HMRC Issues Updated Tax Codes For Savers: Key Changes Explained

Table of Contents

Understanding the New HMRC Tax Codes for Savers

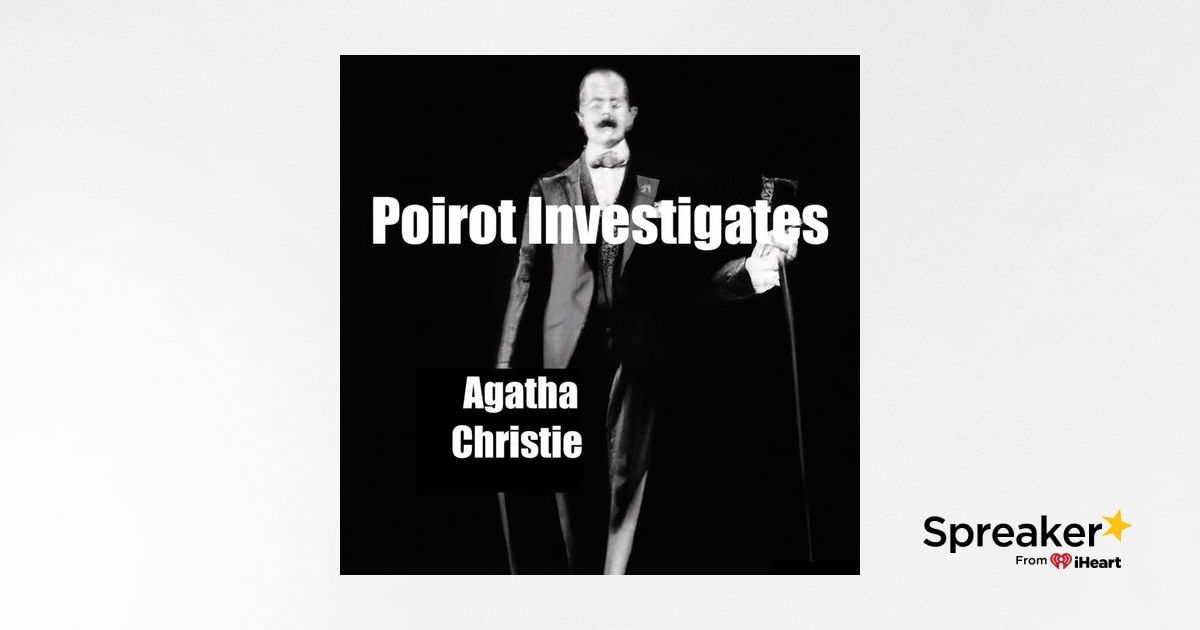

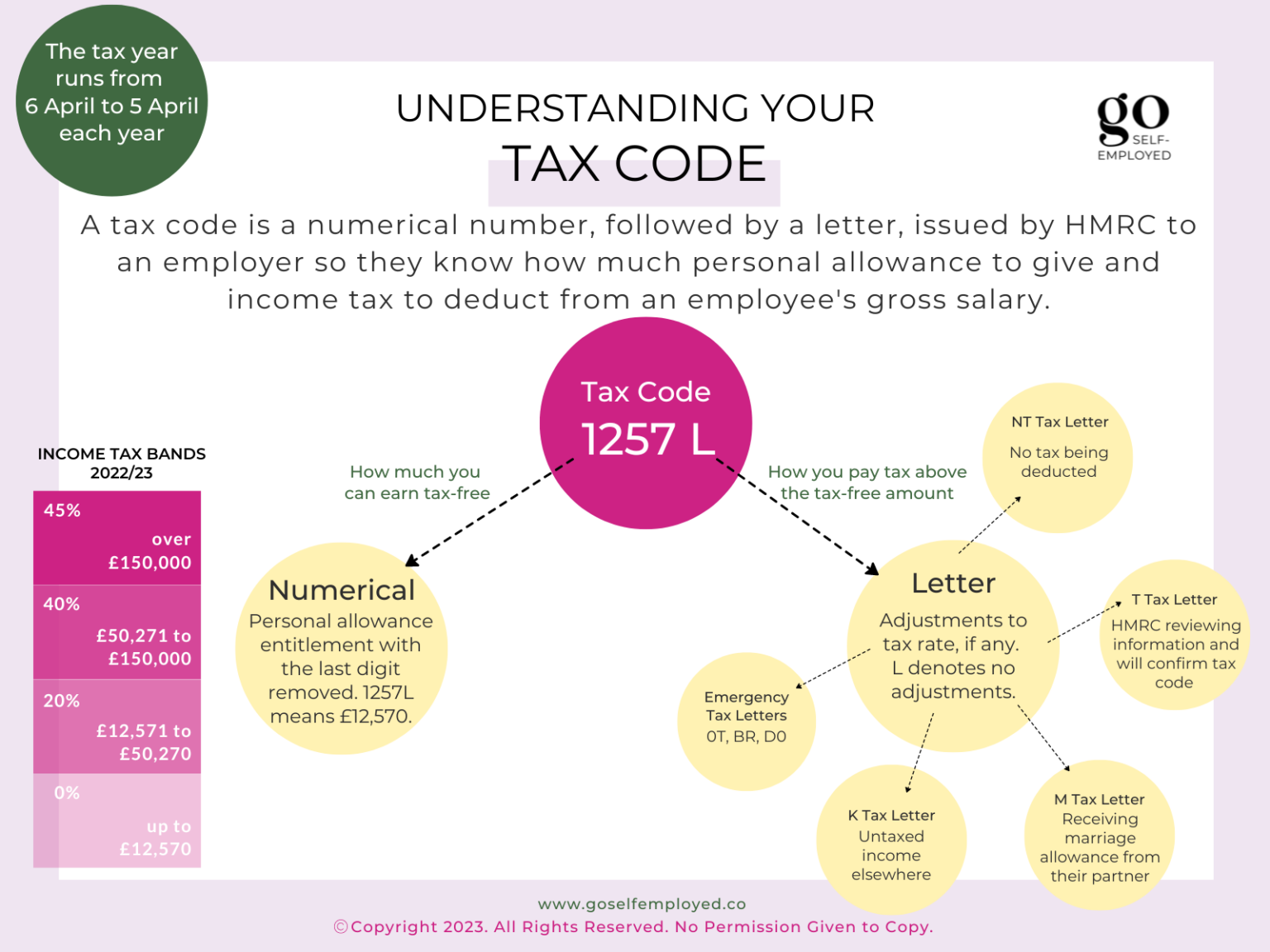

Tax codes are essential for accurately calculating your income tax. They tell your employer or pension provider how much tax to deduct from your earnings and savings income. Savings income includes interest from savings accounts, building society accounts, and dividends from investments. The new HMRC tax codes for 2024-2025 represent adjustments to how this savings income is taxed, compared to previous years.

- Structure of a Tax Code: A tax code typically consists of numbers and a letter (e.g., 1257L). The numbers represent your Personal Allowance, while the letter indicates any additional adjustments or reliefs.

- Decoding the Tax Code: The numbers in your tax code reflect your Personal Allowance (the amount you can earn tax-free). The letter signifies special circumstances, such as additional allowances or deductions.

- Significance of Tax Code Letters: Common letters include:

- K: This indicates that your income tax is being calculated based on your previous year's tax return (it's a temporary tax code until your latest return is processed).

- L: This is a standard tax code for most individuals, indicating their personal allowance.

- BR: This code might show up if you've claimed additional tax relief or benefits.

Key Changes Introduced by HMRC's Update

The HMRC's update for 2024-2025 includes several key changes impacting how savings income is taxed:

