House GOP's Trump Tax Cut Bill: A Comprehensive Overview

Table of Contents

Key Provisions of the House GOP Tax Cut Plan

The overarching goal of the House GOP's Trump Tax Cut plan was to stimulate economic growth by lowering tax burdens on businesses and individuals. This "supply-side economics" approach theorized that reduced taxes would incentivize investment, job creation, and ultimately, higher overall economic output. However, the specific mechanisms and their effectiveness remain a subject of ongoing discussion.

-

Corporate Tax Rate Reductions: The bill proposed a significant reduction in the corporate tax rate, aiming to make the US more competitive globally. While the exact percentage varied across different versions of the bill, a substantial decrease was a consistent feature. This reduction was intended to encourage businesses to expand, invest in new technologies, and create more jobs.

-

Individual Income Tax Bracket Changes: The proposed changes to individual income tax brackets varied significantly. Generally, the plan aimed to simplify the tax code by reducing the number of brackets and lowering rates for many individuals. However, the specific changes to each bracket would have resulted in differing impacts across income levels.

-

Changes to Deductions: The bill proposed modifications to several key deductions. This included changes to the standard deduction (potentially increasing it), limitations on itemized deductions (such as those for mortgage interest and state and local taxes – SALT), impacting taxpayers differently. These changes were often contentious, with critics arguing they disproportionately affected certain income groups or regions.

-

Pass-Through Business Tax Treatment Changes: The bill sought to alter the tax treatment of pass-through businesses (like sole proprietorships, partnerships, and S corporations), impacting small business owners significantly. These changes aimed to provide tax relief, but the specifics varied and were debated extensively.

-

Impact on Estate and Gift Taxes: The proposed changes to estate and gift taxes were a focal point of the debate. The plan aimed to potentially increase exemptions or even eliminate these taxes entirely. This provision sparked considerable debate concerning wealth distribution and intergenerational equity.

Economic Impact and Projections

The economic projections associated with the House GOP's Trump Tax Cut Bill were highly contested. Proponents argued the tax cuts would lead to significant GDP growth, increased job creation, and minimal inflationary pressure. Conversely, critics raised concerns about increased national debt, exacerbating income inequality, and a potential inflationary spiral.

-

GDP Growth Projections: Various economic models produced differing GDP growth projections, ranging from modest increases to more substantial growth. The discrepancies reflected the different underlying assumptions used in each model. It’s critical to examine the methodologies and assumptions of these studies before drawing conclusions.

-

Job Creation Estimates: Similar discrepancies existed in job creation estimates. While some models projected substantial job growth, others suggested more modest or even negative effects in certain sectors.

-

Potential Inflationary Pressures: The possibility of increased inflation was a key concern. Opponents argued that the tax cuts, particularly the corporate tax cuts, could lead to increased prices and reduced purchasing power for consumers.

-

Long-term Fiscal Implications (National Debt): A major point of contention was the bill's projected impact on the national debt. Critics argued that the significant tax cuts would lead to a substantial increase in the deficit and long-term debt.

Political Ramifications and Public Opinion

The House GOP's Trump Tax Cut Bill was deeply intertwined with the political landscape of the time. Its passage was a major legislative victory for the Republican party, aligning with their broader economic agenda. However, it also generated significant political opposition and shaped public discourse.

-

Support from Different Political Factions: While the bill enjoyed strong support within the Republican party, it faced near-uniform opposition from the Democrats. There were also internal divisions within the Republican party regarding specific provisions.

-

Opposition to the Bill and Key Arguments: Opponents argued the bill disproportionately benefited wealthy individuals and corporations at the expense of the middle class and low-income earners. Concerns about the national debt and the long-term consequences fueled opposition.

-

Public Opinion Polls and Surveys: Public opinion on the bill was highly divided, with polls showing varying levels of support and opposition depending on the specific question asked and the demographic group surveyed. This division reflected the complexity of the bill and its varied impacts.

-

Impact on Different Income Groups: The impact of the bill varied considerably across different income groups. While some argued it benefited primarily high-income earners, proponents countered that it spurred economic growth benefiting all groups indirectly.

Comparison to Previous Tax Legislation

The House GOP's Trump Tax Cut Bill can be compared to previous tax legislation, particularly the Tax Cuts and Jobs Act of 2017, to better understand its context and potential long-term effects.

-

Key Differences in Corporate Tax Rates: While both bills featured corporate tax rate reductions, the specific rates differed, influencing the projected economic impacts.

-

Changes to Individual Income Tax Brackets: Similarities and differences in the adjustments made to individual tax brackets are crucial for comparing the two bills' impact on various income groups.

-

Comparison of Overall Tax Revenue Effects: Assessing the long-term effects on government tax revenue is essential for understanding the fiscal implications of each bill.

Conclusion: Evaluating the Legacy of the House GOP's Trump Tax Cut Bill

The House GOP's Trump Tax Cut Bill represented a significant attempt to reshape the American tax system, aiming to stimulate economic growth through lower taxes. Its key provisions—corporate tax rate reductions, changes to individual income tax brackets and deductions, and adjustments to tax treatment of pass-through businesses—generated substantial debate concerning its economic impact, political ramifications, and distributional effects. While proponents highlighted projected GDP growth and job creation, critics raised concerns about increased national debt and exacerbated income inequality. Understanding the long-term consequences of this legislation requires careful consideration of its impact across various income groups and its effects on the national economy. To learn more about the intricacies of the House GOP's Trump Tax Cut Bill and its continuing effects on the American economy, further research into the "Trump Tax Cuts" and related keywords is highly recommended.

