HMRC Tax Return Changes: Who's Affected And What You Need To Know

Table of Contents

Key Changes to the Self-Assessment Tax Return

The HMRC has implemented several significant changes to the self-assessment tax return process, aiming for a more efficient and digitalised system. These HMRC tax return changes impact various aspects of tax reporting and filing.

New Online Portal and Digitalisation

HMRC is pushing towards a fully digital tax system. This means a greater emphasis on online filing through their updated online portal. This offers several advantages:

- Improved user interface: A more intuitive and user-friendly design makes navigating the return simpler.

- Simplified navigation: Finding the relevant sections and completing your return is faster and easier.

- Online support resources: Access to help and guidance is readily available within the portal.

- Deadlines and reminders: The system provides timely reminders to help you meet your filing deadlines.

The digitalisation of the tax return process aims for speed and efficiency, reducing the reliance on paper-based submissions and streamlining the entire process. While most taxpayers have transitioned, HMRC may phase in changes for specific groups over time.

Changes to Reporting Requirements

Several changes affect how you report income and expenses. These HMRC tax return changes require careful attention to detail.

- New categories for reporting income: You might find new categories for reporting specific types of income, requiring more detailed information.

- Specific changes for freelancers, contractors, and the self-employed: These groups may face more stringent reporting requirements for expenses and income streams.

For example, freelancers might need to provide more detail on expenses related to their work, while contractors might face changes in how they report payments received through agencies. New regulations regarding expense reporting, such as stricter evidence requirements, are also part of these HMRC tax return changes.

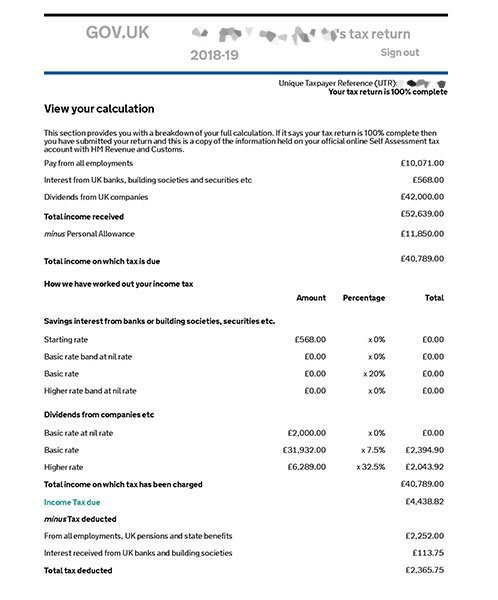

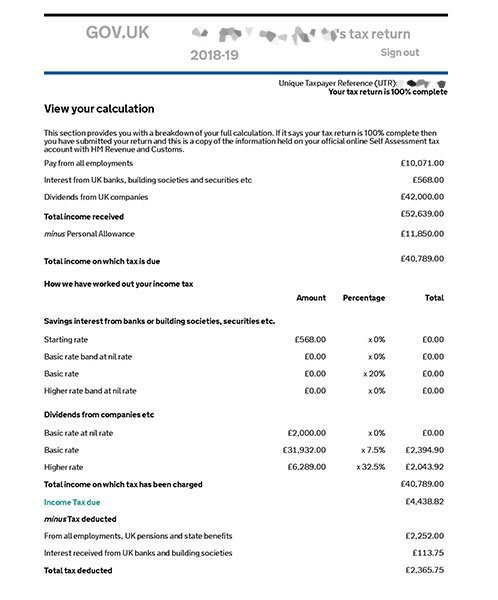

Updated Tax Rates and Allowances

The tax rates and allowances are subject to regular review and adjustment. Staying updated on these HMRC tax return changes is crucial for accurate tax calculations.

- Changes to the higher-rate threshold: The income level at which the higher rate of income tax applies might be altered.

- New allowances for specific expenses: New allowances or changes to existing allowances might impact your taxable income.

- Updated capital gains tax rates: The rates applied to profits from selling assets like property or shares could be adjusted.

Understanding these changes is vital for accurate tax planning. For example, changes to the higher-rate threshold will directly affect higher earners. Refer to official HMRC resources for the most up-to-date details on specific rates and allowances.

Who is Affected by the HMRC Tax Return Changes?

These HMRC tax return changes impact various taxpayer groups. Understanding how they affect you is crucial for compliance.

Self-Employed Individuals

The self-employed, including sole traders, partners, and limited company directors, are significantly affected by these HMRC tax return changes.

- Impact on sole traders, partnerships, and limited companies: New reporting requirements impact how you report income, expenses, and business activities.

For instance, sole traders might need to provide more detailed records of business expenses. Partnerships might face changes in how partnership income is reported. Limited company directors will need to be aware of changes to corporation tax.

