How Climate Change Could Impact Your Creditworthiness When Buying A Home

Table of Contents

Rising Insurance Premiums and Credit Scores

Increased frequency and severity of climate-related disasters are driving up homeowner's insurance premiums. This, in turn, directly affects your ability to secure a mortgage. Higher insurance costs translate to increased monthly expenses, significantly impacting your debt-to-income ratio (DTI). Your DTI is a crucial factor lenders consider when assessing your ability to repay a loan.

- Increased premiums directly impact your monthly expenses. A seemingly small increase in your annual premium can translate into a substantial monthly payment, potentially pushing your DTI over the lender's acceptable threshold.

- Lenders assess DTI to determine your ability to repay the loan. A high DTI indicates a greater risk for the lender, making loan approval less likely or resulting in less favorable loan terms, such as higher interest rates.

- A high DTI can result in loan denial or less favorable terms. Understanding how insurance costs contribute to your DTI is crucial for a successful mortgage application.

- Explore options like flood insurance or other climate-related coverage and their impact on finances. Proactive planning and understanding the potential costs associated with climate-related insurance are essential. Consider the long-term financial implications of living in a high-risk area.

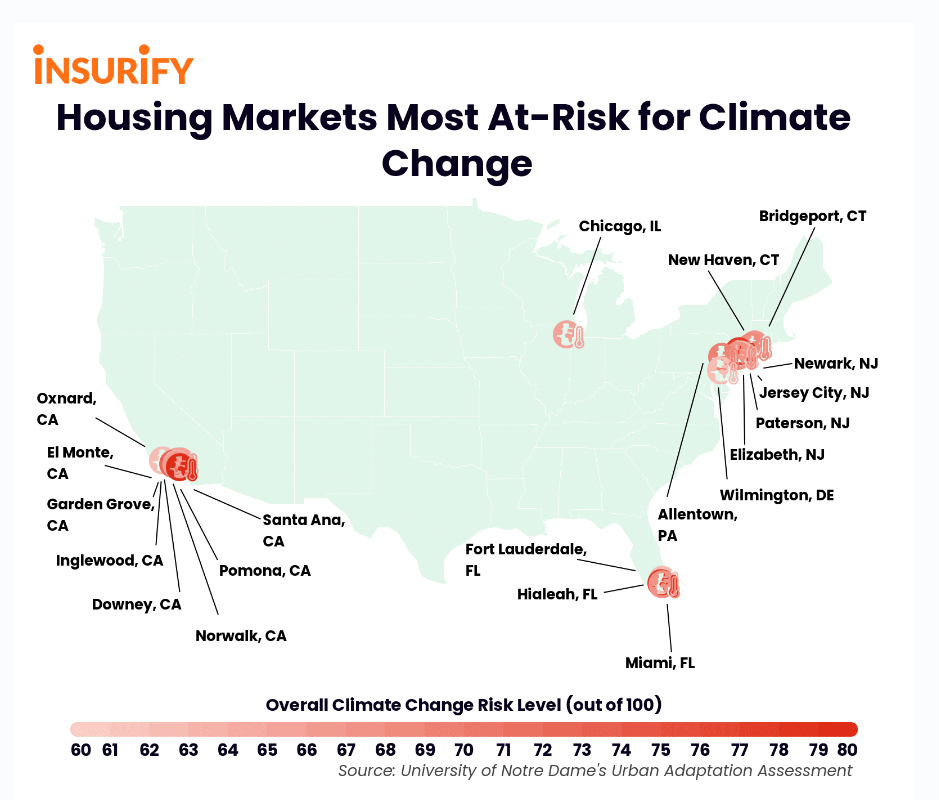

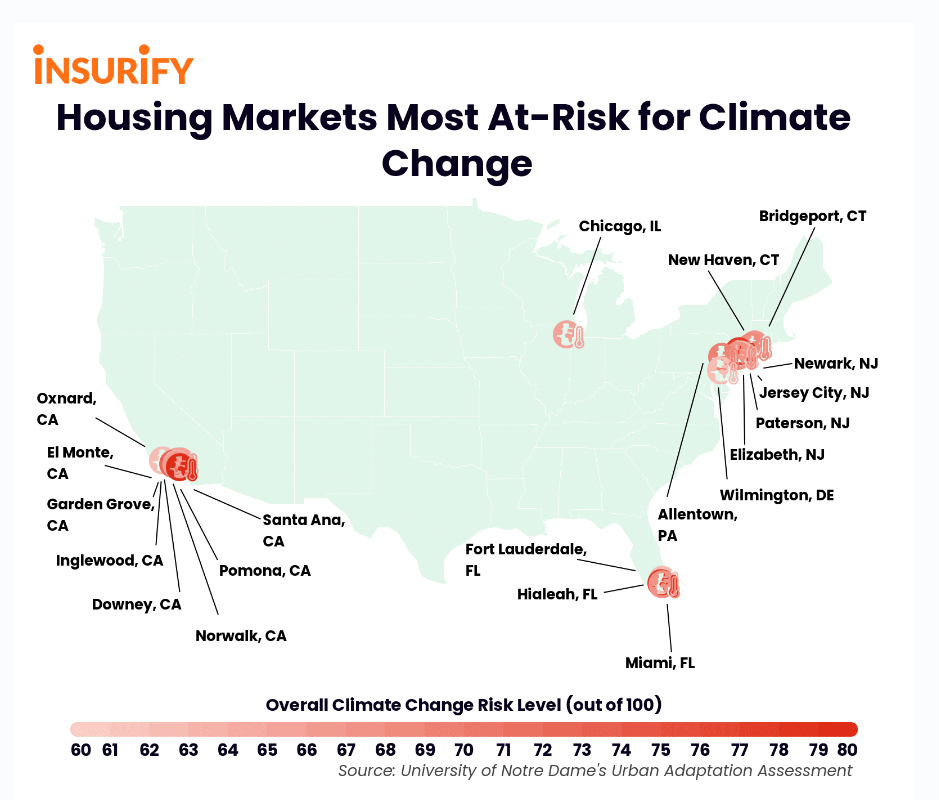

Property Value Depreciation Due to Climate Risk

Properties located in high-risk climate zones—floodplains, wildfire zones, areas prone to extreme heat—are experiencing a decline in value. This depreciation poses a significant challenge for prospective homebuyers. Lenders view property value as crucial collateral; a depreciating asset increases the risk for them.

- Appraisals may reflect lower valuations in high-risk areas. This directly impacts the loan amount you qualify for, as lenders base their loan-to-value ratio (LTV) on the appraised value.

- Lower appraisals can limit the loan amount you qualify for. You may need a larger down payment or be forced to reconsider your home purchase options.

- The property's resale value may be significantly affected in the future. A property's future value is a critical consideration; a property in a high-risk climate zone might lose value more rapidly than one in a safer location.

- Discuss resources for assessing climate risk in specific locations. Several online tools and resources can help you assess the climate-related risks of a particular property or neighborhood. Utilize these tools to make informed decisions.

Increased Scrutiny of Location and Climate Risk by Lenders

Lenders are increasingly incorporating climate risk assessments into their underwriting processes. This means that borrowers in vulnerable locations are facing stricter lending criteria. The days of solely focusing on credit scores and income are fading as lenders take a more holistic approach.

- Lenders are using climate risk models to assess loan applications. These models analyze factors like flood risk, wildfire risk, and the potential for extreme weather events.

- Properties in high-risk areas may face stricter lending criteria. This could include higher down payments, higher interest rates, or even loan denials.

