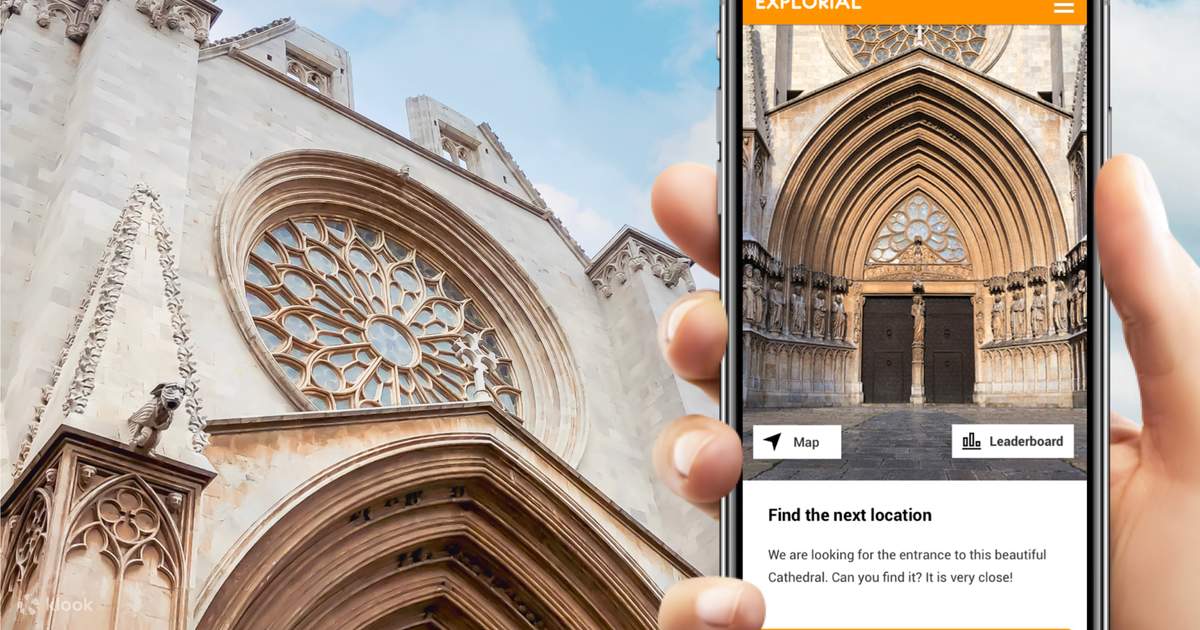

Home Depot Stock: Impact Of Tariffs On Q[Quarter] Earnings

![Home Depot Stock: Impact Of Tariffs On Q[Quarter] Earnings Home Depot Stock: Impact Of Tariffs On Q[Quarter] Earnings](https://autolinq.de/image/home-depot-stock-impact-of-tariffs-on-q-quarter-earnings.jpeg)

Table of Contents

The Impact of Tariffs on Home Depot's Supply Chain

Tariffs, essentially taxes on imported goods, directly impact Home Depot's bottom line. Many of the products Home Depot sells – from lumber and appliances to various building materials – are sourced internationally. Therefore, increased tariffs translate into higher import costs for the company. This increase in the cost of goods sold (COGS) can significantly compress profit margins. Furthermore, tariffs can lead to supply chain disruptions. Delays in shipments, changes in sourcing strategies to find alternative suppliers, and increased logistical complexities all contribute to operational challenges.

- Increased import costs directly impacting Home Depot's profit margins: Higher costs for imported goods mean less profit per unit sold, impacting overall profitability.

- Potential for price increases passed on to consumers: To maintain profit margins, Home Depot may be forced to raise prices for consumers, potentially impacting demand.

- Strategies employed by Home Depot to mitigate tariff impacts: Home Depot has actively sought to mitigate tariff impacts through strategies such as sourcing from alternative markets (diversifying its supply chain), negotiating better terms with existing suppliers, and potentially absorbing some of the increased costs.

- Analysis of the impact on specific product lines and sales figures: A detailed analysis of Q3 earnings would reveal how specific product lines, particularly those reliant on imported goods, were affected by tariffs. For example, a decline in sales of certain imported appliances could be directly linked to higher prices resulting from tariffs.

Analyzing Q3 Earnings in Relation to Tariff Impacts

Home Depot's Q3 earnings report provides critical data for understanding the real-world impact of tariffs. By analyzing key financial metrics, we can assess the extent to which tariffs affected the company's performance. A thorough comparison of Q3 earnings with previous quarters is essential to gauge the magnitude of any tariff-related deviations.

