HMRC Cracks Down On Side Hustle Tax Evasion: The Impact Of The New US-Style System

Table of Contents

Understanding the New HMRC System for Side Hustle Income

HMRC is shifting towards a more data-driven, US-style approach to tax collection, mirroring the systems used in the United States. This means increased data sharing with online platforms and more sophisticated automated checks on self-assessment tax returns. This intensified scrutiny aims to significantly reduce tax evasion within the gig economy and ensure fair tax contributions from all earners.

Key changes under this new system include:

- Increased data collection from online platforms: HMRC is actively collaborating with platforms like Etsy, Fiverr, Uber, and Deliveroo to obtain data on payments made to gig workers. This reduces the reliance on self-reporting and provides HMRC with a clearer picture of individual income.

- More rigorous checks on self-assessment tax returns: Expect more in-depth analysis of self-assessment forms, cross-referencing data from various sources to identify inconsistencies and potential underreporting of side hustle income. This includes comparing declared income against bank statements and other financial records.

- Increased penalties for non-compliance and tax evasion: HMRC is implementing stricter penalties for those who fail to comply with tax regulations. This includes higher fines, increased interest charges, and potential criminal prosecution for serious cases of tax fraud.

- Emphasis on accurate record-keeping and transparent financial reporting: Maintaining meticulous records of all income and expenses is more critical than ever. HMRC expects transparent and readily auditable financial reporting to support declared income and expenses.

Common Side Hustle Tax Evasion Mistakes to Avoid

Many individuals unknowingly make mistakes when declaring their side hustle income, leading to potential penalties from HMRC. Avoiding these common pitfalls is crucial for maintaining tax compliance.

Here are some common errors to avoid:

- Underreporting income: This is perhaps the most prevalent mistake. Failing to declare all income, even small amounts, can lead to significant penalties.

- Failing to register as self-employed: If your side hustle generates taxable income above the personal allowance threshold, you must register as self-employed with HMRC.

- Incorrectly claiming expenses: Misunderstanding allowable expenses or claiming ineligible expenses can result in tax assessments and penalties.

- Ignoring tax deadlines: Missing tax deadlines will attract penalties, even if the tax itself is paid eventually.

- Not understanding allowable expenses for different types of side hustles: The allowable expenses vary greatly depending on the nature of your side hustle. Seek clarification if unsure.

The Penalties for Side Hustle Tax Evasion in the UK

The consequences of side hustle tax evasion in the UK can be severe, ranging from financial penalties to legal repercussions. These penalties are not to be taken lightly.

- Fines: HMRC can impose significant fines, potentially exceeding the amount of unpaid tax.

- Interest charges: Interest will accrue on unpaid tax, increasing the overall debt.

- Legal action: In serious cases of tax evasion, HMRC may initiate legal proceedings, leading to potential imprisonment.

- Impact on credit rating: Tax debts can negatively impact your credit rating, making it difficult to obtain loans or credit in the future.

Strategies for Ensuring Side Hustle Tax Compliance

Proactive steps to ensure compliance with HMRC regulations are vital to avoid penalties and maintain a positive financial standing.

Here’s how to ensure tax compliance:

- Keep accurate records of all income and expenses: Maintain detailed records of every transaction, including invoices, receipts, and bank statements.

- Register as self-employed with HMRC promptly: Do this as soon as your side hustle income exceeds the personal allowance threshold.

- Understand allowable expenses for your specific side hustle: Consult HMRC guidelines or seek professional advice to ensure you are claiming legitimate expenses.

- File your tax return on time: Meet all tax deadlines to avoid penalties. Utilize online filing systems for efficiency.

- Seek professional advice from an accountant or tax advisor: Consider engaging a tax professional, especially if your side hustle income is substantial or complex.

Resources and Support for Side Hustle Taxpayers

HMRC provides numerous resources to help taxpayers understand their obligations:

Consider using tax software or apps to simplify the self-assessment process. If you require professional assistance, seek advice from a qualified accountant or tax advisor.

Conclusion: Protecting Yourself from HMRC’s Side Hustle Crackdown

HMRC is significantly cracking down on side hustle tax evasion with a robust new system. Non-compliance carries severe penalties, impacting your finances and credit rating. Accurate record-keeping, timely tax filings, and understanding allowable expenses are crucial for avoiding the consequences. Don't risk facing the consequences of HMRC's crackdown on side hustle tax evasion. Take control of your finances and ensure compliance by consulting the resources mentioned above or seeking professional tax advice. Proactive tax planning is essential for anyone with side income in the UK.

