HMRC Website Crash: Hundreds Unable To Access Accounts Across UK

Table of Contents

Extent of the HMRC Website Outage

The HMRC website crash represents a significant disruption to the UK's tax system. While precise figures on the number of affected users remain unconfirmed, reports suggest widespread problems accessing online tax services. The outage appears to be nationwide, with anecdotal evidence suggesting difficulties across the UK. The impact is not limited to a specific user group; both individual taxpayers using Self Assessment services and businesses reliant on online tax portals report problems. The duration of the outage is still ongoing at the time of writing, though initial reports indicated the problems began around [Insert Time] on [Insert Date].

- Number of reported incidents: Hundreds of complaints and reports of inability to access HMRC online services have flooded social media and news outlets. The exact number remains unclear pending an official statement.

- Geographic spread of the outage: Reports indicate the outage affects the entire UK, with no specific region appearing disproportionately impacted.

- Types of accounts affected: Self Assessment, PAYE, business tax accounts, and other online HMRC services have all reportedly been affected by the website outage.

- Duration of the outage: The outage began at approximately [Insert Time] on [Insert Date] and is currently ongoing. HMRC has yet to provide an estimated time of restoration.

Causes of the HMRC Website Crash

The precise cause of the HMRC website crash remains unknown at this time. Several possibilities exist, ranging from technical glitches to potential server overload due to high traffic. A planned maintenance issue seems unlikely given the lack of prior announcement, though this possibility can't be ruled out completely. While speculation of a cyberattack is prevalent online, this remains unconfirmed and should be treated with caution until official confirmation from HMRC.

- Official statements from HMRC: [Insert any official statements released by HMRC at the time of writing. If none, state this clearly].

- Speculation on possible technical causes: Overload of HMRC servers due to a high volume of simultaneous user login attempts, or a software malfunction within the HMRC IT infrastructure, are the most likely causes.

- Past incidents of similar nature: [If there are any past incidents of similar HMRC website outages, mention them here].

Impact on Taxpayers and Businesses

The HMRC website crash has significant implications for both individual taxpayers and businesses. Many individuals face the prospect of missing tax filing deadlines, potentially incurring penalties. The inability to access online accounts also makes managing tax payments difficult, potentially leading to late payment charges. For businesses, the disruption impacts cash flow, operational efficiency, and compliance with tax regulations. The knock-on effect could be considerable, affecting business planning and profitability.

- Potential missed tax deadlines and penalties: Taxpayers face the risk of late filing penalties if they are unable to submit their returns on time due to the outage.

- Difficulties in making tax payments: The inability to access online payment systems can cause delays and potential penalties for late payments.

- Disruption to business operations: Businesses heavily reliant on online HMRC services for tax filings and other interactions experience operational disruptions.

- Increased workload for HMRC customer service: The outage is likely to result in a significant increase in calls and inquiries to HMRC's customer service lines.

HMRC's Response to the Outage

As of [Insert Time], HMRC has [Insert a description of HMRC’s response]. Details regarding their plan to address the problem and support affected taxpayers are currently [Insert - e.g., "limited" or "being made available"]. They have yet to release a definitive timeline for service restoration. The channels of communication used by HMRC to provide updates to users include [List the channels, e.g., their website, social media accounts, and press releases].

- Official statements released by HMRC: [List any official statements and their contents here].

- Timeline of the response and restoration efforts: [Describe the timeline of the HMRC's response if available].

- Communication channels used to update taxpayers: [List the methods used by HMRC to communicate with its users].

- Support offered to affected users: [Detail any support provided, such as deadline extensions or payment arrangements].

Conclusion

The HMRC website crash has caused widespread disruption, impacting hundreds of taxpayers and businesses across the UK. The exact cause remains unclear, but the consequences – missed deadlines, payment delays, and operational disruptions – are significant. HMRC's response is currently underway, though details on a resolution timeline remain limited. Stay updated on the latest information regarding the HMRC website crash and its resolution by regularly checking the official HMRC website. Contact HMRC directly if you experience continued problems accessing your online accounts. Remember to bookmark the HMRC website for future easy access to prevent similar issues from significantly impacting your tax compliance.

Featured Posts

-

Delving Into The World Of Agatha Christies Poirot A Critical Examination

May 20, 2025

Delving Into The World Of Agatha Christies Poirot A Critical Examination

May 20, 2025 -

Ajatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Jdydt

May 20, 2025

Ajatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Jdydt

May 20, 2025 -

Premiere Petite Fille Pour Michael Schumacher Une Nouvelle Generation Arrive

May 20, 2025

Premiere Petite Fille Pour Michael Schumacher Une Nouvelle Generation Arrive

May 20, 2025 -

Crisis En La Familia Schumacher Mick Se Separa Y Busca El Amor En Una App De Citas

May 20, 2025

Crisis En La Familia Schumacher Mick Se Separa Y Busca El Amor En Una App De Citas

May 20, 2025 -

The Genius Of Agatha Christie Delving Into The Poirot Mysteries

May 20, 2025

The Genius Of Agatha Christie Delving Into The Poirot Mysteries

May 20, 2025

Latest Posts

-

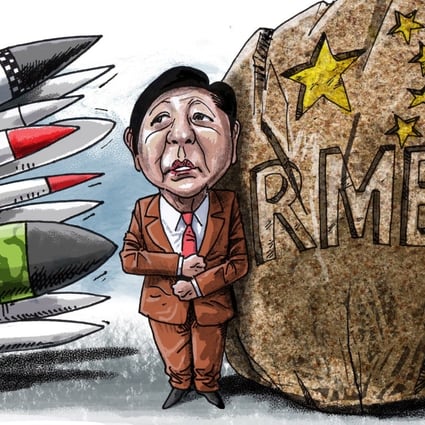

Chinas Demand Philippines Withdraw Typhon Missiles To Maintain Peace

May 20, 2025

Chinas Demand Philippines Withdraw Typhon Missiles To Maintain Peace

May 20, 2025 -

Philippines Stands Strong Against Chinese Pressure Over Missiles

May 20, 2025

Philippines Stands Strong Against Chinese Pressure Over Missiles

May 20, 2025 -

Us Army Expands Pacific Presence With Second Typhon Battery Deployment

May 20, 2025

Us Army Expands Pacific Presence With Second Typhon Battery Deployment

May 20, 2025 -

China Urges Philippines To Remove Typhon Missile System For Regional Stability

May 20, 2025

China Urges Philippines To Remove Typhon Missile System For Regional Stability

May 20, 2025 -

Manila Rejects Chinese Demands Missile System Remains

May 20, 2025

Manila Rejects Chinese Demands Missile System Remains

May 20, 2025