How Donald Trump's First 100 Days Impacted Elon Musk's Net Worth

Table of Contents

- Trump's Regulatory Rollbacks and their Effect on Tesla

- Deregulation of the Automotive Industry

- Impact on the Renewable Energy Sector

- Trade Wars and Global Economic Uncertainty

- Impact on SpaceX and International Projects

- Fluctuations in the Stock Market

- Shifting Political Climate and Investor Sentiment

- Trump's Pronouncements on Electric Vehicles and Space Exploration

- Changes in Government Spending and Investment

- Conclusion: Summarizing the Impact of Trump's First 100 Days on Elon Musk's Net Worth

Trump's Regulatory Rollbacks and their Effect on Tesla

Trump's approach to deregulation significantly impacted various sectors, with potential consequences for Elon Musk's companies.

Deregulation of the Automotive Industry

Trump's administration pursued a policy of deregulation across numerous industries, including the automotive sector. This potentially benefitted Tesla in several ways:

- Easing of Fuel Efficiency Standards: Potential relaxations of fuel efficiency standards could have lowered production costs for Tesla, making their electric vehicles more competitive.

- Streamlined Manufacturing Processes: Reduced bureaucratic hurdles could have sped up Tesla's production timelines and expansion plans.

While precise data directly correlating these specific deregulatory measures to Tesla's immediate stock performance during Trump's first 100 days is difficult to isolate, the overall positive sentiment toward deregulation in the business community likely contributed to a generally positive market environment. Further research is needed to definitively quantify the impact.

Impact on the Renewable Energy Sector

Trump's stance on climate change and renewable energy presented a more complex picture for Tesla's energy division.

- Withdrawal from the Paris Agreement: This move signaled a potential shift away from government support for renewable energy initiatives, potentially impacting the market for Tesla's solar products and energy storage solutions.

- Reduced Federal Incentives: While not enacted in the first 100 days, the threat of reduced federal incentives for renewable energy created uncertainty in the market, which could have affected Tesla Energy's growth trajectory and investor confidence.

The impact on Tesla Energy during this period was likely mixed, with the potential benefits of deregulation in other sectors possibly offset by uncertainty in the renewable energy market. Analyzing Tesla Energy's performance data during this period against broader trends in the renewable energy sector would provide a clearer picture.

Trade Wars and Global Economic Uncertainty

Trump's focus on trade protectionism introduced considerable uncertainty into the global economy, affecting both Tesla and SpaceX.

Impact on SpaceX and International Projects

SpaceX relies on a global supply chain and international collaborations. Trump's trade policies, including tariffs and trade disputes, could have increased costs and complicated logistics for SpaceX projects.

- Increased Material Costs: Tariffs on imported materials could have raised the cost of building rockets and satellites.

- Disrupted International Collaborations: Trade tensions could have negatively impacted SpaceX's partnerships with international space agencies or companies.

Quantifying the precise impact on SpaceX during this period requires detailed analysis of their procurement and financial data, which may not be publicly available to this extent.

Fluctuations in the Stock Market

The overall volatility of the stock market during Trump's first 100 days significantly influenced the valuations of both Tesla and SpaceX (where applicable).

- Investor Sentiment: Trump's policies created market uncertainty, potentially impacting investor confidence in both companies. Rapid shifts in investor sentiment can cause significant stock price fluctuations.

- Market Corrections: The general market volatility could have resulted in corrections that affected Tesla and SpaceX stock prices regardless of the companies' individual performances.

Analyzing the stock market data for Tesla and SpaceX during this period, alongside broader market indices, would be crucial to understanding the specific impact of this volatility.

Shifting Political Climate and Investor Sentiment

The change in political leadership also affected investor perception of Tesla and SpaceX.

Trump's Pronouncements on Electric Vehicles and Space Exploration

Trump's public statements regarding electric vehicles and space exploration could have influenced investor sentiment toward Tesla and SpaceX.

- Positive Statements: Positive comments could have boosted investor confidence.

- Negative or Ambiguous Statements: Conversely, negative or uncertain statements could have caused a decrease in investor confidence.

Carefully tracking Trump's public comments during this period and correlating them with changes in Tesla and SpaceX stock prices would be necessary to analyze their impact accurately.

Changes in Government Spending and Investment

Changes in government spending priorities under the Trump administration could have affected the financial prospects of both Tesla and SpaceX.

- Increased Military Spending: This could have indirectly benefited SpaceX through increased demand for its launch services.

- Reduced Funding for Renewable Energy Research: This could have negatively affected Tesla's long-term prospects.

Analyzing changes in government budgets and spending allocations during this period, and their potential impact on Tesla and SpaceX's revenue streams and projects, would be critical for a complete understanding.

