HMRC Savings Refunds: Are You Missing Out?

Table of Contents

Understanding Entitlement to HMRC Savings Refunds

Several scenarios could make you eligible for an HMRC savings refund. These aren't always obvious, so it's crucial to understand your potential entitlements. You might be entitled to a refund if you've:

- Overpaid Income Tax: Simple errors or changes in circumstances can lead to overpayment. This is a common reason for HMRC savings refunds.

- Unclaimed Marriage Allowance: If you're married or in a civil partnership, and one partner is a non-taxpayer, you may be able to transfer some of your personal allowance to reduce your tax bill.

- Unused Personal Savings Allowance: Did you know you have a tax-free allowance for savings interest? If your interest earned exceeds this allowance, you might be due a refund.

- Pension contributions exceeding annual allowance: If your pension contributions exceeded the annual allowance in a given tax year, you may be entitled to reclaim some of the tax paid.

- Gift Aid donations: If you've donated to a registered charity and have Gift Aid declared, ensure HMRC has received the correct information and that you are claiming the tax relief due to you.

How to Check for Potential HMRC Savings Refunds

The first step is to check your HMRC records. Utilizing the HMRC website and online services is the most efficient way to do this. Here's how:

- Logging into your HMRC online account: Access your account securely using your Government Gateway credentials.

- Navigating to relevant tax year information: You can usually access information for the past several tax years.

- Identifying potential overpayments or unclaimed reliefs: Carefully review your tax summaries and statements for any discrepancies or unclaimed allowances.

- Downloading relevant tax statements and documents: Download copies of your P60, SA302 (self-assessment), and other relevant documents for your records.

It's vital to check your tax returns from previous years, as refunds may be available for multiple years. Don't limit yourself to just the current tax year.

Gathering Necessary Documents for Your HMRC Savings Refund Claim

To successfully claim your HMRC savings refund, you'll need to gather essential documentation. The specific documents will depend on the nature of your claim, but typically include:

- Payslips: These provide evidence of your income and tax deductions.

- P60s: Your P60s summarise your earnings and tax deducted for each tax year.

- Bank statements: These might be required to verify interest earned or other financial transactions.

- Pension contribution statements: Evidence of your pension contributions is crucial for claiming tax relief on pension contributions.

- Proof of charitable donations (Gift Aid): Keep donation receipts and confirmation of Gift Aid declarations.

Missing documentation can significantly delay or even prevent your claim, so ensure you have everything in order before proceeding.

The HMRC Savings Refund Claim Process: A Step-by-Step Guide

Submitting your claim is relatively straightforward once you have all your documents ready.

- Completing the necessary HMRC form online: Use the relevant online forms provided on the HMRC website.

- Uploading supporting documents: Upload scanned copies of your supporting documentation. Ensure they are clear and legible.

- Submitting the claim electronically: Submit your claim securely through the HMRC online portal.

- Tracking the claim's progress online: Once submitted, you can typically track the progress of your claim online.

Remember to keep copies of all submitted documents and correspondence for your records. Processing times vary, but HMRC provides estimates on their website.

Conclusion: Don't Miss Out on Your HMRC Savings Refunds!

Checking for unclaimed tax relief and savings refunds could result in a significant financial boost. This article has outlined the different scenarios where you might be entitled to a refund, how to check your records, gather necessary documents, and submit your claim. Don't delay – take action now to ensure you receive all the money you're entitled to. Start checking for your HMRC savings refunds today! Visit the HMRC website [link to HMRC website] to learn more.

