Hong Kong Monetary Authority Intervention: Impact On HKD/USD And Interest Rates

Table of Contents

2.1 The Hong Kong Dollar Peg and its Mechanics

Hong Kong operates under a linked exchange rate system, maintaining the HKD's peg to the USD within a narrow band of 7.75-7.85 HKD/USD. The HKMA is responsible for upholding this peg through its active management of the foreign exchange market. This involves buying US dollars when the HKD appreciates towards the lower bound of the band and selling US dollars when it weakens towards the upper bound. The difference in interest rates between the US and Hong Kong significantly influences the demand for and supply of both currencies, impacting the pressure on the peg. A higher US interest rate, for example, can attract capital outflow from Hong Kong, putting upward pressure on the HKD/USD exchange rate.

- Mechanism of the currency board system: The HKMA operates under a currency board system, requiring it to maintain sufficient foreign currency reserves (primarily US dollars) to back the HKD in circulation.

- The role of the Exchange Fund: The Exchange Fund, managed by the HKMA, is the primary source of foreign reserves used to maintain the currency peg. Its size and composition are crucial for the stability of the HKD.

- Factors influencing the demand and supply of HKD and USD: These factors include interest rate differentials, capital flows, trade balances, and market speculation.

2.2 HKMA Intervention Strategies and their Impact on HKD/USD

The HKMA employs various strategies to influence the HKD/USD exchange rate. These include buying or selling US dollars in the foreign exchange market and adjusting interest rates. Buying USD increases demand for USD, strengthening the USD relative to the HKD, while selling USD has the opposite effect. Interest rate adjustments aim to manage speculative pressure and control capital flows.

- Impact of buying USD on the HKD/USD exchange rate: Increases the demand for USD, pushing the HKD/USD rate upwards towards the upper band of 7.85.

- Impact of selling USD on the HKD/USD exchange rate: Increases the supply of USD, pushing the HKD/USD rate downwards towards the lower band of 7.75.

- The role of interest rate adjustments in managing speculative pressure: Higher interest rates attract capital inflows, strengthening the HKD, while lower rates can encourage capital outflows, weakening the HKD. This is a crucial tool in managing speculative attacks on the peg.

2.3 The Influence of HKMA Intervention on Hong Kong Interest Rates

HKMA interventions are intrinsically linked to Hong Kong's interest rates. The HKMA often adjusts its interest rates to align with US interest rates, aiming to maintain the stability of the HKD/USD exchange rate. Changes in interest rates influence capital flows: higher rates attract investment, putting upward pressure on the HKD, while lower rates can lead to capital outflows, putting downward pressure.

- How interest rate hikes affect capital inflows: Higher interest rates make Hong Kong a more attractive destination for investment, increasing demand for HKD and strengthening the currency.

- How interest rate cuts affect capital outflows: Lower interest rates can incentivize investors to move their funds elsewhere, increasing the supply of HKD and weakening the currency.

- The correlation between US Federal Reserve policy and HKMA actions: The HKMA typically follows the lead of the US Federal Reserve, adjusting its interest rates to maintain the HKD/USD peg in line with US monetary policy.

2.4 Case Studies of HKMA Interventions and their Outcomes

The HKMA has intervened numerous times throughout its history to maintain the HKD's peg. Analyzing these past interventions reveals valuable insights into its effectiveness and consequences. For example, during periods of significant capital outflow, the HKMA may raise interest rates to attract capital inflows and maintain the peg. Conversely, during periods of high capital inflow, the HKMA might lower interest rates to mitigate inflationary pressure.

- Specific historical examples of HKMA interventions (dates, circumstances, outcomes): Detailed case studies would require referencing specific dates and analyzing the circumstances surrounding each intervention. Academic journals and HKMA publications are valuable resources for this research.

- Analysis of the success or failure of each intervention: The effectiveness of each intervention can be assessed by analyzing its impact on the HKD/USD exchange rate, interest rates, and overall market stability.

- Lessons learned from past interventions: Past interventions provide valuable insights into the challenges and opportunities faced by the HKMA and inform its future strategies.