Conclusion: Summarizing the Impact of Trump's First 100 Days on Elon Musk's Net Worth

In conclusion, the impact of Donald Trump's first 100 days on Elon Musk's net worth was complex and multifaceted. While potential benefits arose from deregulation in certain sectors, uncertainties introduced by trade policies and shifts in government priorities likely counteracted some positive effects. The overall impact required a nuanced analysis of market fluctuations, investor sentiment, and specific policy changes affecting both Tesla and SpaceX. The relationship between political events and individual wealth is intricate and often indirect, highlighting the need for further research and analysis. Learn more about how political events impact the net worth of major tech leaders by exploring related articles and economic analyses.

100 Billion Loss Doesnt Stop Elon Musk Hurun Global Rich List 2025

100 Billion Loss Doesnt Stop Elon Musk Hurun Global Rich List 2025

The Great Decoupling A New Era Of Global Economic Restructuring

The Great Decoupling A New Era Of Global Economic Restructuring

Bayern Munich Vs Eintracht Frankfurt Tactical Analysis And Predicted Lineup

Bayern Munich Vs Eintracht Frankfurt Tactical Analysis And Predicted Lineup

Declaration Du Ministre Francais De L Europe Sur Le Partage Du Bouclier Nucleaire

Declaration Du Ministre Francais De L Europe Sur Le Partage Du Bouclier Nucleaire

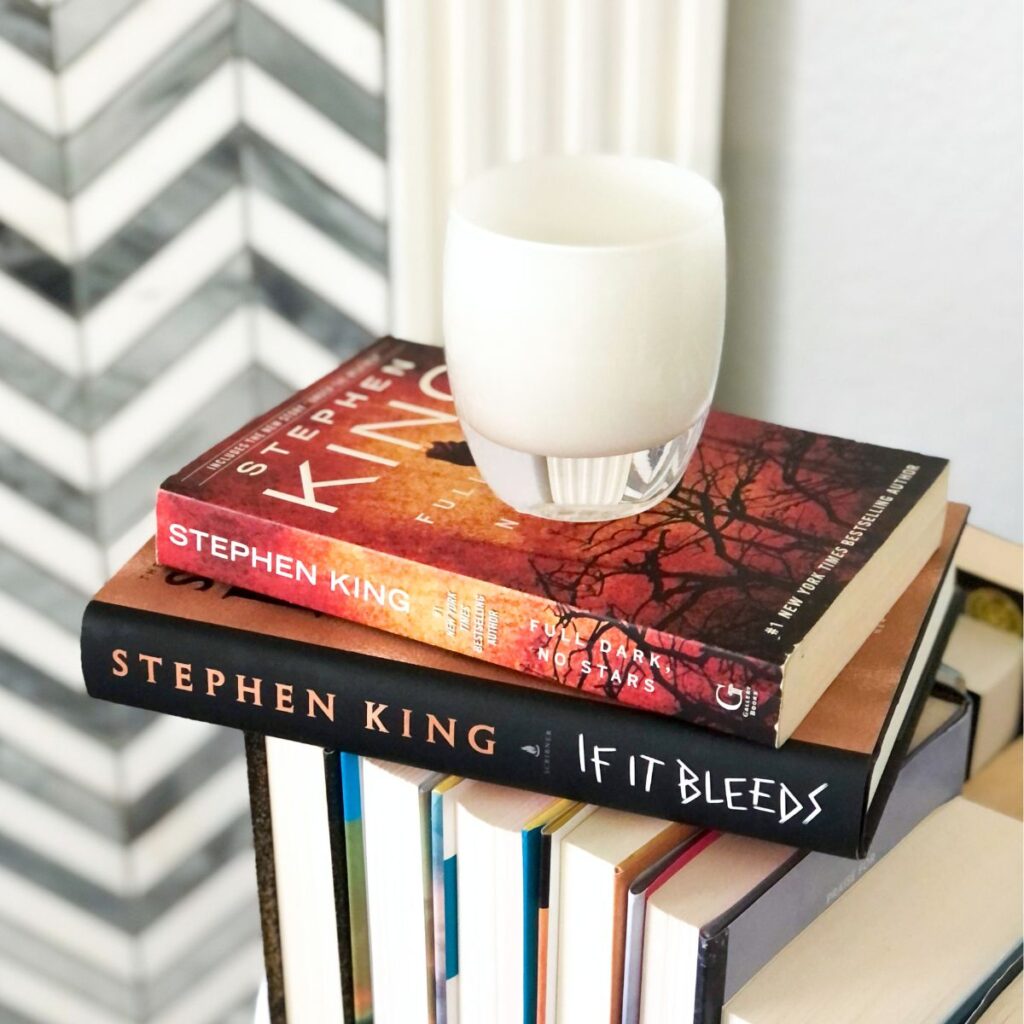

Complete This Critically Acclaimed Stephen King Series In Under 5 Hours

Complete This Critically Acclaimed Stephen King Series In Under 5 Hours