Featured Posts

-

K Sepernontas Ta Tampoy I Dynami Tis Marthas

May 20, 2025

K Sepernontas Ta Tampoy I Dynami Tis Marthas

May 20, 2025 -

Cooperation Bilaterale Le President Mahama Renforce Les Liens Diplomatiques Avec La Cote D Ivoire

May 20, 2025

Cooperation Bilaterale Le President Mahama Renforce Les Liens Diplomatiques Avec La Cote D Ivoire

May 20, 2025 -

New Light On Agatha Christie Private Correspondence Exposes Book Conflict

May 20, 2025

New Light On Agatha Christie Private Correspondence Exposes Book Conflict

May 20, 2025 -

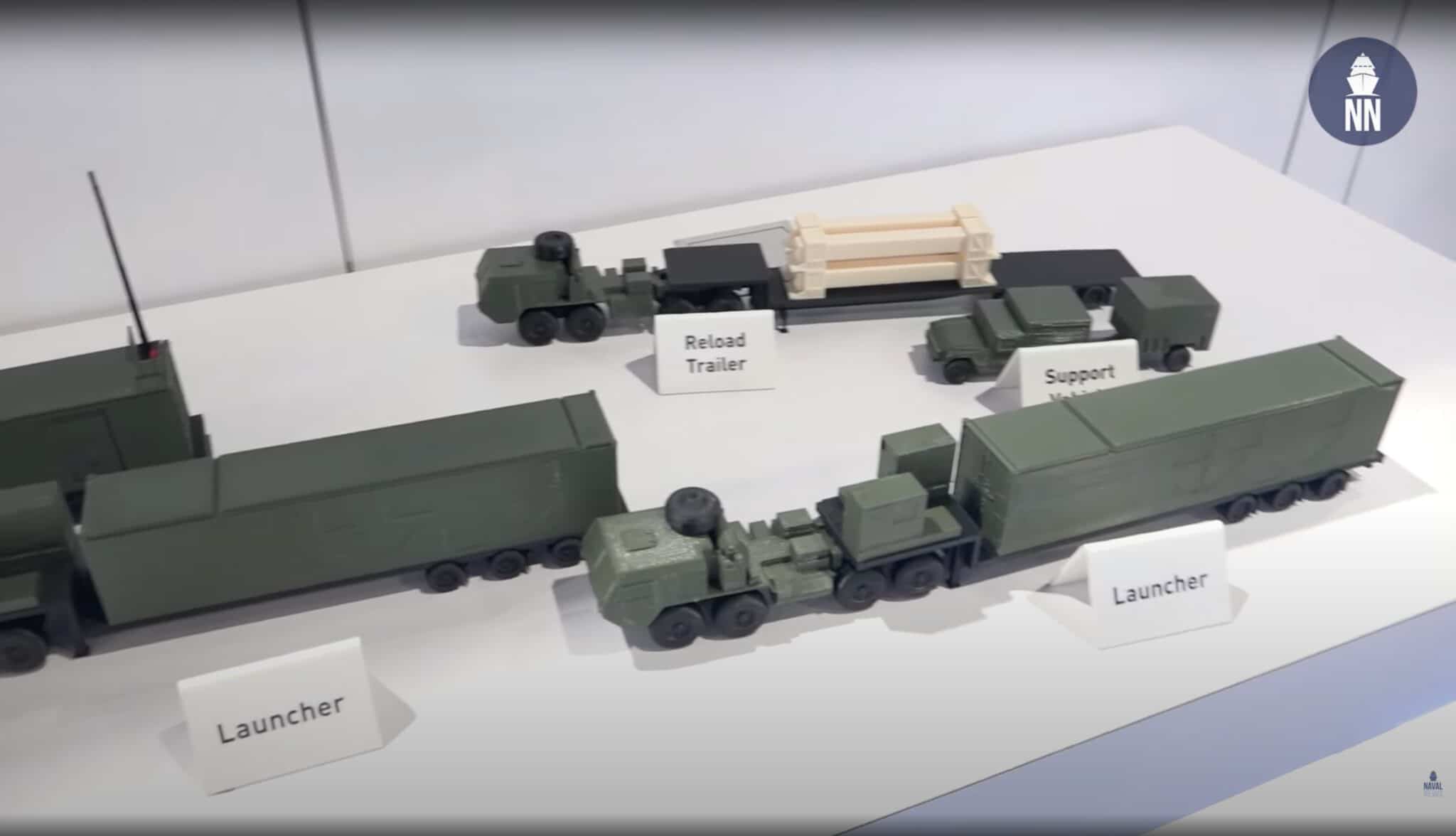

Drone Truck Could Revolutionize Usmc Tomahawk Missile Deployment

May 20, 2025

Drone Truck Could Revolutionize Usmc Tomahawk Missile Deployment

May 20, 2025 -

Matheus Cunha To Arsenal Transfer Speculation Mounts Under New Sporting Director

May 20, 2025

Matheus Cunha To Arsenal Transfer Speculation Mounts Under New Sporting Director

May 20, 2025

Latest Posts

-

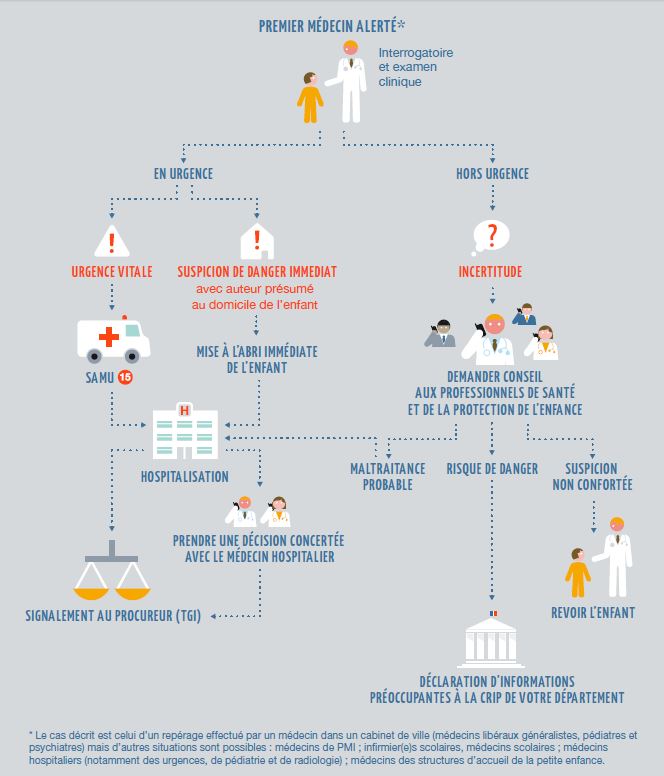

