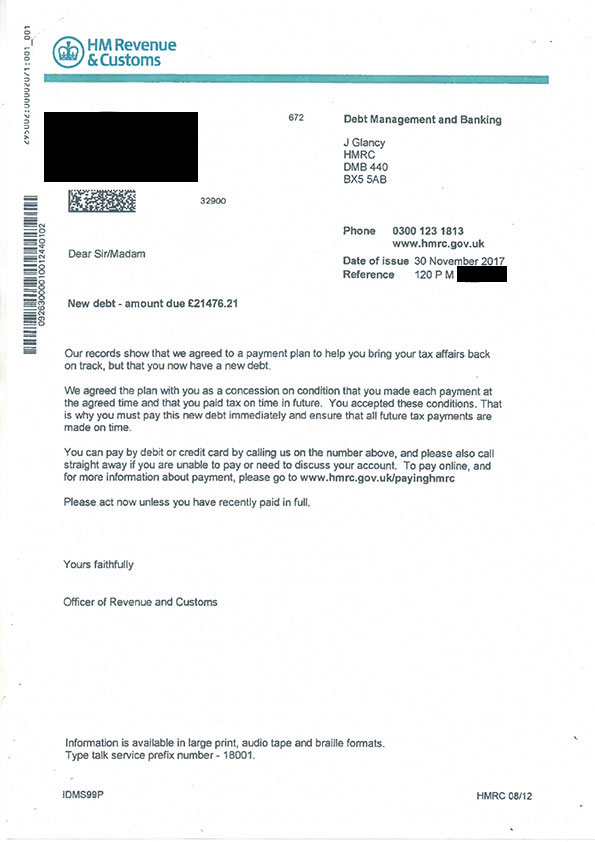

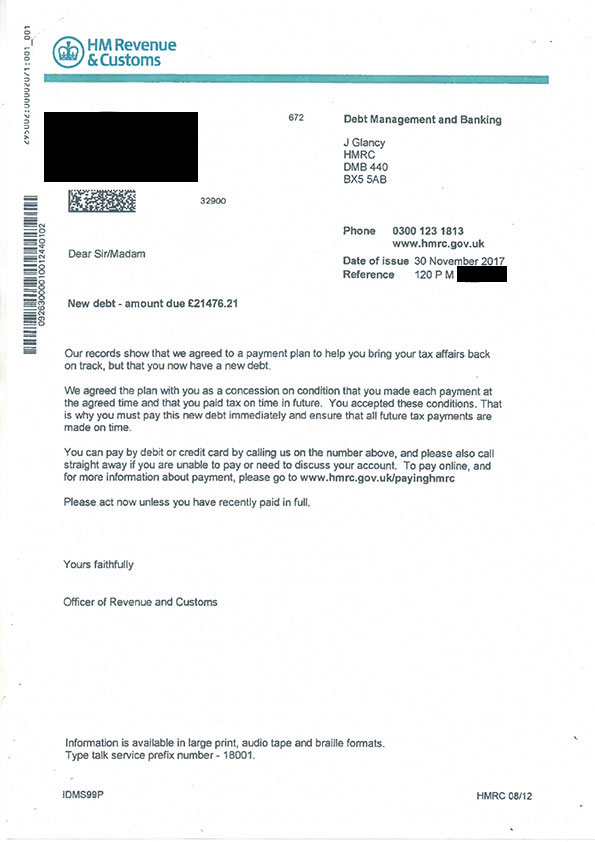

HMRC Sending Letters: Income Tax Review For Earners Over £23,000

Table of Contents

Why You Might Receive an HMRC Letter: Common Reasons for Income Tax Reviews

HMRC uses various methods to ensure accurate tax collection. Receiving a letter often signals a review of your income tax return. Several factors can trigger this:

HMRC's Data Matching Exercise

HMRC routinely matches data from your employer (via your P60 and payroll information) and other sources (banks, pension providers) against your submitted self-assessment tax return (SA300). Discrepancies, even minor ones, can trigger an income tax review. This is a standard procedure, not necessarily indicative of wrongdoing.

Self-Assessment Tax Return Errors

Errors on your self-assessment tax return are a common reason for HMRC review. Even small mistakes can lead to a detailed examination. Common errors include:

- Incorrect Income Declaration: Failing to accurately report all sources of income, such as freelance work, rental income, or investments.

- Missing Deductions: Forgetting to claim allowable deductions, like expenses for self-employed individuals or charitable donations.

- Errors in Calculating Tax Due: Miscalculations in applying tax rates, allowances, or reliefs can result in an incorrect tax liability.

Suspicious Activity

In some cases, HMRC may suspect tax evasion or fraudulent activity. This might involve a more thorough investigation, requiring additional documentation and potentially involving penalties beyond those for simple errors.

What to Do If You Receive an HMRC Letter: A Step-by-Step Guide

Receiving an HMRC letter shouldn't be ignored. Prompt action is crucial:

- Don't Ignore the Letter: Ignoring HMRC correspondence can lead to penalties and further complications. Respond immediately.

- Gather Your Documents: Collect all relevant documents to support your income and expenses. This might include:

- P60s (from your employer)

- Payslips

- Bank statements

- Receipts for business expenses (if applicable)

- Proof of charitable donations (if applicable)

- Understand Your Rights: Remember you have rights as a taxpayer. You can seek help from a tax advisor if the review is complex.

