How Increased Federal Debt Could Affect Your Mortgage Application

Table of Contents

The Relationship Between Federal Debt and Interest Rates

Increased federal debt often leads to higher interest rates. When the government borrows more money, it increases demand for funds, driving up borrowing costs across the board. This includes mortgage rates. The connection is multifaceted:

- Increased government borrowing competes with private borrowing for funds. More government borrowing means less money available for private sector loans, including mortgages. This increased competition pushes interest rates upward.

- The Federal Reserve may raise interest rates to combat inflation fueled by government spending. Excessive government spending can contribute to inflation. To control inflation, the Federal Reserve (the central bank of the US) often raises interest rates, making borrowing more expensive, including mortgages.

- Higher inflation generally leads to higher interest rates to maintain purchasing power. When inflation rises, lenders need to charge higher interest rates to ensure the real return on their loans isn't eroded by rising prices. This protects the lender's purchasing power.

- Investors demand higher yields on government bonds to compensate for increased risk. As government debt increases, the perceived risk of holding government bonds also increases. Investors demand higher yields (interest rates) to compensate for this added risk. This increase in bond yields often translates to higher rates across other sectors, including mortgages.

Related Keywords: Mortgage interest rates, interest rate hikes, inflation, government borrowing, bond yields, Treasury yields.

How Higher Interest Rates Impact Mortgage Affordability

Even a small increase in interest rates can significantly increase the monthly payments on a mortgage, making homeownership less affordable for many. This impact is substantial:

- Higher interest rates increase the total cost of a mortgage over its lifespan. A seemingly small increase in the interest rate can add tens of thousands of dollars to the overall cost of a mortgage over 15 or 30 years.

- Borrowers may qualify for smaller loan amounts due to increased monthly payments. Lenders use affordability calculations that limit monthly mortgage payments to a percentage of a borrower's income. Higher interest rates reduce the loan amount a borrower can qualify for.

- Rising rates can reduce the number of potential homebuyers, impacting the housing market. As mortgages become less affordable, demand decreases, potentially slowing down the housing market.

- Affordability calculations become more stringent with higher rates. Lenders employ stricter affordability criteria when interest rates are high, making it more challenging for prospective homeowners to qualify for a mortgage.

Related Keywords: Mortgage affordability, monthly mortgage payments, loan amount, homebuyer affordability, housing market impact, housing affordability crisis.

Potential Impact on Mortgage Loan Availability

In times of economic uncertainty fueled by high federal debt, lenders may become more cautious, tightening lending standards and reducing the availability of mortgages. This cautious approach can manifest in several ways:

- Lenders may require higher credit scores and larger down payments. To mitigate risk, lenders often increase their requirements for borrowers, demanding higher credit scores and larger down payments.

- Loan applications might face increased scrutiny and longer processing times. Lenders may take longer to process applications and conduct more thorough reviews of borrowers' financial situations.

- Some lenders may reduce their mortgage offerings or become less willing to take risks. Some lenders may choose to limit their mortgage offerings or become more selective about the borrowers they finance.

- The overall supply of available mortgages could decrease. A combination of stricter lending standards and reduced lender participation can lead to a decrease in the overall availability of mortgages.

Related Keywords: Mortgage lending standards, credit score requirements, down payment, loan approval process, mortgage availability, mortgage application process.

Strategies for Navigating a High-Debt Environment When Applying for a Mortgage

Despite the challenges, prospective homebuyers can take steps to improve their chances of mortgage approval:

- Improve credit score: A higher credit score demonstrates creditworthiness and improves your chances of securing a favorable interest rate.

- Save for a larger down payment: A larger down payment reduces the loan amount, lowering the risk for lenders and potentially improving your chances of approval.

- Shop around for the best mortgage rates: Comparing rates from different lenders can help you secure the most favorable terms.

- Work with a reputable mortgage broker: A broker can help navigate the complexities of the mortgage application process and find the best options for your situation.

- Maintain a stable financial situation: Demonstrating a consistent and stable income and manageable debt is crucial for lenders.

Related Keywords: Mortgage pre-approval, best mortgage rates, mortgage broker, improve credit score, financial stability, pre-approval mortgage.

Conclusion

Increased federal debt presents a complex challenge for prospective homeowners. Its potential impact on Federal Debt and Mortgage Rates is significant, affecting affordability, loan availability, and the overall mortgage application process. By understanding these potential effects and taking proactive steps to improve their financial standing, prospective homebuyers can navigate these challenges and increase their chances of securing a mortgage. Remember to thoroughly research your options and seek professional advice when applying for a mortgage in a high-debt environment. Don't let concerns about rising Federal Debt and Mortgage Rates prevent you from pursuing your dream of homeownership; be prepared and informed. Start planning your financial strategy today to effectively manage the impact of federal debt on mortgage rates.