-

Revised Savings Allowance: The starting rate for savings allowance has increased, meaning you can earn more interest tax-free. This is good news for many savers. The personal savings allowance is £1,000 for basic-rate taxpayers, £500 for higher-rate taxpayers, and £0 for additional-rate taxpayers. This allowance has increased for basic-rate and higher-rate taxpayers as of October 2024.

-

Changes to Dividend Allowance: The dividend allowance, the amount of dividend income you can receive tax-free, remains unchanged at £2,000. However, the tax rates on dividends above this allowance have been slightly adjusted.

-

Impact on Tax Bands: The personal allowance for the 2024/2025 tax year remains unchanged, but some tax bands on higher incomes have seen adjustments, influencing the effective tax rate on savings income above the personal allowance.

-

Examples: A basic-rate taxpayer with £2,000 in savings interest will see a part of it tax-free due to the savings allowance, while a higher-rate taxpayer with the same amount will pay tax on a larger portion.

How the Changes Affect Different Types of Savers

The updated HMRC tax codes will affect different savers in various ways:

- Basic-Rate Taxpayers: They will benefit from the increased personal savings allowance, reducing the amount of tax they pay on savings interest.

- Higher-Rate Taxpayers: They will still have a reduced savings allowance, though it increased slightly, resulting in tax liability on a larger portion of their savings interest.

- Additional-Rate Taxpayers: Their savings allowance remains at £0.

