House GOP Releases Specifics On Trump Tax Proposals

Table of Contents

Key Provisions of the Proposed Tax Cuts

The heart of the House GOP's Trump tax plan centers around substantial reductions in both individual and corporate tax rates. These proposed changes aim to stimulate economic growth, but their effectiveness remains a point of contention.

-

Individual Income Tax Rate Reductions: The plan proposes [Specific Percentage]% reduction in the top individual income tax bracket, [Specific Percentage]% reduction in the next bracket, and so on (insert specifics for all brackets). This would translate to significant tax savings for high-income earners, although the impact on lower income brackets is less pronounced.

-

Standard Deduction Changes: The standard deduction would be [Increased/Decreased] to [Specific Amount], potentially impacting the number of individuals itemizing deductions. This change could benefit lower- and middle-income individuals, offsetting some other aspects of the plan.

-

Corporate Tax Rate Reduction: A dramatic reduction in the corporate tax rate from [Current Rate]% to [Proposed Rate]% is a cornerstone of the plan. Proponents argue this will boost business investment and job creation. Critics worry about its impact on the national debt.

-

Capital Gains and Dividend Taxes: The plan includes [Specific Changes] to capital gains and dividend taxes. These changes, depending on their specifics, could significantly impact investors and shareholders. Further analysis is needed to fully understand their implications.

Impact on Different Income Groups

The distributional effects of the proposed Trump tax cuts are a key area of debate. While the plan promises broad-based tax relief, the benefits are not evenly distributed across all income levels.

-

Middle-Class Tax Cuts: The plan claims to deliver significant tax savings for middle-income families. However, the actual savings will depend on individual circumstances and may vary greatly. Independent analyses are needed to confirm these claims.

-

High-Income Earners: High-income earners stand to benefit substantially from the proposed reductions in top individual and corporate tax rates. This concentration of benefits has drawn criticism from those arguing for more equitable tax policies.

-

Low-Income Earners: The impact on low-income earners is less clear. While the increased standard deduction may offer some benefits, the overall effect could be minimal or even negative depending on other provisions. Further investigation into the plan's details is necessary to assess its effect on this group.

Economic Implications and Projections

The proposed Trump tax plan's economic consequences are subject to considerable uncertainty. Economists offer diverse projections regarding its impact on key economic indicators.

-

GDP Growth: Proponents predict significant boosts to GDP growth, fueled by increased business investment and consumer spending. However, critics argue the effects will be less dramatic or even negative, pointing to potential inflationary pressures.

-

Job Creation: The plan's supporters claim it will lead to substantial job creation. However, the magnitude of this effect is difficult to predict and depends on various factors, including business confidence and global economic conditions.

-

National Debt and Deficit: A major concern surrounding the plan is its potential to significantly increase the national debt and deficit. The long-term fiscal sustainability of the plan is a subject of intense debate among policymakers and economists.

-

Inflationary Pressures: The significant tax cuts could potentially lead to increased inflation, eroding the purchasing power of consumers. The Federal Reserve's response to such inflationary pressures will be crucial.

Political Reactions and Analysis

The House GOP's Trump tax proposals have ignited fierce political debate. Reactions from various parties and interest groups have been sharply divided.

-

Democratic Reaction: Democrats overwhelmingly oppose the plan, criticizing its regressive nature and potential impact on the national debt. They argue that the plan disproportionately benefits the wealthy while offering limited relief to lower and middle-income families.

-

Republican Support: While there is general support within the Republican party, the level of enthusiasm varies. Some Republicans have expressed concerns about certain aspects of the plan, particularly its potential fiscal implications.

-

Congressional Approval: The likelihood of Congressional approval remains uncertain. The plan's passage will require overcoming significant political hurdles and negotiating compromises among different factions.

-

Public Opinion: Public opinion polls reveal a mixed response to the tax proposals, with significant variation depending on political affiliation and income level.

Conclusion: Understanding the House GOP's Trump Tax Plan

The House GOP's release of Trump's tax proposals marks a significant development in the ongoing debate surrounding tax reform. This detailed plan, promising sweeping tax cuts, carries significant implications for different income groups and the overall economy. While proponents argue it will stimulate economic growth and create jobs, critics express concerns about its regressive nature and potential impact on the national debt. Staying informed about the ongoing debate, analyzing independent economic forecasts, and understanding the potential consequences of these Trump tax proposals is crucial for all citizens. Further research into independent analyses and government reports is recommended for a complete understanding of this complex issue and its potential implications for the future of tax policy.

