HKMA's US Dollar Purchases: A Sign Of Pressure On The Hong Kong Dollar Peg?

Table of Contents

Understanding the Hong Kong Dollar Peg

The Linked Exchange Rate Mechanism

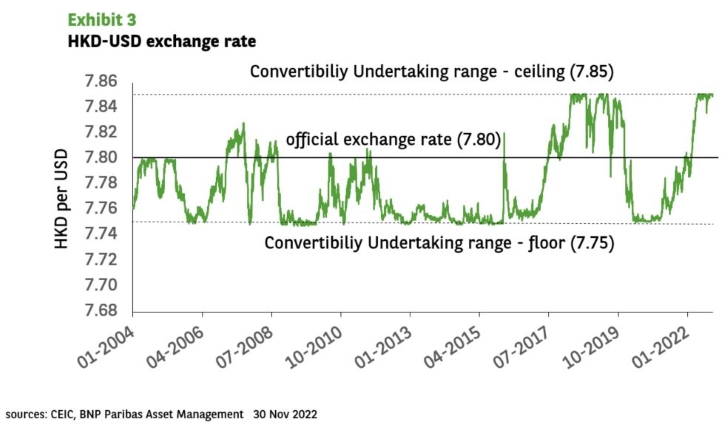

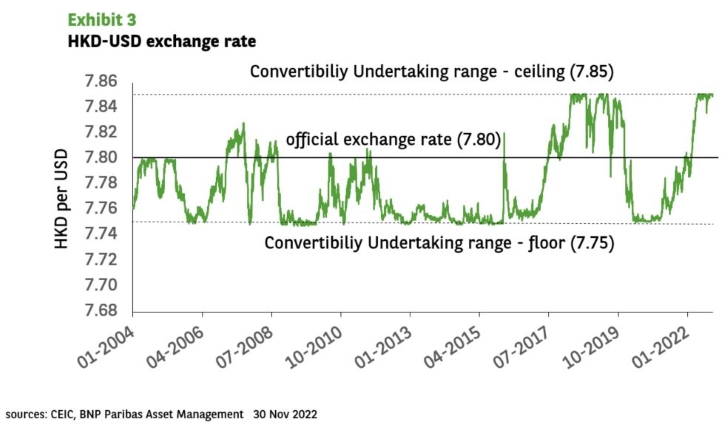

The Hong Kong dollar (HKD) operates under a linked exchange rate system, maintaining a narrow band against the US dollar (USD). This band is typically between 7.75 and 7.85 HKD per USD. The HKMA plays a crucial role in maintaining this peg through its intervention in the foreign exchange market.

- Intervention Points: When the HKD weakens towards the 7.85 HKD/USD level, the HKMA buys HKD and sells USD, increasing demand for the HKD and pushing its value back up. Conversely, when the HKD strengthens towards 7.75 HKD/USD, the HKMA sells HKD and buys USD.

- Role of the HKMA: The HKMA acts as the ultimate guarantor of the peg, using its substantial foreign exchange reserves to manage fluctuations. This involves buying and selling US dollars to influence the exchange rate.

- Buying and Selling of US Dollars: The HKMA's actions directly impact the supply and demand of both currencies, influencing the exchange rate and maintaining its stability within the predetermined band.

- Impact on Interest Rates: The linked exchange rate system also influences interest rates in Hong Kong. To maintain the peg, interest rates in Hong Kong tend to track US interest rates, ensuring that the cost of borrowing is relatively similar in both currencies.

Historical Context of the Peg

The Hong Kong dollar's peg to the US dollar has been in place since 1983, providing considerable stability to the Hong Kong economy. This stability has attracted foreign investment and contributed to Hong Kong's economic success.

- Major Events that Tested the Peg: The Asian Financial Crisis of 1997-98 posed a significant challenge to the peg, but the HKMA successfully defended it through aggressive intervention.