- ISA Holders: Income earned within ISAs remains tax-free, unaffected by these tax code changes.

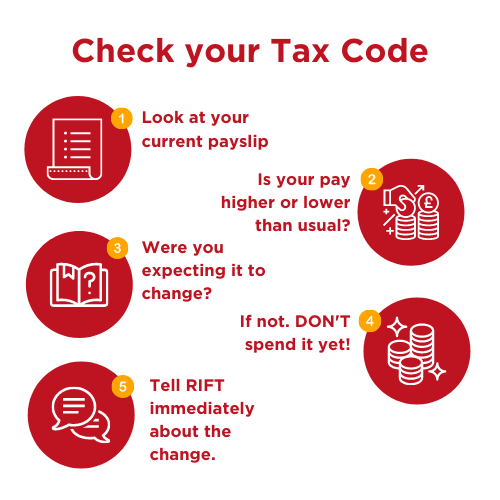

Checking Your Tax Code and Taking Action

It is vital to verify that your tax code is accurate. You can check this through the following ways:

- Online: Access your HMRC online account to view your tax code details.

- By Phone: Contact HMRC's helpline for assistance (phone number and website provided below).

If your tax code is incorrect, you may need to:

- Contact HMRC: Immediately inform HMRC about any discrepancies in your tax code.

- Provide Necessary Information: Be prepared to provide relevant information to support your case. Failure to do so could lead to penalties.

HMRC Contact Information:

- Website: [Insert HMRC Website Link Here]

- Phone Number: [Insert HMRC Phone Number Here]

Conclusion

The recent HMRC update to saver tax codes introduces significant changes to how savings income is taxed. Understanding these changes, particularly the adjustments to the personal savings allowance and potential tax implications on different income levels, is essential to ensure you're paying the correct amount of tax. Don't delay! Check your HMRC tax code today to ensure you are paying the correct amount of tax on your savings and to avoid potential penalties. Use the resources provided to check your HMRC tax code and contact HMRC with any questions or concerns. Remember to review your tax code annually to ensure its accuracy.

Featured Posts

-

Deite Tampoy Nea Epeisodia Sto Mega

May 20, 2025

Deite Tampoy Nea Epeisodia Sto Mega

May 20, 2025 -

The Pointless Comeback Of Michael Schumacher A Hindsight Analysis

May 20, 2025

The Pointless Comeback Of Michael Schumacher A Hindsight Analysis

May 20, 2025 -

L Integrale Agatha Christie Une Vie D Aventures Et De Mysteres

May 20, 2025

L Integrale Agatha Christie Une Vie D Aventures Et De Mysteres

May 20, 2025 -

A Critical Analysis Of Agatha Christies Poirot Stories

May 20, 2025

A Critical Analysis Of Agatha Christies Poirot Stories

May 20, 2025 -

Hmrc Tax Codes Understanding Your New Code For Savings

May 20, 2025

Hmrc Tax Codes Understanding Your New Code For Savings

May 20, 2025

Latest Posts

-

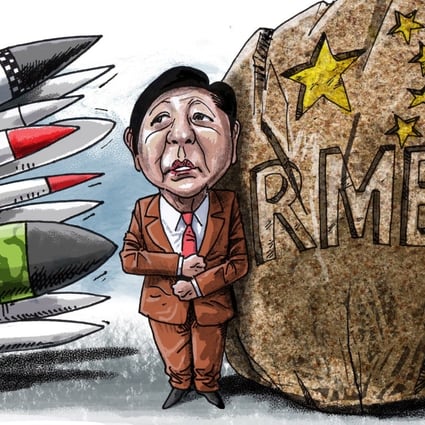

Regional Stability At Risk Chinas Call For Philippines To Remove Typhon Missiles

May 20, 2025

Regional Stability At Risk Chinas Call For Philippines To Remove Typhon Missiles

May 20, 2025 -

Chinas Demand Philippines Withdraw Typhon Missiles To Maintain Peace

May 20, 2025

Chinas Demand Philippines Withdraw Typhon Missiles To Maintain Peace

May 20, 2025 -

Philippines Stands Strong Against Chinese Pressure Over Missiles

May 20, 2025

Philippines Stands Strong Against Chinese Pressure Over Missiles

May 20, 2025 -

Us Army Expands Pacific Presence With Second Typhon Battery Deployment

May 20, 2025

Us Army Expands Pacific Presence With Second Typhon Battery Deployment

May 20, 2025 -

China Urges Philippines To Remove Typhon Missile System For Regional Stability

May 20, 2025

China Urges Philippines To Remove Typhon Missile System For Regional Stability

May 20, 2025