- Higher down payments or stricter loan terms might be required. To mitigate the increased risk, lenders may impose stricter conditions on borrowers in high-risk zones.

- Highlight the importance of researching the climate risk of your desired location. Proactive research can help you avoid financial pitfalls and secure a mortgage more easily.

Government Regulations and Climate-Related Disclosures

Government regulations regarding mortgages and climate risk disclosures are evolving rapidly. These changes are influencing lenders' decisions and will significantly impact homebuyers in the coming years.

- Mandatory climate risk disclosures may be implemented. This will require lenders to provide borrowers with more transparent information about the climate-related risks associated with a property.

- Regulations may influence lending practices in certain areas. We may see stricter lending standards for properties in high-risk zones.

- Staying informed about evolving government guidelines is vital. Keeping up-to-date with these changes will allow you to make informed decisions.

Conclusion

Climate change's impact on home buying is undeniable. Higher insurance costs, property value depreciation, and increased lender scrutiny are all significant factors that can affect your creditworthiness and ability to secure a mortgage. Understanding these risks and taking proactive steps to mitigate them is crucial. Before purchasing a home, thoroughly research the climate risk in your chosen location, understand your insurance needs, and seek advice from financial professionals to mitigate potential impacts on your creditworthiness. Speak with a mortgage lender about potential climate-related risks and what to expect. By proactively addressing climate change's impact on home buying, you can significantly improve your chances of securing a mortgage and achieving your dream of homeownership.

Featured Posts

-

Acces Limite Aux 2 Et 3 Roues Sur Le Boulevard Fhb Des Le 15 Avril

May 20, 2025

Acces Limite Aux 2 Et 3 Roues Sur Le Boulevard Fhb Des Le 15 Avril

May 20, 2025 -

Ferraris Hamilton Pursuit Could It Cost Leclercs Loyalty

May 20, 2025

Ferraris Hamilton Pursuit Could It Cost Leclercs Loyalty

May 20, 2025 -

Paley Center To Honor Gma On Its 50th Anniversary

May 20, 2025

Paley Center To Honor Gma On Its 50th Anniversary

May 20, 2025 -

Agatha Christies Poirot Adaptations Mysteries And Critical Analyses

May 20, 2025

Agatha Christies Poirot Adaptations Mysteries And Critical Analyses

May 20, 2025 -

Discover Yourself The Benefits Of Solo Travel And How To Get Started

May 20, 2025

Discover Yourself The Benefits Of Solo Travel And How To Get Started

May 20, 2025

Latest Posts

-

Paulina Gretzkys Hottest Photos A Revealing Look

May 20, 2025

Paulina Gretzkys Hottest Photos A Revealing Look

May 20, 2025 -

Paulina Gretzky Dustin Johnsons Wife Career And Family Life

May 20, 2025

Paulina Gretzky Dustin Johnsons Wife Career And Family Life

May 20, 2025 -

Wayne Gretzkys Daughter Paulinas Playdate Mini Dress

May 20, 2025

Wayne Gretzkys Daughter Paulinas Playdate Mini Dress

May 20, 2025 -

Paulina Gretzkys Playdate Fashion Mini Dress Details

May 20, 2025

Paulina Gretzkys Playdate Fashion Mini Dress Details

May 20, 2025 -

Wayne Gretzkys Daughter Paulina Makes Rare Appearance With Husband

May 20, 2025

Wayne Gretzkys Daughter Paulina Makes Rare Appearance With Husband

May 20, 2025