- Previous Interventions by the HKMA: The HKMA has intervened in the foreign exchange market on numerous occasions throughout the years, demonstrating its commitment to maintaining the peg. These interventions have ranged from minor adjustments to significant operations depending on market conditions.

- Long-Term Benefits and Drawbacks of the Peg: While the peg has offered stability and predictability, it has also limited Hong Kong's monetary policy independence, tying it closely to the US economic cycle.

Reasons Behind Recent HKMA US Dollar Purchases

Increased Capital Outflows

Recent HKMA interventions may be a response to increased capital outflows from Hong Kong. Several factors might contribute to this trend:

- Geopolitical Factors: Rising US-China tensions and broader geopolitical uncertainty can lead to investors seeking safer havens, resulting in capital flowing out of Hong Kong.

- Economic Uncertainty: Global economic slowdowns or concerns about the Hong Kong economy itself might prompt investors to withdraw funds.

- Interest Rate Differentials: Changes in interest rate differentials between the US and Hong Kong can influence capital flows. If US interest rates rise significantly, investors may move funds to the US to take advantage of higher returns.

- US-China Tensions: The ongoing geopolitical tensions between the US and China can create uncertainty for investors, potentially leading to capital flight from Hong Kong.

Speculative Attacks on the HKD

Another potential reason for the HKMA's actions is the possibility of speculative attacks targeting the HKD peg.

- How These Attacks Work: Speculators might attempt to bet against the peg by selling HKD, pushing it towards the weaker end of the band. This could trigger a larger sell-off, potentially jeopardizing the peg.

- Historical Examples: Past speculative attacks on Asian currencies, though not always directly targeting Hong Kong, underscore the vulnerability of pegged exchange rates.

- HKMA's Countermeasures: The HKMA's US dollar purchases act as a countermeasure, stemming the outflow of HKD and signaling its commitment to defending the peg.

Maintaining Interest Rate Parity

The HKMA's interventions are also crucial for maintaining interest rate parity within the peg mechanism.

- Connection to US Interest Rates: To prevent large capital flows based on interest rate differentials, the Hong Kong interbank rate (HIBOR) needs to closely track US interest rates.

- Impact on Borrowing Costs: If HIBOR diverges too significantly from US interest rates, it could create arbitrage opportunities and destabilize the currency peg.

- Implications for Hong Kong's Economy: Maintaining interest rate parity has significant implications for Hong Kong's economy, impacting borrowing costs for businesses and consumers.

Implications of HKMA Intervention

Impact on Hong Kong's Foreign Exchange Reserves

The HKMA's interventions to defend the peg deplete its foreign exchange reserves.

- Current Levels of Reserves: While Hong Kong still possesses substantial reserves, continued large-scale interventions could reduce these reserves over time.

- Potential Consequences of Low Reserves: A significant depletion of reserves could weaken confidence in the peg's sustainability, potentially attracting further speculative attacks.

- Diversification Strategies: The HKMA may need to consider diversifying its foreign exchange reserves to mitigate risks associated with dependence on the US dollar.

Economic Consequences for Hong Kong

The HKMA's actions have far-reaching economic consequences for Hong Kong.

- Impact on Businesses: Businesses might experience increased borrowing costs or uncertainty regarding future exchange rates.

- Impact on Consumers: Fluctuations in the exchange rate can affect the price of imported goods, impacting consumer spending.

- Impact on Investors: Investor confidence in the Hong Kong dollar and the stability of the economy is affected by the HKMA's interventions.

Potential Future Scenarios for the HKD Peg

Several future scenarios are possible regarding the HKD peg's stability.

- Weakening Peg: Continued pressure from capital outflows and speculative attacks could lead to a gradual weakening of the peg.

- Revaluation of the HKD: While unlikely in the short term, a potential revaluation of the HKD could occur if economic fundamentals significantly shift.

- Maintaining the Status Quo: The HKMA's continued commitment to defending the peg could maintain the status quo, though this depends on global economic conditions and the effectiveness of its interventions.