Featured Posts

-

Ivoire Tech Forum 2025 La Strategie Numerique Ivoirienne Sur La Scene Internationale

May 20, 2025

Ivoire Tech Forum 2025 La Strategie Numerique Ivoirienne Sur La Scene Internationale

May 20, 2025 -

Peterborough Uniteds Efl Trophy Triumph Darren Fergusons Reaction

May 20, 2025

Peterborough Uniteds Efl Trophy Triumph Darren Fergusons Reaction

May 20, 2025 -

4eme Pont D Abidjan Un Bilan Des Depenses Et Un Apercu Des Echeances Du Projet En Cote D Ivoire

May 20, 2025

4eme Pont D Abidjan Un Bilan Des Depenses Et Un Apercu Des Echeances Du Projet En Cote D Ivoire

May 20, 2025 -

Agatha Christies Poirot From Novels To Screen

May 20, 2025

Agatha Christies Poirot From Novels To Screen

May 20, 2025 -

Schumacher Bunic O Prima Imagine Cu Noua Generatie

May 20, 2025

Schumacher Bunic O Prima Imagine Cu Noua Generatie

May 20, 2025

Latest Posts

-

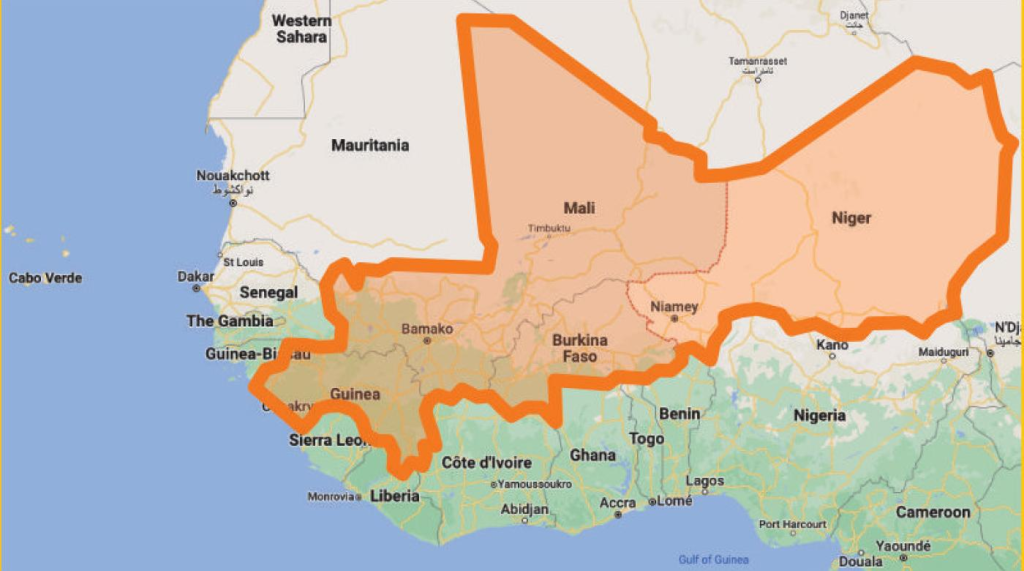

Niger Retreat Ecowas Economic Affairs Department Defines Strategic Priorities

May 20, 2025

Niger Retreat Ecowas Economic Affairs Department Defines Strategic Priorities

May 20, 2025 -

Ecowas Charts Course For Economic Development At Niger Retreat

May 20, 2025

Ecowas Charts Course For Economic Development At Niger Retreat

May 20, 2025 -

Eurovision 2025 Finalists Ranked From Hypnotic To Horrible

May 20, 2025

Eurovision 2025 Finalists Ranked From Hypnotic To Horrible

May 20, 2025 -

The Eurovision Song Contest 2025 Definitive Ranking Of Finalists

May 20, 2025

The Eurovision Song Contest 2025 Definitive Ranking Of Finalists

May 20, 2025 -

Philippine Typhon Missile Deployment Weighing The Pros And Cons

May 20, 2025

Philippine Typhon Missile Deployment Weighing The Pros And Cons

May 20, 2025