Featured Posts

-

Final Destination Bloodlines Trailer What To Expect From The New Installment

May 19, 2025

Final Destination Bloodlines Trailer What To Expect From The New Installment

May 19, 2025 -

La Muerte De Una Leyenda Del Tenis El Sentido Pesame De Rafa Nadal

May 19, 2025

La Muerte De Una Leyenda Del Tenis El Sentido Pesame De Rafa Nadal

May 19, 2025 -

I Anastasi Toy Lazaroy Sta Ierosolyma Mia T Heologiki Kai Istoriki Proseggisi

May 19, 2025

I Anastasi Toy Lazaroy Sta Ierosolyma Mia T Heologiki Kai Istoriki Proseggisi

May 19, 2025 -

Mtabet Mbashrt Lqdas Alqyamt Fy Dyr Sydt Allwyzt Ebr Alwkalt Alwtnyt Llielam

May 19, 2025

Mtabet Mbashrt Lqdas Alqyamt Fy Dyr Sydt Allwyzt Ebr Alwkalt Alwtnyt Llielam

May 19, 2025 -

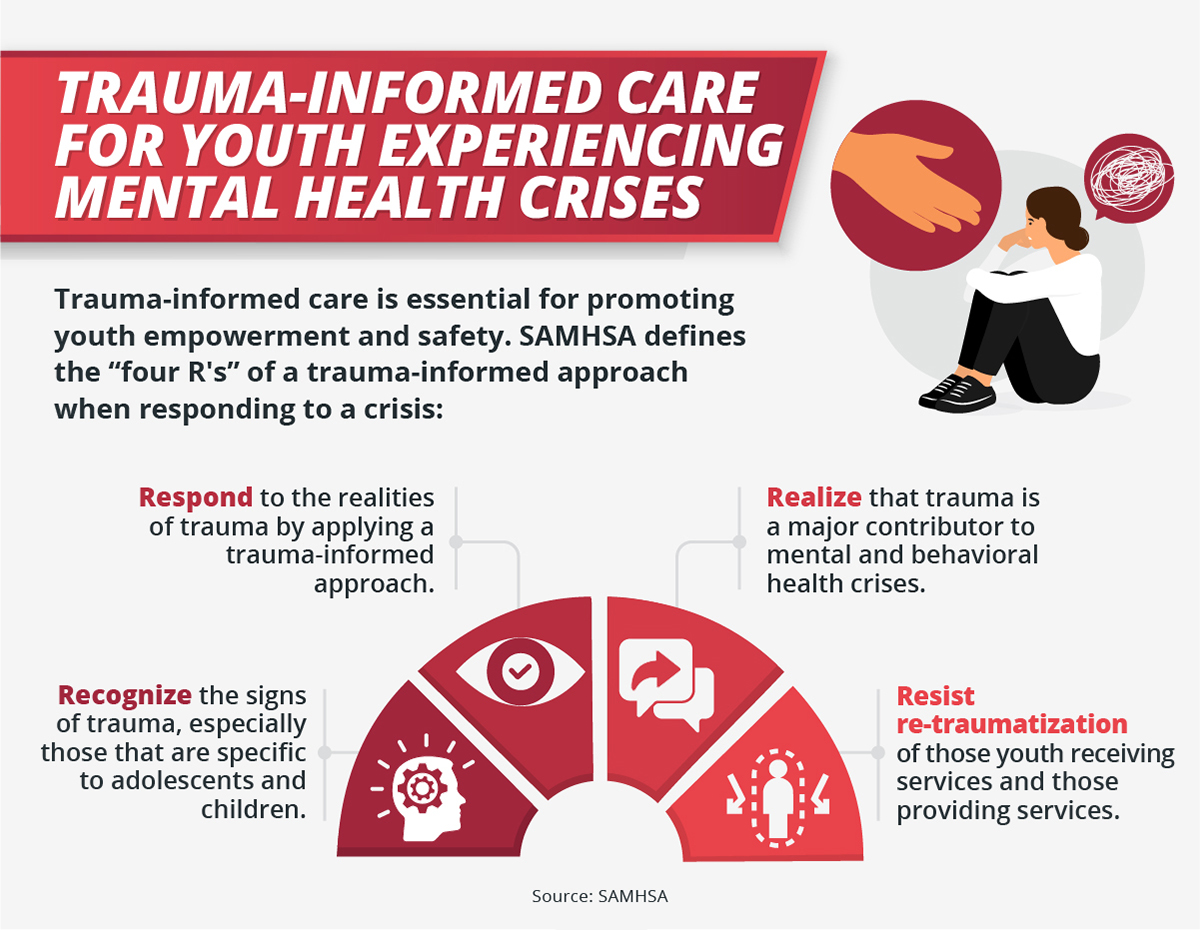

Suncoasts Mental Health Crisis A Strain On Resources

May 19, 2025

Suncoasts Mental Health Crisis A Strain On Resources

May 19, 2025