HMRC Tax Letters: Are You Affected? (Over £23,000 Income)

Table of Contents

Understanding HMRC Tax Letters for Higher Earners (£23,000+)

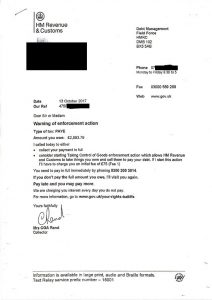

Many individuals receive HMRC correspondence, but those with incomes above £23,000 often face more complex tax situations and consequently, more frequent communication. This section outlines the most common reasons for receiving an HMRC tax letter in this income bracket.

- Self-Assessment Tax Returns: The most prevalent reason for an HMRC letter is related to your Self Assessment tax return. HMRC might contact you if:

- Your return is submitted late or overdue, incurring potential penalties.

- There are discrepancies or inconsistencies between the information you provided and other data held by HMRC.

- They require additional information to fully process your tax return. This could relate to expenses, income sources, or other relevant details.

- You owe additional tax, requiring payment to settle your outstanding liability. This could result from an underestimation of your tax liability or changes in tax legislation.

- Tax Code Changes: Your tax code determines the amount of Income Tax deducted from your earnings. An HMRC letter might indicate:

- A change to your tax code, reflecting a change in your circumstances (e.g., marriage, starting a new job).

- A request for information to establish your correct tax code. This is often required when there’s a discrepancy between your reported income and your tax code.

- An explanation of a discrepancy between your current tax code and your income, potentially leading to overpayment or underpayment of tax.

- National Insurance Contributions (NICs): HMRC might contact you regarding your National Insurance Contributions if:

- There's an underpayment of NICs, leading to a demand for payment.

- There's an overpayment of NICs, which they may refund.

- They require clarification regarding your employment status, particularly if you're self-employed or operate through a limited company.

- Your earnings information needs updating to ensure accurate NIC calculations.

- Capital Gains Tax (CGT): If you've disposed of assets that generated a capital gain (such as property or shares), expect a letter outlining:

- Your capital gains tax liability.

- The payment method and deadline for settling your CGT liability.

- A request for supplementary information or documentation to support your capital gains calculation.

- Other Enquiries: HMRC may contact you for various other reasons, including:

- A tax audit to verify the accuracy of your tax returns and financial records.

- Queries concerning tax relief or allowances you've claimed.

- Notifications regarding changes in tax legislation impacting your tax situation.

Responding to HMRC Tax Letters: A Step-by-Step Guide

Responding promptly and accurately to HMRC correspondence is crucial to avoid penalties and potential legal issues. Here’s a structured approach:

- Read the letter thoroughly: Carefully review the entire letter, understanding the reason for contact, any deadlines imposed, and the specific actions required.

- Gather all relevant documentation: Collect essential documents like payslips, P60s, bank statements, invoices, receipts, and any other supporting evidence relevant to the letter's content.

- Respond within the stipulated deadline: Adhering to deadlines is paramount. Late responses can attract penalties.

- Utilize the appropriate communication channels: Respond via the preferred method specified in the letter, whether it's the online portal, telephone, or postal mail.

- Keep detailed records: Maintain copies of all correspondence (both sent and received), along with supporting documents. This creates an auditable trail.

- Seek professional assistance if necessary: If the letter's contents are unclear or you require guidance, consulting a qualified tax advisor is highly recommended. They can provide expert advice and ensure compliance with HMRC regulations.

Avoiding HMRC Tax Letters: Proactive Tax Planning

Proactive tax planning significantly reduces the likelihood of receiving unwelcome HMRC correspondence. These strategies can help:

- Meticulous record-keeping: Maintain accurate and detailed records of all income and expenses. This simplifies tax return completion and reduces the risk of errors.

- Timely tax return submission: File your Self Assessment tax return on time and ensure its accuracy.

- Staying informed about tax legislation: Keep abreast of tax law changes that could impact your financial situation.

- Utilizing tax software: Employing reputable tax software can streamline the tax return process, minimize errors, and potentially identify tax-saving opportunities.

- Seeking professional tax advice: Regular consultations with a tax advisor can provide personalized guidance and help you navigate complex tax situations, proactively identifying and mitigating potential problems.

