the net worth of Elon Musk, Jeff Bezos, and Mark Zuckerberg following Trump's inauguration were not solely attributable to any single factor. The interplay of Trump's economic policies, global market volatility, and the specific performance of each company created a complex picture. Understanding these interwoven factors is crucial to comprehending the impact of political events on the fortunes of tech giants and the broader economy. Learn more about the complex relationship between political events and the fortunes of tech giants by exploring further research on the impact of presidential administrations on the stock market. Understand how economic policy impacts your investments and learn more about the effects of Trump's economic policies by visiting [link to relevant resource]. Keep informed about how factors like trade wars, regulatory changes, and market volatility affect the wealth of prominent figures and the broader economy.

Featured Posts

-

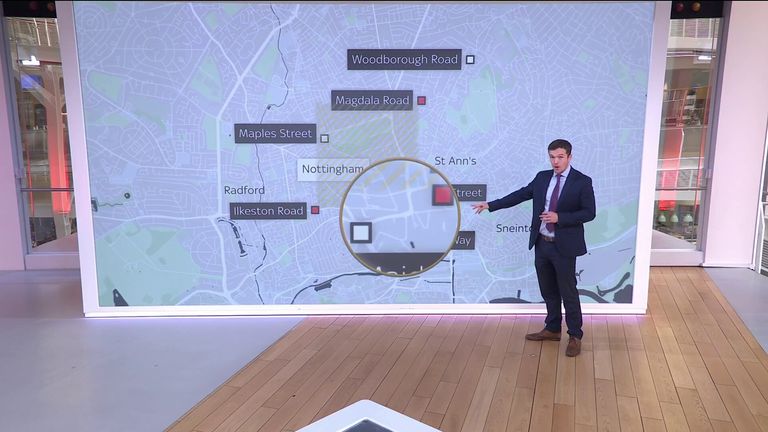

Nhs Trust Chiefs Commitment To Nottingham Attack Inquiry

May 10, 2025

Nhs Trust Chiefs Commitment To Nottingham Attack Inquiry

May 10, 2025 -

Strictly Come Dancing Katya Jones Departure And The Wynne Evans Allegations

May 10, 2025

Strictly Come Dancing Katya Jones Departure And The Wynne Evans Allegations

May 10, 2025 -

Kraujingos Plintos Nuotraukos Dakota Johnson Ir Skandalas

May 10, 2025

Kraujingos Plintos Nuotraukos Dakota Johnson Ir Skandalas

May 10, 2025 -

Oilers Vs Kings Expert Predictions And Odds For Game 1 Of The Nhl Playoffs

May 10, 2025

Oilers Vs Kings Expert Predictions And Odds For Game 1 Of The Nhl Playoffs

May 10, 2025 -

Politicheskaya Izolyatsiya Zelenskogo Analiz Sobytiy 9 Maya

May 10, 2025

Politicheskaya Izolyatsiya Zelenskogo Analiz Sobytiy 9 Maya

May 10, 2025