Conclusion

The HKMA's recent purchases of US dollars underscore the ongoing challenges in maintaining the Hong Kong dollar's peg to the US dollar. While the peg has historically shown resilience, current geopolitical and economic uncertainties place significant pressure on the system. The HKMA's interventions reflect its commitment to maintaining stability, but the long-term sustainability of the peg depends on various factors, including global economic conditions and the overall health of the Hong Kong economy. The depletion of foreign exchange reserves warrants close monitoring. The situation necessitates continued vigilance and proactive management by the HKMA.

Call to Action: Stay informed about the evolving situation surrounding the Hong Kong dollar peg and the HKMA's interventions. Follow reputable financial news sources for updates on HKMA US dollar purchases and their impact on the Hong Kong dollar. Regularly review analysis on the linked exchange rate mechanism to better understand the complexities of this crucial aspect of Hong Kong's economy.

Featured Posts

-

Ufc 314 Fight Card Main Event And Prelim Bout Order Announced

May 05, 2025

Ufc 314 Fight Card Main Event And Prelim Bout Order Announced

May 05, 2025 -

Louisiana Derby 2025 Analyzing The Odds And Top Contenders For The Kentucky Derby

May 05, 2025

Louisiana Derby 2025 Analyzing The Odds And Top Contenders For The Kentucky Derby