Conclusion:

Understanding your tax obligations, particularly when earning over £23,000, is crucial for avoiding unnecessary contact from HMRC. While receiving an HMRC tax letter can be stressful, a prompt and accurate response minimizes potential complications. Remember, proactive tax planning and meticulous record-keeping are your best allies. If you need help navigating HMRC tax letters or require assistance with your tax affairs, don't hesitate to seek professional advice. Take control of your finances and mitigate future HMRC tax letters through informed planning and timely action.

Featured Posts

-

Cadillac F1 Seat Support Grows For Mick Schumacher

May 20, 2025

Cadillac F1 Seat Support Grows For Mick Schumacher

May 20, 2025 -

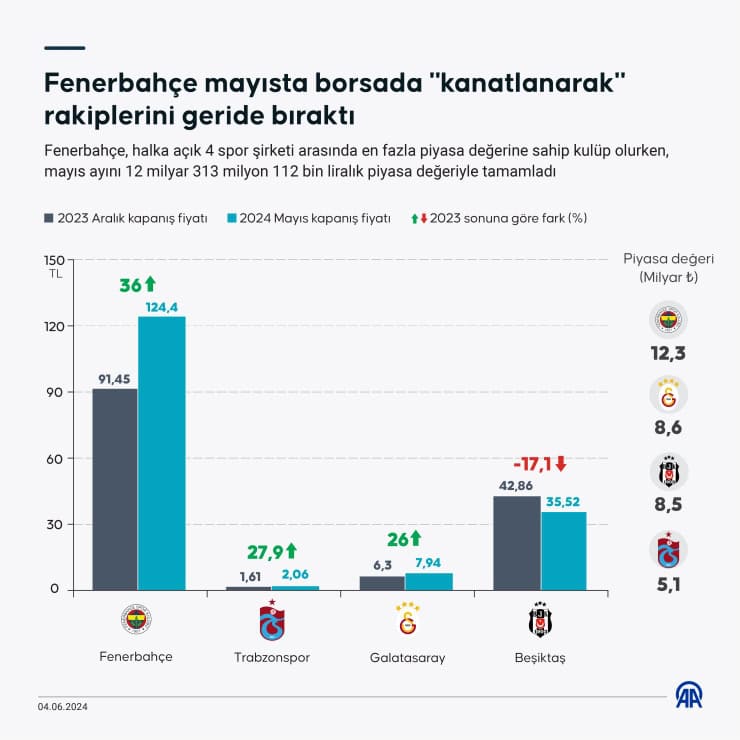

Mourinho Nun Etkisi Fenerbahce Oyuncusunun Ajax Transferi

May 20, 2025

Mourinho Nun Etkisi Fenerbahce Oyuncusunun Ajax Transferi

May 20, 2025 -

Bespomoschnoe Polozhenie Shumakhera Drug Podelilsya Trevozhnymi Podrobnostyami

May 20, 2025

Bespomoschnoe Polozhenie Shumakhera Drug Podelilsya Trevozhnymi Podrobnostyami

May 20, 2025 -

Formula 1 Yeni Sezon Takvim Sueruecueler Ve Beklentiler

May 20, 2025

Formula 1 Yeni Sezon Takvim Sueruecueler Ve Beklentiler

May 20, 2025 -

Dusan Tadic Fenerbahce Tarihine Gecen Bir Efsane

May 20, 2025

Dusan Tadic Fenerbahce Tarihine Gecen Bir Efsane

May 20, 2025

Latest Posts

-

F1 Kaos Hamilton Och Leclerc Diskvalificerade

May 20, 2025

F1 Kaos Hamilton Och Leclerc Diskvalificerade

May 20, 2025 -

Formula 1 Chinese Gp The Hamilton Leclerc Contact Controversy

May 20, 2025

Formula 1 Chinese Gp The Hamilton Leclerc Contact Controversy

May 20, 2025 -

Chinese Grand Prix 2024 Hamilton Leclerc Incident Analysis

May 20, 2025

Chinese Grand Prix 2024 Hamilton Leclerc Incident Analysis

May 20, 2025 -

Ferrari Nin Cin Grand Prix Felaketi Hamilton Ve Leclerc Diskalifiye

May 20, 2025

Ferrari Nin Cin Grand Prix Felaketi Hamilton Ve Leclerc Diskalifiye

May 20, 2025 -

Hamilton And Leclerc Clash Impact On The Chinese Grand Prix

May 20, 2025

Hamilton And Leclerc Clash Impact On The Chinese Grand Prix

May 20, 2025