- Gross profit margin analysis: A decline in gross profit margin can indicate increased pressure from higher import costs due to tariffs.

- Net income comparison to previous quarters: A significant decrease in net income compared to previous quarters may signal a substantial negative impact from tariffs.

- Sales growth figures for different product categories: Analyzing sales growth for specific product categories will highlight which areas were most affected by tariff-related price increases or supply chain disruptions.

- Discussion of any changes in inventory levels: Changes in inventory levels may reflect challenges in sourcing or a deliberate strategy to adjust to changing market conditions influenced by tariffs.

Investor Sentiment and Future Outlook for Home Depot Stock

The market's reaction to Home Depot's Q3 earnings announcement, specifically regarding the tariff impact, is a crucial indicator of investor sentiment. Analyzing stock price fluctuations following the announcement, along with analyst ratings and predictions, paints a clearer picture of the future outlook for HD stock. Considering potential future scenarios for tariff policies and comparing Home Depot's performance to competitors like Lowe's provides further context.

- Stock price fluctuations following the earnings report: A significant drop or rise in the stock price post-earnings announcement often reflects the market's assessment of the tariff impact.

- Analyst ratings and recommendations: Analyst opinions on Home Depot's stock, considering the tariff situation, offer valuable insights into future expectations.

- Potential future scenarios for tariff policies and their impact on HD stock: Predicting future tariff policies is inherently challenging, but analyzing potential scenarios and their impact on Home Depot's profitability is vital for informed investment decisions.

- Comparison to competitor performance (e.g., Lowe's): Comparing Home Depot's performance to that of its main competitor, Lowe's, allows for a more nuanced understanding of the industry's response to tariffs.

Navigating the Tariff Landscape: Home Depot Stock's Future

In conclusion, the impact of tariffs on Home Depot's Q3 earnings is a complex issue. While Home Depot demonstrated resilience, the analysis reveals that increased import costs and potential supply chain disruptions directly affected its profitability. Monitoring tariff developments remains crucial for future Home Depot stock performance. The company's ability to adapt its sourcing strategies and mitigate the effects of tariffs will significantly impact its future success. Home Depot's strong business model suggests it will continue to navigate these challenges, but investors should remain vigilant. Conduct further research on Home Depot stock, stay informed about tariff policies, and make informed investment decisions based on this analysis and your own comprehensive Home Depot stock forecast. Consider exploring detailed HD stock analysis to build a robust investment strategy. Understanding the intricacies of Home Depot investment in the current economic climate is key to maximizing returns.

![Home Depot Stock: Impact Of Tariffs On Q[Quarter] Earnings Home Depot Stock: Impact Of Tariffs On Q[Quarter] Earnings](https://autolinq.de/image/home-depot-stock-impact-of-tariffs-on-q-quarter-earnings.jpeg)

Featured Posts

-

Dexter Resurrection Analyzing The New Villains Appeal

May 22, 2025

Dexter Resurrection Analyzing The New Villains Appeal

May 22, 2025 -

How Google Made Virtual Meetings Better

May 22, 2025

How Google Made Virtual Meetings Better

May 22, 2025 -

Canada Post Strike Looms Impact On Businesses

May 22, 2025

Canada Post Strike Looms Impact On Businesses

May 22, 2025 -

Self Guided Walking Trip Exploring Provence From Mountains To Med

May 22, 2025

Self Guided Walking Trip Exploring Provence From Mountains To Med

May 22, 2025 -

Outrun Movie Michael Bay Directing Sydney Sweeney Cast

May 22, 2025

Outrun Movie Michael Bay Directing Sydney Sweeney Cast

May 22, 2025

Latest Posts

-

Philadelphia Fuel Costs Consistent 6 Cent Rise Predicted

May 22, 2025

Philadelphia Fuel Costs Consistent 6 Cent Rise Predicted

May 22, 2025 -

Gas Buddy Virginia Gasoline Prices Fall This Week

May 22, 2025

Gas Buddy Virginia Gasoline Prices Fall This Week

May 22, 2025 -

Philly Gas Prices Continue Upward Trend Average Rises 6 Cents

May 22, 2025

Philly Gas Prices Continue Upward Trend Average Rises 6 Cents

May 22, 2025 -

Major Route 581 Delays Box Truck Crash Investigation

May 22, 2025

Major Route 581 Delays Box Truck Crash Investigation

May 22, 2025 -

Route 581 Traffic Stopped Following Box Truck Crash

May 22, 2025

Route 581 Traffic Stopped Following Box Truck Crash

May 22, 2025