- Responding to HMRC:

- Carefully review the letter to understand the specific areas needing clarification.

- Provide accurate and complete information to support your tax return.

- Use the HMRC online portal whenever possible for efficient communication.

- If you are unsure how to respond or the review is complex, seek professional assistance from a qualified tax advisor.

Avoiding HMRC Income Tax Reviews: Best Practices for Tax Compliance

Proactive measures minimize the risk of an HMRC income tax review:

- Accurate Record Keeping: Maintaining detailed and organized financial records throughout the year is vital. This simplifies the tax return process and reduces the likelihood of errors.

- Filing Your Tax Return on Time: Meet the self-assessment deadline to avoid late filing penalties. Plan ahead and submit your return well in advance.

- Using Tax Software: Tax software can help reduce errors in calculating your tax liability and ensure accurate completion of your self-assessment.

- Seeking Professional Advice: A tax advisor can provide valuable guidance, particularly if you have complex financial circumstances or are self-employed.

Understanding Penalties for Non-Compliance: Consequences of Ignoring HMRC Letters

Non-compliance with HMRC's requests can result in penalties:

- Late Filing Penalties: Penalties for late filing increase the longer you delay. These can be substantial, significantly impacting your finances.

- Accuracy Penalties: Submitting inaccurate information or deliberately underreporting income can attract significant penalties, often calculated as a percentage of the underpaid tax.

- Interest Charges: Interest is charged on unpaid tax, adding to the overall cost of non-compliance.

Conclusion: Taking Control of Your Income Tax with HMRC

Receiving an HMRC letter regarding your income tax can be stressful, but understanding the process and taking prompt action are key. Maintaining accurate records, filing your tax return on time, and seeking professional help when needed are essential for tax compliance. Don't delay dealing with your HMRC income tax review; contact a qualified tax advisor today if you need help understanding your tax obligations or have received an HMRC tax review letter. Proactive tax planning and adherence to HMRC guidelines are the best ways to avoid future issues and maintain good standing with HMRC. Seek expert help with your HMRC tax review and ensure peace of mind. Get income tax help now to prevent further complications.

Featured Posts

-

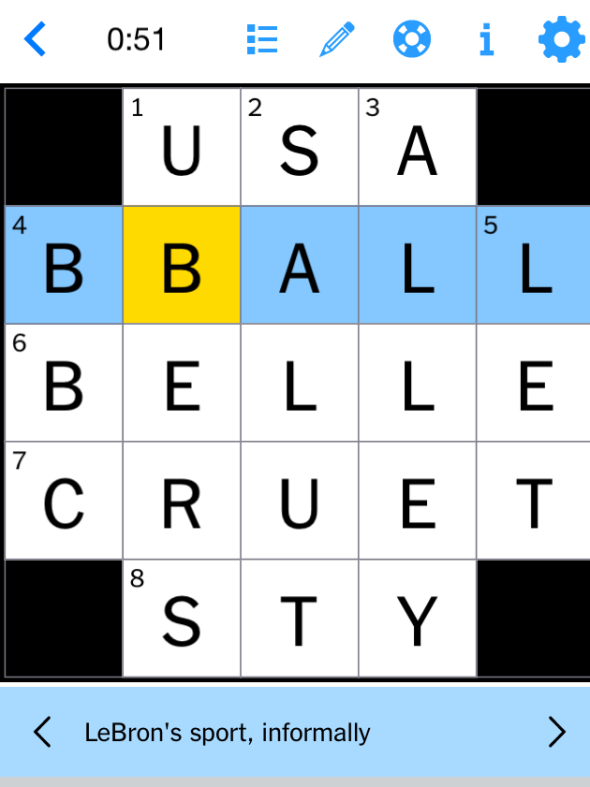

Solve The Nyt Mini Crossword April 13 Answers

May 20, 2025

Solve The Nyt Mini Crossword April 13 Answers

May 20, 2025 -

Agatha Christie Et L Ia Revolution Ou Evolution Dans L Enseignement De L Ecriture

May 20, 2025

Agatha Christie Et L Ia Revolution Ou Evolution Dans L Enseignement De L Ecriture

May 20, 2025 -

Crisis En La Familia Schumacher Mick Se Separa Y Busca El Amor En Una App De Citas

May 20, 2025

Crisis En La Familia Schumacher Mick Se Separa Y Busca El Amor En Una App De Citas

May 20, 2025 -

March 27 Nyt Mini Crossword Solutions

May 20, 2025

March 27 Nyt Mini Crossword Solutions

May 20, 2025 -

Msc Et Cote D Ivoire Terminal Succes Avec L Arrivee Du Diletta A Abidjan

May 20, 2025

Msc Et Cote D Ivoire Terminal Succes Avec L Arrivee Du Diletta A Abidjan

May 20, 2025

Latest Posts

-

Iznenadenje Jennifer Lawrence Ponovno Mama

May 20, 2025

Iznenadenje Jennifer Lawrence Ponovno Mama

May 20, 2025 -

Jennifer Lawrence Majcinstvo I Drugo Dijete

May 20, 2025

Jennifer Lawrence Majcinstvo I Drugo Dijete

May 20, 2025 -

Novo Dijete Jennifer Lawrence Obiteljska Sreca

May 20, 2025

Novo Dijete Jennifer Lawrence Obiteljska Sreca

May 20, 2025 -

Potvrda Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Potvrda Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025