May 05, 2025 -

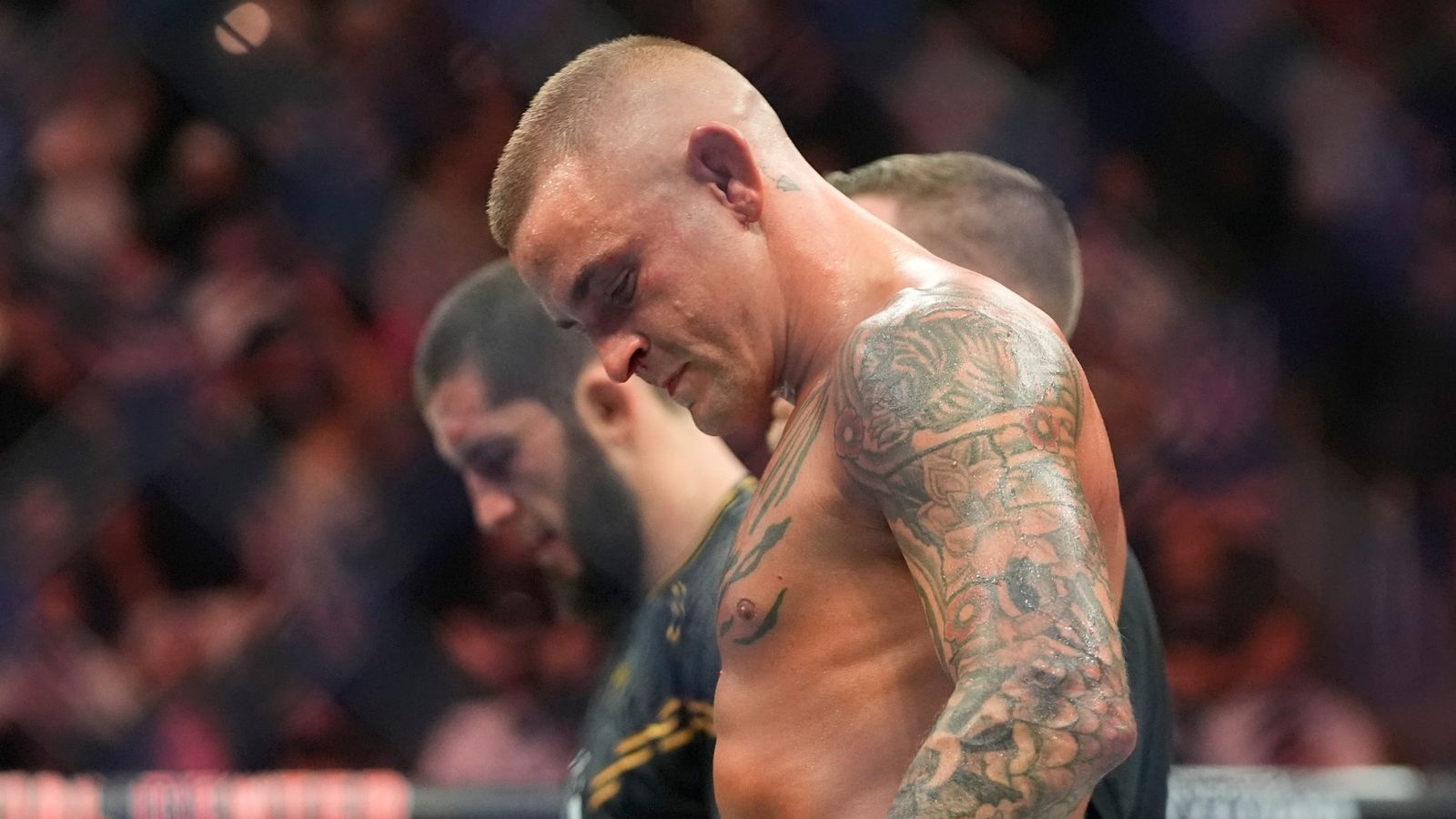

Is Dustin Poiriers Retirement A Regret Paddy Pimbletts Opinion

May 05, 2025

Is Dustin Poiriers Retirement A Regret Paddy Pimbletts Opinion

May 05, 2025 -

Pimblett Vs Chandler Ufc 314 Referee Intervention Requested Due To Concerns

May 05, 2025

Pimblett Vs Chandler Ufc 314 Referee Intervention Requested Due To Concerns

May 05, 2025 -

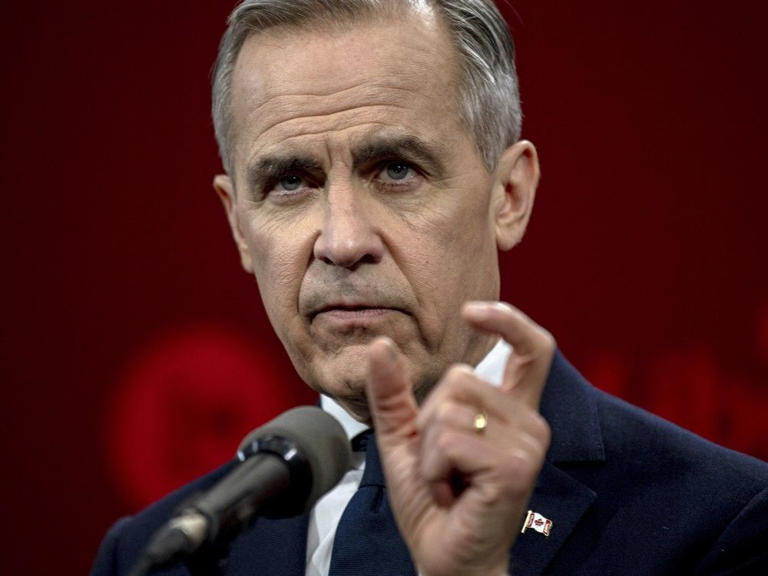

Press Conference Carneys Vision For Economic Transformation

May 05, 2025

Press Conference Carneys Vision For Economic Transformation

May 05, 2025

Latest Posts

-

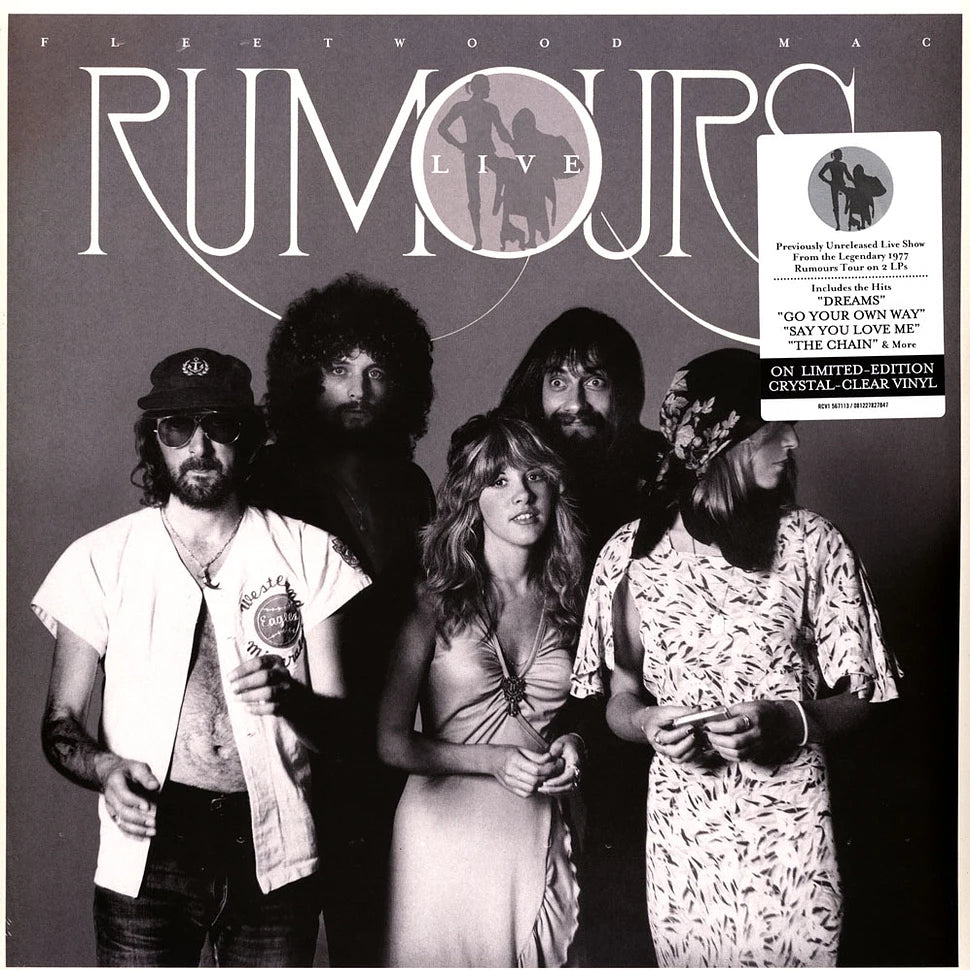

Fleetwood Macs Legacy A Deep Dive Into Their Supergroup Status And Rumours

May 05, 2025

Fleetwood Macs Legacy A Deep Dive Into Their Supergroup Status And Rumours

May 05, 2025 -

The Story Behind Rumours Fleetwood Macs Personal Lives And The Making Of A Masterpiece 48 Years Later

May 05, 2025

The Story Behind Rumours Fleetwood Macs Personal Lives And The Making Of A Masterpiece 48 Years Later

May 05, 2025 -

Rumours At 48 Fleetwood Macs Implosion And The Album That Defined A Generation

May 05, 2025

Rumours At 48 Fleetwood Macs Implosion And The Album That Defined A Generation

May 05, 2025 -

Novo Izdanje Gibonija Promoviranje Na Sajmu Knjiga U Sarajevu

May 05, 2025

Novo Izdanje Gibonija Promoviranje Na Sajmu Knjiga U Sarajevu

May 05, 2025 -

48 Years On How Fleetwood Macs Personal Turmoil Forged Rumours

May 05, 2025

48 Years On How Fleetwood Macs Personal Turmoil Forged Rumours

May 05, 2025