Conclusion: Understanding Hong Kong Monetary Authority Intervention and its Market Impact

The HKMA plays a pivotal role in maintaining the HKD/USD peg, significantly influencing both exchange rates and interest rates in Hong Kong. Understanding the HKMA's interventions is critical for all stakeholders operating within the Hong Kong financial market. Investors and businesses must monitor HKMA actions closely to make informed investment and business decisions. Further research into the HKMA's policies and interventions will improve your understanding of the complex dynamics of the Hong Kong financial market and allow for more effective risk management. Stay informed about Hong Kong Monetary Authority interventions and their impact on HKD/USD and interest rates to navigate the Hong Kong financial landscape effectively.

Featured Posts

-

Rusya Merkez Bankasi Ndan Kripto Para Uyarisi Yatirimcilar Icin Riskler Neler

May 08, 2025

Rusya Merkez Bankasi Ndan Kripto Para Uyarisi Yatirimcilar Icin Riskler Neler

May 08, 2025 -

Sec Review Of Grayscales Xrp Etf Potential For Price Increase

May 08, 2025

Sec Review Of Grayscales Xrp Etf Potential For Price Increase

May 08, 2025 -

Arsenal Protiv Ps Zh Predviduvanja Za Prviot Mech

May 08, 2025

Arsenal Protiv Ps Zh Predviduvanja Za Prviot Mech

May 08, 2025 -

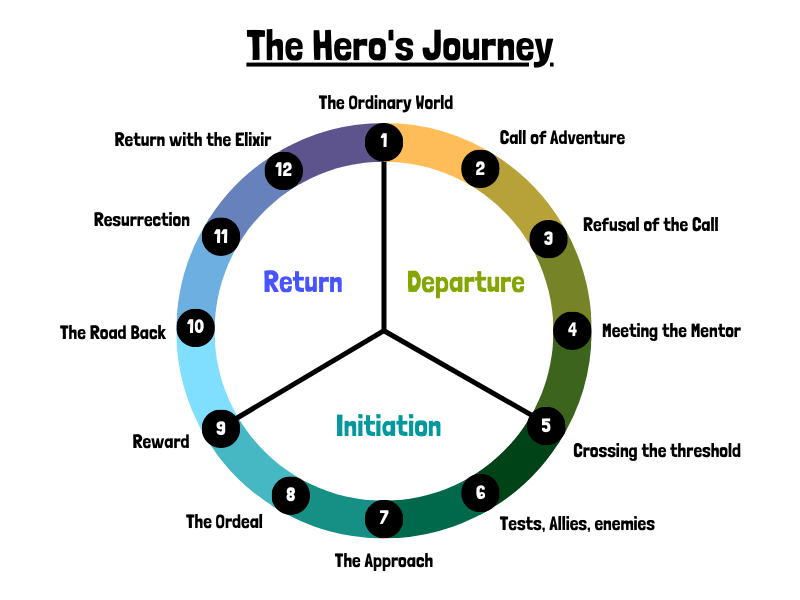

Unveiling The Past A Rogue One Heros Journey In The New Star Wars Series

May 08, 2025

Unveiling The Past A Rogue One Heros Journey In The New Star Wars Series

May 08, 2025 -

Most Intense War Films Streaming Now On Amazon Prime A Viewers Guide

May 08, 2025

Most Intense War Films Streaming Now On Amazon Prime A Viewers Guide

May 08, 2025

Latest Posts

-

Doblete De Arrascaeta Garante Triunfo Do Flamengo No Brasileirao

May 08, 2025

Doblete De Arrascaeta Garante Triunfo Do Flamengo No Brasileirao

May 08, 2025 -

El Nuevo Titulo De Filipe Luis

May 08, 2025

El Nuevo Titulo De Filipe Luis

May 08, 2025 -

Fecha 3 Copa Libertadores Previa Liga De Quito Vs Flamengo Grupo C

May 08, 2025

Fecha 3 Copa Libertadores Previa Liga De Quito Vs Flamengo Grupo C

May 08, 2025 -

Arrascaeta Lidera Flamengo A Vitoria Sobre Gremio No Brasileirao

May 08, 2025

Arrascaeta Lidera Flamengo A Vitoria Sobre Gremio No Brasileirao

May 08, 2025 -

Filipe Luis Consigue Otro Titulo

May 08, 2025

Filipe Luis Consigue Otro Titulo

May 08, 2025