Landlords and Property Owners

Landlords and property owners also face significant changes through these HMRC tax return changes.

- New rules around reporting rental income: More detailed reporting of rental income is required.

- Allowable expenses: Changes affect what expenses can be deducted from rental income.

- Capital gains tax: Updated capital gains tax rates and regulations could impact tax liabilities upon selling a property.

Understanding these changes is critical for accurate tax calculation on rental income.

Other Affected Taxpayers

Several other groups might be impacted by these HMRC tax return changes.

- Investors: Changes to capital gains tax rates or reporting requirements could affect investors.

- Those with foreign income: Individuals with income from overseas sources might see altered reporting requirements.

- Those receiving specific benefits: Changes could affect how certain benefits are reported or taxed.

These are just examples, and it is recommended to check the HMRC website for details specific to your situation.

Avoiding Penalties and Ensuring Compliance with HMRC Tax Return Changes

Staying compliant with these HMRC tax return changes is crucial to avoid penalties.

Understanding Your Obligations

Understanding your individual tax obligations is paramount. Non-compliance carries serious consequences.

- Penalties for late filing: Failure to file on time can result in significant penalties.

- Inaccurate information: Providing incorrect information can lead to investigations and penalties.

- Tax evasion: Intentionally underreporting income is a serious offense with severe consequences.

Seeking Professional Advice

For complex tax situations, seeking professional help is highly recommended.

- Benefits of using an accountant or tax advisor: Professionals can guide you through the complexities and ensure accurate filing.

Professional advice can save time, prevent mistakes, and ultimately avoid costly penalties.

Utilizing HMRC Resources

HMRC provides various resources to help you navigate the tax system.

- Links to relevant HMRC websites: The HMRC website is your primary source for up-to-date information.

- Helpline numbers: Contact HMRC directly if you have specific questions.

- Online guides: HMRC offers online guides to explain tax regulations and procedures.

Using these resources can be incredibly beneficial in ensuring compliance.

Conclusion

The recent HMRC tax return changes represent a significant update to the UK tax system. Understanding these changes, their impact on different taxpayer groups, and how to maintain compliance is crucial for all taxpayers. By familiarizing yourself with the updated online portal, new reporting requirements, and adjusted tax rates, you can effectively manage your tax obligations and avoid potential penalties. If you're unsure about any aspect of these HMRC tax return changes, don't hesitate to seek professional advice or utilize the extensive resources provided by HMRC. Take control of your tax obligations today and ensure the accurate and timely submission of your HMRC tax return.

Featured Posts

-

450 000 E Jaminet Et Le Stade Toulousain Trouvent Un Accord

May 20, 2025

450 000 E Jaminet Et Le Stade Toulousain Trouvent Un Accord

May 20, 2025 -

M Night Shyamalans The Village An Agatha Christie Inspired Thriller

May 20, 2025

M Night Shyamalans The Village An Agatha Christie Inspired Thriller

May 20, 2025 -

Full Solutions For The Nyt Mini Crossword April 25

May 20, 2025

Full Solutions For The Nyt Mini Crossword April 25

May 20, 2025 -

Le Nouveau Restaurant Rooftop Des Galeries Lafayette A Biarritz Presentation Avec Imanol Harinordoquy Et Jean Michel Suhubiette

May 20, 2025

Le Nouveau Restaurant Rooftop Des Galeries Lafayette A Biarritz Presentation Avec Imanol Harinordoquy Et Jean Michel Suhubiette

May 20, 2025 -

Circulation 2 Et 3 Roues Boulevard Fhb Ex Vge Limitee A Partir Du 15 Avril

May 20, 2025

Circulation 2 Et 3 Roues Boulevard Fhb Ex Vge Limitee A Partir Du 15 Avril

May 20, 2025

Latest Posts

-

Analyzing The Risks Of The Philippines Typhon Missile System Deployment

May 20, 2025

Analyzing The Risks Of The Philippines Typhon Missile System Deployment

May 20, 2025 -

Philippine Typhon Missile Deployment A Detrimental Strategy

May 20, 2025

Philippine Typhon Missile Deployment A Detrimental Strategy

May 20, 2025 -

Eurovision 2024 Louanes Participation Confirmed

May 20, 2025

Eurovision 2024 Louanes Participation Confirmed

May 20, 2025 -

Public Works Ministrys 6 Billion Investment In Coastal Protection

May 20, 2025

Public Works Ministrys 6 Billion Investment In Coastal Protection

May 20, 2025 -

Frances Eurovision 2024 Hope Louane Unveils Her Song

May 20, 2025

Frances Eurovision 2024 Hope Louane Unveils Her Song

May 20, 2025