Featured Posts

-

L Allemagne Investit Dans Sa Protection Civile Une Reponse A Des Annees De Sous Estimation

May 13, 2025

L Allemagne Investit Dans Sa Protection Civile Une Reponse A Des Annees De Sous Estimation

May 13, 2025 -

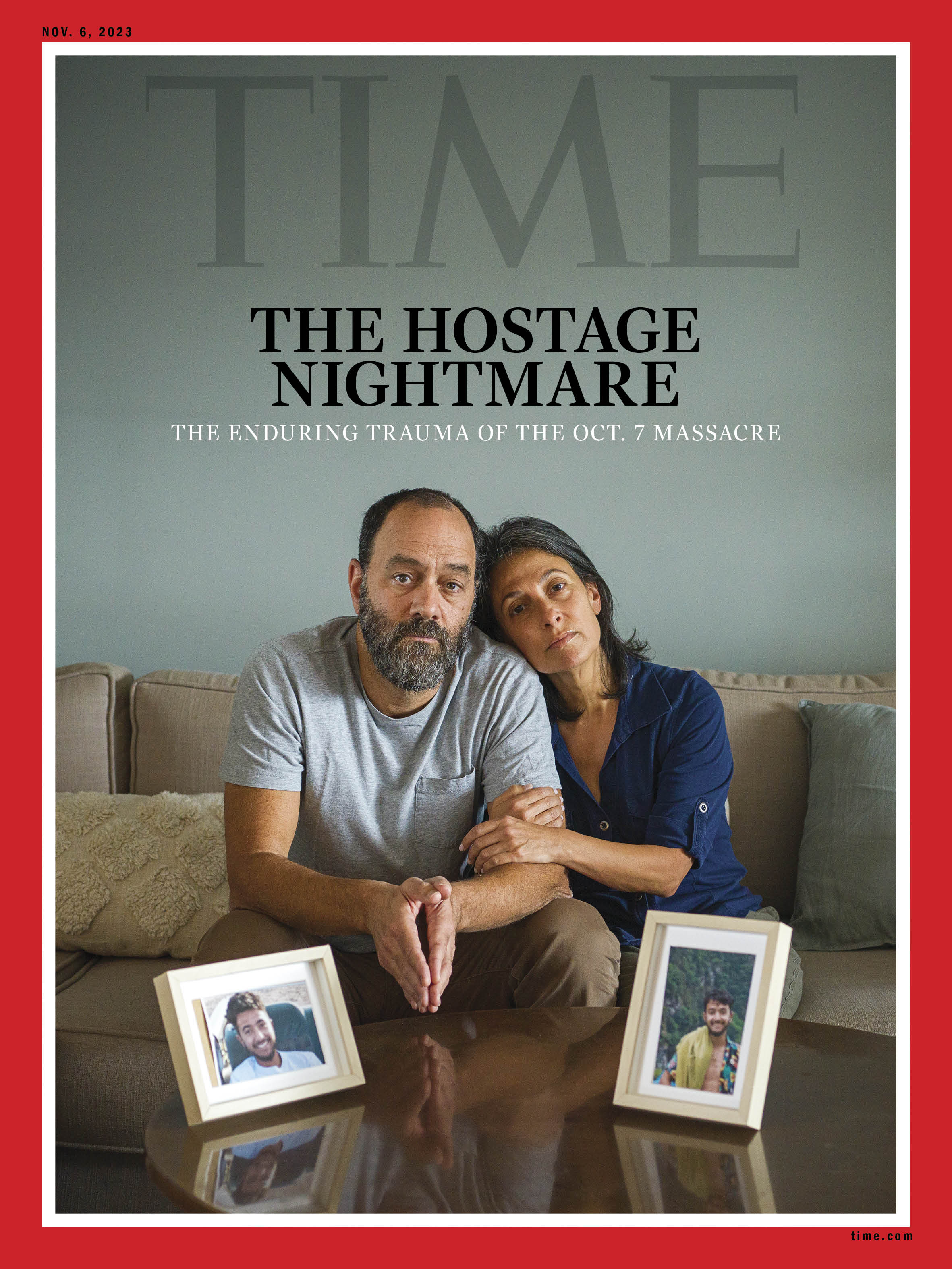

The Gaza Hostage Situation A Continuing Nightmare For Families

May 13, 2025

The Gaza Hostage Situation A Continuing Nightmare For Families

May 13, 2025 -

As Roma Calificare In Optimile Europa League Dupa Victoria Dramatica Asupra Lui Fc Porto 3 2

May 13, 2025

As Roma Calificare In Optimile Europa League Dupa Victoria Dramatica Asupra Lui Fc Porto 3 2

May 13, 2025 -

Nba Draft Lottery Analyzing The Chicago Bulls Chances At Cooper Flagg

May 13, 2025

Nba Draft Lottery Analyzing The Chicago Bulls Chances At Cooper Flagg

May 13, 2025 -

Exploring Doom The Dark Ages

May 13, 2025

Exploring Doom The Dark Ages

May 13, 2025