Featured Posts

-

Uncovering The Truth A U S Nuclear Base Beneath Greenlands Ice

May 15, 2025

Uncovering The Truth A U S Nuclear Base Beneath Greenlands Ice

May 15, 2025 -

First Up Bangladesh Yunus In China Rubios Caribbean Trip And More Top News Today

May 15, 2025

First Up Bangladesh Yunus In China Rubios Caribbean Trip And More Top News Today

May 15, 2025 -

Bim Subat Aktueel Katalogu Indirimli Ueruenler Ve Kampanyalar 25 26 Subat

May 15, 2025

Bim Subat Aktueel Katalogu Indirimli Ueruenler Ve Kampanyalar 25 26 Subat

May 15, 2025 -

College Van Omroepen Werkt Aan Herstel Vertrouwen Bij Npo

May 15, 2025

College Van Omroepen Werkt Aan Herstel Vertrouwen Bij Npo

May 15, 2025 -

The Fight Begins A Deep Dive Into The Gop Mega Bills Implications

May 15, 2025

The Fight Begins A Deep Dive Into The Gop Mega Bills Implications

May 15, 2025

Latest Posts

-

Breaking News Bangladesh China Caribbean Developments First Ups Daily Report

May 15, 2025

Breaking News Bangladesh China Caribbean Developments First Ups Daily Report

May 15, 2025 -

Dzho Bayden Na Vistavi Otello Analiz Yogo Obrazu Ta Porivnyannya Z Inavguratsiyeyu Trampa

May 15, 2025

Dzho Bayden Na Vistavi Otello Analiz Yogo Obrazu Ta Porivnyannya Z Inavguratsiyeyu Trampa

May 15, 2025 -

First Posts First Up Key Global Events Bangladesh China Caribbean And Beyond

May 15, 2025

First Posts First Up Key Global Events Bangladesh China Caribbean And Beyond

May 15, 2025 -

First Up Bangladesh Yunus In China Rubios Caribbean Trip And More Top News Today

May 15, 2025

First Up Bangladesh Yunus In China Rubios Caribbean Trip And More Top News Today

May 15, 2025 -

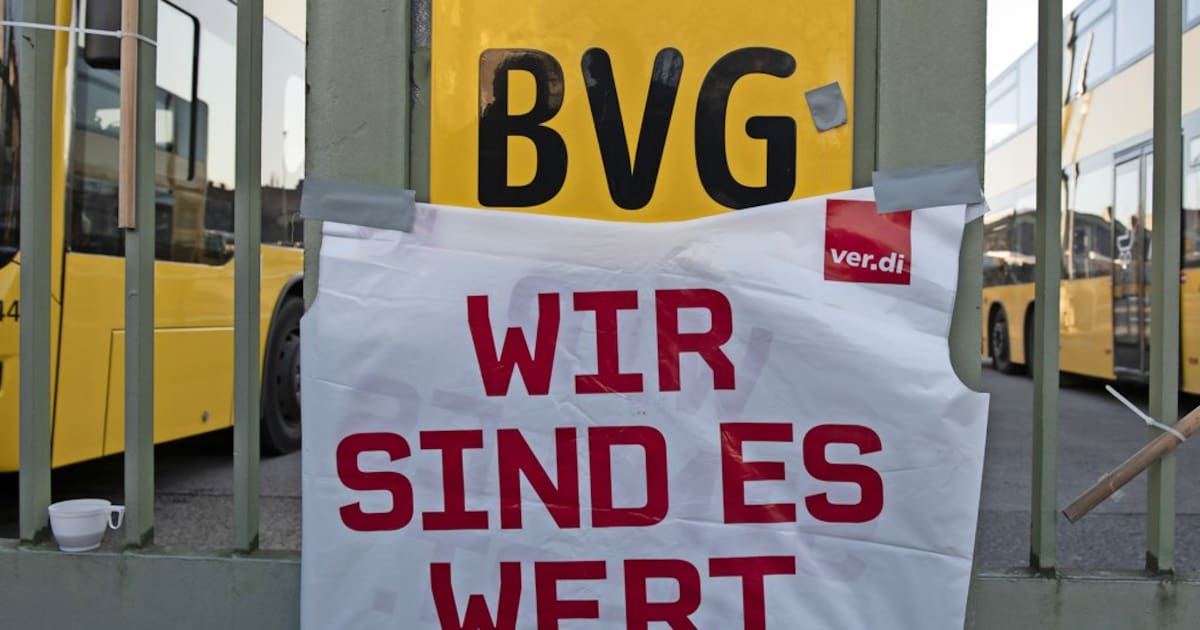

Tarifkonflikt Bvg Geloest Was Bedeutet Die Einigung Fuer Fahrgaeste

May 15, 2025

Tarifkonflikt Bvg Geloest Was Bedeutet Die Einigung Fuer Fahrgaeste

May 15, 2025