Allegations De Maltraitance Et D Abus Sexuels A La Fieldview Care Home Informations Et Mises A Jour

May 20, 2025

Allegations De Maltraitance Et D Abus Sexuels A La Fieldview Care Home Informations Et Mises A Jour

May 20, 2025 -

Fieldview Care Home Le Point Sur L Enquete Concernant Les Cas De Maltraitance Et D Abus Sexuels

May 20, 2025

Fieldview Care Home Le Point Sur L Enquete Concernant Les Cas De Maltraitance Et D Abus Sexuels

May 20, 2025 -

Maltraitance Et Abus Sexuels Presumes A La Fieldview Care Home Reactions Et Suites

May 20, 2025

Maltraitance Et Abus Sexuels Presumes A La Fieldview Care Home Reactions Et Suites

May 20, 2025 -

Enquete Sur Les Allegations De Maltraitance Et D Abus Sexuels A La Fieldview Care Home Maurice

May 20, 2025

Enquete Sur Les Allegations De Maltraitance Et D Abus Sexuels A La Fieldview Care Home Maurice

May 20, 2025 -

Cas De Maltraitance Et D Abus Sexuels Presumes A La Fieldview Care Home Maurice Info

May 20, 2025

Cas De Maltraitance Et D Abus Sexuels Presumes A La Fieldview Care Home Maurice Info

May 20, 2025